What is going on

To understand what is happening currently in the US market we need to have some background. First, we need to understand a few terms:

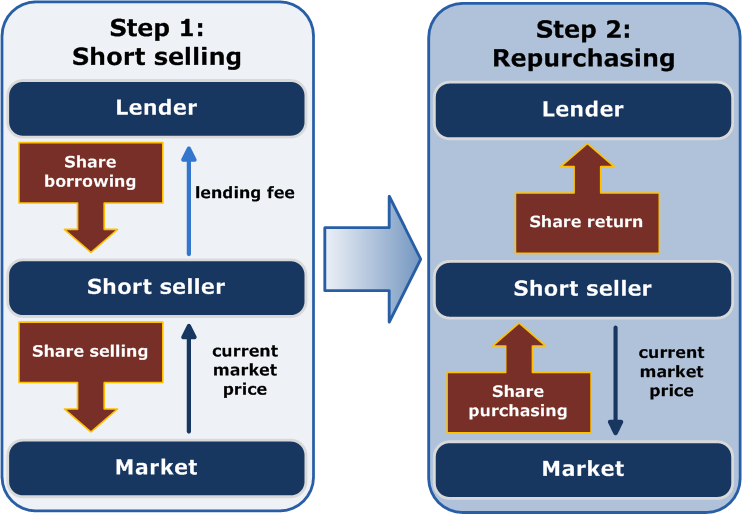

- Short Selling: You borrow a stock, sells the stock, and then buys the stock back to return it to the lender. Short sellers/You are betting that the stock you have sold will drop in price.

- Short Squeeze: You borrowed stock from a lender and sold it hoping the price will fall but price rises. You have to buy at higher price to return the stock to the lender. Instead of making money, you lost it.

Now the terms are clear, let's see how thing unfolded:

- Some hedge fund started shorting Gamestop (GME) share, they kept on shorting the share for months. In return, they made a lot of money.

- As some analysis pointed 140% share of GME was shorted at one point of time, meaning hedge funds have shorted more share than actually existed.

- Enter Wallstreetbets a subreddit related to trading and investing. Someone on the subreddit realized these greedy hedge funds have shorted more share than the actual number od share.

- Lo and behold, these sub Redditor of Wallstreetbets started buying every share of Gamestop, pushing prices up like crazy. Sub Redditors knew that in some month short sellers have to buy these share as they have to return it to lenders.

- Sub Redditors also started buying call option of the Gamestop, market maker writes a call option for the option premium. The market maker will not write a naked call option (writing option without owning them). So the call option writers also started buying Gamestop share pushing the share price even higher.

- Hedge funds have lost a lot of money in this whole Hungama, some may go bankrupt.

- Spillover effects are being seen in some other stock like AMC and Blackberry.

- On 12 January 2021 Gamestop was selling for $19.95 as on 28 Jan pre-market it is selling for $440.

Some Twitter threads

So many folks (esp. the media) are missing the complete backstory on $GME and how we got here.

— Josh Gross (@endtwist) January 27, 2021

This has been simmering for over a year and the story behind it is great. I’ve been tracking this since September and devoured all of the details from the origin through today.

So back in September 2019 (!) some guy named DeepFuckingValue posted this on r/wallstreetbets: https://t.co/SPaQvI9O7i

— Josh Gross (@endtwist) January 27, 2021

It was just a post about his LEAPS (aka,

— Josh Gross (@endtwist) January 27, 2021

Long-Term Equity Anticipation Securities — tl;dr long-dated calls) on GME.

At the time, nobody understood his position at all. The top comment on that post?

"Bid-ask spread on these are ridiculous, good luck getting rid of them" lol.