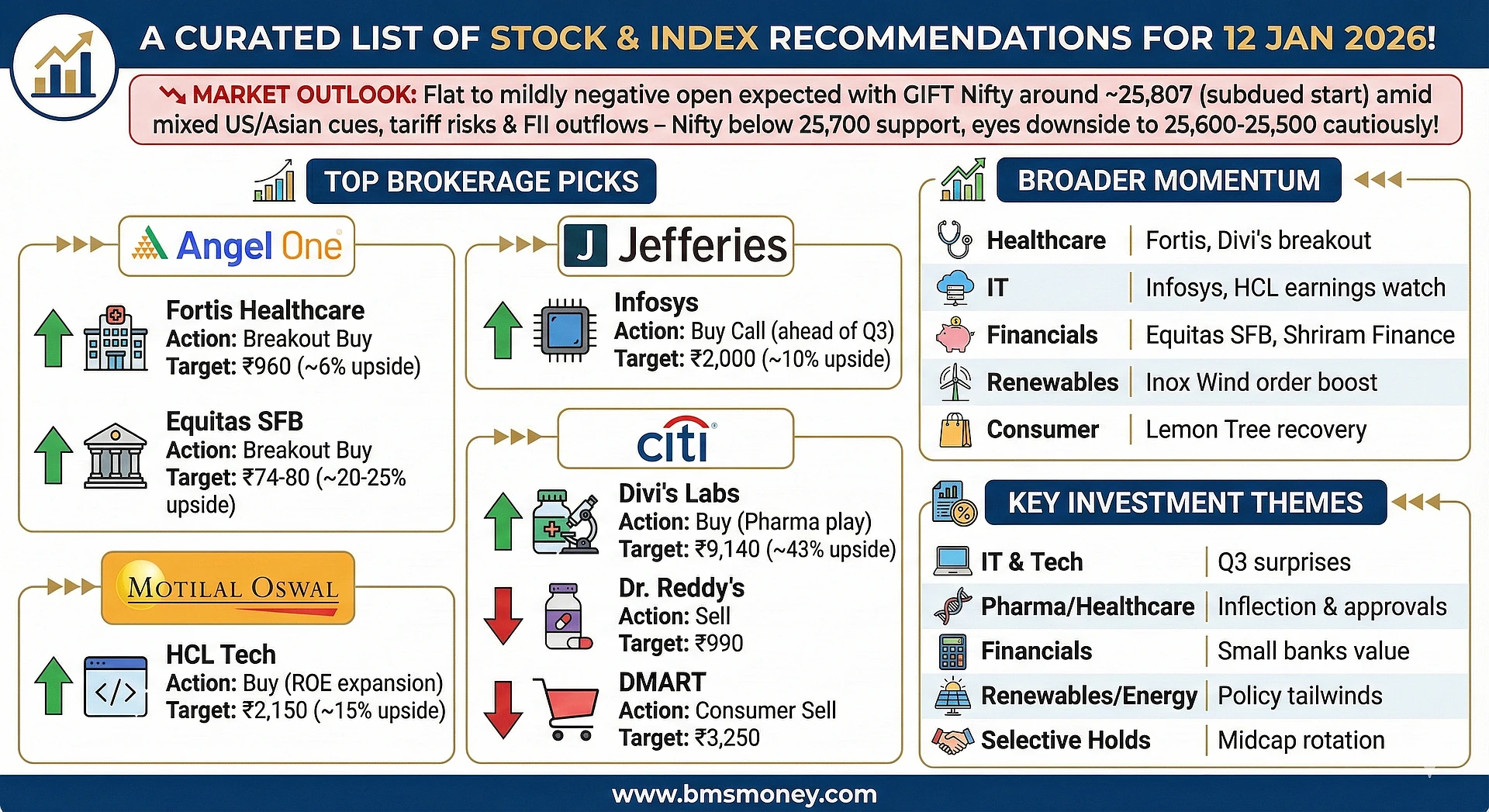

Markets face a flat to mildly negative start on January 12, 2026, as global cues remain mixed and selling pressure persists ahead of key Q3 earnings.

Key Themes & Picks

-

GIFT Nifty signals a subdued start, reflecting persistent selling pressure.

-

Cautious sentiment prevails ahead of major IT and banking results.

-

Healthcare and financials see renewed focus amid regulatory updates.

-

Key picks: Fortis Healthcare and Equitas Small Finance Bank highlighted.

-

US-India trade developments remain a key volatility monitor.

The Indian stock market is poised for a flat to mildly negative opening on January 12, 2026, amid mixed global cues and sustained selling pressure from the previous week. Gift Nifty futures were trading at around 25,807.50 early Monday, signaling a subdued start for the benchmark Nifty 50, which closed the prior session at 25,683.30 after a 0.75% decline. Overnight, US markets ended on a high note with the S&P 500 reaching a fresh record close at 6,966.28, driven by gains in chipmakers like Broadcom, while Asian markets showed mixed performances—Australia's S&P/ASX 200 up 0.71% and South Korea's Kospi gaining 0.83%, but with Japan closed for a holiday. Oil prices rose modestly as protests in Iran intensified, with Brent crude at $62.43 a barrel.

Key themes today include cautious sentiment in IT and banking sectors ahead of Q3 earnings from majors like TCS and HCLTech, alongside renewed focus on healthcare and financials amid regulatory updates. A total of around 15-20 recent recommendations were aggregated from credible sources, though fresh calls specifically dated January 12 were sparse due to the early timing of the report (pre-market snapshot). Standout calls include Angel One's buy on Fortis Healthcare (target ₹960) and Equitas Small Finance Bank (target ₹74-80), alongside broader upgrades in renewables and pharma from global firms like Citi and Jefferies. Investors should monitor US-India trade developments and potential tariff rulings for volatility.

Section 1: Index Outlook

Analyst sentiment on major indices remains neutral to bearish in the near term, with momentum indicators pointing to downside risks if key supports break. The Nifty 50 faces resistance at 25,900-26,000, while a breach below 25,700 could accelerate declines toward 25,600-25,500. Sensex outlook mirrors this, with global cues from US jobs data providing some uplift but offset by FII outflows of ₹3,769 crore last session. Bank Nifty, under pressure from rate uncertainties, is seen consolidating around 52,000-53,000.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Neutral (Hold) | 25,500-26,000 | Bearish momentum; Q3 IT earnings watch; US tariff risks | HDFC Securities, Centrum Broking |

| Sensex | Neutral | 83,000-85,000 | Mixed global cues; FII selling pressure | Moneycontrol Market Outlook |

| Bank Nifty | Bearish | 52,000-53,500 | Banking sector caution amid RBI policy signals | Nilesh Jain, Centrum Broking |

| Nifty Midcap 100 | Neutral | 58,000-60,000 | Selective buying in midcaps; value in renewables | Goodreturns Market Analysis |

Overall, indices are expected to trade range-bound with downside bias unless positive Q3 surprises emerge.

Section 2: Sector-Wise Stock Picks

Banking & Financials

Financial stocks remain in focus amid FII flows and tariff concerns. Analyst calls emphasize value in small finance banks and selective NBFCs.

- Equitas Small Finance Bank (EQUITASBNK.NS) – Buy, Target: ₹74-80 (Upside ~20-25%), Rationale: Bullish breakout above key EMAs; strong Q3 growth expected in lending. Source: Angel One.

- Shriram Finance (SHRIRAMFIN.NS) – Hold, Target: ₹3,200 (Upside ~5%), Rationale: Steady asset quality; watch for Q3 disbursements. Source: Moneycontrol Stocks to Watch.

IT & Tech

IT sector outlook is mixed with downgrade risks for FY27, but select picks like Infosys and HCLTech are favored ahead of earnings.

- Infosys (INFY.NS) – Buy, Target: ₹2,000 (Upside ~10%), Rationale: Strong EPS CAGR; positioned for AI-driven growth. Source: Jefferies.

- HCL Technologies (HCLTECH.NS) – Buy, Target: ₹2,150 (Upside ~15%), Rationale: ROE expansion; consistent earnings amid global tech race. Source: Motilal Oswal.

Healthcare & Pharma

Healthcare sees bullish calls on hospitals and labs, with Citi highlighting inflection points.

- Fortis Healthcare (FORTIS.NS) – Buy, Target: ₹960 (Upside ~6%), Rationale: Bullish chart pattern; ARPU growth in Q3. Source: Angel One.

- Divi's Laboratories (DIVIS.NS) – Buy, Target: ₹9,140 (Upside ~43%), Rationale: Key drug launches in 2026; earnings inflection. Source: Citi.

- Dr. Reddy's Laboratories (DRREDDY.NS) – Sell, Target: ₹990 (Downside ~28%), Rationale: Semaglutide challenges; margin pressure. Source: Citi.

Consumer & Retail

Retail picks focus on Q3 updates, with margin concerns in quick commerce.

- Avenue Supermarts (DMART.NS) – Sell, Target: ₹3,250 (Downside ~15%), Rationale: Slowing SSSG; competitive intensity. Source: Citi.

- Lemon Tree Hotels (LEMONTREE.NS) – Hold, Target: ₹150 (Upside ~5%), Rationale: Reorganization for growth; occupancy recovery. Source: Moneycontrol Stocks to Watch.

Renewables & Energy

Renewables attract buys on structural growth, though supply waves temper energy.

- Inox Wind (INOXWIND.NS) – Buy, Target: ₹203 (Upside ~78%), Rationale: Order book strength; policy tailwinds. Source: ETMarkets.

Section 3: Global & Thematic Insights

Global brokerages like Morgan Stanley highlight India's underrepresentation in indices (1.7% weight vs. 3.4% GDP share), seeing opportunities in high-quality firms amid AI and infrastructure themes. Macquarie and Jefferies favor midcaps in renewables, with CLSA noting rotation in 2026 strategies. BSE/NSE announcements include corporate filings like press releases from Websol Energy on government ties, but no major regulatory shifts today. Thematic focus: US-China AI race boosting IT picks; energy supply waves supporting oil-related holds.

Conclusion & Disclaimer

Overall market sentiment leans neutral-bearish, with selective bullishness in healthcare and IT. Investors should watch Fortis, Equitas SFB, and Divi's Labs for near-term plays. This is a pre-market snapshot—updates may evolve post-open.

This is aggregated data for informational purposes; consult a financial advisor. Not investment advice. Market risks apply.

Sources & Citations

- Moneycontrol.com (Trade Setup, Stocks to Watch)

- CNBC-TV18 (Analyst Ratings, IT Outlook)

- Economic Times (Stock Picks, Nifty500 Upsides)

- Business Standard (Angel One Calls)

- NSE India (Announcements)

- Morgan Stanley Research (India Insights)