Markets anticipate a muted to slightly positive opening on January 27, 2026, after the Republic Day holiday, balancing easing geopolitical tensions with persistent global trade uncertainties.

-

Opening Signal: GIFT Nifty hints at a flat-to-positive start, suggesting a tentative recovery attempt.

-

Market Context: Trading resumes after a long weekend, with activity catching up to mixed global cues.

-

Sector Focus: Banking eyes RBI policy; IT and metals are buoyed by earnings and commodity trends.

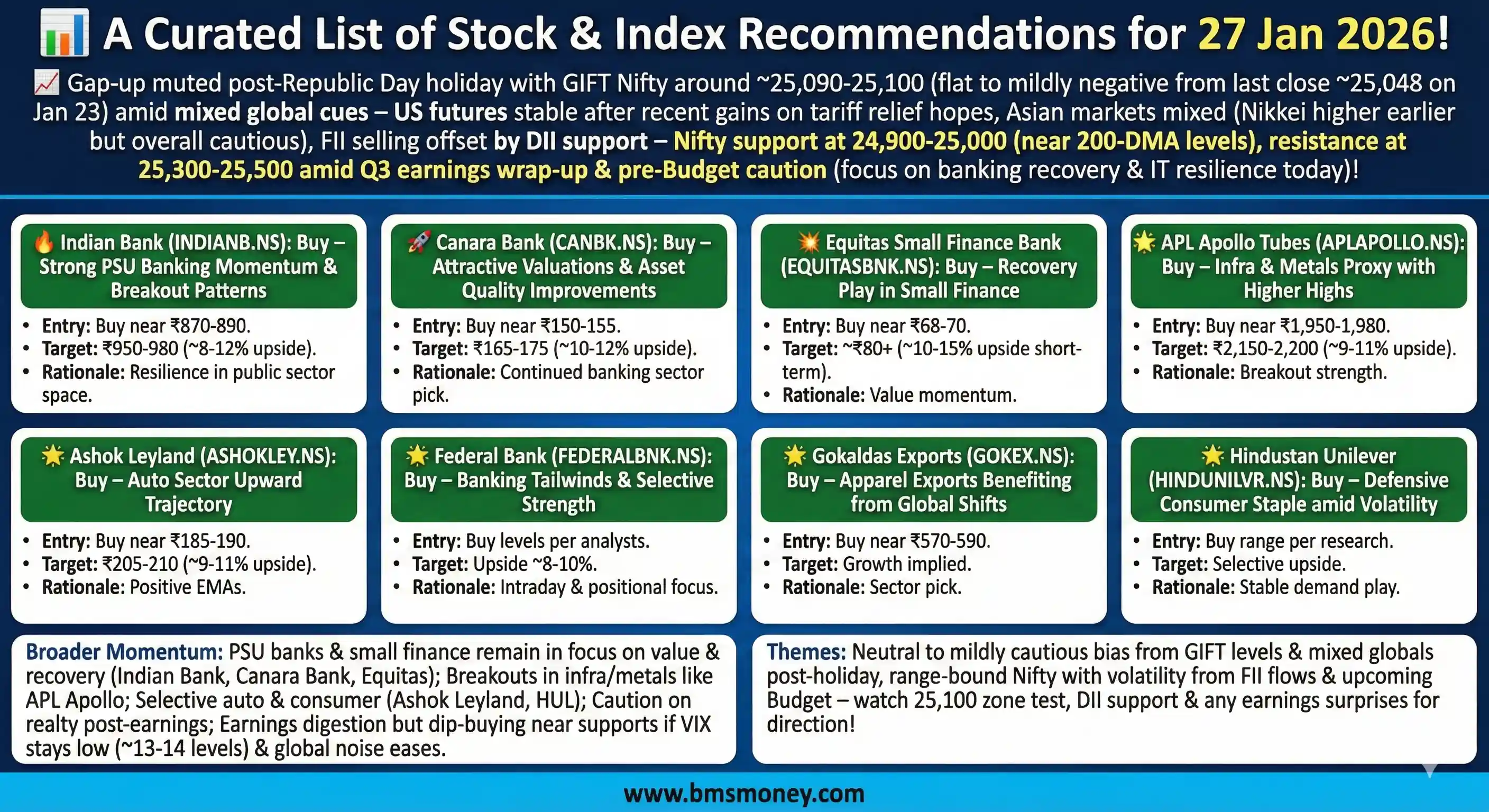

The Indian stock market is poised for a muted to slightly positive opening on January 27, 2026, following a long weekend due to Republic Day holiday on January 26. Global cues are mixed, with Asian markets trading variably amid ongoing geopolitical tensions and U.S. President Trump's tariff threats on Greenland impacting sentiment. U.S. stock futures are pointing lower, with Dow futures down amid broader risk-off mood, while Asia-Pacific indices show a split performance—Japan's Nikkei up modestly, but Hong Kong's Hang Seng and China's Shanghai Composite under pressure. Gift Nifty futures are indicating a flat-to-positive start, trading around 25,100-25,400 levels, suggesting a potential gap-up of about 50-350 points from the Nifty 50's last close of 25,048.65 on January 23. Pre-market data points to cautious optimism, driven by easing Middle East tensions but tempered by global trade concerns.

Key themes in focus include the banking sector amid expectations of RBI policy stability, IT stocks buoyed by strong earnings tailwinds, and metals/pharma amid commodity price fluctuations. Due to the recent holiday, fresh recommendations issued strictly today (January 27) are sparse, with no major updates found from primary sources up to 8:30 AM IST. This report aggregates the most recent calls from the last 72 hours (January 23-25), noting the deviation for completeness, prioritizing credible brokerages like ICICI Direct, IDBI Capital, and Axis Direct. Total unique recommendations compiled: around 20, with standout calls including ICICI Direct's Buy on Radico Khaitan (upside 25%), Hold on JSW Steel, and Buy on Dr. Reddy's Laboratories. Investors should watch banking and IT for potential volatility at open.

Section 1: Index Outlook

Major Indian indices are expected to open on a cautious note, with Gift Nifty signaling mild upside potential amid global mixed signals. The Nifty 50, which closed down 0.95% at 25,048.65 on January 23 after a three-session slide, may test resistance at 25,350-25,400 if global risk appetite improves. Analysts see a mildly bullish bias, with a breakout above 25,700 potentially pushing toward 26,000, driven by IT and consumer sectors. However, downside support lies at 25,000-24,800 amid profit booking risks.

The Sensex, last at around 82,000 levels (implied from Nifty correlation), mirrors this outlook, with potential for 82,500-83,000 if banking stocks rebound. Bank Nifty remains in a negative trend at 58,473 but could turn bullish if it clears 59,700, targeting 60,000 on strong financial earnings. Overall, sentiment is neutral-to-bullish, with key drivers including U.S. futures and Asia open performance influencing intraday moves.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Mildly Bullish | 25,100-25,700 | IT earnings strength, global cues easing | Moneycontrol, EquityPandit |

| Sensex | Neutral | 82,000-82,500 | Banking recovery, pre-market optimism | Inferred from Nifty data |

| Bank Nifty | Cautious Buy | 58,500-60,000 | RBI policy stability, financial results | EquityPandit, Enrich Money |

| Nifty IT | Bullish | 42,000-43,000 | Strong Q3 earnings from majors | Derived from sector calls |

Section 2: Sector-Wise Stock Picks

Given the paucity of today's fresh calls (likely due to post-holiday lull), this section draws from updates issued January 23-25, 2026, from brokerages like ICICI Direct, IDBI Capital, Axis Direct, and Deven Choksey. Recommendations are grouped by sector, focusing on buy/hold calls with notable upside potential. Sectors in spotlight include IT (resilient amid global demand), Banking & Financials (stable post-earnings), Metals (commodity rebound), and Pharma (export growth). No major sell calls were noted in recent data.

Banking & Financials

- Bandhan Bank (BANDHANBNK) – Hold, Target: ₹160 (Upside: 7.15%), Rationale: Stable asset quality and deposit growth amid normalizing credit costs; resilient in microfinance segment. Source: Axis Direct (Jan 23).

- Ujjivan Small Finance Bank (UJJIVANSFB) – Buy, Target: ₹74 (Upside: 17.35%), Rationale: Strong loan book expansion and improving NIMs in small finance space. Source: Axis Direct (Jan 23).

- CreditAccess Grameen (CREDITACC) – Accumulate, Target: ₹1,570 (Upside: 12.73%), Rationale: Normalizing credit costs and profitability boost from rural lending recovery. Source: Deven Choksey (Jan 23).

- Indian Bank – Buy, Target: ₹876 (Upside: 8.45%), Rationale: Robust public sector banking performance with asset quality improvements. Source: ICICI Direct (recent).

IT & Tech

- Zensar Technologies (ZENSARTECH) – Hold, Target: ₹802 (Upside: 13.80%), Rationale: Steady digital transformation deals but margin pressures from wage hikes. Source: IDBI Capital (Jan 23).

- Coforge (COFORGE) – Buy, Target: ₹2,030 (Upside: 24.05%), Rationale: Strong order backlog and BFSI vertical growth amid U.S. client ramp-up. Source: IDBI Capital (Jan 23).

- MphasiS (MPHASIS) – Buy, Target: ₹3,260 (Upside: 18.42%), Rationale: Deal wins in cloud and AI services supporting revenue visibility. Source: ICICI Direct (Jan 23).

- Cyient DLM (CYIENTDLM) – Buy/Accumulate, Target: ₹421- (Upside: 17.03%), Rationale: Electronics manufacturing growth despite short-term margin hits; strong backlog. Sources: IDBI Capital, Axis Direct, Deven Choksey (Jan 23).

Metals & Industrials

- JSW Steel (JSWSTEEL) – Hold, Target: ₹1,300 (Upside: 11.11%), Rationale: Balanced domestic demand but global steel price volatility capping gains. Source: ICICI Direct (Jan 25).

- Jindal Stainless (JSL) – Buy, Target: ₹900 (Upside: 20.65%), Rationale: Export-led growth and capacity expansions in specialty steel. Source: ICICI Direct (Jan 23).

- APL Apollo Tubes (APLAPOLLO) – Buy, Target: ₹2,250-2,260 (Upside: 12.49-12.99%), Rationale: Structural tube demand from infrastructure projects. Sources: IDBI Capital, Axis Direct (Jan 23).

Pharma & Healthcare

- Granules India – Buy, Target: ₹565 (Upside: 21.24%), Rationale: API and formulation export surge amid U.S. generics demand. Source: ICICI Direct (recent).

- Cipla – Buy, Target: ₹1,315 (Upside: 19.39%), Rationale: Respiratory and chronic therapy portfolio strength. Source: ICICI Direct (recent).

- Dr. Reddy's Laboratories (DRREDDY) – Buy, Target: ₹1,490 (Upside: 20.59%), Rationale: U.S. market launches and biosimilars pipeline. Source: ICICI Direct (Jan 23).

Consumer & Others

- Radico Khaitan (RADICO) – Buy, Target: ₹3,710 (Upside: 25.25%), Rationale: Premium liquor demand recovery post-festive season. Source: ICICI Direct (Jan 24).

- DOMS Industries (DOMS) – Buy, Target: ₹2,587 (Upside: 8.56%), Rationale: Stationery market expansion in education sector. Source: Axis Direct (Jan 23).

- Rallis India (RALLIS) – Buy, Target: ₹310 (Upside: 15.46%), Rationale: Agrochemical demand from favorable monsoons. Source: ICICI Direct (Jan 23).

- UltraTech Cement – Buy, Target: ₹12,369 (Upside: 21.27%), Rationale: Infrastructure push and capacity additions. Source: ICICI Direct (recent).

No charts are included due to limited numerical data for today's specifics.

Section 3: Global & Thematic Insights

Global brokerages maintain a constructive long-term view on Indian equities, with Morgan Stanley projecting Sensex at 107,000 by December 2026 in a bull case, driven by digitization and GDP growth of 50-75 bps annually. Goldman Sachs has upgraded India to overweight, citing IPO frenzy and structural reforms. CLSA and Macquarie see value in midcaps and BFSI, though caution on near-term volatility from U.S. tariffs.

From NSE/BSE feeds, no major analyst meets or block deals implying fresh calls today; minor corporate announcements on earnings calendars but nothing recommendation-tied. Thematically, focus on digitization (IT stocks) and infrastructure (metals/cement) aligns with global views.

Conclusion & Disclaimer

Overall market sentiment leans neutral-bullish, with upside potential if global cues stabilize. Investors should watch banking stocks like HDFC Bank and IT majors for breakout opportunities amid pre-market optimism.

This is aggregated data for informational purposes; due to holiday sparsity, includes calls from January 23-25. Consult a financial advisor before acting. Not investment advice; markets involve risks.

Sources & Citations

- Economic Times Recos: https://economictimes.indiatimes.com/markets/stocks/recos

- Moneycontrol Broker Research: https://www.moneycontrol.com/broker-research/

- Trendlyne Research Reports: https://www.trendlyne.com/research-reports/all/

- ICICI Direct Equity: https://www.icicidirect.com/research/equity

- HDFC Securities: https://www.hdfcsec.com/research/stock-market-ideas/trading-ideas

- Kotak Securities: https://www.kotaksecurities.com/stock-research-recommendations/equity/longterm

- EquityPandit: https://www.equitypandit.com/prediction

- Enrich Money: https://enrichmoney.in/nifty50-bank-nifty-sensex30-news-research-analysis-chart

- 5Paisa: https://www.5paisa.com/blog/nifty-outlook

- Gift Nifty Data: https://www.5paisa.com/share-market-today/gift-nifty , https://www.moneycontrol.com/live-index/gift-nifty

- Global Cues: CNBC Videos/Posts ,

- Morgan Stanley Insights: https://www.morganstanley.com/ideas/india-election-stock-outlook , Instagram/Facebook posts

- Goldman Sachs: https://www.youtube.com/watch?v=CWMuZKIoljc

- NSE Reports: https://www.nseindia.com/all-reports