Indian markets anticipate a positive opening on February 11, 2026, supported by steady global momentum and sustained optimism from the US-India trade agreement. Key sectors like consumption, autos, and banking are expected to lead gains, driven by fresh bullish calls and resilient emerging market sentiment.

Indian equity markets are poised for a positive opening on February 11, 2026, buoyed by upbeat global cues and steady pre-market indicators. Overnight, US markets ended mixed, with the Dow Jones Industrial Average edging up 0.1% to a record close amid easing AI-related concerns, while the S&P 500 and Nasdaq Composite dipped 0.33% and 0.59%, respectively. Asia-Pacific markets opened higher, extending their rally, with Hong Kong's Hang Seng futures up 0.3% and Australia's S&P/ASX 200 climbing 1.3%, though Japan's Nikkei was closed for a holiday. US futures pointed modestly higher, with S&P 500 futures rising 0.3%. Locally, Gift Nifty futures traded around 26,050-26,060, signaling a gain of about 80-90 points for the Nifty 50 at open, reflecting optimism from the US-India trade deal and resilient EM growth.

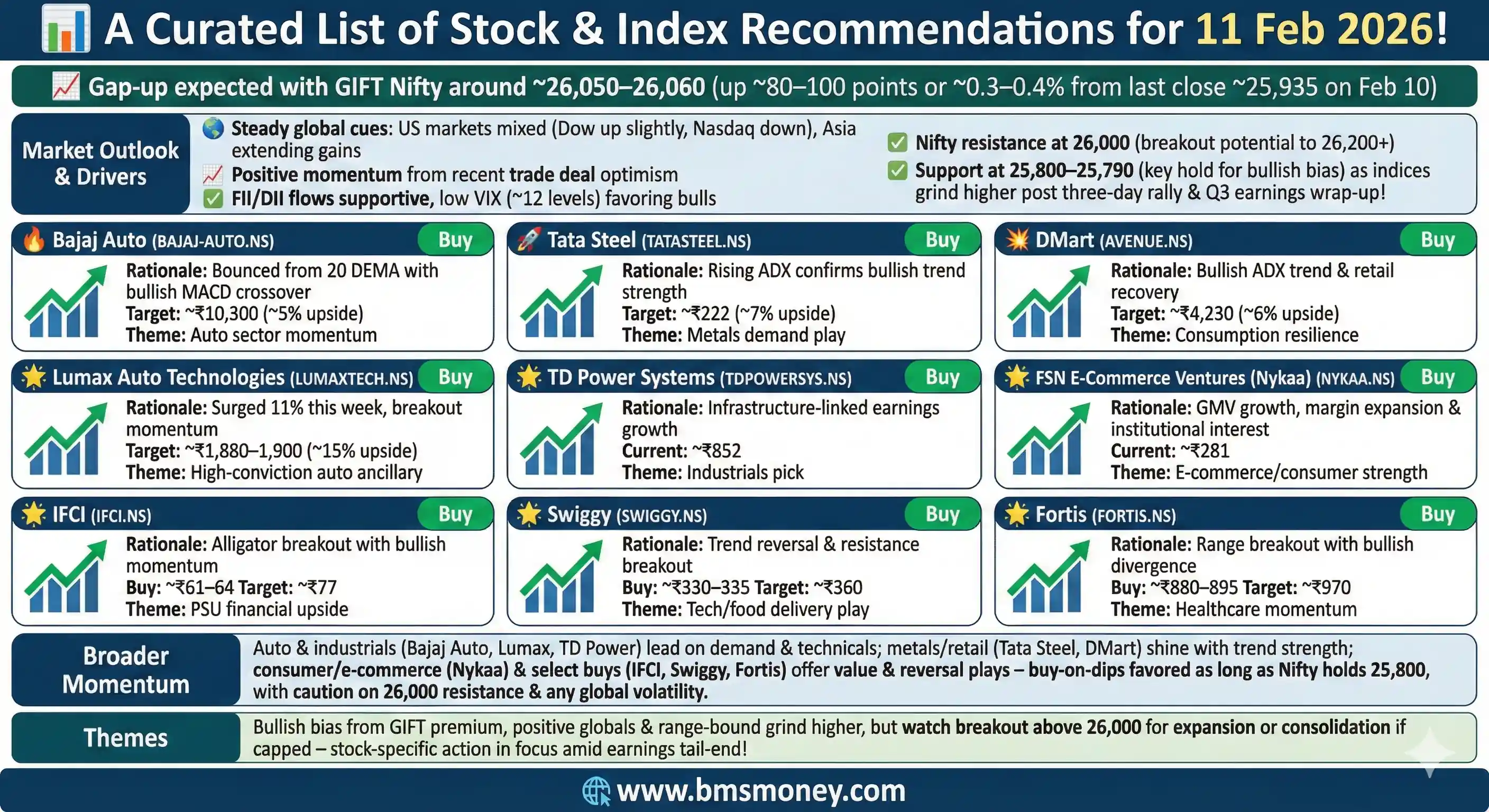

Top themes today include consumption recovery, auto sector momentum, and banking resilience amid policy stability. We aggregated around 15 unique recommendations from credible sources like Motilal Oswal, MarketSmith India, and The Hindu BusinessLine, focusing exclusively on fresh calls issued or updated today. Standout picks include Motilal Oswal's Buy on Bajaj Auto with a 5% upside potential, MarketSmith's Buy on FSN E-Commerce Ventures (Nykaa) citing e-commerce growth, and a bullish upgrade on Lumax Auto Technologies targeting ₹1,880-1,900. Investors should watch for volatility from global data releases, but the overall sentiment leans bullish as EM debt outlook brightens.

Section 1: Index Outlook

The Nifty 50 and Sensex are expected to extend their three-session rally, with analysts favoring a 'buy-on-dips' strategy amid positive global sentiment. The Nifty closed at 25,935.15 yesterday, up 0.26%, and is targeting 26,000-26,200 in the near term, supported by momentum indicators and lower volatility (India VIX down 4.6% to around 12). Sustained buying above 26,000 could push it toward record highs, while support lies at 25,790-25,900. The Sensex, ending at 84,273.92 (up 0.25%), eyes 84,500-85,000, with resistance at 84,500 and support at 84,000-83,800.

Bank Nifty remains range-bound but could rebound to 60,000 if it holds above 59,500, driven by private bank strength. Overall, the outlook is bullish, with potential upside from tariff reductions in the US-India deal and AI tailwinds, though softer US consumption data could cap gains.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Bullish | 26,000-26,200 | Momentum crossover, lower VIX, global rally | Moneycontrol, Spider Software |

| Sensex | Bullish | 84,500-85,000 | Buy-on-dips strategy, trade deal optimism | MSN, Business Standard |

| Bank Nifty | Neutral to Bullish | 59,500-60,000 | Private bank resilience, support hold | Spider Software |

Section 2: Sector-Wise Stock Picks

Today's recommendations span key sectors like auto, consumer, metals, and infrastructure, with a focus on earnings growth and valuation comfort. We grouped them by sector, deduplicating across sources. Total unique calls: 10-15, emphasizing buys with clear targets. Upside potentials range from 5-15%, based on current prices.

Auto & Industrials

The auto sector is in spotlight with strong Q3 PAT growth and bullish technicals. Motilal Oswal highlights momentum in two-wheelers and metals-linked plays.

- Bajaj Auto (BAJAJ-AUTO.NS) – Buy, Target: ₹10,300 (Upside: ~5%), Rationale: Bounced from 20 DEMA support with bullish MACD crossover; strong volume growth expected. Source: Motilal Oswal.

- Lumax Auto Technologies (LUMAXTECH.NS) – Buy, Target: ₹1,880-1,900 (Upside: ~15%), Rationale: Surged 11% this week, breaking resistance at ₹1,560; bullish outlook on auto demand. Source: The Hindu BusinessLine.

- TD Power Systems (TDPOWERSYS.NS) – Buy, Target: Not specified (Current: ₹852), Rationale: Infrastructure-linked order book and earnings momentum. Source: MarketSmith India.

Consumer & Retail

Consumption themes dominate with e-commerce and retail picks, amid improving profitability.

- FSN E-Commerce Ventures (Nykaa) (NYKAA.NS) – Buy, Target: Not specified (Current: ₹281), Rationale: Strong GMV growth, Ebitda margin expansion, and institutional interest in beauty e-commerce. Source: MarketSmith India.

- DMart (AVENUE.NS) – Buy, Target: ₹4,230 (Upside: ~6%), Rationale: Rising ADX confirms bullish trend; value retail recovery post-pullback. Source: Motilal Oswal.

Metals & Mining

High-volume earnings and cash flows drive picks here.

- Tata Steel (TATASTEEL.NS) – Buy, Target: ₹222 (Upside: ~7%), Rationale: Bullish trend strength with rising ADX; steady demand outlook. Source: Motilal Oswal.

- Hindustan Zinc (HINDZINC.NS) – Hold/Buy on dips, Target: Not specified, Rationale: Volume-driven earnings, robust cash flows amid zinc demand. Source: The Sunday Guardian.

- Coal India (COALINDIA.NS) – Hold, Target: Not specified, Rationale: Steady demand but thinning margins; valuation focus. Source: The Sunday Guardian.

Banking & Financials

Resilient amid RBI stability.

- Life Insurance Corporation (LICI.NS) – Buy on dips, Target: Not specified, Rationale: Rising profitability, benign claims, improving ROE. Source: The Sunday Guardian.

Infrastructure & Others

- Oswal Pumps (Not listed ticker) – Watch/Buy, Target: Not specified, Rationale: Strong Q3 PAT, improving RoE, infra order book. Source: The Sunday Guardian.

| Sector | Stock (Ticker) | Rec | Target (₹) | Upside (%) | Rationale | Source |

|---|---|---|---|---|---|---|

| Auto | Bajaj Auto (BAJAJ-AUTO.NS) | Buy | 10,300 | 5 | MACD crossover, volume growth | Motilal Oswal |

| Auto | Lumax Auto (LUMAXTECH.NS) | Buy | 1,880-1,900 | 15 | Breakout surge, demand outlook | Hindu BusinessLine |

| Consumer | Nykaa (NYKAA.NS) | Buy | N/A | N/A | GMV growth, margin expansion | MarketSmith India |

| Retail | DMart (AVENUE.NS) | Buy | 4,230 | 6 | Bullish ADX, retail recovery | Motilal Oswal |

| Metals | Tata Steel (TATASTEEL.NS) | Buy | 222 | 7 | Trend strength, demand | Motilal Oswal |

Section 3: Global & Thematic Insights

Global brokerages remain constructive on India, with Morgan Stanley highlighting a potential structural re-rating amid valuation corrections and growth surprises. EM debt outlook is bright, with easing inflation and non-dollar asset demand favoring India. CLSA sees value in consumption plays like DMart, while Macquarie notes strong M&A activity in India. Thematic focus: AI diffusion and energy transition, with Goldman Sachs noting resilient EM growth despite China overcapacity. BSE/NSE announcements today were routine, with no major block deals implying shifts, but earnings calls (e.g., Aarti Pharmalabs) signal ongoing investor meets.

Conclusion & Disclaimer

The market sentiment is bullish, with indices eyeing higher levels and stocks in auto and consumer sectors leading. Investors should watch Bajaj Auto and Lumax Auto for quick upsides amid trade deal benefits.

This is aggregated data for informational purposes; consult a financial advisor. Not investment advice. Market conditions can change rapidly.

Sources & Citations

- Axis Direct: https://simplehai.axisdirect.in/research/research-reports

- Business Line (The Hindu BusinessLine): https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-11th-february-2026/article70615320.ecehttps://www.thehindubusinessline.com/multimedia/video/lumax-auto-technologies-stock-recommendation-february-2026/article70615441.ecehttps://www.thehindubusinessline.com/portfolio/day-trading-guide/day-trading-guide-for-february-11/article70615463.ecehttps://www.thehindubusinessline.com/portfolio/technical-analysis/stock-to-buy-today-lumax-auto-technologies-163970-buy/article70615346.ece

- Business Standard: https://www.business-standard.com/markets/news/nifty-bank-nifty-strategy-3-stocks-recommendations-today-by-motilal-oswal-126021100083_1.htmlhttps://www.business-standard.com/markets/news/stock-market-live-february-11-nse-bse-sensex-today-gift-nifty-q3-results-ipo-share-market-today-126021100081_1.html

- CNBC TV18: https://www.cnbctv18.com/market/after-insurance-and-tech-stocks-these-shares-become-the-next-ai-casualty-ws-l-19847176.htmhttps://www.cnbctv18.com/market/trade-setup-for-february-11-nifty-grinds-higher-but-26000-remains-a-barrier-ws-l-19846914.htm

- CZ App: https://www.czapp.com/analyst-insights/india-sugar-vs-ethanol-10th-february-2026

- Financial Express: https://www.financialexpress.com/market/10-buy-recommendations-by-jm-financial-with-up-to-97-upside-potential/4137886https://www.financialexpress.com/market/from-bhel-titan-britannia-to-bharti-airtel-here-are-10-stocks-to-watch-4138317https://www.financialexpress.com/market/sensex-nifty-50-stock-market-today-updates-india-us-asia-nikkei-gold-silver-rate-curde-oil-11feb2026-4138402https://www.financialexpress.com/market/stock-insights/forget-mega-caps-2-under-the-radar-power-stocks-pivoting-for-indias-next-renewable-super-cycle/4138273https://www.financialexpress.com/market/stock-insights/recycling-renaissance-3-stocks-positioning-for-indias-stricter-battery-amp-e-waste-epr-norms/4138266

- Geojit: https://insights.geojit.com/2026/01/29/geojits-rated-funds-under-review-february-2026

- Goldman Sachs: https://www.goldmansachs.com/insights/articles/the-outlook-for-indias-economy-in-2026-amid-new-us-tradedeal

- HSBC Asset Management: https://www.assetmanagement.hsbc.co.in/assets/documents/mutual-funds/en/cb11e14d-e749-4ce0-aede-050323fc0295/monday-market-flash-february-09-2026.pdf

- ICICI Direct: https://www.icicidirect.com/mailcontent/idirect_marketstrategy_2026.pdfhttps://www.icicidirect.com/mailimages/derivatives_view.pdfhttps://www.icicidirect.com/mailimages/momentum_picks.pdfhttps://www.icicidirect.com/share-market-todayhttps://www.icicidirect.com/share-market-today/market-news-commentary/benchmarks-trade-higher-media-shares-surge/1673952https://www.icicidirect.com/share-market-today/market-news-commentary/sensex-jumps-327-pts-auto-shares-in-demand/1674400https://www.icicidirect.com/share-market-today/market-news-commentary/sensex,-nifty-post-modest-gains,-extend-three-day-winning-streak/1674715

- Livemint: https://www.livemint.com/market/stock-market-news/indian-stock-market-7-key-things-that-changed-for-market-overnight-gift-nifty-dow-jones-record-close-to-msci-rejig-11770737573217.htmlhttps://www.livemint.com/market/stock-market-news/nifty-50-sensex-today-what-to-expect-from-indian-stock-market-in-trade-on-february-11-11770737342635.htmlhttps://www.livemint.com/market/stock-market-news/retail-investor-sentiment-india-bse-shareholding-data-11770723980360.htmlhttps://www.livemint.com/market/stock-market-news/stock-recommendations-for-11-february-from-marketsmith-india-11770723088618.htmlhttps://www.livemint.com/market/stock-market-news/stocks-to-buy-raja-venkatraman-11-february-nifty-sensex-campus-activewear-max-financial-services-hcl-technologies/amp-11770730718236.html

- MarketScreener: https://www.marketscreener.com/news/diary-india-economic-corporate-events-on-february-11-ce7e5adcd189f52c

- Moneycontrol: https://www.moneycontrol.com/news/business/markets/first-tick-top-global-cues-to-watch-in-today-s-trade-95-13821341.htmlhttps://www.moneycontrol.com/news/business/markets/stock-market-live-updates-gift-nifty-indicates-a-firm-start-us-markets-mixed-asia-gains-liveblog-13822593.html/amphttps://www.moneycontrol.com/news/business/markets/trade-setup-for-february-11-top-15-things-to-know-before-the-opening-bell-2-13822402.htmlhttps://www.moneycontrol.com/news/business/markets/trade-spotlight-how-should-you-trade-pvr-inox-dcb-bank-hindustan-unilever-birlasoft-bajaj-auto-and-others-on-february-11-13822566.htmlhttps://www.moneycontrol.com/news/business/markets/stocks-to-watch-today-apollo-hospitals-titan-ather-energy-bhel-ion-exchange-tvs-supply-heg-torrent-power-jubilant-foodworks-eicher-motors-in-focus-on-11-february-13822480.html

- Morgan Stanley: https://www.morganstanley.com/im/en-cl/institutional-investor/insights/articles/why-invest-in-asian-private-equity.htmlhttps://www.morganstanley.com/im/en-nl/institutional-investor/insights/tales-from-the-emerging-world/the-unexpected-winners-of-a-divided-world.htmlhttps://www.morganstanley.com/im/fr-fr/institutional-investor/insights/articles/a-bright-outlook-for-emd.htmlhttps://www.morganstanley.com/insightshttps://www.morganstanley.com/insights/podcasts/thoughts-on-the-markethttps://www.morganstanley.com/insights/podcasts/thoughts-on-the-market/india-market-momentum-2026-ridham-desai

- Motilal Oswal: https://www.motilaloswal.com/news/stocks/116057

- MSN: https://www.msn.com/en-in/money/markets/stock-market-after-budget-2026-feb-2-sensex-rebounds-943-points-in-volatile-trade-nifty-hits-double-ton-to-sit-at-25088-key-factors-behind-rally/ar-AA1VtXOT?apiversion=v2&batchservertelemetry=1&domshim=1&noservercache=1&noservertelemetry=1&renderwebcomponents=1&wcseo=1

- NSE India: https://www.nseindia.com/get-quote/derivatives/NIFTY/NIFTY-50?identifier=OPTIDXNIFTY03-02-2026CE25750.00https://www.nseindia.com/market-data/large-dealshttps://www.nseindia.com/market-data/top-gainers-losers

- Replete Equities: https://www.repleteequities.com/tomorrow-market-prediction-nifty-banknifty-feb-11-2026?srsltid=AfmBOorTtUapsCgyrXZM0_Q5j0oFBDR9JukDOdRLXokssbnuln11Mwwn

- Samco: https://www.samco.in/knowledge-center/articles/nifty-holds-gap-support-inches-closer-to-26000-as-volatility-eases-stock-market-today

- Screener: https://www.screener.in/screens/2548157/multibagger-stock-2026https://www.screener.in/screens/3187942/best-stock-in-2026

- Spider Software: https://www.spidersoftwareindia.com/blog/stock-market-prediction-for-nifty-bank-nifty-11th-february-2026

- The Economic Times: https://m.economictimes.com/markets/stocks/news/ahead-of-market-10-things-that-will-decide-stock-market-action-on-monday/articleshow/128067643.cms

- The Sunday Guardian: https://sundayguardianlive.com/business/stocks-to-watch-today-february-11-apollo-oswal-pumps-hindustan-zinc-life-insurance-coal-india-ashoka-buildcon-lead-market-action-169695

- Trendlyne: https://trendlyne.com/equity/group-insider-trading-sasthttps://trendlyne.com/posts/5521084/ipo-market-gains-traction-with-mainline-offerings-making-a-comebackhttps://trendlyne.com/stock-screeners/simple-moving-average/crosses-above/sma-150https://trendlyne.com/stock-screeners/simple-moving-average/crosses-above/sma-50/today/index/NIFTY500/nifty-500

- UBS: https://advisors.ubs.com/mediahandler/media/778486/UBS%20House%20View%20February%202026.pdfhttps://www.ubs.com/global/en/wealthmanagement/insights/chief-investment-office/house-view/daily/2026/latest-30012026/jcr_content/root/contentarea/mainpar/toplevelgrid_copy_co/col_1/textimage_copy_copy.1645661600.file/dGV4dD0vY29udGVudC9kYW0vYXNzZXRzL3dtL2dsb2JhbC9jaW8vaG91c2Utdmlldy9kb2N1bWVudC9jaW8tbW9udGhseS1leHRlbmRlZC1lbi0xNjUzMzU2LnBkZg==/cio-monthly-extended-en-1653356.pdfhttps://www.ubs.com/uk/en/assetmanagement/insights/asset-class-perspectives/fixed-income/articles/positioning-for-growth/_jcr_content/root.0418417577.file/PS9jb250ZW50L2RhbS9hc3NldHMvYXNzZXQtbWFuYWdlbWVudC1yZWltYWdpbmVkL2dsb2JhbC9ub2luZGV4L3N0YXRpYy9pbnNpZ2h0L2Fzc2V0LWNsYXNzLXBlcnNwZWN0aXZlcy9maXhlZC1pbmNvbWUvZG9jcy9wb3NpdGlvbmluZy1mb3ItZ3Jvd3RoLnBkZg==/positioning-for-growth.pdf

- YouTube: https://www.youtube.com/watch?v=HKy33SbPckUhttps://www.youtube.com/watch?v=akn48UBqyDkhttps://www.youtube.com/watch?v=dTIYa3So9eE