The Indian markets showed bullish sentiment on December 12, 2025, rebounding strongly with major indices closing higher, fueled by positive global cues from the US Federal Reserve's recent rate cut despite ongoing rupee depreciation and FII outflows. Key themes included market recovery, robust IPO activity, macroeconomic data releases, and sector-specific gains in automobiles and commodities, offsetting concerns over currency weakness and soft demand in some areas.

- Sensex surges 449 points amid global liquidity boost.

- Nifty climbs above 26,000 on rebound momentum.

- Rupee hits record low, pressuring imports.

- Auto industry achieves best-ever November sales.

- Silver prices cross ₹2 lakh milestone.

Sensex Rises 450 Points, Nifty Above 26,000 Amid Metal and Auto Gains

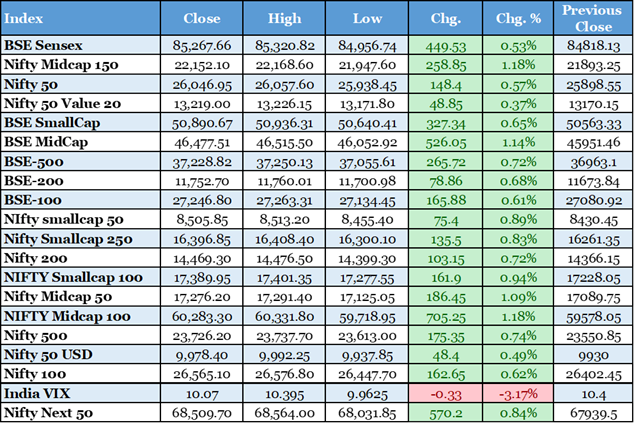

Indian benchmark indices extended gains on December 12, 2025, with the BSE Sensex closing up approximately 450 points or 0.53% at around 85,268. The NSE Nifty settled higher by about 0.44%, reclaiming the 26,000 mark. This rebound came after a positive opening, supported by strong performances in metal stocks like Hindalco and Tata Steel, which benefited from global commodity trends. Auto shares also contributed significantly following the release of record November wholesale data. Broader markets participated in the upmove, with midcap and smallcap indices outperforming. Sectoral rotation was evident, with realty and metals leading while some FMCG names lagged. The rally reflected improved global liquidity sentiment post recent policy actions abroad. Domestic institutional buying offset moderate foreign outflows. Volatility remained contained as investors awaited further data points. This performance marked a continuation of resilience despite currency pressures. Overall trading volumes were healthy across cash and derivatives segments. Analysts noted support from festive spillover demand in consumer-linked sectors. The advance-decline ratio favored buyers on both exchanges. Banking stocks showed mixed trends amid steady bond yields. IT shares traded steady ahead of global cues. Energy names gained on crude stability. Pharma held firm on defensive appeal. Infrastructure plays rose on policy expectations. Realty benefited from rate-sensitive optimism. The market breadth indicated sustained participation beyond large-caps. This close positioned indices for potential further upside if global risks ease. Investors monitored upcoming economic indicators closely. The day's gains reinforced the year's positive trajectory for Indian equities.

Rupee Hits Record Low Near 90.55 Against Dollar

The Indian rupee depreciated further on December 12, 2025, touching a fresh all-time low around 90.55 per US dollar during intraday trade. It closed weakly amid persistent dollar demand from importers and cautious sentiment ahead of global developments. This marked continued pressure despite interventions by the Reserve Bank of India. Factors included elevated crude oil imports and portfolio outflows. The currency's slide raised concerns over imported inflation risks. Corporate hedgers increased forward bookings to mitigate volatility. Exporters benefited from competitive pricing. The RBI's forex reserves provided a buffer against sharp moves. Analysts expected range-bound trade near current levels short-term. Depreciation could impact fiscal calculations for oil marketing companies. Electronics and pharmaceutical importers faced higher costs. The trend highlighted emerging market currency challenges. Bond yields remained stable as investors assessed implications. Equity markets shrugged off the weakness focusing on domestic strengths. The rupee's real effective exchange rate indicated moderate undervaluation. Policy makers monitored for orderly market conditions. This development underscored the need for export diversification. Global dollar strength post policy signals abroad added pressure. Trade deficit data influenced sentiment. The currency's performance affected mutual fund flows in debt segments. Overall, it posed challenges for inflation targeting framework. Investors awaited cues from upcoming central bank communications. The low reinforced calls for structural reforms to bolster inflows.

The Hindu BusinessLine, https://www.thehindubusinessline.com/markets/stock-market-live-updates-december-12-2025/article70384586.ece

India's November CPI Inflation Rises to 0.71%

India's retail inflation measured by CPI rose to 0.71% in November 2025 from a multi-year low in October, data released on December 12 showed. Food prices continued deflationary trend but at a slower pace. Core inflation remained stable around 4%. The uptick was driven by vegetables, spices, and fuel categories. This reading stayed well below RBI's target band. It supported expectations of accommodative monetary policy. Rural inflation was slightly higher than urban. Housing and education components eased marginally. The low print provided relief amid growth focus. Analysts projected average FY26 inflation near 2-3%. This bolstered bond market sentiment with yields softening. Equity investors viewed it positively for rate-sensitive sectors. The data aligned with seasonal base effects waning. Gold and silver price rises influenced miscellaneous items. Transport inflation moderated on fuel stability. Health costs showed mild deceleration. The release reinforced RBI's comfort on price stability. It could influence upcoming policy review discussions. Consumer spending power benefited from subdued prices. Fiscal planning gained flexibility on subsidy burdens. The trend highlighted agricultural supply chain efficiencies. Overall, it signaled balanced macro environment. Markets reacted calmly focusing on growth indicators. This development aided sentiment in consumption themes.

CNBC, https://www.cnbc.com/2025/12/12/india-inflation-cpi-november.html

Auto Industry Achieves Record November Sales Across Segments

India's automobile sector posted its best-ever November wholesales in 2025, per SIAM data released on December 12. Passenger vehicles surged 18.7% YoY to 4.12 lakh units. Two-wheelers grew 21.2% to 19.44 lakh units. Three-wheelers rose 21.3% to over 72,000 units. Festive demand spillover and GST reforms fueled momentum. Utility vehicles drove PV growth. Scooters led two-wheeler gains. Electric variants showed mixed trends. Production hit nearly 29.43 lakh units. Exports remained strong across categories. This performance indicated sustained consumer confidence. Rural demand recovery supported two-wheelers. Urban preferences boosted SUVs. Inventory levels normalized post-festive. Dealers reported healthy retail offtake. The data lifted auto stock sentiments. Ancillary industries benefited from volume uptick. It contributed positively to manufacturing PMI. Job creation in sector received boost. Policy support encouraged green mobility shift. Analysts forecasted continued trajectory into 2026. This marked robust post-pandemic recovery. Overall, it underscored economic resilience in consumption.

Business Standard, https://www.business-standard.com/industry/auto/auto-industry-logs-best-ever-november-sales-across-segments-siam-125121200399_1.html

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsIndia's Forex Reserves Increase to $687.26 Billion

India's foreign exchange reserves rose by $1.03 billion to $687.26 billion for the week ending December 12, 2025, RBI data showed. This build-up reflected valuation gains and moderate interventions. Reserves provided ample import cover exceeding 12 months. It bolstered confidence against external shocks. The increase supported rupee stability efforts. Gold reserves component contributed positively. Foreign currency assets formed the bulk. This level ranked among global highs. It aided sovereign rating perceptions. Capital inflow management gained flexibility. The accretion offset some outflow pressures. Analysts viewed it as prudent buffer building. Debt servicing capacity remained strong. It facilitated orderly market operations. Emerging market peers faced contrasting trends. This development reinforced macro stability narrative. Investors noted positively in portfolio decisions. Overall, it enhanced policy space for growth measures.

Wall Street Closes Lower on AI and Inflation Concerns

US stocks declined on December 12, 2025, with S&P 500 and Nasdaq dropping over 1% amid renewed AI spending worries. Broadcom's outlook disappointed investors. Tech heavyweights like Nvidia and Alphabet fell sharply. Dow also ended lower but outperformed peers. Bond yields rose on persistent inflation signals. This selloff impacted global sentiment including Indian IT stocks. Rotation into defensives was observed. Volatility index spiked moderately. The moves reflected profit-taking after recent highs. Earnings season anxieties built up. This could influence FII flows into emerging markets. Indian exporters in tech services faced scrutiny. Broader risk-off tone prevailed. Analysts cautioned on overvaluation in growth pockets. Defensive sectors held better. Energy gained on supply concerns. Financials mixed on rate path. The session highlighted sector divergences. Markets awaited upcoming data releases. This development added caution to global cues. Indian indices showed resilience comparatively. Overall, it underscored interconnected risks.

Top Performing Equity Fund Categories for You

Top Performing Large Cap Funds Top Performing Mid Cap Funds Top Performing Small Cap FundsICICI Prudential AMC Anchor Book Raises Over Rs 3,000 Crore

ICICI Prudential AMC secured strong anchor interest ahead of its IPO on December 12, 2025. It raised around Rs 3,022 crore from institutional investors. This signaled robust demand for financial services listings. The IPO aimed at larger valuation in mutual fund space. Participation from global and domestic funds was notable. It boosted sentiment in asset management stocks. Broader financial sector gained from liquidity optimism. This success highlighted investor confidence in India's savings growth. Mutual fund industry expansion underpinned the move. Regulatory environment supported such offerings. The anchor round stabilized subscription expectations. Market participants viewed it positively for listing gains. This added to vibrant primary market activity. IPO pipeline remained healthy. It contributed to capital market deepening. Overall, it reflected maturing investor base.

Silver Prices Surge Past Rs 2 Lakh Per Kg Milestone

Silver futures crossed the Rs 2 lakh per kg mark in India on December 12, 2025, extending a sharp yearly rally. Global demand and industrial usage drove the surge. This benefited precious metal investors. Jewelry sector faced higher input costs. Import bills for refiners increased. Hedging activity rose among traders. The metal's performance outpaced gold recently. Safe-haven appeal amid uncertainties supported prices. This trend offered diversification opportunities. Commodity exchanges saw heightened volumes. It impacted related manufacturing margins. Analysts projected sustained strength short-term. Central bank purchases globally added tailwinds. This milestone highlighted commodity cycle shifts. Investors monitored industrial recovery cues. Overall, it boosted sentiment in alternative assets.

Business Standard, https://www.business-standard.com/markets/news/silver-prices-breach-rs-2-lakh-milestone-as-2025-rally-soars-to-nearly-130pc-125121200667_1.html

Top Performing Debt Fund Categories for You

Top Performing Liquid Funds Top Performing Ultra Short Duration Funds Top Performing Corporate Bond FundsUS Treasury Yields Rise on Fed Caution Signals

US 10-year Treasury yields climbed on December 12, 2025, after comments urging caution on further rate cuts. This reflected data-dependent policy stance. It strengthened dollar globally impacting emerging currencies. Bond markets priced slower easing path. This influenced capital flow dynamics. Indian debt yields tracked the move marginally. Equity risk appetite faced pressure. The yield curve steepened slightly. Investors assessed inflation persistence. Upcoming jobs and CPI data gained focus. This shift tempered aggressive rate cut bets. Global borrowing costs implications were noted. Emerging market assets adjusted accordingly. Analysts revised growth forecasts mildly. The development added to volatility drivers. Markets awaited clarity from officials. Overall, it signaled transitional monetary phase.

Crude Oil Forecast Sees WTI in $55-60 Range for 2026

Global crude outlook pointed to WTI averaging $55-60 in 2026 amid rising supply and demand balance, noted on December 12, 2025. Non-OPEC production growth offset demand worries. This lower price trajectory benefited oil importers like India. It eased fiscal subsidy burdens. Refining margins faced challenges domestically. Energy stocks reacted mixed. The forecast supported inflation moderation. Geopolitical risks remained monitored. Inventory builds influenced sentiment. This outlook aided budget planning. Consumer fuel prices gained stability room. Transportation sectors benefited indirectly. Overall, it provided positive macro tailwind.

Business Standard, https://www.business-standard.com/markets/news/crude-oil-outlook-wti-seen-at-55-60-as-asian-demand-offsets-rising-supply-125121200574_1.html