Indian markets are set for a flat-to-mildly positive opening on February 18, 2026, tracking supportive global cues and continued momentum in banking and financials. With volatility easing and select mid-cap breakouts in focus, early trade may see range-bound moves amid thin holiday volumes in parts of Asia. Fresh technical calls highlight opportunities in consumer, industrial, and banking stocks.

Indian equity benchmarks extended a modest recovery on February 17, 2026, with the Nifty 50 closing at 25,725.40 (up 0.17% or 42.65 points) and the Sensex at 83,450.96 (up 0.21% or 173.81 points). Gains were led by IT, PSU Banks, and FMCG stocks, while metals and realty saw profit-taking. Market breadth remained positive, with roughly 1,820 advancing vs. 1,092 declining shares on the NSE.

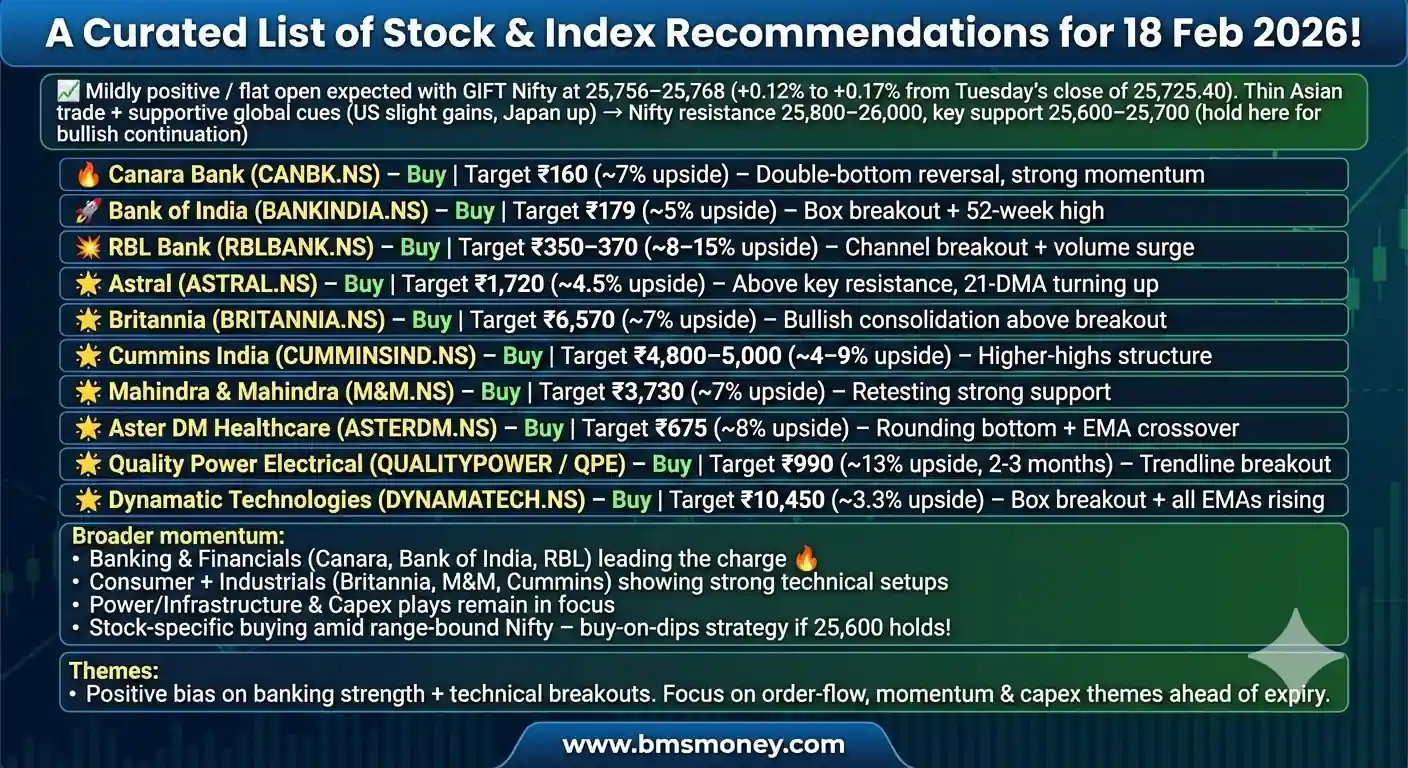

As of early February 18 (around 7:30 AM IST), GIFT Nifty traded in the 25,756–25,768 range, signaling a flat-to-mildly positive opening for the cash market. Overnight global cues were supportive: US stocks eked out slight gains on Tuesday (tech rebound + financials), while Asian markets showed mixed-to-positive action (Japan’s Nikkei extending gains). India VIX eased further, reflecting reduced near-term volatility, though low liquidity (several Asian markets closed for holidays) may keep moves range-bound.

Key themes for today’s open include continued strength in banking and financials, technical breakout plays in mid-caps, and selective buying in consumer and industrial names. Analysts from Kotak Securities, Waves Strategy Advisors, AT Research, MarketSmith India, BusinessLine, and others issued fresh technical and short-term calls overnight/early morning. Approximately 15–20 unique buy ideas surfaced, with no major sell/hold downgrades noted in pre-market coverage. Standout calls include Astral (BusinessLine), multiple banking picks (Canara Bank, Bank of India, RBL Bank), and Britannia (Kotak).

Section 1: Index Outlook The Nifty 50 is consolidating near the upper end of its recent range (25,600–25,800). Immediate resistance lies at 25,750–25,800; a sustained move above this could open 25,900–26,000 quickly. Key support sits at 25,600–25,700 (yesterday’s low + psychological level). Bias remains cautiously bullish as long as the index holds above 25,600.

Bank Nifty (closed ~61,174, up 0.37%) shows stronger relative momentum and is eyeing record highs near 61,765, with support at 60,900–60,500. PSU Banks continue to outperform on domestic liquidity and policy tailwinds.

Sectoral indices: Nifty IT and FMCG remain constructive; metals face near-term caution.

| Index | Outlook | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Bullish bias | 25,800–26,000 | Hold above 25,750; IT + banking rotation | Moneycontrol, ET Markets |

| Sensex | Positive | 83,800–84,200 | Follow-through from Feb 17 recovery | Goodreturns |

| Bank Nifty | Strong | 61,500–61,765 | PSU Bank momentum, support at 60,900 | Multiple technical desks |

| Nifty IT | Constructive | +1–2% upside | Global tech rebound cues | MarketSmith India |

Section 2: Sector-Wise Stock Picks Fresh calls focus on technical breakouts, chart patterns (double-bottom, rounding-bottom, box breakouts), and momentum indicators (RSI, EMAs, volume). All are Buy rated for short-term (intraday to 2–3 sessions or up to 2–3 months for longer-horizon picks).

Banking & Financials (strongest theme today)

- Canara Bank (CMP ₹149.11) – Buy, Target ₹160, SL ₹144. Double-bottom reversal; RSI bullish (Kotak Securities – Amol Athawale).

- Bank of India (CMP ₹170.2) – Buy, Target ₹179, SL ₹164. Box breakout + 52-week high; trading above all major EMAs (AT Research – Aditya Thukral). Also featured in HDFC Securities note.

- RBL Bank (CMP ₹322.25) – Buy, Target ₹350–355 (short-term) or ₹370 (2–3 months), SL ₹312/₹302. Channel breakout + volume surge; KST momentum turning up (Ashish Kyal / MarketSmith India).

Consumer & FMCG

- Britannia Industries (CMP ₹6,145.5) – Buy, Target ₹6,570, SL ₹5,930. Bullish consolidation above breakout levels (Kotak Securities).

- Mahindra & Mahindra (CMP ₹3,489.2) – Buy, Target ₹3,730, SL ₹3,360. Retesting retracement support; uptrend revival expected (Kotak).

Healthcare

- Aster DM Healthcare (CMP ₹625.9) – Buy, Target ₹675, SL ₹605. Rounding-bottom formation + EMA bullish crossover (Ashish Kyal).

Industrials & Engineering

- Cummins India (CMP ₹4,597.8) – Buy, Target ₹4,800–5,000, SL ₹4,430. Higher-highs structure; near record high with room in RSI (Ashish Kyal).

- Dynamatic Technologies (CMP ₹10,117) – Buy, Target ₹10,450, SL ₹9,770. Box breakout + upward-sloping EMAs (AT Research).

Pipes / Plastics

- Astral (CMP ₹1,646) – Buy, Target ₹1,720, SL ~₹1,590 (accumulate on dips to ₹1,610). Above key resistance ₹1,593; 21-DMA turning up (BusinessLine technical desk).

Power / Electrical

- Quality Power Electrical Equipments Ltd (CMP ₹874) – Buy range ₹865–880, Target ₹990 (2–3 months), SL ₹820. Trendline breakout + 100-DMA reclaim; strong order book in power/grid theme (MarketSmith India).

Chemicals

- Acutaas Chemicals (CMP ₹2,075.9) – Buy, Target ₹2,160, SL ₹1,990. Short consolidation within larger uptrend; above all EMAs (AT Research).

Metals (Global Brokerage Note)

- Hindalco – Buy, Target ₹1,210 (HSBC, radar posted early Feb 18). Negative reaction to Novelis event seen as overdone; structural margin gains expected.

Section 3: Global & Thematic Insights Global brokerages were relatively quiet on fresh India calls overnight, but HSBC reiterated preference for Hindalco in metals/mining. No major upgrades/downgrades from Morgan Stanley, Jefferies, or CLSA surfaced in pre-market scans.

Thematic focus remains on domestic cyclicals (banking, power infra, select industrials) amid stable macros and easing VIX. Regulatory feeds (BSE/NSE) showed routine announcements with no major analyst-meet triggers today. Mid-cap rotation continues, but stock-specific action dominates after recent broader swings. Liquidity remains a watchpoint due to Asian holidays.

Conclusion & Disclaimer Overall sentiment is mildly bullish with a positive bias for selective buys, particularly in banking and technical breakout stocks. Investors should monitor Nifty’s hold above 25,700 and Bank Nifty strength for broader confirmation. Actionable takeaway: Focus on dips in quality banking names (Canara Bank, Bank of India) and momentum plays like Astral and RBL Bank at market open.

This is a pre-market snapshot aggregated from credible sources as of ~7:30 AM IST on February 18, 2026. Markets evolve rapidly—updates may follow post-open. This compilation is for informational purposes only and is not investment advice. Consult a registered financial advisor before acting. Past performance is not indicative of future results.

Sources & Citations

- Moneycontrol Trade Spotlight (Full list of 9 Buy ideas including Canara Bank, Britannia, Aster DM Healthcare, RBL Bank, Cummins India, Bank of India, Dynamatic Technologies, etc.) → https://www.moneycontrol.com/news/business/markets/trade-spotlight-how-should-you-trade-canara-bank-britannia-aster-dm-healthcare-rbl-bank-dynamatic-technologies-and-others-on-february-18-13832871.html

- The Hindu BusinessLine – Stock to Buy Today: Astral → https://www.thehindubusinessline.com/portfolio/technical-analysis/stock-to-buy-today-astral-1646-buy/article70642919.ece

- Mint / MarketSmith India – Stock Recommendations for 18 February (Quality Power Electrical + RBL Bank) → https://www.livemint.com/market/stock-market-news/stock-recommendations-18-february-marketsmith-india-sensex-nifty-quality-power-electrical-equipments-rbl-bank-11771332380370.html

- Economic Times – Market Trading Guide for Wednesday (Feb 18) (LG Electronics, Bank of India, etc.) → https://economictimes.indiatimes.com/markets/stocks/news/market-trading-guide-lg-electronics-bank-of-india-among-3-stocks-to-buy-on-wednesday-for-up-to-9-upside/slideshow/128469662.cms

- Goodreturns – Stock Market Outlook for 18 February 2026 → https://www.goodreturns.in/news/stock-market-outlook-18-february-2026-sensex-nifty-likely-to-trade-firm-with-positive-bias-bank-nift-1490133.html

Additional Supporting Links (Pre-market & Cues)

- NDTV Profit – Live Updates with GIFT Nifty (positive signal) → https://www.ndtvprofit.com/markets/stock-market-live-updates-share-market-news-today-sensex-nifty-buy-sell-hold-put-call-ratio-pcr-gift-nifty-fno-futures-options-chain-bse-nse-announcem-11051477

- Moneycontrol Live Blog – GIFT Nifty signals positive opening → https://www.moneycontrol.com/news/business/markets/stock-market-live-updates-gift-nifty-signals-positive-opening-us-asian-markets-advance-liveblog-13832903.html

- EquityPandit – GIFT Nifty Live (real-time level ~25,756–25,768) → https://www.equitypandit.com/giftnifty/