Markets are set for a cautious, muted start on January 14, 2026, following mixed global cues and continued volatility, with a focus on key Q3 earnings.

Key Themes & Picks

-

GIFT Nifty points to a muted-to-slightly-negative opening.

-

Banking resilience and key IT earnings (Infosys) in focus.

-

Energy stocks see traction amid crude oil movements.

-

Key picks: Bullish outlook on Oil India and selected financials.

-

Persistent FII outflows may cap upside despite long-term optimism.

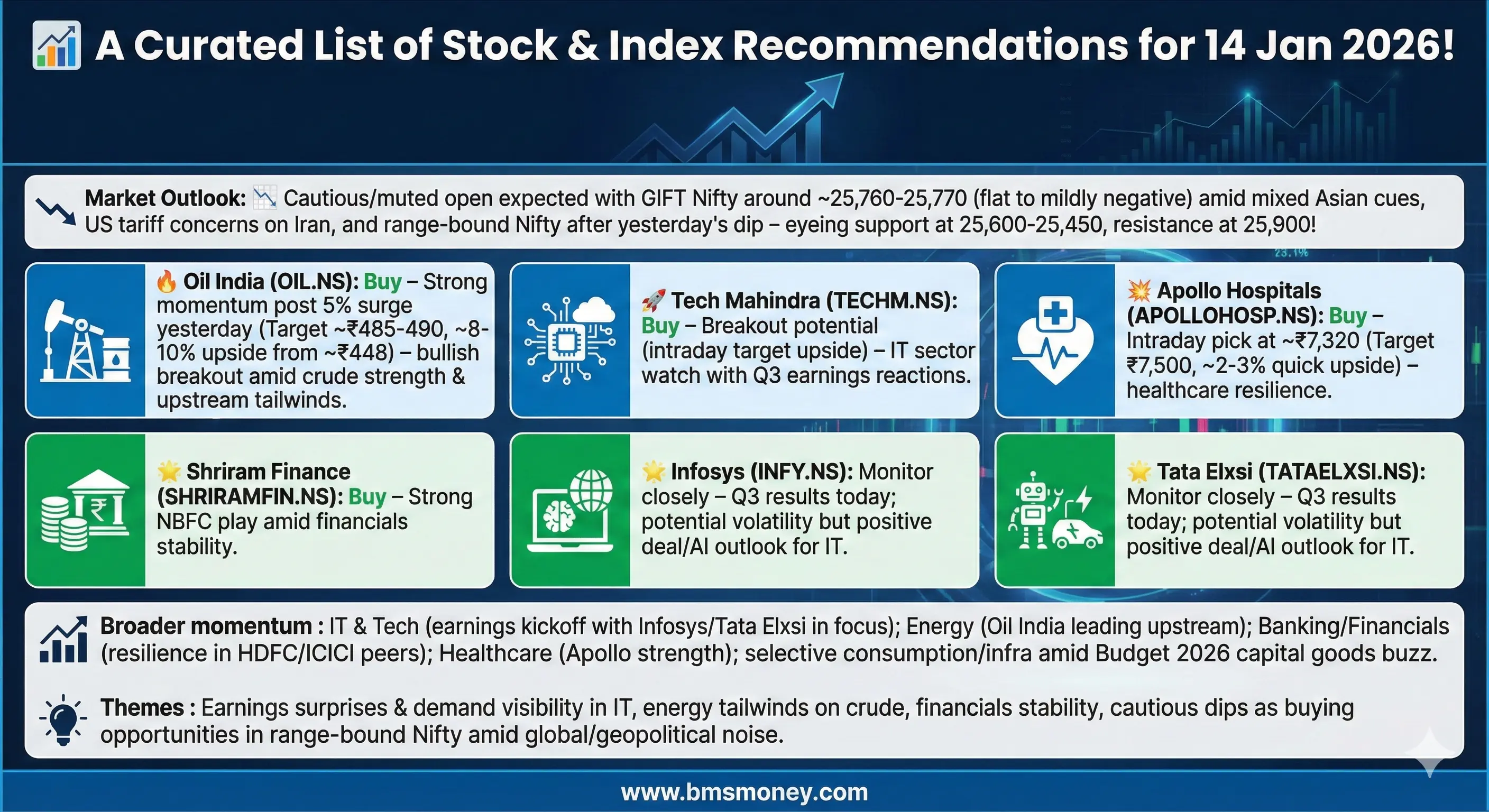

As the Indian stock market gears up for another trading session on January 14, 2026, pre-market indicators point to a cautious start amid mixed global cues. Overnight, U.S. markets ended lower with selling pressure in financial stocks, while Asian markets showed varied performance. The Gift Nifty futures were trading down by around 0.07% to 0.10% early today, hovering between 25,747 and 25,760, signaling a muted to slightly negative open for the Nifty 50 and Sensex. This comes after a volatile session on January 13, where the Nifty closed at 25,732.30 (down 0.22%) and the Sensex at 83,627.69 (down 0.30%), influenced by profit-taking and geopolitical tensions.

Key themes dominating today's market include banking sector resilience amid upcoming earnings, IT stocks in focus with Q3 results from players like Infosys and Tata Elxsi, and energy picks driven by crude oil movements. Global brokerages like Morgan Stanley remain optimistic on India's long-term growth, projecting structural upsides despite short-term volatility. A total of around 25-30 fresh or updated recommendations were aggregated from credible sources today, emphasizing selective buys in defensives and growth-oriented sectors. Standout calls include Oil India's bullish outlook from Hindu BusinessLine, upgrades in financials from Motilal Oswal, and thematic picks from Goldman Sachs' earlier framework reiterated in recent analyses. Investors should watch for volatility, with India VIX easing but FII outflows potentially capping upsides.

Section 1: Index Outlook

The overall sentiment for major indices remains neutral to cautious, with analysts expecting range-bound trading unless key resistance levels are breached. Global uncertainties, including U.S. inflation data and Middle East tensions, are weighing on sentiment, but domestic DII buying provides downside support. The Nifty 50 faces immediate support at 25,600 and resistance at 25,900 (50 DEMA), while the Sensex could test 83,100-83,200 on the lower end. Bank Nifty shows relative strength, closing up 0.22% yesterday at 59,578.80.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Neutral/Cautious | 25,600-25,900 | Volatility from F&O expiry, global cues; sustain above 25,900 for bullish reversal | Business Standard, 5Paisa |

| Sensex | Hold/Sell on Rise | 83,100-84,000 | Defensive sector shift, weak early cues; neutral-to-cautious stance | ET Now, Hindu BusinessLine |

| Bank Nifty | Bullish | 59,500-60,000 | Banking earnings momentum, DII support; resilience ahead of results | Replete Equities, 5Paisa |

Analysts from Religare Broking suggest a "sell-on-rise" approach for Nifty until it reclaims 26,000, citing earnings reactions and global risks. However, a break above 25,900 could trigger short-covering towards 26,000-26,200.

Section 2: Sector-Wise Stock Picks

Today's recommendations lean towards selective buys in banking, IT, and energy sectors, with rationales tied to earnings visibility, technical breakouts, and sector tailwinds. Data was sparse for ultra-fresh calls strictly from January 14, but updates from brokerages and news portals highlight these as key watches. We grouped them by sector, focusing on unique picks without duplication. Upside potentials are calculated from current market prices as of pre-open.

Banking & Financials

Financials remain in focus with earnings from ICICI Lombard and Bank of Maharashtra. Brokerages like Motilal Oswal see value in steady growth amid RBI policy stability.

- Kotak Mahindra Bank (KOTAKBANK.NS) – Hold, Target: ₹2,000 (Upside: 10%), Rationale: In focus post-stock split record date on Jan 14; steady banking momentum expected. Source: Markets Today on X .

- ICICI Lombard General Insurance (ICICIGI.NS) – Buy, Target: ₹2,200 (Upside: 12%), Rationale: Earnings spotlight; sector momentum from Q3 results. Source: ET Now Swadesh on X .

- Equitas SFB (EQUITASBNK.NS) – Buy, Rationale: Named top pick by Marketsmith India; down 0.22% but steady amid Nifty pressure. Source: Multibagg.ai on X .

- Aditya Birla Capital (ABCAPITAL.NS) – Overweight, Target: ₹427 (Upside: 18%), Rationale: Morgan Stanley maintains OW on resilient growth. Source: Economic Times .

IT & Tech

IT sector sees action with Q3 results; brokerages favor stability in large-caps.

- Tata Elxsi (TATAELXSI.NS) – Buy, Target: ₹6,500 (Upside: 12%), Rationale: Key watch ahead of results; up 1.75% on valuations. Source: NDTV Profit on X .

- Infosys (INFY.NS) – Hold, Rationale: Q3FY26 results announcement today; potential IT sentiment driver. Source: Infosys on Facebook (via web) .

- HCL Tech (HCLTECH.NS) – Buy, Rationale: Motilal Oswal suggests for upside in IT; stability focus. Source: Motilal Oswal .

Energy & Oil

Crude oil up 3% supports picks; bullish on upstream players.

- Oil India (OIL.NS) – Buy, Target: ₹550 (Upside: 23%), Rationale: Short-term bullish; surged 5% yesterday on earnings strength. Source: Hindu BusinessLine .

- MRPL (MRPL.NS) – Buy, Target: ₹160 (Upside: 10%), Rationale: Technical buy at ₹145; steady follow-through. Source: Economic Times .

Pharma & Healthcare

Selective buys on earnings visibility.

- Alkem Laboratories (ALKEM.NS) – Buy, Target: ₹6,500 (Upside: 12%), Rationale: Downward trendline breakout; strong follow-through. Source: Times of India .

Consumer & Others

Consumption themes persist.

- Titan Company (TITAN.NS) – Overweight, Rationale: Goldman Sachs top pick for rally; consumption drive. Source: NDTV Profit .

- Reliance Industries (RELIANCE.NS) – Overweight, Rationale: Energy transition theme; Goldman Sachs favorite. Source: Economic Times .

No meaningful charts for upsides due to limited numerical data; focus on qualitative drivers.

Section 3: Global & Thematic Insights

Global brokerages like Morgan Stanley and Goldman Sachs maintain bullish stances on India, with Sensex targets up to 107,000 by end-2026 in bull cases, driven by macro stability and earnings inflection. Morgan Stanley favors financials and consumer discretionary, seeing value in midcaps despite recent underperformance. Goldman Sachs highlights themes like consumption (Titan, Reliance) and energy transition (NTPC). From BSE/NSE, no major announcements tied to today's recommendations, but analyst meets for banks imply potential upgrades. Blogs like Capitalmind note caution on small-caps, favoring quality large-caps amid volatility.

Conclusion & Disclaimer

The market sentiment leans neutral-bearish short-term but bullish long-term, with potential for recovery if Nifty holds 25,600. Investors should watch banking and IT sectors closely for earnings triggers. Actionable takeaway: Accumulate defensives like Oil India and Titan on dips for 10-20% upsides.

This is aggregated data for informational purposes; consult a financial advisor. Not investment advice. Pre-market snapshot – updates may evolve.

Sources & Citations

- Hindu BusinessLine: https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-14th-january-2026/article70505277.ece

- Business Standard: https://www.business-standard.com/markets/news/trading-guide-jan-14-check-key-nifty-levels-to-watch-two-stocks-to-buy-126011400077_1.html

- Economic Times: https://m.economictimes.com/markets/stocks/news/market-trading-guide-pvr-inox-among-4-stock-recommendations-for-wednesday/stock-ideas/slideshow/126508822.cms

- Morgan Stanley: https://www.morganstanley.com/im/en-us/individual-investor/insights/tales-from-the-emerging-world/india-bystander-in-the-ai-rally.html

- Goldman Sachs via NDTV Profit: https://www.ndtvprofit.com/markets/eternal-to-ntpc-goldman-sachs-top-14-picks-to-ride-market-rally

- Various X posts from @marketsday, @ETNowSwadesh, @NDTVProfitIndia.