- Once upon a time per capita GDP of India was higher than China. Now GDP per capita of India is one-sixth of China's GDP per capita.

- For year 2023, GDP per capita of India was 2239 USD and for China it was 12174 USD.

- In 2022, India had GDP per capita of 2099 USD whereas China GDP per capita was 11560 USD.

- In 2021 GDP per capita of India was $1936 whereas the GDP per capita of China stood at $11188.

Top 10 small cap mutual funds based on 5 years

| Fund Name |

|---|

| Quant Small Cap Fund |

| Nippon India Small Cap Fund |

| Franklin India Smaller Companies Fund |

| Bank Of India Small Cap Fund |

| Tata Small Cap Fund |

| Canara Robeco Small Cap Fund |

| Edelweiss Small Cap Fund |

| Invesco India Smallcap Fund |

| HDFC Small Cap Fund |

| Kotak Small Cap Fund |

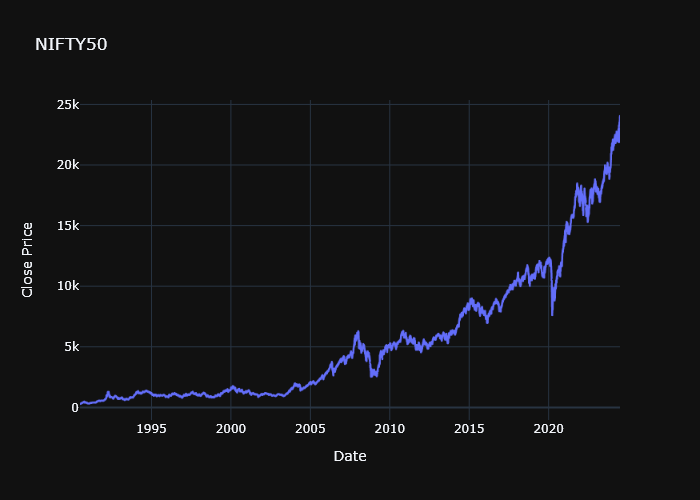

- longer investment horizon curtails chances of negative return, if someone has invested in NIFTY 50 for 10 more years he would not have received a negative return.

- For a ten-year investment period, the average return is 11.45% (CAGR).

- A 15-year investment period provides the best average return of 12.37% (CAGR).

- Since June 1994, NIFTY 50 has given a return of 10.35% (CAGR).