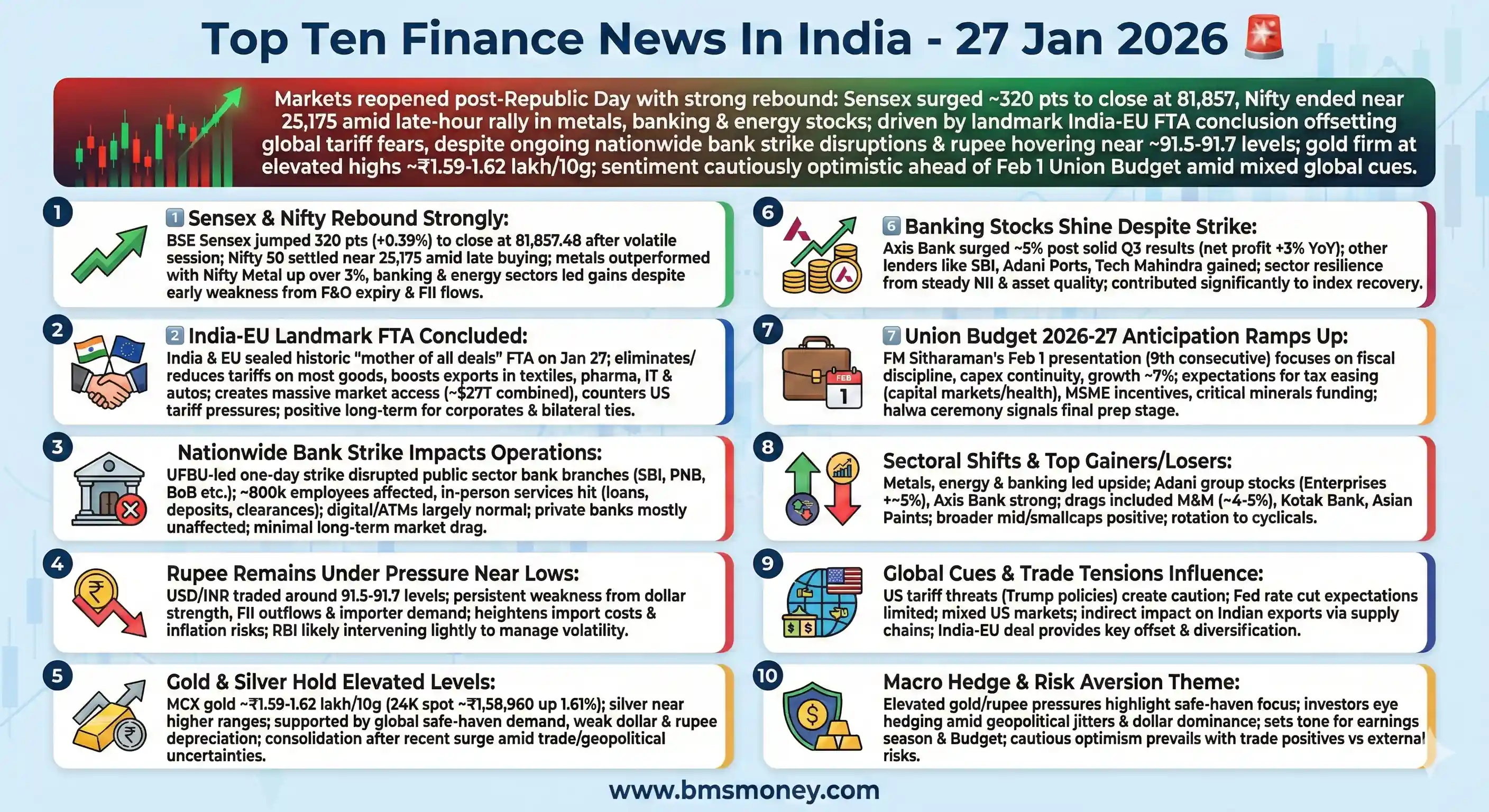

Indian markets staged a resilient bullish rebound on January 27, 2026, as optimism from a landmark India-EU free trade agreement countered persistent global trade tensions. The announcement fueled gains in metals, banking, and energy stocks, driving benchmark indices higher despite a disruptive nationwide bank strike. Attention now shifts to the upcoming Union Budget and the detailed implementation of the trade pact, while safe-haven demand continued to lift gold prices.

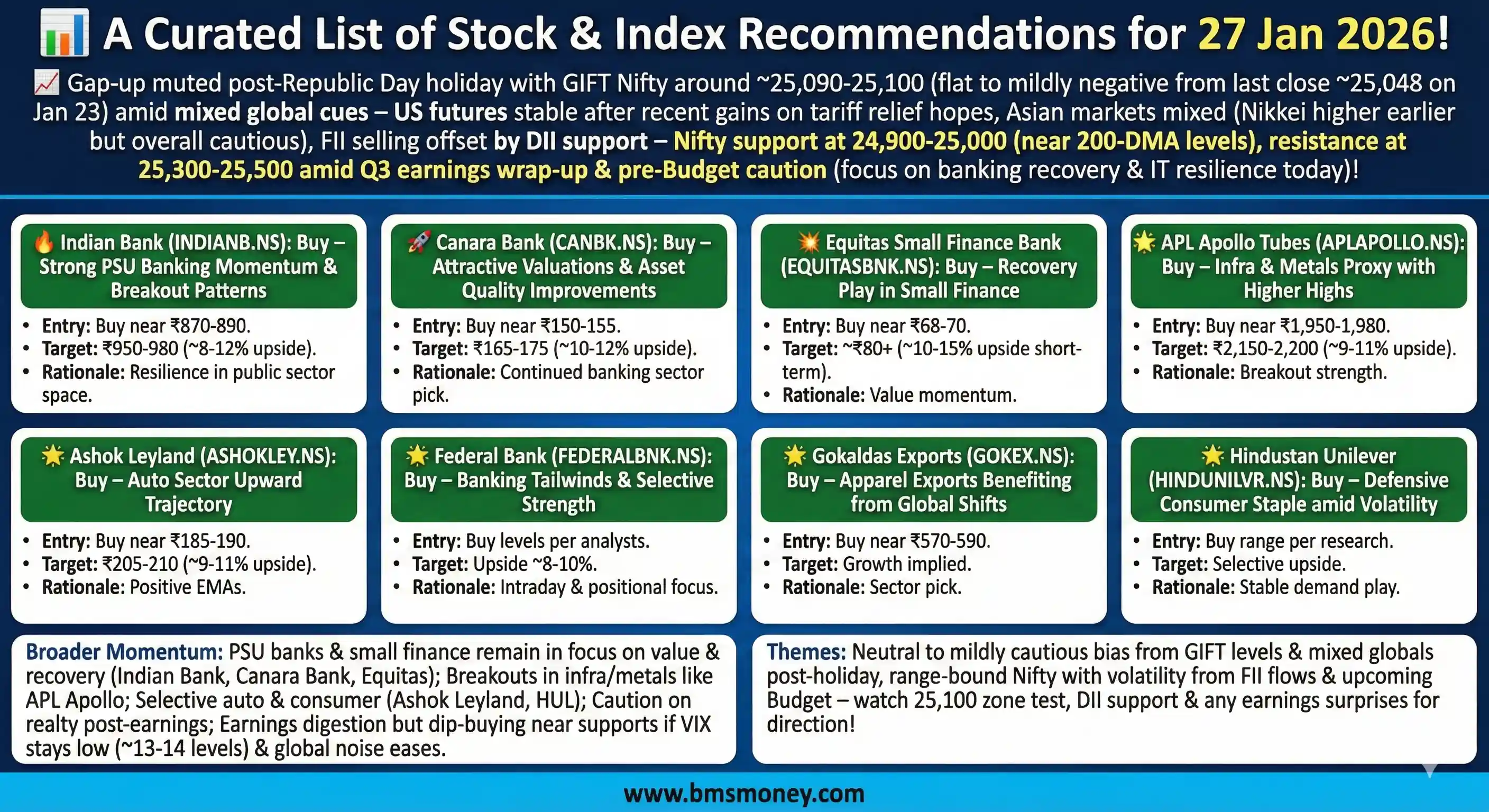

Markets anticipate a muted to slightly positive opening on January 27, 2026, after the Republic Day holiday, balancing easing geopolitical tensions with persistent global trade uncertainties.

-

Opening Signal: GIFT Nifty hints at a flat-to-positive start, suggesting a tentative recovery attempt.

-

Market Context: Trading resumes after a long weekend, with activity catching up to mixed global cues.

-

Sector Focus: Banking eyes RBI policy; IT and metals are buoyed by earnings and commodity trends.

Indian financial markets were closed for Republic Day on January 26, 2026, with investor focus shifting to upcoming developments in trade, banking labor relations, and currency and commodity markets.

-

Market Status: All major indices were closed for the national holiday, with no trading activity.

-

Key Development: A landmark India-EU trade deal was finalized, with an announcement pending.

-

Sector Alert: A nationwide bank strike is planned for January 27 over workweek demands.