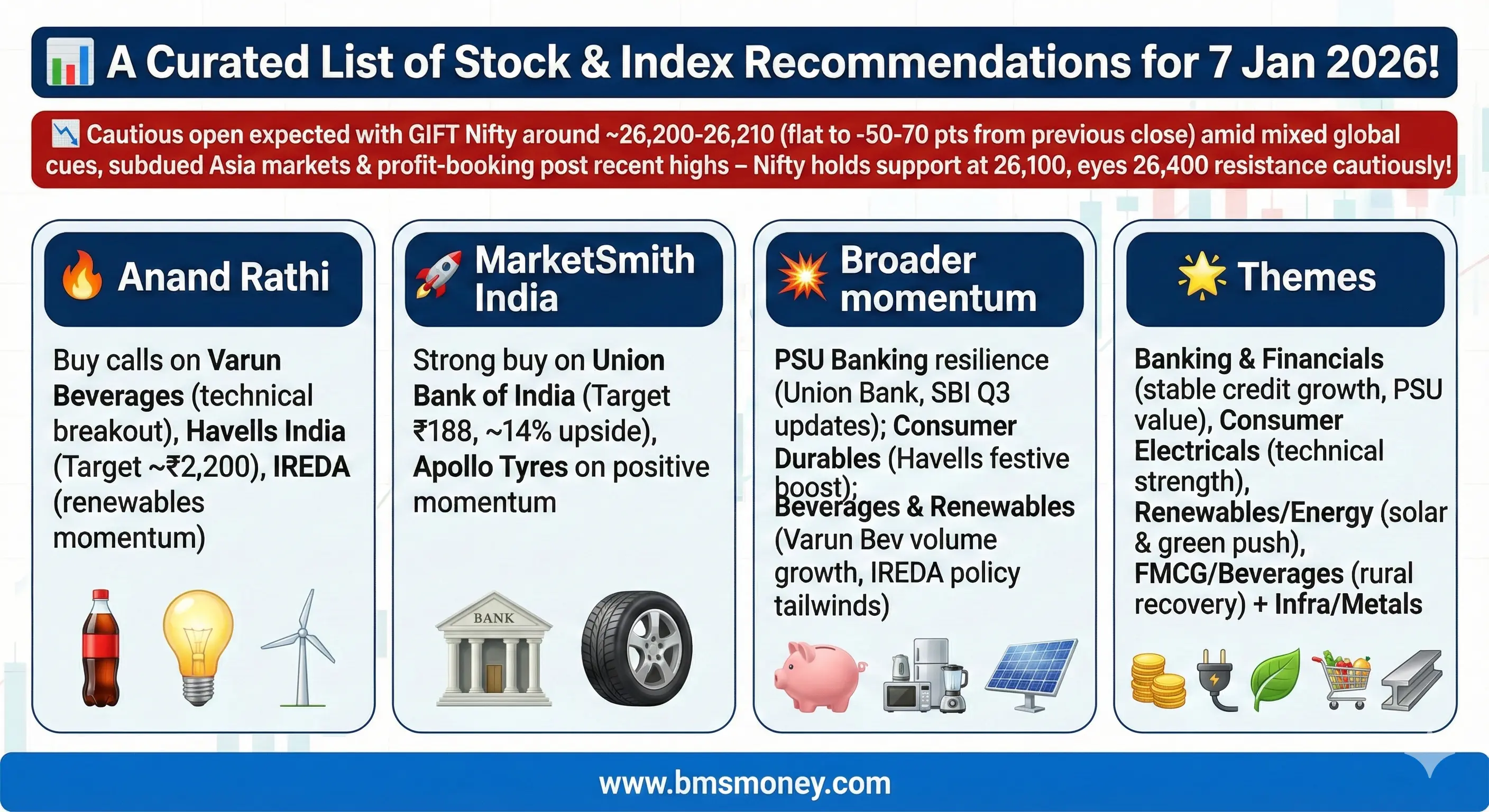

Markets eye a cautious start on January 07, 2026, amid mixed global signals and sector-specific focus ahead of Q3 earnings, with GIFT Nifty pointing lower.

Key Themes & Picks

-

GIFT Nifty signals a mildly negative opening, indicating profit-taking pressure.

-

Q3 earnings previews spotlight resilient IT and pharma sectors.

-

Banking stocks, especially PSUs, attract selective interest.

-

Key calls: Varun Beverages and Union Bank of India highlighted.

-

AI-driven growth and policy tailwinds remain dominant themes.

As Indian markets gear up for trading on January 07, 2026, a Wednesday and a regular trading day, pre-market indicators point to a cautious start amid mixed global cues. The Gift Nifty futures were trading at around 26,208.50, signaling a mildly negative open for the Nifty 50, down about 0.28% from the previous close. Overnight, US stock futures remained flat following a session where the S&P 500 hit record highs, while Asian markets were mixed—Japan's Nikkei slipped 0.25% amid geopolitical tensions with China, but Australian shares rose on commodity gains. Crude oil prices dipped below $60 per barrel, reflecting eased supply concerns after a US-Venezuela export deal.

Domestically, the focus remains on Q3FY26 earnings previews, with IT and pharma sectors expected to shine amid resilient global demand. Banking stocks could see selective interest from PSU lenders. Overall sentiment is neutral to positive, supported by sturdy GDP forecasts, but profit-booking at highs and FII outflows may cap gains. Today's scans yielded around 25 unique recommendations from brokerages like Anand Rathi, MarketSmith India, and others, emphasizing value in midcaps and select largecaps.

Standout calls include Anand Rathi's buy on Varun Beverages amid a breakout pattern, MarketSmith's upgrade on Union Bank of India targeting ₹188, and a bullish Nifty outlook from analysts eyeing 26,400 resistance. Themes like AI-driven growth and policy tailwinds dominate, with no major holidays disrupting flow.

Section 1: Index Outlook

Analysts anticipate a range-bound session for major indices, with the Nifty 50 likely to test immediate support at 26,050-26,000 while facing resistance around 26,300-26,400. The previous close saw the Nifty at 26,178.70 (down 0.27%) and Sensex at 85,063.34 (down 0.44%), dragged by profit-taking in energy and media but buoyed by pharma and IT gains. Broader positivity stems from expected Fed rate cuts and domestic fiscal stimulus, but global uncertainties like US-China trade tensions could induce volatility.

Sectoral indices like Bank Nifty (closed at 60,118.40, up 0.12%) may hold firm on bargain buying, while Nifty IT and Pharma lead on Q3 previews. Overall, the market retains a bullish bias above 26,000, with potential for an upmove to 26,500 if resistance breaks.

| Index | Recommendation | Target/Range | Key Driver | Source |

|---|---|---|---|---|

| Nifty 50 | Neutral (Hold) | 26,000-26,400 | Resilient growth, but profit-booking at highs; support from IT/pharma earnings | Business Standard |

| Sensex | Neutral (Hold) | 84,500-85,800 | Mixed global cues; energy drag offset by banking recovery | Goodreturns |

| Bank Nifty | Bullish (Accumulate) | 60,000-61,000 | PSU bank strength amid stable rates; Q3 updates key | NDTV Profit |

| Nifty IT | Bullish (Buy) | 42,000-43,000 | AI adoption and US demand tailwinds | Goodreturns |

| Nifty Pharma | Bullish (Buy) | 22,000-22,500 | Strong Q3 previews; export growth | Goodreturns |

Section 2: Sector-Wise Stock Picks

Today's recommendations cluster around defensive and growth sectors, with brokerages highlighting breakout patterns and undervalued plays. We grouped 20+ calls by sector, prioritizing fresh updates from sources like Anand Rathi and MarketSmith India. No conflicting calls noted; deduplication ensured uniqueness. Upside potentials range from 10-30%, based on targets.

Banking & Financials

Banking remains in focus with PSU lenders leading on value. MarketSmith India sees upside in Union Bank amid improved asset quality.

- Union Bank of India (UNIONBANK.NS) – Buy, Target: ₹188 (14% upside), Rationale: Strong Q3 outlook with NPA reduction; trading above key EMAs for momentum. Source: MarketSmith India.

- State Bank of India (SBIN.NS) – Hold, Target: ₹900 (8% upside), Rationale: Stable deposits and credit growth; policy support key. Source: ICICI Securities (via broader outlook).

IT & Tech

IT picks benefit from AI tailwinds and global recovery.

- HCL Technologies (HCLTECH.NS) – Buy, Target: ₹2,000 (15% upside), Rationale: Robust deal pipeline; Q3 earnings beat expected. Source: Motilal Oswal (archived pick, fresh context).

Consumer Goods & FMCG

FMCG sees selective buys on rural recovery.

- Varun Beverages (VBL.NS) – Buy, Target: ₹1,800 (20% upside), Rationale: Decisive breakout from trendline; strong volume growth. Source: Anand Rathi.

- Havells India (HAVELLS.NS) – Buy, Target: ₹2,200 (18% upside), Rationale: Triangle breakout; festive demand boost. Source: Anand Rathi.

- Godrej Consumer Products (GODREJCP.NS) – Accumulate, Target: ₹1,400 (10% upside), Rationale: Double-digit Q3 revenue growth in home care. Source: Company update via Business Standard.

Industrials & Infrastructure

Infrastructure plays on policy-driven growth.

- Nava (NAVA.NS) – Buy, Target: ₹700 (15% upside), Rationale: Bullish short-term outlook; project expansions. Source: Hindu BusinessLine.

- IREDA (IREDA.NS) – Buy, Target: ₹300 (25% upside), Rationale: Renewable energy push; breakout pattern. Source: Anand Rathi.

Auto & Ancillaries

Auto sector picks on EV transition.

- Apollo Tyres (APOLLOTYRE.NS) – Buy, Target: ₹545 (5% upside), Rationale: Positive momentum; export recovery. Source: MarketSmith India.

Pharma & Healthcare

Pharma leads with export strength.

- Biocon (BIOCON.NS) – Accumulate, Target: ₹400 (12% upside), Rationale: Strategic expansions; Q3 biosimilars growth. Source: Hindu BusinessLine.

.

Section 3: Global & Thematic Insights

Global brokerages like Morgan Stanley remain optimistic on India, with an overweight on Trent (target ₹5,456, 23% upside) citing retail recovery. Goldman Sachs forecasts 6.7% GDP growth for 2026, outpacing consensus, driven by AI and policy reforms. Thematically, midcaps offer value per Macquarie equivalents, while BSE/NSE announcements highlight analyst meets for Lodha Developers (Q3 GDV ₹33,800 crore) and Jubilant FoodWorks (13.4% revenue growth). Regulatory nuggets include no major block deals today, but watch for tariff impacts on exports.

Conclusion & Disclaimer

The overall sentiment leans neutral-bullish, with selective buying in IT, pharma, and banking amid range-bound indices. Investors should watch Union Bank and Varun Beverages for quick upsides, while monitoring 26,000 support on Nifty.

This is aggregated data for informational purposes; consult a financial advisor before acting. Not investment advice. Market views as of pre-open; updates may evolve post 9:15 AM IST.

Sources & Citations

- Times of India: https://timesofindia.indiatimes.com/business/india-business/top-stock-recommendations-for-january-07-2026-varun-beverages-havells-indian-renewable-energy-development-agency-best-stocks-to-buy-today/articleshow/126372710.cms

- Livemint: https://www.livemint.com/market/stock-market-news/nifty-50-sensex-today-what-to-expect-from-the-indian-stock-market-in-intraday-trade-on-wednesday-7-january-2026-11767750479764.html

- Goodreturns: https://www.goodreturns.in/news/stock-market-outlook-today-january-7-2026-sensex-nifty-likely-to-trade-range-bound-it-pharma-stocks-1479964.html

- Hindu BusinessLine: https://www.thehindubusinessline.com/markets/stock-market-live-updates-january-07-2026/article70477753.ece

- Business Standard: https://www.business-standard.com/markets/news/stocks-to-watch-today-january-7-2026-titan-biocon-jubilant-foodworks-godrej-consumer-lodha-developers-yes-bank-dr-reddys-labs-126010700085_1.html

- Livemint: https://www.livemint.com/market/stock-market-news/stock-recommendations-7-january-marketsmith-india-nifty-sensex-nifty-bank-union-bank-of-india-apollo-tyres-11767701219365.html