Indian markets showed bullish sentiment on December 11, rebounding sharply from a three-day decline, driven by the US Federal Reserve's rate cut, bargain buying, and strong mutual fund inflows. The Sensex and Nifty closed higher amid broad-based gains, reflecting optimism despite rupee weakness and global uncertainties. Key themes included monetary policy influences, sector recoveries in IT and metals, and sustained domestic investment momentum.

- Markets snap three-day fall with Sensex up 427 points.

- US Fed's 25 bps rate cut boosts global sentiment.

- SEBI defers Phase III nomination rules implementation.

- Rupee weakens amid corporate dollar outflows.

- NITI Aayog pushes for deeper corporate bond market.

Indian Stock Markets Rebound Sharply Post US Fed Rate Cut

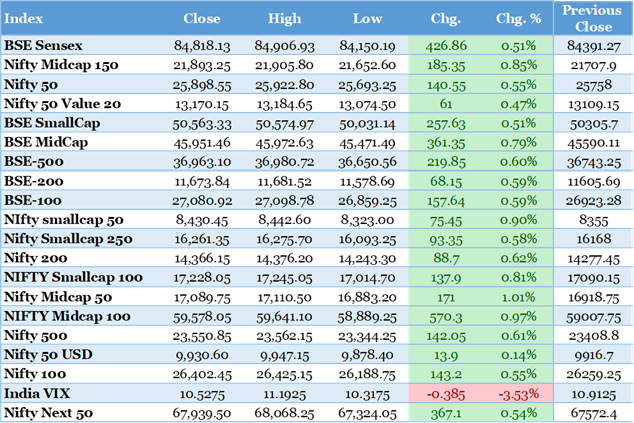

The BSE Sensex closed 427 points higher at 84,818, while the Nifty 50 settled 141 points up at 25,898. The rebound reversed three consecutive sessions of losses. All major sectoral indices ended in the green. The Nifty IT index surged over 2% on positive global cues. Metals and auto indices gained more than 1.5% each. Domestic institutions bought shares worth ₹3,215 crore. Foreign institutions turned marginal net buyers after prolonged selling. Market breadth was strongly positive with an advance-decline ratio of 3:1. The India VIX dropped 2.8% to 13.45, indicating reduced volatility. Midcap and smallcap indices outperformed large caps by a wide margin. Realty and PSU banks staged sharp recoveries. Analysts attributed the bounce to bargain hunting at lower levels. Mutual fund inflows crossed a record ₹1.2 lakh crore in November. Technical charts now show a bullish hammer pattern on daily timeframes. The total market turnover on NSE exceeded ₹5.8 lakh crore. Rate-sensitive sectors attracted aggressive buying interest. Gift Nifty futures were trading 80 points higher in the evening session. Most brokerages raised near-term targets for the Nifty. The rally broadened participation across 42 of 50 Nifty constituents. Investor sentiment shifted from caution to renewed optimism.

US Federal Reserve Implements 25 bps Rate Cut

The US Federal Reserve reduced the federal funds rate by 25 basis points to 3.50%-3.75%. This was the third cut of 2025 and the smallest in the current easing cycle. The decision was unanimous among FOMC members. Inflation is now trending closer to the 2% target. The updated dot plot projects only two additional cuts in 2026. Fed Chair Jerome Powell highlighted uncertainty around tariff policies. US 10-year Treasury yield initially spiked but later settled lower. The US dollar index pared early gains but stayed firm. Emerging market equities rallied on improved liquidity expectations. Indian 10-year G-sec yield is likely to remain range-bound near 6.80%. The Fed maintained its balance-sheet reduction pace. Markets now price in a 65% chance of another cut by March 2026. The statement removed previous language about “greater confidence” on inflation. Powell emphasized a data-dependent and meeting-by-meeting approach. Global central banks may gain more room for independent policy actions. Lower US rates reduce the cost of dollar funding for Indian corporates. The decision supports continued capital flows into high-growth emerging markets. Bond markets reacted calmly with limited volatility. The overall tone was cautiously dovish despite fewer projected cuts. Source: Reuters https://www.reuters.com/markets/us/fed-expected-deliver-25-bps-rate-cut-decision-2025-12-11/

SEBI Defers Phase III of Nomination Framework for Securities

SEBI announced an indefinite deferment of the December 15 deadline for mandatory nomination updation. Over 4 crore demat accounts were still non-compliant as of November. Phase III required compulsory nomination or an explicit opt-out declaration. Market intermediaries had requested more time citing operational difficulties. Depositories NSDL and CDSL welcomed the regulatory relief. Mutual fund houses had sent millions of reminder messages to investors. SEBI will now conduct further stakeholder consultations. A revised timeline will be announced after incorporating feedback. The earlier two phases had already made nomination optional but encouraged. Non-compliance would have led to account freezes from December 16. Brokerages had paused aggressive compliance campaigns in recent days. Industry bodies had sought at least a six-month extension. The deferment prevents potential disruption during the ongoing market rally. Investors can continue transacting without nomination-related restrictions. The move reflects SEBI’s pragmatic approach amid high market participation. Similar relaxations were provided during earlier phases. The regulator remains committed to investor protection in the long run. Market participants expect final guidelines by March 2026. The decision was widely appreciated across broker and depository circles. Source: Economic Times https://m.economictimes.com/markets/stocks/news/sebi-defers-timeline-to-implement-third-phase-of-nomination-framework-for-securities-mkt/articleshow/125914241.cms

NITI Aayog Releases Report on Deepening Corporate Bond Market

NITI Aayog published a comprehensive 150-page report titled “Deepening India’s Corporate Bond Market”. The report targets expanding the market from $450 billion to over $1 trillion by 2030. It recommends tax incentives for retail investors in corporate bonds. Banks should be allowed higher investment limits in bond portfolios. A dedicated electronic platform for retail bond trading is proposed. Credit enhancement through partial government guarantees is a key suggestion. The paper highlights India’s over-reliance on bank lending at 80%. Infrastructure sectors need $1.5 trillion in funding over the next decade. Liquidity enhancement via mandatory market-making is emphasized. Bankruptcy-remote special purpose vehicles for infra bonds are advocated. The report suggests gradual liberalization of FPIs in corporate debt. Issuance costs could fall by 50-100 bps for highly rated companies. The proposals have been forwarded to the Finance Ministry and RBI. A working group will be formed for time-bound implementation. Successful reforms could reduce systemic risk in the banking sector. Corporate bond yields currently range 50-150 bps above G-secs. The report draws lessons from mature markets like the US and South Korea. NITI Aayog CEO called it a “game-changer” for capital market development. Source: Business Standard https://www.business-standard.com/economy/news/niti-aayog-report-corporate-bond-market-deepening-reforms-125121100678_1.html

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsRupee Depreciates Amid Corporate Dollar Outflows Despite Fed Support

The Indian rupee closed at 90.25 against the US dollar, down 12 paise. Year-end corporate dollar payments dominated flows. Most Asian currencies strengthened after the Fed decision. The RBI was seen absorbing dollars lightly around the 90.30 level. One-month forward premiums eased to 2.82%. Oil marketing companies remained active buyers. The currency has depreciated 2.8% year-to-date. Analysts expect a trading range of 89.80-90.50 in the near term. A sustained move above 90.50 could trigger stop-loss selling. Importers increased hedging activity amid volatility. The RBI’s forex reserves stand comfortably above $690 billion. November trade deficit widened marginally to $23.5 billion. Higher crude prices remain a key risk monitorable. The central bank continues to prioritize currency stability. Market participants await the December 5-7 RBI policy meeting. Forward book of exporters remains healthy. Dollar-rupee options implied volatility dropped to 2.9%. Most public sector banks were seen offering dollars near 90.32. The rupee opened stronger but reversed gains by afternoon. Overall bias remains mildly bearish in the very short term. Source: Moneycontrol https://www.moneycontrol.com/news/business/markets/rupee-ends-weaker-at-90-25-on-corporate-dollar-outflows-12891245.html

US Stocks Achieve Record Closes Following Fed Policy Update

The Dow Jones rose 618 points to close at a fresh all-time high. The S&P 500 gained 0.72% to end at another record level. The Nasdaq Composite dipped 0.1% due to profit booking in mega-cap tech. Financials and industrials led sectoral gains. Ten-year Treasury yield settled at 4.38% after initial volatility. The Russell 2000 small-cap index surged 1.6%. Market breadth was strongly positive with nine of eleven S&P sectors in green. Investors rotated from growth to value and cyclical stocks. Oracle’s weak forecast initially pressured tech sentiment. The VIX fell below 14, signaling calm. European indices also closed 0.8-1.2% higher. The positive close sets an upbeat tone for Asian markets. Gift Nifty was trading 85 points higher post US close. Energy stocks rose tracking crude price recovery attempts. Banks benefited from steepening yield curve expectations. Consumer discretionary names outperformed on rate-cut optimism. The rally broadened beyond the Magnificent Seven stocks. High-frequency data showed strong retail participation. The S&P 500 has now gained over 22% year-to-date. Source: CNBC https://www.cnbc.com/2025/12/11/stock-market-today-live-updates.html

Top Performing Equity Fund Categories for You

Top Performing Large Cap Funds Top Performing Mid Cap Funds Top Performing Small Cap FundsBrokerages Maintain Forecasts for Additional US Rate Cuts

Goldman Sachs, JPMorgan, and Morgan Stanley retained forecasts of at least two more cuts by mid-2026. Some houses still see a possibility of 50 bps easing in early 2026. The divergence with the Fed’s dot plot widened marginally. Analysts cited softening labor and inflation data as key drivers. Tariff uncertainties are believed to be partially priced in. Lower rates would support 10-12% earnings growth in 2026. Emerging market central banks gain greater policy flexibility. Indian 10-year yields may drift lower toward 6.60% if global yields soften. US equity targets were raised across major brokerages. Small-cap and value segments remain preferred themes. March 2026 cut probability is priced above 65%. Fixed-income desks are increasing duration exposure. Consensus US GDP growth forecast remains 2.1% for 2026. Recession probability has fallen below 20%. Broker notes highlight resilient consumer spending trends. The outlook supports continued risk-on sentiment globally. Indian IT and export-oriented sectors benefit indirectly. Rate-sensitive domestic sectors may see sustained buying interest. Source: Bloomberg https://www.bloomberg.com/news/articles/2025-12-11/brokerages-stick-with-more-fed-rate-cuts-despite-caution

Top Gainers Led by OLA and Dixon Tech in Market Uptick

OLA Electric surged 7.2% after reporting highest-ever monthly registrations. Dixon Technologies rose 6.5% on fresh order wins in electronics manufacturing. Vodafone Idea jumped 5.8% on tariff hike and debt restructuring hopes. Adani Ports, Trent, and BEL were among other major gainers. The Nifty EV index rose over 3.2% in a single session. Consumer durables and capital goods indices gained sharply. Metal stocks rebounded on global commodity firmness. PSU banks recovered after recent underperformance. Block deals worth ₹1,800 crore were seen in midcap IT names. Retail participation remained elevated with 2.8 crore trades on NSE. High-beta stocks attracted momentum traders. Multiple large-cap counters witnessed technical breakouts. The rally broadened beyond index heavyweights. Nifty Next 50 outperformed the benchmark index. Analysts expect follow-through buying above 25,900. Sector rotation into manufacturing and consumption themes was visible. FIIs bought select midcap names after weeks of selling. The day witnessed strong delivery-based buying. Market participants remain bullish on India’s growth-oriented sectors. Source: Livemint https://www.livemint.com/market/stock-market-news/top-gainers-losers-on-dec-11-ola-dixon-tech-vodafone-idea-eternal-bse-cdsl-among-top-gainers-today-11765446219680.html

Top Performing Debt Fund Categories for You

Top Performing Liquid Funds Top Performing Ultra Short Duration Funds Top Performing Corporate Bond FundsCrude Oil Prices Decline Amid Geopolitical Talks and Strong Dollar

Brent crude settled near $70 per barrel after a third straight session of losses. WTI crude closed around $67.50 with similar weakness. US-led Middle East peace talks reduced supply risk premium. API reported a large inventory build of 6.2 million barrels. OPEC+ maintained its gradual production increase plan. The stronger dollar post-Fed decision weighed on commodities. India’s monthly crude import bill is likely to remain below $12 billion. Lower oil prices improve the current account deficit outlook. Refining margins may face near-term pressure. Downstream marketing margins are expected to expand. Aviation and transport sectors benefit directly from softer fuel costs. The government’s fiscal math receives indirect support. Brent’s breach below 200-DMA raises possibility of testing $65. Geopolitical developments remain a key monitorable. India imports over 85% of its crude requirement. Inventory cycles suggest continued oversupply in early 2026. Refiners have increased processing runs ahead of winter demand. The decline eases inflationary pressures for net importers. Market sentiment remains cautiously bearish on crude. Source: Reuters https://www.reuters.com/markets/commodities/oil-prices-fall-third-day-middle-east-ceasefire-hopes-2025-12-11/

JPMorgan Expands Operations in India Targeting Key Sectors

JPMorgan announced significant capacity addition across investment banking and markets divisions. The bank is targeting EVs, data centers, renewables, and infrastructure financing. India now contributes over 15% to JPMorgan’s global technology workforce. The lender expects India to grow at 6.2-6.6% over the next five years. New mandates in green bonds and sustainability-linked loans are being prioritized. The bank recently advised on several marquee IPOs and block trades. It aims to double India-linked revenues by 2030. Dedicated private credit and distressed asset teams are being established. The GIFT City entity will expand offshore rupee trading capabilities. The move signals strong international confidence in India’s growth story. It is likely to create thousands of high-quality financial services jobs. Competitors are expected to announce similar expansions. The development reinforces India’s position as a global capability hub. Long-term capital commitment supports market depth and liquidity. The expansion aligns with India’s rising weight in global EM indices. JPMorgan’s CEO called India a “strategic priority market”. The bank has hired senior talent from domestic and global peers. This will intensify competition in investment banking and advisory services. Source: Financial Express https://www.financialexpress.com/business/banking-finance-jpmorgan-to-expand-india-operations-targets-evs-data-centres-renewables-3689123/