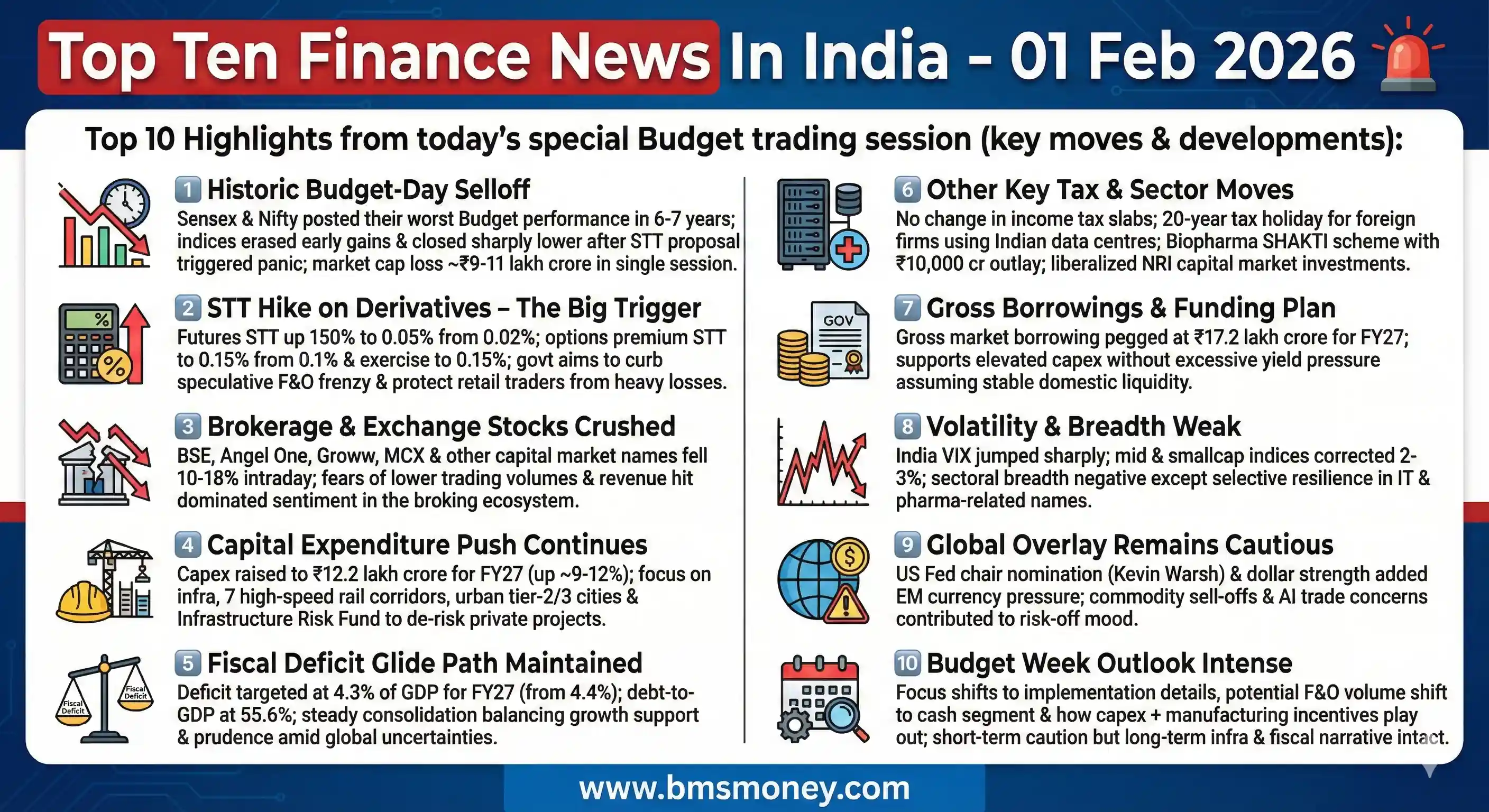

Indian equity markets suffered a severe Budget-day crash on February 01, 2026, with indices recording their worst performance in nearly seven years after the Union Budget proposed a sharp hike in the Securities Transaction Tax (STT). Despite a pro-growth capex push, panic over reduced derivatives liquidity triggered aggressive selling across financials, eclipsing all positive fiscal announcements and igniting extreme volatility.

Indian equity markets endured a highly volatile and bearish session on February 01, 2026, during the special Sunday trading for the Union Budget presentation, with benchmark indices posting their worst Budget-day performance in six to seven years. The overriding negative trigger was the proposed hike in Securities Transaction Tax (STT) on derivatives, intended to curb speculative trading but sparking fears of reduced volumes and liquidity in the F&O segment. Positive elements such as higher capital expenditure, manufacturing incentives, and fiscal consolidation were overshadowed, leading to sharp selling in brokerage, exchange, and derivative-linked stocks, while broader sentiment turned cautious amid global uncertainties.

- Sensex crashed 1,547 points (1.88%) to close at 80,723.

- Nifty 50 declined 495 points (1.96%) to settle below 24,850 at 24,825.

- India VIX surged over 14%, reflecting spiked volatility fears.

- Capital expenditure raised to ₹12.2 lakh crore for infrastructure focus.

- Fiscal deficit targeted at 4.3% of GDP for FY27 with prudent glide path.

Union Budget 2026 Triggers Sharp Market Decline with STT Hike on Derivatives

Finance Minister Nirmala Sitharaman presented the Union Budget 2026-27 on February 01, 2026, proposing a significant increase in Securities Transaction Tax (STT) on futures and options to moderate excessive speculation in the derivatives market. STT on futures was raised from 0.02% to 0.05%, while on options premium it increased to 0.15% from 0.1% and on exercise of options to 0.15% from 0.125%. This adjustment, set to take effect from April 1, 2026, aims to protect retail investors from substantial losses in leveraged trades and generate modest additional revenue. The proposal immediately sparked intense selling pressure during the extended trading session. Markets opened flat to mildly positive but reversed sharply as the STT details emerged. The Sensex plunged 1,546.84 points or 1.88% to close at 80,722.94, erasing early intraday gains that had touched near 82,726. The Nifty 50 fell 495.20 points or 1.96% to 24,825.45, marking one of the steepest single-day drops on Budget day in recent history. Brokerage firms, exchanges, and related entities faced the heaviest losses, with some stocks dropping 10-18% amid expectations of lower trading turnover. The India VIX jumped over 14% to levels indicating elevated fear in the market. Analysts observed that derivatives volumes have grown exponentially, and the hike seeks to shift focus toward cash equities. Government officials described the change as measured and necessary to address systemic risks from over-leveraging. Retail participation in F&O has been high, often leading to losses, prompting regulatory caution. The move complements earlier SEBI efforts to tighten derivatives norms. Short-term liquidity in options and futures may decline as traders adjust strategies. Hedging and arbitrage activities could face higher costs. Some experts anticipate a gradual migration to equity cash segments or alternative instruments. Broader indices like midcap and smallcap also corrected 2-3%. Sectoral performance was largely negative except for selective resilience in IT. The Budget's fiscal prudence was acknowledged, but this single measure dominated headlines and sentiment. Overall, the session underscored markets' acute sensitivity to transaction cost increases. Long-term, it may foster more sustainable trading patterns.

Brokerage and Capital Market Stocks Plunge on STT Hike Concerns

The STT increase on derivatives in the Union Budget 2026-27 directly hit listed companies in the capital markets and brokerage space hard. Shares of major exchanges like BSE and MCX, along with retail brokers such as Angel One and others, witnessed steep declines of up to 18% intraday. Investors feared that higher transaction costs would suppress trading volumes, particularly in the high-turnover F&O segment. Brokerage revenues, heavily reliant on derivatives activity, face near-term compression risks. The proposal targets curbing speculative excess that has led to widespread retail losses. Market participants noted previous STT tweaks had already moderated growth in derivatives. This sharper hike could accelerate volume shifts to cash markets or even offshore venues. Exchanges may see reduced fee income from futures and options trades. Retail-focused platforms could experience client attrition or lower activity levels. Analysts highlighted the interconnected impact on financial services indices. Volatility in these stocks spiked as traders repositioned aggressively. Some viewed the change as protective for long-term market health by discouraging over-leveraging. Others warned of short-term liquidity drying up in key segments. The sell-off was broad within the ecosystem, including depository participants. Business models may need recalibration toward advisory services or equity focus. Investor confidence in the sector turned markedly cautious overnight. The measure aligns with broader regulatory intent to enhance investor protection. Despite the rout, some believe adaptation could stabilize revenues longer-term. The reaction illustrated how policy tweaks in taxation can swiftly alter sector dynamics.

Reuters - https://www.reuters.com/world/india/indian-shares-likely-open-higher-ahead-union-budget-2026-02-01

Capital Expenditure Allocation Raised to ₹12.2 Lakh Crore for FY27

The Union Budget 2026-27 increased capital expenditure outlay to ₹12.2 lakh crore, a notable step-up to sustain infrastructure momentum amid global headwinds. This allocation prioritizes high-speed rail corridors, urban development in tier-2/3 cities, and logistics enhancements. Seven new high-speed passenger rail projects were announced to improve connectivity. An Infrastructure Risk Fund was proposed to mitigate risks for private developers in large projects. Public investment remains a core growth driver as private capex lags. The hike supports employment through construction and related multiplier effects. It counters trade uncertainties and protectionism impacting exports. Sectors like steel, cement, construction equipment, and engineering stand to benefit. Fiscal room was preserved via modest deficit reduction. Analysts see this as continuity of the infrastructure-led strategy. Higher transfers to states for capital projects were implied. The outlay includes clean energy and freight network upgrades. Long-term productivity gains are anticipated from better connectivity. Market response in infra stocks was relatively muted but positive amid overall declines. Implementation execution will determine realized impact. This forms a central pillar for economic resilience. The measure aims to crowd in private participation over time.

The Financial Express - https://www.financialexpress.com/business/news-top-budget-2026-quotes-from-infra-risk-fund-to-higher-capex-fm-sitharamans-key-announcements/4127099/

Fiscal Deficit Target Set at 4.3% of GDP for FY27

The government projected a fiscal deficit of 4.3% of GDP for 2026-27, down marginally from the revised 4.4% for the current year. This reflects steady consolidation while accommodating elevated capex. Gross borrowings are estimated at ₹17.2 lakh crore, with net at ₹11.7 lakh crore. Debt-to-GDP ratio is targeted at 55.6%. The glide path balances growth support with sustainability. It accounts for geopolitical risks and trade disruptions. Analysts appreciate the prudent approach avoiding sharp austerity. Borrowing plans suggest stable domestic absorption if inflation remains anchored. The strategy prioritizes resilience in a volatile global environment. Critics seek bolder reforms, but predictability aids planning. Rating agencies may view it favorably for stability. It enables continued public investment without excessive yield pressure. Overall, it underscores disciplined macroeconomic framework.

The Economic Times - https://economictimes.indiatimes.com/news/economy/policy/union-budget-2026-27-business-as-usual-with-capex-push-modest-fiscal-consolidation-and-risks/articleshow/127846752.cms

20-Year Tax Holiday for Foreign Firms Using Indian Data Centres

A 20-year tax holiday extending to 2047 was announced for foreign entities providing services through Indian data centres. This incentive seeks to attract global tech investments amid rising AI and cloud demand. It addresses prior tax uncertainty concerns for overseas players. Data centre operators and related infrastructure stocks reacted positively. The move promotes India as a competitive global hub. Technology transfer and skilled job creation are expected benefits. It aligns with digital economy and self-reliance goals. Eligibility and compliance details will influence uptake. This complements semiconductor and electronics push. Long-term, it enhances export potential in services.

Biopharma SHAKTI Scheme Launched with ₹10,000 Crore Allocation

The Budget introduced Biopharma SHAKTI, committing ₹10,000 crore over five years to position India as a global biopharma manufacturing leader. Focus areas include scale-up, innovation, and self-sufficiency. Banking and private investment reforms support infrastructure. It builds on PLI schemes for pharmaceuticals. FDI inflows and high-value jobs are anticipated. Sector competitiveness in healthcare strengthens. Disbursement mechanisms will be key to success.

The Financial Express - https://www.financialexpress.com/business/news-bio-pharma-shakti-scheme-launched-with-rs-10000-crore-outlay/4127374

Gross Market Borrowings Pegged at ₹17.2 Lakh Crore for FY27

Gross borrowings for 2026-27 were set at ₹17.2 lakh crore to fund fiscal requirements amid consolidation. Net borrowings stand at ₹11.7 lakh crore. This supports capex without undue market strain. Domestic liquidity is relied upon for absorption. Global rate dynamics could affect costs. The plan signals economic confidence.

The Economic Times - https://economictimes.indiatimes.com/news/economy/finance/budget-2026-india-to-borrow-17-2-lakh-crore-in-2026-27/articleshow/127835411.cms

No Revisions to Income Tax Slabs; Other Relief Measures Announced

Income tax slabs remained unchanged for FY26, offering continuity despite expectations. TCS rates were reduced for education and medical. ITR filing deadlines extended for certain forms. NPS incentives persist. A new Income Tax Act rollout from April 2026 was clarified. Stability aids taxpayer planning.

Trump Nominates Kevin Warsh as Next Federal Reserve Chair

President Donald Trump nominated former Fed Governor Kevin Warsh to succeed Jerome Powell as Fed Chair. The pick, requiring Senate confirmation, signals potential policy shifts. Warsh's background includes crisis management experience. Dollar strengthened initially on the news. Global EMs, including India, monitor for rate and flow implications.

Reuters - https://www.reuters.com/world/us/live-updates-trump-nominates-kevin-warsh-next-fed-chair-2026-01-30