This post will describe the methodology used for different calculations on this website.

Rolling Return

On this website following rolling returns for funds are displayed:

- 1-month rolling returns

- 3-month rolling returns

- 6-month rolling returns

- 1-year rolling returns, and

- 3-year rolling returns

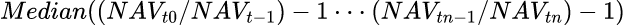

To calculate rolling returns following formula is used:

Here n (time period) for each rolling return is as follows.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fund Ranking Method

Fund Eligibility to be ranked

Each category must have 10 funds which are a minimum three-year-old. We do not consider AUM (Asset Under Management) as a criterion. Three-year data is used for ranking.

Rank Calculation

The fund is ranked based on the total score obtained for returns, risk, and risk-adjusted factors. The process for obtaining a ranking score for the fund is as follows:

- Calculated funds factor

- Calculate the mean and standard deviation for category

- Obtain the p-value for the fund using the mean and standard deviation of the category and factor value of the fund.

- Multiply the p-value of the fund with the weight of the factor.

Return

For return score calculation rolling return of the fund and percentage-positive returns are used.

Risk

For risk score calculation, VaR, standard deviation, and drawdown are used.

Risk-Adjusted Return

For risk-adjusted score calculation, Sharpe ratio, Sortino Ratio, and alpha are used.