Indian markets closed flat but resilient on February 11, 2026, with the Nifty holding near 26,000 as strong auto and consumer earnings offset IT weakness and rising bond yields. Corporate fundraising and continued optimism around US trade talks provided selective support, keeping sentiment cautiously positive amid mixed global cues.

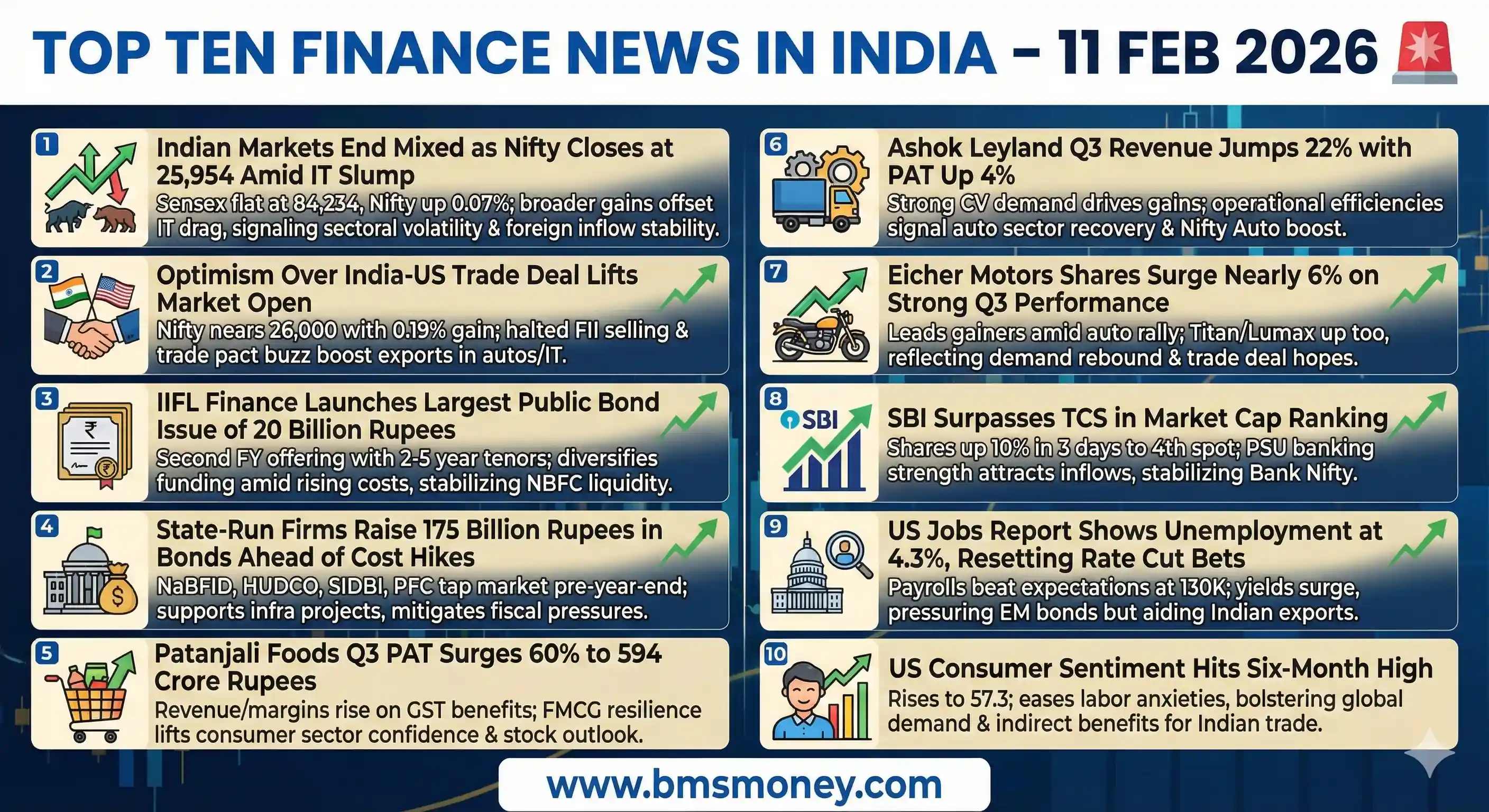

Indian Markets End Mixed as Nifty Closes at 25,954 Amid IT Slump

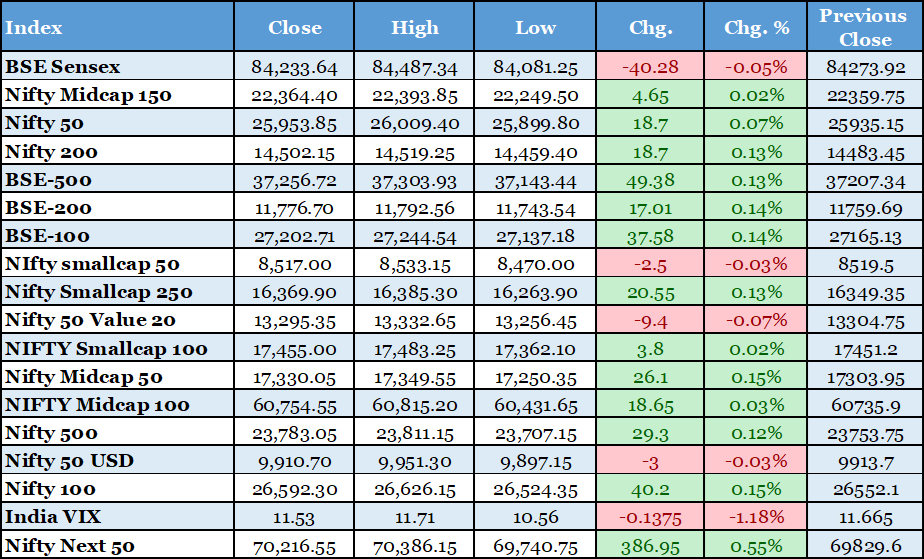

The BSE Sensex concluded the trading session on a flat note at 84,233.64, marking a minor decline of 0.05%, while the Nifty50 managed a slight uptick of 0.07% to settle at 25,953.85. This performance came amidst a choppy market environment characterized by sectoral divergences, where information technology stocks exerted downward pressure on the benchmarks. Investors remained cautious as they awaited additional third-quarter earnings reports from key companies and monitored incoming global economic indicators that could influence sentiment. Broader market indices, including the midcap and smallcap segments, fared better with modest gains, reflecting selective buying interest in undervalued stocks. Foreign institutional investors (FIIs) paused their selling streak, contributing net inflows that helped stabilize the market. However, domestic institutional investors (DIIs) continued their buying spree, providing a counterbalance to potential outflows. This mixed close underscores the ongoing volatility in the Indian equity markets, driven by a combination of domestic corporate health and international macroeconomic developments. From a financial implication perspective, the IT sector's underperformance could signal short-term profit-taking amid concerns over global tech demand slowdowns, potentially leading to reallocation of funds towards cyclical sectors like manufacturing and infrastructure. Analysts suggest that if the Nifty sustains above 25,900, it could pave the way for further upside towards 26,200, but a breach below 25,700 might trigger corrections. Overall, this day's trading highlights the market's resilience in the face of headwinds, with implications for portfolio strategies favoring diversified exposure.

Business Standard https://www.business-standard.com/markets/news/stock-market-live-february-11-nse-bse-sensex-today-gift-nifty-q3-results-ipo-share-market-today-126021100081_1.html

Optimism Over India-US Trade Deal Lifts Market Open

The Nifty50 index approached the psychological 26,000 level, advancing 0.19% to 25,983.75, while the Sensex climbed 0.15% to 84,403.92 during the opening bell, propelled by favorable global market cues and renewed excitement surrounding the potential India-US trade agreement. Market experts attribute this positive start to increased participation across broader segments and a halt in foreign institutional investor selling, which had been a drag in previous sessions. The anticipation stems from recent diplomatic engagements aimed at reducing tariffs and enhancing bilateral trade, particularly in sectors like automobiles, pharmaceuticals, and information technology. This optimism is further bolstered by comments from US officials indicating a willingness to fast-track negotiations, which could open new export avenues for Indian firms. However, analysts caution that gains might remain capped unless the indices decisively break above key resistance levels, such as 26,000 for Nifty. In the broader context, this development aligns with India's push for stronger economic ties amid global supply chain shifts away from China. Financially, a successful trade deal could boost corporate earnings for export-oriented companies, potentially leading to higher stock valuations and increased foreign direct investment. Sectors like autos and IT stand to benefit most, with possible ripple effects on currency stability as the rupee strengthens against the dollar. Investors are advised to monitor upcoming policy announcements, as any delays could introduce volatility. This opening surge reflects growing confidence in India's economic diplomacy, with long-term implications for market capitalization and sectoral growth.

IIFL Finance Launches Largest Public Bond Issue of 20 Billion Rupees

IIFL Finance, a prominent non-banking financial company backed by Fairfax Financial Holdings, announced its largest public bond issuance to date, aiming to raise 20 billion rupees ($220.60 million). This marks the company's second public offering in the current fiscal year, featuring bonds with tenors of two, three, and five years, and interest payment options including monthly, quarterly, annual, or cumulative. The move comes at a time when borrowing costs are on the rise due to tighter monetary policies and liquidity constraints in the banking system. By tapping the public debt market, IIFL seeks to diversify its funding sources beyond traditional bank loans, which have become more expensive. In the broader context, this issuance reflects a trend among NBFCs to front-load fundraising ahead of anticipated further increases in interest rates, driven by inflationary pressures and global economic uncertainties. The bonds are expected to attract retail and high-net-worth investors seeking stable returns in a volatile equity market. Financial implications include potential stabilization of IIFL's liquidity position, enabling sustained lending activities in consumer finance and gold loans. However, it also underscores the sector's vulnerability to rate hikes, which could squeeze net interest margins if not managed effectively. Market watchers anticipate strong subscription given IIFL's solid credit rating and track record. This development could set a precedent for other NBFCs, influencing overall credit availability in the economy and impacting growth in retail lending segments. Investors should evaluate the yield curve and compare with government securities for risk-adjusted returns.

State-Run Firms Raise 175 Billion Rupees in Bonds Ahead of Cost Hikes

Several Indian public sector undertakings, including the National Bank for Financing Infrastructure and Development (NaBFID), Housing and Urban Development Corporation (HUDCO), Small Industries Development Bank of India (SIDBI), and Power Finance Corporation (PFC), are gearing up to raise a combined 175 billion rupees ($1.93 billion) through bond issuances this week. This strategic move is designed to secure funds before borrowing costs escalate further towards the end of the fiscal year, amid expectations of persistent inflation and potential rate adjustments by the Reserve Bank of India. Merchant bankers have reported robust demand for these high-rated instruments, attributed to their government backing and attractive yields compared to private sector alternatives. In the economic landscape, this fundraising supports critical infrastructure projects in sectors like housing, small industries, and power, aligning with the government's capital expenditure push to stimulate growth. By locking in rates now, these entities aim to mitigate fiscal pressures on the central budget, potentially reducing reliance on subsidies or equity infusions. Financially, successful issuances could enhance liquidity in the bond market, encouraging more institutional participation and stabilizing yields. However, it highlights underlying concerns about rising debt servicing costs for the public sector, which might strain future budgets if economic recovery slows. Analysts predict that this activity could influence benchmark government bond yields, with spillover effects on corporate borrowing. For investors, these bonds offer a safe haven amid equity volatility, with implications for portfolio diversification. Overall, this proactive approach underscores the importance of timely capital market access in sustaining India's infrastructure-led growth narrative.

Patanjali Foods Q3 PAT Surges 60% to 594 Crore Rupees

Patanjali Foods, a leading player in the fast-moving consumer goods sector, posted a remarkable 60% year-on-year increase in profit after tax for the third quarter, reaching 594 crore rupees. The company attributes this surge to improved operational efficiencies, stable raw material costs, and benefits from recent GST rate rationalizations on edible oils and food products. Revenue growth was equally impressive, driven by strong demand in branded foods and wellness segments, with EBITDA margins expanding due to better supply chain management. Looking ahead, Patanjali expects robust performance in FY26, buoyed by policy continuity and expanding distribution networks. In the broader market context, this result highlights the resilience of the FMCG sector amid moderating inflation and reviving rural consumption, which has been a drag in previous quarters. Financial implications include potential upward revisions in earnings forecasts for Patanjali and peers, leading to stock price appreciation and enhanced investor sentiment towards consumer staples. The surge could also signal a broader economic recovery, as FMCG performance often mirrors household spending trends. Analysts recommend monitoring input cost volatility, particularly in commodities like palm oil, which could impact future margins. This earnings beat positions Patanjali as a key beneficiary of government initiatives promoting indigenous brands, with possible market share gains from multinational competitors. Investors may find opportunities in related stocks, contributing to sectoral indices like Nifty FMCG. Overall, this development reinforces confidence in India's consumption story, with long-term growth prospects tied to demographic shifts and urbanization.

Economic Times https://economictimes.indiatimes.com/markets

Ashok Leyland Q3 Revenue Jumps 22% with PAT Up 4%

Ashok Leyland, a major commercial vehicle manufacturer, reported a 22% year-on-year jump in consolidated revenue for the third quarter, fueled by robust demand across medium and heavy commercial vehicles, as well as light commercial segments. Profit after tax rose modestly by 4% to 796 crore rupees, supported by cost optimization measures and favorable product mix shifts towards higher-margin models. The company's performance was bolstered by infrastructure spending and economic activity recovery post-monsoon, with export volumes also contributing positively. Operational highlights include improved plant utilization and supply chain efficiencies, which helped offset rising input costs. In the automotive sector context, this result underscores a cyclical upturn driven by government capex in roads, mining, and logistics, aligning with India's ambition to become a manufacturing hub. Financially, the revenue growth could lead to upgraded valuations for Ashok Leyland, attracting institutional interest and supporting the Nifty Auto index. However, the muted PAT increase reflects margin pressures from commodity inflation, prompting caution on sustainability. Analysts project continued momentum in FY26, contingent on fuel price stability and policy support for electric vehicles. This earnings report may catalyze positive sentiment in ancillary industries like auto components, enhancing overall market breadth. Investors should assess debt levels and capex plans for long-term viability. Ultimately, Ashok Leyland's results affirm the sector's role in economic revival, with implications for employment and GDP contributions through multiplier effects.

Business Standard https://www.business-standard.com/markets

Eicher Motors Shares Surge Nearly 6% on Strong Q3 Performance

Eicher Motors emerged as a top gainer on the indices, with its shares surging 6.45% intraday, amid a broader rally in automobile stocks where peers like Titan Company and Lumax Industries also posted gains of up to 7%. In contrast, IT giants like TCS experienced declines of 2.53%, highlighting sectoral rotations. The surge in Eicher was primarily driven by its stellar third-quarter results, featuring strong sales in premium motorcycles under the Royal Enfield brand and commercial vehicles via Volvo Eicher joint venture. Key factors included urban demand recovery, new model launches, and export expansion into emerging markets. In the market landscape, this performance reflects optimism around the auto sector's rebound, fueled by favorable monsoons, festive season spillovers, and anticipated benefits from the India-US trade deal reducing import duties. Financial implications encompass potential market cap expansion for Eicher, drawing FII inflows and bolstering investor portfolios focused on discretionary spending. However, risks include supply chain disruptions and competitive pressures from electric vehicle entrants. Analysts foresee sustained growth if macroeconomic indicators remain supportive, with earnings multiples likely to expand. This stock movement contributed to the Nifty's intraday highs, demonstrating how earnings surprises can drive selective buying. For the broader economy, strong auto sales indicate consumer confidence and industrial activity, with linkages to steel and rubber sectors. Investors are encouraged to track volume guidance and margin outlooks in upcoming quarters.

SBI Surpasses TCS in Market Cap Ranking

State Bank of India (SBI) eclipsed Tata Consultancy Services (TCS) to claim the position of India's fourth-largest company by market capitalization, with its shares appreciating 10% over the past three trading sessions. This milestone was achieved amid robust quarterly earnings from public sector banks, showcasing asset quality improvements and loan growth acceleration. SBI's market cap now stands ahead of TCS, reflecting a shift in investor preferences towards financial stocks amid digital transformation and credit expansion. Key drivers include government recapitalization efforts, fintech integrations, and deposit mobilization strategies. In the corporate landscape, this ranking change highlights the strength of PSU banks in a recovering economy, with implications for the Bank Nifty index's stability. Financially, it could attract more passive inflows from ETFs and mutual funds tracking large-cap benchmarks, potentially enhancing liquidity and valuations. However, challenges like non-performing assets in stressed sectors remain a watchpoint. Analysts attribute the surge to favorable interest rate differentials and policy support for inclusive banking. This development may encourage similar performances from other PSBs, fostering competition in the financial services space. For the market at large, it signals a rebalancing away from overvalued tech stocks towards value-oriented banking plays. Investors should consider macroeconomic factors like RBI's repo rate decisions, which could influence net interest income. Overall, SBI's ascent underscores the pivotal role of banking in India's growth trajectory, with broader effects on credit availability and economic multipliers.

Business Standard https://www.business-standard.com/markets

US Jobs Report Shows Unemployment at 4.3%, Resetting Rate Cut Bets

The US January nonfarm payrolls data revealed an addition of 130,000 jobs, surpassing economist expectations, while the unemployment rate dipped to 4.283%, marking a better-than-anticipated labor market performance. This robust report prompted a reevaluation among traders, who scaled back bets on aggressive Federal Reserve rate cuts in 2026, leading to a surge in Treasury yields. The data indicated wage growth moderation but persistent job creation in sectors like healthcare, leisure, and professional services, defying slowdown fears. In the global context, this strength bolsters the US dollar and influences commodity prices, with oil and gold reacting to shifted monetary policy outlooks. For Indian markets, the implications are twofold: higher US yields could attract capital outflows from emerging markets, pressuring the rupee and equity valuations, while a resilient US economy supports export demand for Indian goods. Bond markets in India may see yields firming in sympathy, impacting borrowing costs for corporates. Analysts now anticipate the Fed to maintain rates longer, potentially delaying global easing cycles. This report underscores labor market resilience amid inflation control efforts, with possible effects on international trade dynamics. Indian investors should monitor FII flows, as a stronger dollar might exacerbate volatility. Overall, the data resets expectations for a soft landing, indirectly benefiting India's trade partners but challenging its monetary policy independence.

US Consumer Sentiment Hits Six-Month High

US consumer sentiment climbed to 57.3 in February, its highest level since August, according to preliminary data from the University of Michigan survey, despite lingering anxieties over labor market conditions and persistent high living costs. The improvement was driven by easing inflation perceptions and stock market gains, though future expectations remain tempered by geopolitical uncertainties. Economists highlight that while current conditions improved, long-term outlooks reflect concerns over policy changes and economic inequality. In the international arena, this uptick signals potential sustained consumer spending, a key driver of US GDP, which could enhance global demand for imports. For India, stronger US sentiment translates to better export prospects in IT services, pharmaceuticals, and textiles, potentially boosting corporate revenues and stock performances. However, it might also delay Fed rate cuts, leading to higher global interest rates and currency pressures on the rupee. Financial markets reacted with equity gains and bond yield adjustments, reflecting recalibrated growth forecasts. Analysts advise watching for revisions in the final survey data, as sentiment can sway retail sales and investment. This development reinforces the US economy's consumer-led recovery, with spillover effects on emerging markets through trade and investment channels. Indian policymakers may find opportunities in strengthened bilateral ties, but must navigate imported inflation risks. Overall, the sentiment rise fosters optimism for global stability, aiding India's external sector balance.

Reuters https://www.reuters.com/business/us-consumer-sentiment-improves-modestly-february-2026-02-06