Indian equities open sharply lower on January 19, 2026, tracking weak global sentiment and pre-earnings caution, with GIFT Nifty signaling a significant drop.

Key Themes & Picks

-

GIFT Nifty indicates a sharply negative open, down 0.6–0.65%.

-

Key Q3 bank earnings (HDFC Bank, ICICI Bank) dominate market focus.

-

Selective buys in banking, IT, and PSUs advised despite the weak open.

-

Top picks: HDFC Bank, HCL Tech, and value plays in metals.

-

Renewed US tariff threats and elevated volatility add to caution.

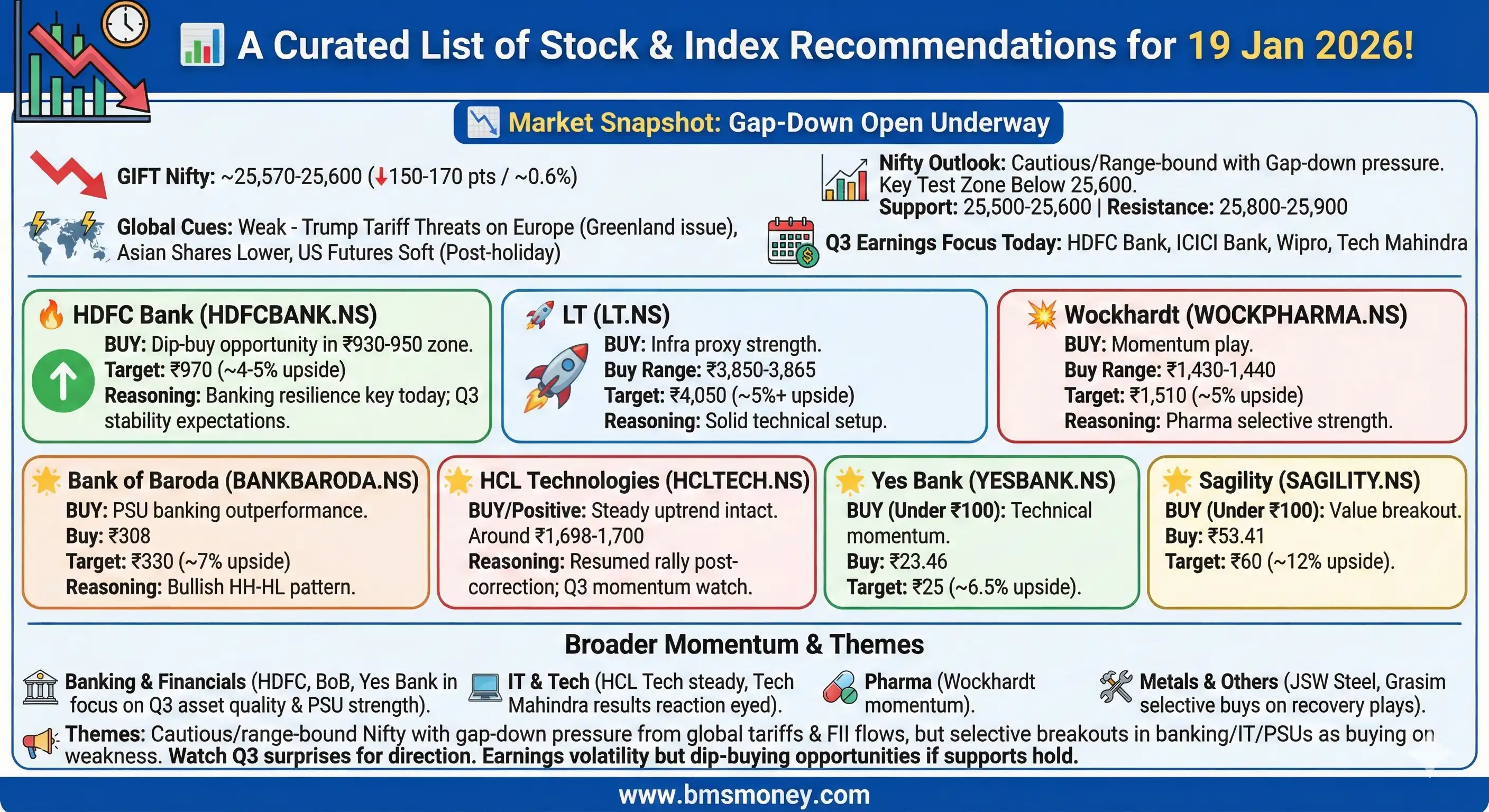

Indian equities opened lower on January 19, 2026, tracking Gift Nifty's signal of a negative start. Gift Nifty traded around 25,571–25,599 (down ~150–170 points or 0.6–0.65% from Friday's close of 25,694), pointing to Nifty opening near or below 25,600. Asian shares weakened on renewed US tariff threats (Trump's levies on Europe over Greenland), while US futures remained soft post-holiday. Brent crude at ~$62–64, with India VIX up slightly. Early trade shows caution ahead of key Q3 results (HDFC Bank, ICICI Bank, Wipro, Tech Mahindra, others) and mixed global risk appetite.

Fresh recommendations (primarily from morning notes, 00:00–8:30 AM IST) remain focused on selective buys in banking, IT, and mid/small caps despite the weak open. Anand Rathi (Ganesh Dongre) reiterated buys on HDFC Bank, LT, Wockhardt; Choice Broking (Sumeet Bagadia) on Bank of Baroda, JSW Steel, Grasim (and under-₹100 picks like Yes Bank, Sagility, HFCL); Hindu BusinessLine highlights HCL Technologies as a buy amid its Q3 anticipation (though results were earlier in Jan; stock in focus for momentum). Total unique fresh calls ~12–15, with emphasis on technical breakouts and dip-buying opportunities. Themes: Banking asset quality in Q3 spotlight, IT resilience, value in PSUs/metals.

Section 1: Index Outlook

Nifty closed Friday at 25,694 (+0.11% weekly), Sensex at 83,570 (+0.23%), with IT leading gains but profit-taking in heavyweights. Opening gap-down reflects global trade war fears, but analysts see potential range-bound trade with support at 25,500–25,600 and resistance at 25,800–25,900. A decisive break above 25,900 could trigger short-covering toward 26,000–26,400 (IT earnings boost). Bank Nifty holds bullish above 59,500–60,000, targeting 60,450+ on Q3 stability. Overall: Neutral with cautious bullish tilt if earnings surprise positively.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Neutral (Gap-Down) | 25,500–25,900 (near-term); upside 26,000+ on breakout | Earnings season, 25,900 break key; global tariffs weigh | ET Now, Economic Times, Mint |

| Sensex | Neutral | 83,000–84,000 | Banking/IT Q3, mixed cues | Goodreturns, Reuters |

| Bank Nifty | Bullish (Hold) | 59,500–60,800 | Q3 asset quality stability, reversal from EMA | Choice India, analysts |

| Nifty IT | Positive | 43,000–44,000+ | HCL Tech momentum, sector resilience | Hindu BusinessLine |

Section 2: Sector-Wise Stock Picks

Banking & Financials

Q3 results in focus (HDFC/ICICI today); stable metrics expected, but provisions may pressure PAT. Dip buys favored.

- HDFC Bank (HDFCBANK.NS) – Buy, Buy range ₹930–950, Target ₹970 (~4–5% upside), Stop Loss ₹910. Rationale: Resilient post-Q3 stability, strong deposits/NII; buy on dips amid results. Source: Anand Rathi (Ganesh Dongre, Jan 19).

- Bank of Baroda (BANKBARODA.NS) – Buy, Buy at ₹308.25, Target ₹330 (~7% upside), Stop Loss ₹295. Rationale: Strong bullish HH-HL pattern, PSU momentum. Source: Choice Broking (Sumeet Bagadia, Jan 19).

- Yes Bank (YESBANK.NS) – Buy (under ₹100), Buy at ₹23.46, Target ₹25 (~6.5% upside), Stop Loss ₹22.68. Rationale: Momentum play, technical strength. Source: Choice Broking (Sumeet Bagadia, Jan 19).

IT & Tech

HCL Tech in spotlight for steady uptrend (results earlier, but continued focus); sector seen resilient.

- HCL Technologies (HCLTECH.NS) – Buy/Positive, Around ₹1,698–1,700 levels. Rationale: Steady appreciation since Oct 2025 from ₹1,380 support; resumed rally post-correction, bullish chart hints further upside. Source: Hindu BusinessLine (Today's Stock Recommendation, Jan 19).

- LT (LT.NS) – Buy, Buy range ₹3,850–3,865, Target ₹4,050 (~5%+ upside), Stop Loss ₹3,800. Rationale: Infra proxy, buy on range breakout. Source: Anand Rathi (Ganesh Dongre, Jan 19).

- Tech Mahindra (TECHM.NS) – Buy, Buy above ₹1,675, Target ₹1,798 (multiday, ~7–8% upside), Stop Loss ₹1,625. Rationale: Consolidation breakout after Nov rally, strong momentum. Source: Raja Venkatraman (NeoTrader, Jan 19).

Pharma & Healthcare

- Wockhardt (WOCKPHARMA.NS) – Buy, Buy range ₹1,430–1,440, Target ₹1,510 (~5% upside), Stop Loss ₹1,385. Rationale: Technical momentum buy. Source: Anand Rathi (Ganesh Dongre, Jan 19).

Metals & Others

- JSW Steel (JSWSTEEL.NS) – Buy, Target implied ~10% upside in recovery. Rationale: Metal sector performing, bullish trend. Source: Choice Broking (Sumeet Bagadia, Jan 19).

- Grasim Industries (GRASIM.NS) – Buy, Target implied ~15% in diversified play. Rationale: Strong fundamentals. Source: Choice Broking.

- Sagility (SAGILITY.NS) – Buy (under ₹100), Buy at ₹53.41, Target ₹60 (~12% upside), Stop Loss ₹50.53. Rationale: Value breakout. Source: Choice Broking.

- HFCL (HFCL.NS) – Buy (under ₹100), Target implied momentum. Rationale: Telecom proxy. Source: Choice Broking.

| Sector | Avg Upside | Top Picks Example |

|---|---|---|

| Banking | 4–7% | HDFC Bank 4–5%, BoB 7% |

| IT | 5–8% | HCL Tech momentum, TECHM 7–8% |

| Pharma | ~5% | Wockhardt |

Section 3: Global & Thematic Insights

Global sentiment cautious: Trade war risks (Trump tariffs) pressure risk assets; no major fresh global brokerage India calls today, but prior optimism on earnings persists. Thematic: PSU banks/metals outperforming, IT/commodities performing. Early trade stocks in focus: Reliance, HDFC/ICICI (results), BHEL, IRFC, Wipro/TechM (results reaction). No significant BSE/NSE regulatory nuggets; earnings calls dominate.

Conclusion & Disclaimer

Overall sentiment neutral to cautious with gap-down open, but selective bullish on banking/IT dips and technical picks if Q3 delivers stability. Actionable takeaway: Monitor Nifty support at 25,500–25,600; accumulate HDFC Bank/LT/HCL Tech on weakness near supports; watch banking results for direction.

This is aggregated data for informational purposes; consult an advisor. Not investment advice. Markets volatile—views can evolve intraday.

Sources & Citations (Fresh/Primary, Jan 19 Focus)

- Livemint/Anand Rathi (Ganesh Dongre): HDFC, LT, Wockhardt — https://www.livemint.com/market/stock-market-news/buy-or-sell-ganesh-dongre-recommends-three-stocks-to-buy-on-monday-19-january-2026-11768717028491.html

- Livemint/Choice Broking (Sumeet Bagadia): BoB, JSW Steel, Grasim; under-₹100 picks — https://www.livemint.com/market/stock-market-news/buy-or-sell-sumeet-bagadia-recommends-three-stocks-to-buy-on-monday-19-january-2026-11768613054295.html (and related under-₹100 article)

- Hindu BusinessLine: HCL Tech buy recommendation — https://www.thehindubusinessline.com/markets/stock-market-live-updates-19-january-2026/article70521877.ece

- Economic Times: Nifty outlook, Gift Nifty levels — https://m.economictimes.com/markets/stocks/live-blog/bse-sensex-today-nifty50-stock-market-live-updates-gift-nifty-ril-icici-bank-share-price-19-january-2026/liveblog/126665689.cms

- Mint: Market expectations, tariff concerns — https://www.livemint.com/market/stock-market-news/nifty-50-sensex-today-what-to-expect-from-indian-stock-market-on-january-19-amid-trump-s-greenland-tariffs-concerns-11768759189390.html

- Goodreturns/Reuters/others: Index outlook, global cues.