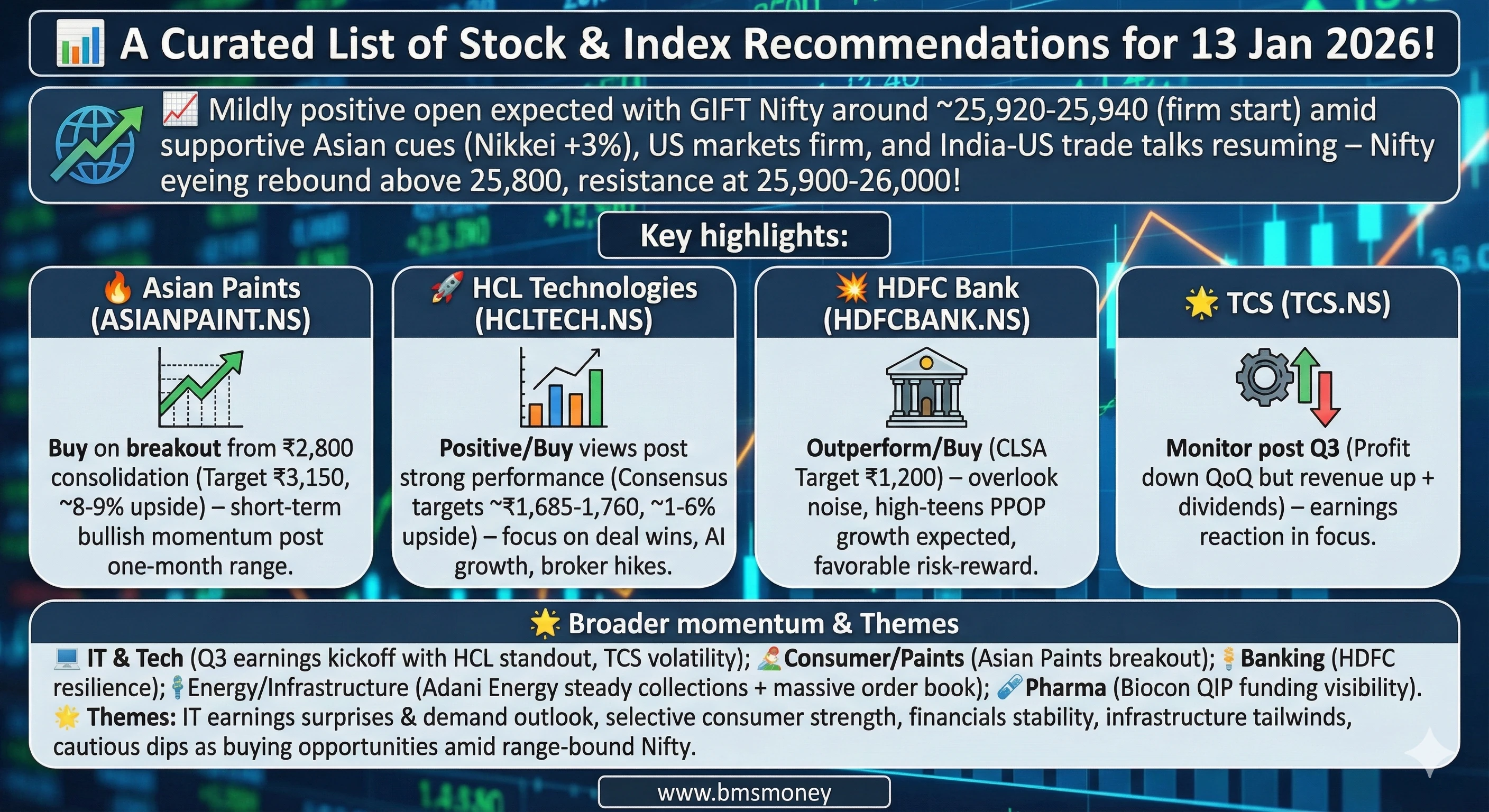

Markets anticipate a mildly positive start on January 13, 2026, supported by strong global cues as the Q3 earnings season gains momentum.

Key Themes & Picks

-

GIFT Nifty signals a firm opening, supported by strong global gains.

-

Q3 earnings season kicks off with mixed reactions to TCS results.

-

Focus shifts to stock-specific opportunities in paints, banking, and IT.

-

Key picks: Asian Paints and HCL Technologies highlighted for potential upside.

-

Nifty resistance near 26,000 may cap gains amid earnings volatility.

Indian equity markets are poised for a mildly positive opening on January 13, 2026, buoyed by supportive global cues. Gift Nifty futures were trading around 25,920–25,942 levels in early pre-market hours, signaling a firm to positive start compared to the Nifty 50's previous close near 25,790. Asian markets showed strength, with Japan's Nikkei jumping significantly, while US markets closed higher overnight despite some futures softness. Key themes include the kickoff of Q3 earnings season (with TCS delivering mixed results: profit decline but revenue growth and dividend), focus on IT post-earnings reactions, and selective stock-specific opportunities in paints, banking, and energy.

Analyst activity today centers on individual stocks rather than sweeping index or sector upgrades, with notable fresh calls on Asian Paints (bullish breakout) and positive brokerage views on HCL Technologies amid its performance. Around 10-15 credible mentions emerged from morning updates and live portals. Standout picks include a Buy on Asian Paints with short-term upside potential to ₹3,150 and constructive notes on HDFC Bank and HCLTech. Pre-market snapshot as of ~7:35 AM IST: Optimism from global flows supports, but earnings volatility could introduce swings—watch Nifty resistance near 26,000.

Section 1: Index Outlook

Nifty 50 rebounded after a recent losing streak, forming a potential bullish reversal, though momentum indicators and elevated VIX warrant caution. Resistance looms at 25,900–26,000 (aligned with 20-day EMA); support at 25,700–25,500. Bank Nifty faces pressure below 59,000. Overall, range-bound to mildly bullish bias prevails, with dips offering buying chances if key supports hold.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Cautious Buy on Dips | 25,900–26,000 (resistance); Support 25,700 | Rebound post-losing streak; Sustain above 26,000 for upside momentum | Moneycontrol Trading Plan |

| Sensex | Neutral | Align with Nifty | Global support but domestic caution | Financial Express |

| Bank Nifty | Sell on Rise | Below 59,000 risks to 58,800 | Bearish below support; Potential further downside | Moneycontrol |

Sentiment leans neutral to mildly bullish, with 26,000 as a pivotal level for bulls.

Section 2: Sector-Wise Stock Picks

Recommendations remain stock-centric, driven by technical breakouts, earnings reactions, and corporate updates. Key sectors: Consumer (Paints), IT (post-Q3), Banking, and Energy/Infrastructure.

Consumer Durables & Paints

- Asian Paints (ASIANPAINT.NS) – Buy, Current ~₹2,896. Target: ₹3,150 (upside ~8-9%). Rationale: Broken one-month consolidation around ₹2,800 with positive momentum; short-term bullish outlook. Source: The Hindu BusinessLine (January 13 recommendation).

IT & Tech

- HCL Technologies (HCLTECH.NS) – Positive/Buy, Targets around ₹1,700+ (consensus ~₹1,685, upside ~1-2% from recent levels). Rationale: Strong Q3 traction with deal wins and AI/digital platforms; brokerages maintain constructive views on growth/margins. Source: NDTV Profit Brokerage Radar; Trendlyne Consensus.

- Tata Consultancy Services (TCS.NS) – Monitor (Mixed post-Q3). Rationale: Profit down QoQ but revenue up; dividend declared—expect volatility on results reaction. Source: NDTV Profit Live Updates.

Banking & Financials

- HDFC Bank (HDFCBANK.NS) – Outperform/Buy, Target ~₹1,200. Rationale: Overlook short-term noise; expect high-teens core PPOP growth, improving opex efficiency. Source: The Hindu BusinessLine Live (CLSA note).

Energy & Infrastructure

- Adani Energy Solutions – Watch. Rationale: Steady 101.75% collection efficiency; strong ₹77,787 Cr order book in transmission. Source: India Infoline Top Stocks.

Pharma & Healthcare

- Biocon (BIOCON.NS) – Watch. Rationale: Corporate actions in focus (e.g., potential funding visibility). Source: NDTV Profit Stocks to Watch.

Limited broad sector calls; emphasis on earnings and technical setups.

Section 3: Global & Thematic Insights

Global views stay constructive on India for 2026, focusing on earnings recovery, domestic flows, and midcap value. No major fresh India-specific upgrades from globals like Jefferies/CLSA today, but ongoing positive bias amid EPS growth expectations. Regulatory/BSE-NSE: No major announcements tied to recommendations.

Conclusion & Disclaimer

Overall sentiment: Neutral to mildly bullish, with selective buying in quality names amid earnings kickoff. Investors should monitor Nifty support at 25,700 and earnings-driven moves in IT heavyweights.

Actionable takeaway: Dips in Asian Paints or HCLTech offer potential entry points; track TCS volatility closely.

Disclaimer: This is aggregated data from public sources for informational purposes only. It is not investment advice. Markets are volatile; consult a qualified advisor before acting. Past performance is no guarantee of future results.

Sources & Citations

- Gift Nifty & Pre-market: Moneycontrol Live Updates, NDTV Profit, Financial Express.

- Index Outlook: Moneycontrol Trading Plan, Economic Times Pre-market.

- Stock Picks: The Hindu BusinessLine Asian Paints, NDTV Profit Brokerage Radar, India Infoline Top Stocks, NDTV Profit Stocks to Watch.

- Live Updates: CNBC-TV18, BusinessLine Live.