Indian markets are poised for a positive start on February 19, 2026, with GIFT Nifty indicating firm opening momentum, tracking higher Asian peers and sustained domestic buying in PSU banks, metals, and IT. While trading proceeds normally, settlement halts due to a holiday may cap volumes, with early focus on fresh technical calls and sector-specific tailwinds.

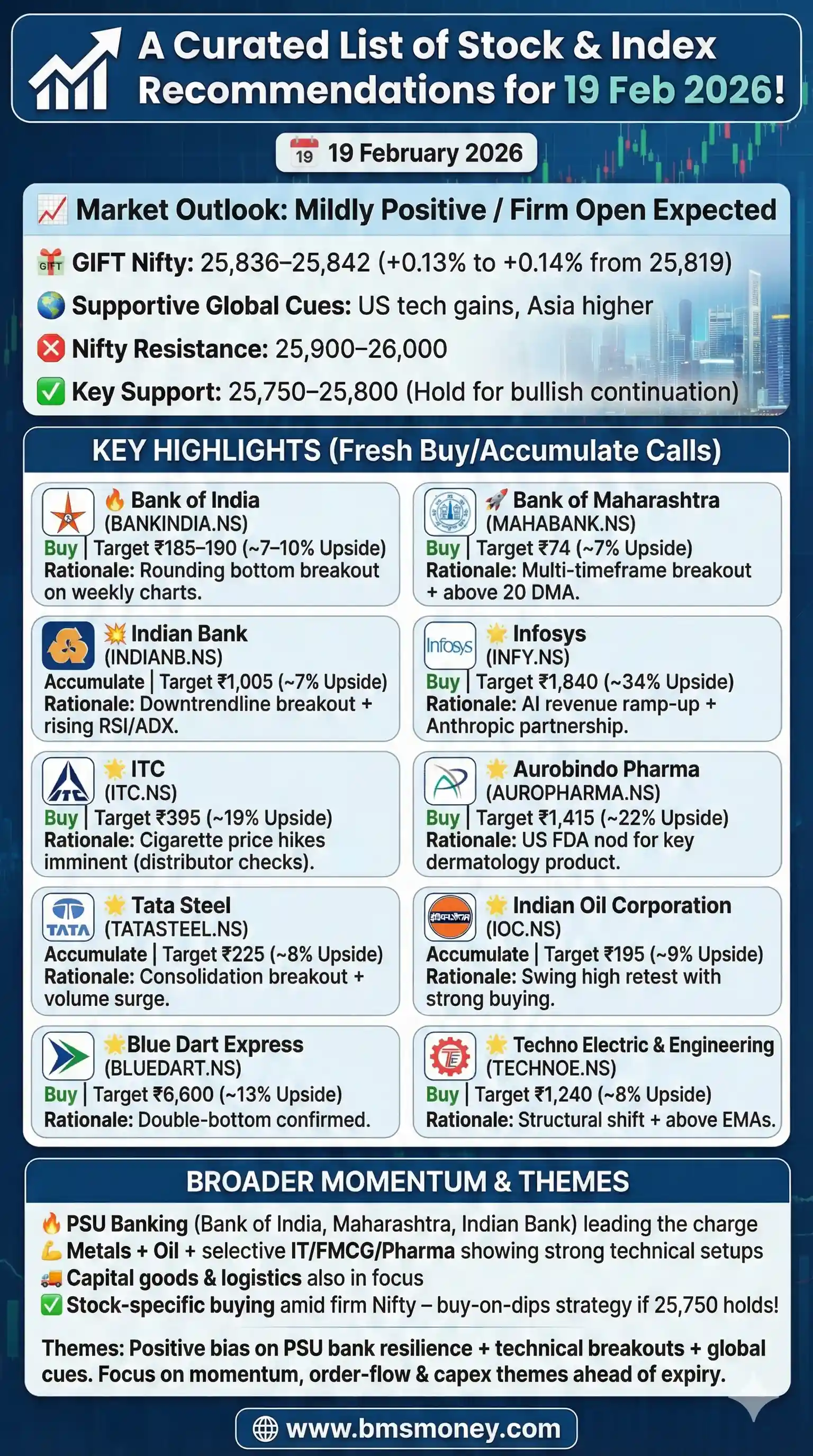

Indian equity markets are poised for a positive start on February 19, 2026, with GIFT Nifty trading at approximately 25,836–25,842, up 0.13–0.14% from the previous close. This signals a firm opening for the NSE Nifty 50 and BSE Sensex after Wednesday’s gains, where the Nifty closed at 25,819.35 (up 0.37%) and the Sensex at 83,734.25 (up 0.34%). Asian markets are trading higher amid supportive global cues, while domestic focus remains on sector-specific momentum in PSU banks, metals, and selective large-caps.

Note: February 19 is a settlement holiday (Chhatrapati Shivaji Maharaj Jayanti), meaning equity and derivatives trading on NSE/BSE proceeds normally, but clearing/settlement and fund payouts are paused. This pre-market snapshot (as of ~7:30 AM IST) aggregates fresh analyst calls and technical ideas published or updated today from credible sources. Around a dozen unique recommendations emerged this morning, centered on IT/AI tailwinds, FMCG pricing power, PSU bank strength, and technical breakouts. Broader themes include continued outperformance in PSU banks/metals and selective global brokerage updates on AI execution and regulatory approvals. Standout calls include BofA maintaining Buy on Infosys, Axis Securities accumulating Bank of India, and technical Buy on Blue Dart Express. Volatility may persist near key levels, with investors watching FII flows and global risk sentiment.

Section 1: Index Outlook Analysts expect an upward bias for the session, driven by positive global cues and domestic sectoral momentum in PSU banks and metals. The Nifty is likely to remain firm if it sustains above 25,800, with potential upside toward 25,900–26,000 in the near term. Immediate support lies at 25,750 and 25,650. The Sensex should mirror this, targeting psychological levels around 84,000+ on sustained buying. Bank Nifty continues to show relative strength, supporting financials.

No fresh overarching index targets from major brokerages this morning, but technical views align on bullish bias with selective consolidation risks. PSU Bank and Metal indices are highlighted for outperformance.

| Index | Outlook | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Bullish bias | 25,900–26,000 | Sustain >25,800; PSU/metals momentum | Moneycontrol Trading Plan |

| Sensex | Bullish bias | 84,000+ | Global cues, banking strength | ET Markets, 5paisa |

| Bank Nifty | Positive | Fresh highs possible | Relative strength in PSU banks | Multiple technical notes |

Section 2: Sector-Wise Stock Picks

Banking & Financials (PSU Banks in Focus) PSU banks continue to attract attention amid broader outperformance versus Nifty.

- Bank of India – Axis Securities: Accumulate/Buy. Target: ₹185–190 (3–4 weeks). Rationale: Clear uptrend with higher highs/lows and rounding bottom breakout on weekly charts.

- Bank of Maharashtra – LKP Securities (Rupak De): Buy at CMP ₹69. Target: ₹74. Stop-loss: ₹67. Rationale: Steady uptrend post multi-timeframe breakout; dips bought; strong volumes and above 20 DMA.

- Indian Bank – SBI Securities (Sudeep Shah): Accumulate in ₹940–930 zone. Target: ₹1,005. Stop-loss: ₹900. Rationale: Downward trendline breakout; PSU Bank/Nifty ratio rising; bullish momentum indicators (RSI, ADX, MACD).

IT & Tech

- Infosys – BofA: Buy (maintained). Target: ₹1,840. Rationale: Positive positioning on AI opportunity (5.5% revenue from AI-first offerings); Anthropic partnership highlights services role in enterprise AI; execution risks noted but net opportunity seen as larger.

FMCG / Tobacco

- ITC – UBS: Buy. Target: ₹395 (cut from ₹420). Rationale: Imminent cigarette price hikes (e.g., 84mm segment from ₹17 to ₹24/stick) expected to minimize volume/EBIT impact after distributor checks; minimal hikes in price-sensitive segments.

Pharma

- Aurobindo Pharma – HSBC: Buy. Target: ₹1,415 (raised). Rationale: US FDA approval for Adquey (difamilast 1%) — potential $250–300 mn brand; specialist sales investment needed for success.

Metals & Mining

- Tata Steel – SBI Securities (Sudeep Shah): Accumulate in ₹210–208 zone. Target: ₹225. Stop-loss: ₹203. Rationale: Breakout from ₹207–201 consolidation with volume spike; above key MAs; RSI rebound and bullish ADX.

Oil & Gas / Refining

- Indian Oil Corporation (IOC) – SBI Securities (Sudeep Shah): Accumulate in ₹180–177 zone. Target: ₹195. Stop-loss: ₹170. Rationale: Retest of swing high (now support) with strong buying; above MAs; rising ADX and RSI >60.

Consumer Durables / Electronics

- LG Electronics – Goldman Sachs: Coverage initiated (positive stance implied). Target: ₹1,750. Rationale: Faster-than-industry growth in mid/premium segments via income shifts, innovation, and ‘Global South’ export/manufacturing strategy; margin limits from competition/commodities noted.

Logistics / Courier

- Blue Dart Express – The Hindu BusinessLine (technical): Buy / Go long at ₹5,826; accumulate on dip to ₹5,720. Target: ₹6,600. Initial SL: ₹5,525 (trail higher). Rationale: Double-bottom pattern confirmed above ₹5,720; consolidation breakout expected above ₹5,890 after January upswing from ₹5,200.

Capital Goods / Engineering

- Techno Electric & Engineering – LKP Securities (Rupak De): Buy at CMP ₹1,151.7. Target: ₹1,240. Stop-loss: ₹1,100. Rationale: Signs of structural shift post-decline; above 21/55 EMA; RSI upward.

- Elgi Equipments – LKP Securities (Rupak De): Buy at CMP ₹537.25. Target: ₹580. Stop-loss: ₹520. Rationale: Consolidation breakout; reclaimed 200 DMA; RSI strengthening.

Consumer Staples (Cautious)

- Dabur – Morgan Stanley: Underweight. Target: ₹400. Rationale: Management restructuring — Mohit Malhotra re-designated Global CEO (effective Feb 17); new India CEO appointment (April 15).

Section 3: Global & Thematic Insights Global brokerages (BofA, UBS, Goldman Sachs, Morgan Stanley, HSBC) remain active on India coverage this morning, focusing on AI execution in IT, pricing power in FMCG, regulatory wins in pharma, and management transitions. Domestic technical analysts (LKP, SBI Securities) emphasize breakouts and volume confirmation in PSU banks, metals, and capital goods. Thematic tailwinds include PSU bank resilience and selective mid/premium consumption plays. No major regulatory announcements from BSE/NSE today beyond the settlement holiday note. Overall, the market shows bifurcated strength — defensive in large-caps with momentum in PSU/financials and metals.

Conclusion & Disclaimer Sentiment is mildly bullish for the February 19 session, with upward bias in indices supported by positive global cues and domestic sectoral flows into PSU banks and metals. Investors should monitor Nifty’s hold above 25,800 and watch banking/metals for leadership. Actionable takeaway: Focus on high-conviction names like Infosys (AI theme), Bank of India (technical breakout), and ITC (pricing tailwind) while using strict stop-losses given the settlement holiday’s liquidity nuances. Markets may evolve intraday with fresh flows.

Disclaimer: This is an aggregation of publicly available analyst views and technical ideas published on February 19, 2026, for informational purposes only. It is not investment advice. Past performance is no guarantee of future results. Consult a certified financial advisor and conduct your own due diligence before making any investment decisions. Prices and targets are indicative and subject to market movements.

Sources & Citations (all verified as fresh, published/updated on February 19, 2026)

- Times of India (TOI Business Desk) – Main brokerage roundup (Infosys, ITC, Aurobindo Pharma, LG Electronics, Dabur): https://timesofindia.indiatimes.com/business/india-business/infosys-itc-lg-electronics-dabur-aurobindo-pharma-top-stocks-to-watch-on-february-19-2026/articleshow/128533882.cms (07:02 IST)

- Economic Times / ET Now – Axis Securities on Bank of India: https://economictimes.indiatimes.com/news/videos/bank-of-india-shows-strong-momentum-axis-securities-recommends-accumulate/videoshow/128498265.cms (07:00 AM IST)

- The Hindu BusinessLine – Technical pick on Blue Dart Express: https://www.thehindubusinessline.com/multimedia/video/todays-stock-recommendation-february-19-2026/article70647464.ece (today’s video recommendation)

- Moneycontrol – Trade Spotlight (LKP Securities & SBI Securities technical calls on Bank of Maharashtra, Indian Bank, Tata Steel, IOC, Techno Electric, Elgi Equipments): https://www.moneycontrol.com/news/business/markets/trade-spotlight-how-should-you-trade-techno-electric-elgi-equipments-bank-of-maharashtra-indian-bank-tata-steel-and-others-on-february-19-13834914.html

- Moneycontrol – Trading Plan & First Tick (Nifty/Sensex/Bank Nifty outlook): https://www.moneycontrol.com/news/business/markets/trading-plan-can-nifty-stay-above-25-800-bank-nifty-hit-fresh-record-high-13834928.html and https://www.moneycontrol.com/news/business/markets/first-tick-top-global-cues-to-watch-in-today-s-trade-101-13833358.html

- 5paisa – Pre-open market cues & Nifty outlook: https://www.5paisa.com/blog/sensex-nifty-stock-market-live-updates-february-19-2026