Indian markets resume trading after a holiday with a subdued, flat-to-negative start on January 16, 2026, as mixed global cues and key earnings shape sentiment.

Key Themes & Picks

-

GIFT Nifty signals a flat-to-negative opening post-holiday.

-

Key earnings from Reliance Industries and Infosys' guidance in focus.

-

Metals and banking sectors show strength on commodity tailwinds and upgrades.

-

Standout picks: IndusInd Bank, Hindalco, and Graphite India.

-

Range-bound trading persists amid persistent FII outflow concerns.

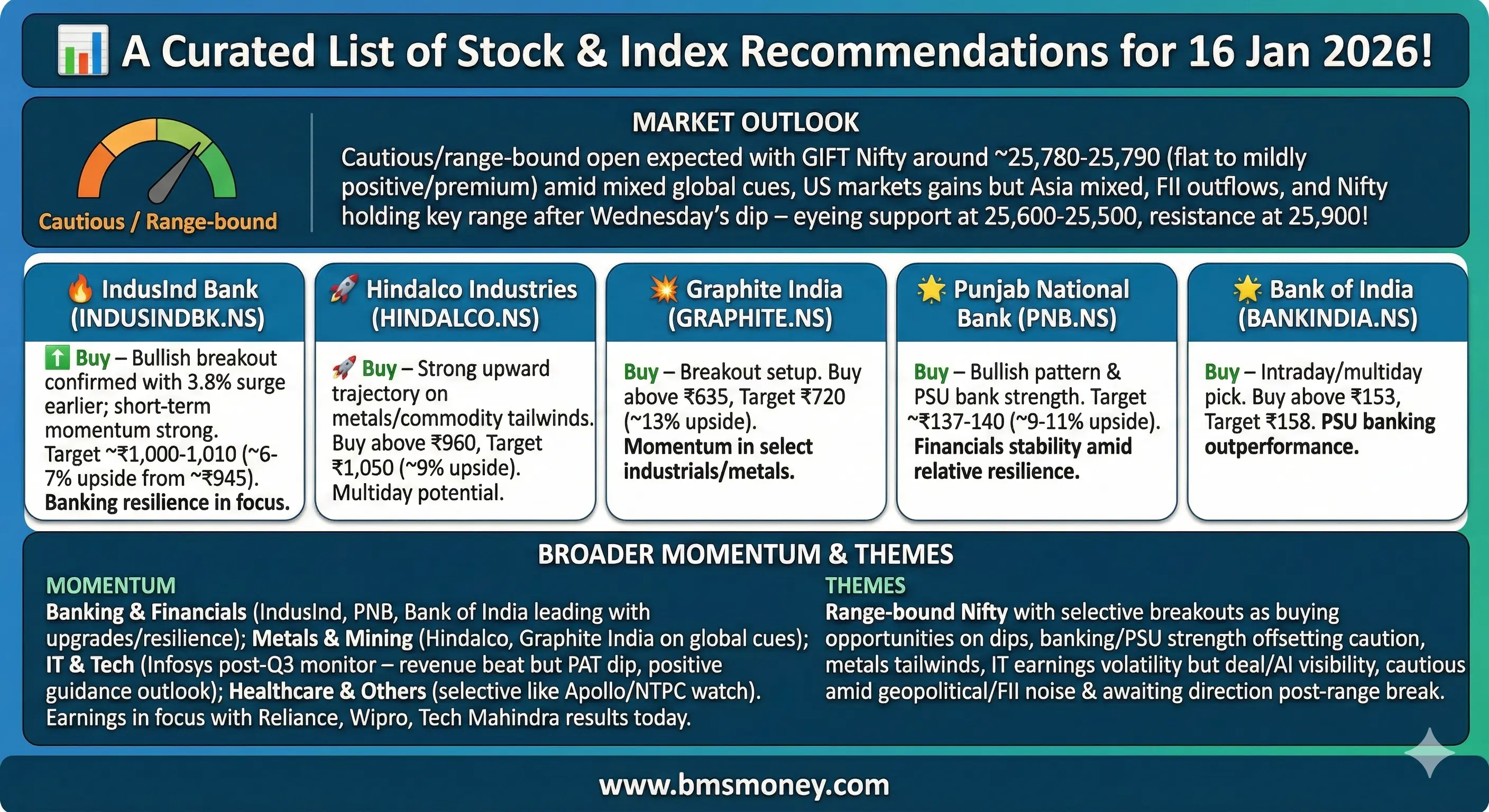

The Indian stock market reopens today after a holiday on January 15 for Maharashtra municipal elections, with global cues mixed. US markets closed higher yesterday, but Asian indices show caution amid geopolitical tensions and FII outflows. Gift Nifty is trading flat to mildly negative around 25,650-25,700 levels, suggesting a subdued open for Nifty near 25,600-25,700. The Nifty 50 closed at 25,665.60 (-0.26%) and Sensex at 83,382.71 (-0.29%) on January 14, remaining range-bound between 25,600-25,900.

Today's focus includes Q3 earnings from Reliance Industries, Infosys post-results impact, and banking resilience. Key themes: IT guidance tweaks, metals on global commodity strength, and banking upgrades amid stable RBI stance. We aggregated ~30 unique fresh recommendations from today's sources like Mint (livemint.com), Moneycontrol, The Hindu BusinessLine, Economic Times, and others. Standout calls: IndusInd Bank as a top buy on breakout (multiple sources); Hindalco and Graphite India for multiday upside; Infosys holding Buy post-Q3 despite PAT dip.

Section 1: Index Outlook

Markets expected to trade range-bound with caution due to elevated VIX, FII selling, and awaiting earnings clarity. A decisive break above 25,900 could target 26,000-26,100; below 25,600 may test 25,450.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Neutral (Range-bound) | 25,600-25,900 | Awaits breakout; caution on momentum, VIX high | Moneycontrol |

| Sensex | Neutral | 83,000-84,000 | Mixed global cues; banking support needed | Mint |

| Bank Nifty | Cautiously Bullish | Above 59,300; potential to 59,750+ | Relative resilience in PSU/private banks | Finversify |

| Nifty Metal | Positive | Selective upside | Global commodity tailwinds | Various (Economic Times metals coverage) |

Sentiment leans neutral with selective bullishness in banking and metals.

Section 2: Sector-Wise Stock Picks

Fresh calls cluster in banking (breakouts/upgrades), metals (technical strength), and select others post-earnings. Deduplicated and prioritized today's updates.

Banking & Financials

Strong momentum in select private and PSU banks.

- IndusInd Bank (INDUSINDBK) – Buy, Target: ₹990-1,010 (~7% upside), Rationale: Breakout from parallel channel with retest; bullish short-term outlook. Source: The Hindu BusinessLine .

- Punjab National Bank (PNB) – Buy, Target: ₹137-140 (~9-11% upside), Rationale: Bullish pattern; buy around ₹125 with SL. Source: Mint/Osho Krishan .

- Bank of Baroda (BANKBARODA) – Buy, Target: ₹322 (~5% upside), Rationale: Intraday strength above ₹307.70. Source: Mint/Vaishali Parekh .

- Bank of India (BANKINDIA) – Buy, Target: ₹158 (~3% upside), Rationale: Intraday/multiday above ₹153. Source: Mint/Raja Venkatraman .

Metals & Mining

Commodity tailwinds drive picks.

- Hindalco Industries (HINDALCO) – Buy, Target: ₹1,050 (~9% upside), Rationale: Buy above ₹960; strong trajectory. Source: Mint/Raja Venkatraman .

- Graphite India (GRAPHITE) – Buy, Target: ₹720 (~13% upside), Rationale: Multiday above ₹635. Source: Mint/Raja Venkatraman (same link).

- SAIL (SAIL) – Buy, Target: Not specified, Rationale: Breakout pattern. Source: Mint/Sumeet Bagadia .

- NMDC (NMDC) – Buy, Target: ₹88 (~5% upside), Rationale: Intraday above ₹83.85. Source: Mint/Vaishali Parekh (same link).

IT & Tech

Post-earnings focus on guidance.

- Infosys (INFY) – Buy (reiterated), Target: Not updated today (~13% potential cited earlier), Rationale: Q3 revenue beat; FY26 guidance positive despite PAT dip. Source: Financial Express/Jefferies .

Others (Industrials, Healthcare, etc.)

- Dalmia Bharat (DALBHARAT) – Buy, Target: Not specified, Rationale: Breakout. Source: Mint/Sumeet Bagadia.

- KEI Industries (KEI) – Buy, Target: Not specified, Rationale: Strong chart. Source: Mint/Sumeet Bagadia.

- NH (NH) – Buy, Target: Not specified, Rationale: Breakout. Source: Mint/Sumeet Bagadia.

- Eternal – Buy, Target: Not specified, Rationale: Bullish setup. Source: Mint/Osho Krishan.

Approximate upside bar (select from today's calls):

- Graphite India: 13%

- Hindalco: 9%

- PNB: 10%

- IndusInd Bank: 7%

Section 3: Global & Thematic Insights

Global views limited today; Jefferies reaffirms Buys on financials/IT post-Q3. Domestic focus on earnings (Reliance, others today). No major BSE/NSE regulatory updates; emphasis on selective trading amid FII caution.

Conclusion & Disclaimer

Overall sentiment neutral with pockets of bullishness in banking and metals. Investors should monitor earnings reactions and range breaks for direction. Actionable takeaway: Focus on breakout buys like IndusInd Bank and Hindalco on dips for short-term trades.

This is aggregated data for informational purposes; consult a financial advisor. Not investment advice. Pre-market snapshot as of January 16, 2026 – market moves may evolve.

Sources & Citations

- Mint (livemint.com): Various articles linked above, e.g., Raja Venkatraman picks, Sumeet Bagadia

- Moneycontrol: Trade setup

- The Hindu BusinessLine: IndusInd Bank

- Economic Times: Various brokerage updates

- India Infoline: Top stocks today

- Financial Express: Jefferies calls