| Fund Name |

|---|

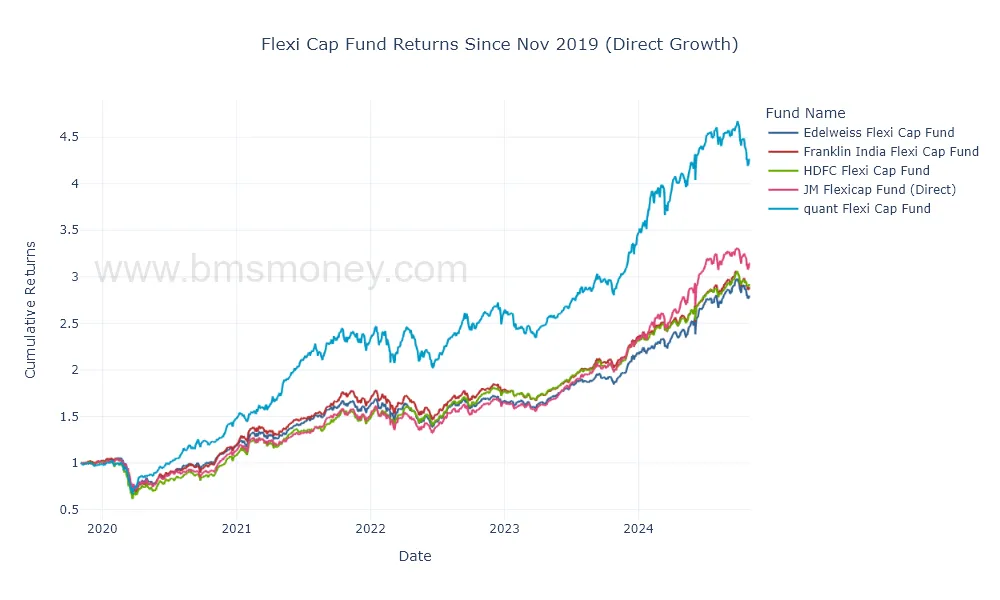

| quant flexi cap fund |

| JM Flexicap Fund |

| HDFC Flexi Cap Fund |

| Franklin India Flexi Cap Fund |

| Edelweiss Flexi Cap Fund |

| HSBC Flexi Cap Fund |

Top 10 small cap mutual funds based on 5 years SIP return.

| Fund Name |

|---|

| Quant Small Cap Fund |

| Nippon India Small Cap Fund |

| Tata Small Cap Fund |

| Bank of India Small Cap Fund |

| Invesco India Smallcap Fund |

| Edelweiss Small Cap Fund |

| Franklin India Smaller Companies Fund |

| Canara Robeco Small Cap Fund |

- Hurst exponent measures market behavior: trending, mean-reverting, or random.

- H > 0.5 indicates trending, suggesting continuation.

- H < 0.5 signals mean reversion, suggesting reversal.

- H = 0.5 implies randomness, resembling an efficient market.

- Useful for trend-following, mean-reversion strategies, and portfolio diversification.