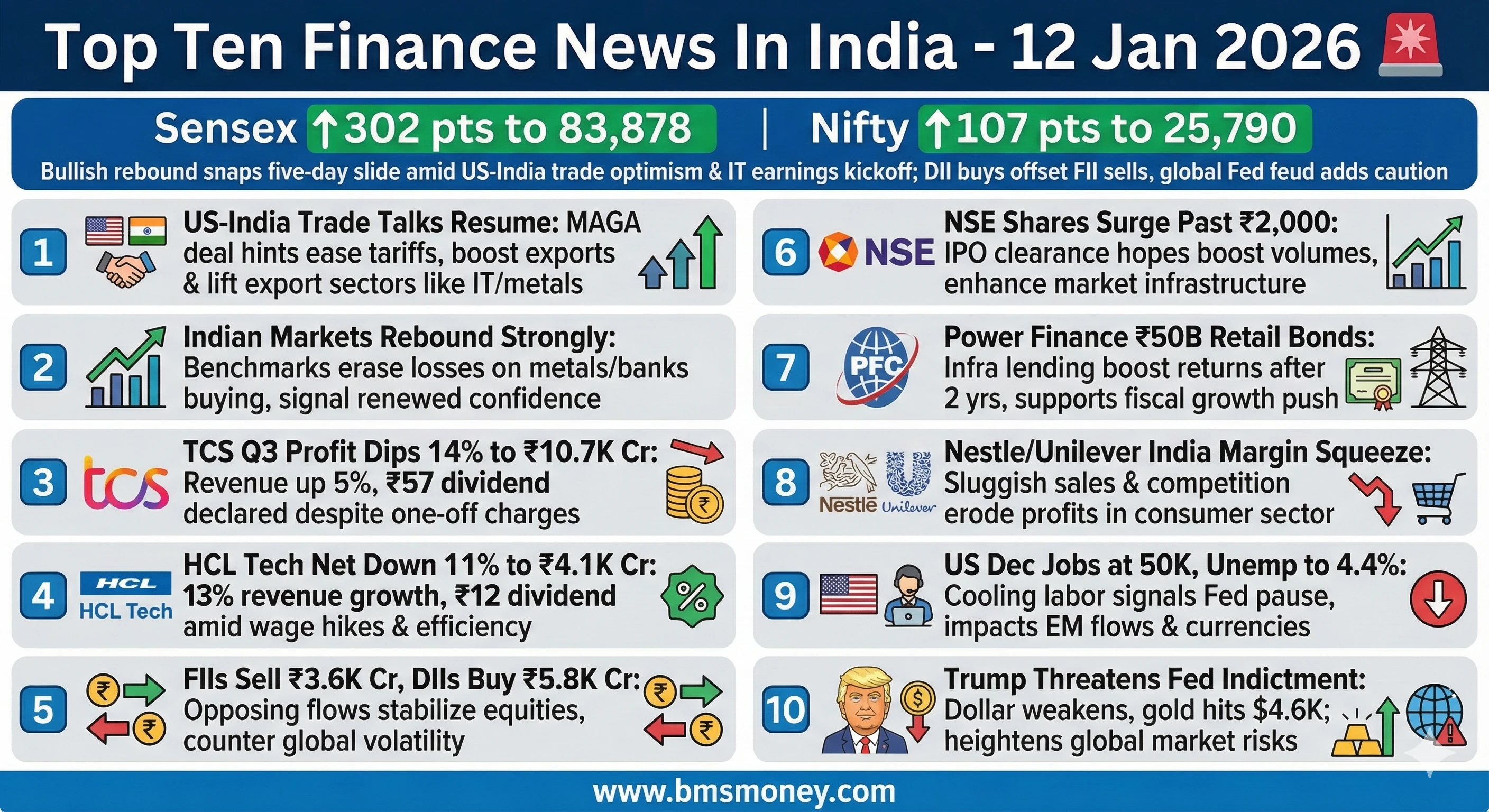

The Indian markets staged a bullish recovery on January 12, snapping a five-day losing streak amid optimism over resumed US-India trade talks and strong IT earnings kickoff. Overall sentiment turned positive, driven by gains in metals and banking sectors, though IT results showed mixed profits due to exceptional charges. Key themes included corporate earnings, foreign investment flows, and global trade cues pressuring consumer giants.

Indian Markets Rebound, Sensex Up 302 Points

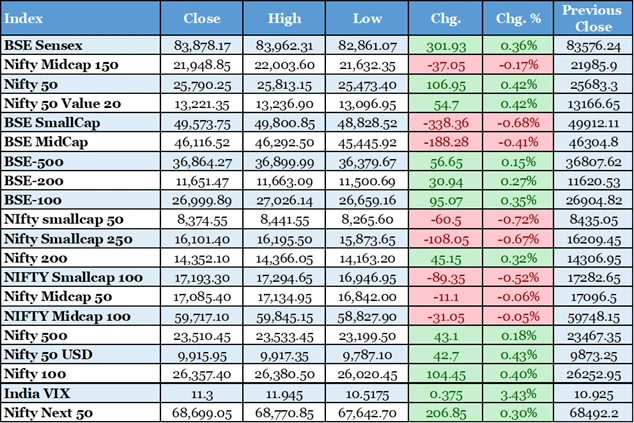

Benchmark indices in India closed higher after a prolonged downturn, marking a significant rebound. The Sensex ended the day at 83,878 points, gaining 302 points from the previous close. Similarly, the Nifty settled at 25,790, reflecting broad-based buying interest. Key drivers included strong performances in metals and banking stocks. This recovery helped erase losses accumulated over the past five trading sessions. Investors showed renewed confidence amid positive global cues and domestic developments. However, technical analysts warn of resistance levels that could cap further upside. Upcoming corporate earnings are expected to influence market direction in the near term. Volatility remains a concern due to external factors like geopolitical tensions. The financial implication is improved liquidity and potential for continued upward momentum if support levels hold. Sectoral indices also saw gains, with Bank Nifty leading the charge. This shift in sentiment could attract more domestic institutional investments.

US-India Trade Talks Resume, Potential MAGA Deal in Sight

The United States has officially resumed trade negotiations with India after a period of stalled discussions. Officials from both sides expressed optimism about forging a significant agreement under the MAGA framework. India has been labeled as a 'real friend' by US negotiators, highlighting strengthened bilateral ties. This move aims to reduce existing tariffs on key goods and services between the two nations. Export sectors in India, particularly IT services and metals, stand to benefit substantially from eased trade barriers. The talks occur against a backdrop of global economic uncertainties, including supply chain disruptions and inflationary pressures. Immediate market reaction was positive, with Indian indices climbing on the news. Analysts predict this could lead to increased foreign direct investment inflows into India. However, challenges remain, such as addressing intellectual property concerns and agricultural subsidies. If successful, the deal could add momentum to India's economic growth trajectory. The financial implications include potential rupee strengthening and improved corporate earnings for export-oriented firms. Overall, this development fosters a more stable trading environment amid international volatility. Money Control, https://www.moneycontrol.com/news/business/economy/maga-deal-in-making-us-resumes-trade-talks-with-real-friend-india-13769145.html

TCS Q3 Profit Falls 14% to ₹10,657 Crore

Tata Consultancy Services announced its third-quarter results, showing a notable decline in profits. The net profit dropped 14% year-on-year to ₹10,657 crore due to one-time charges. These charges stemmed from labor code implementations and internal restructuring efforts. Despite the profit dip, revenue increased by 5% to ₹67,087 crore, indicating operational growth. The results surpassed some analyst expectations when excluding exceptional items. TCS declared an interim dividend of ₹57 per share, signaling confidence in cash flows. This performance highlights ongoing cost pressures within the IT industry. However, it also underscores the sector's resilience amid global economic challenges. Deal wins remained strong, supporting future revenue pipelines. The immediate financial implication is mixed stock reactions, with potential for recovery in subsequent quarters. Investors are focusing on margin improvements and client spending trends. Overall, TCS's results set the tone for other IT majors' earnings. Livemint, https://www.livemint.com/market/stock-market-news/tcs-q3-results-it-major-posts-14-yoy-fall-in-profit-to-rs-10-657-crore-even-as-revenue-rises-5-11768213505438.html

HCL Tech Q3 Net Profit Down 11% to ₹4,076 Crore

HCL Technologies reported its quarterly earnings, revealing an 11% year-on-year decline in net profit. The profit stood at ₹4,076 crore, impacted by recent wage hikes across the organization. Revenue, however, showed robust growth of 13.3% to ₹33,872 crore. The company announced a dividend of ₹12 per share to reward shareholders. This marks the beginning of the IT earnings season with varied outcomes. Selective client spending in key markets contributed to the profit squeeze. Operational efficiencies helped mitigate some of the cost increases. The financial implications include cautious optimism for the sector's outlook. Analysts anticipate revenue momentum to continue despite margin pressures. HCL's strong order book supports long-term growth prospects. This result influences investor sentiment towards other tech firms. Broader industry trends like digital transformation drive future performance. Money Control, https://www.moneycontrol.com/news/business/earnings/hcltech-q3-results-net-profit-declines-11-to-rs-4-076-crore-it-firm-declares-rs-12-dividend-13768598.html

FIIs Sell ₹3,638 Crore in Equities, DIIs Buy ₹5,839 Crore

Foreign institutional investors continued their selling spree in Indian equities on the day. They offloaded stocks worth ₹3,638 crore amid shifting global sentiments. In contrast, domestic institutional investors stepped up with purchases totaling ₹5,839 crore. This opposing flow helped stabilize the market despite external pressures. FII selling is attributed to concerns over US interest rates and geopolitical issues. DII buying reflects strong domestic confidence and ample liquidity. The net effect was a balanced market close with minimal volatility. Financial implications include sustained support for mid and small-cap stocks. This dynamic highlights India's resilience to foreign outflows. Analysts monitor these trends for potential shifts in market direction. Continued DII strength could offset FII withdrawals in the short term. Overall, it underscores the growing role of local investors in market stability. Business Standard, https://www.business-standard.com/markets/news/fiis-trimmed-stakes-in-12-small-cap-stocks-for-two-consecutive-quarters-shares-slide-up-to-45-126482787_1.html

NSE Shares Surge Past ₹2,000 on IPO Clearance Hopes

Shares of the National Stock Exchange in the unlisted market crossed the ₹2,000 mark. This surge followed positive comments from SEBI regarding an impending IPO approval. Trading volumes increased significantly as investors anticipated the listing. The development is expected to enhance market infrastructure and accessibility. NSE's IPO could attract substantial institutional interest. This move aligns with efforts to deepen India's capital markets. Financial implications include potential valuation boosts for exchange-related entities. It also signals regulatory progress in streamlining listings. Investors are optimistic about improved liquidity post-IPO. Challenges such as compliance and market conditions remain. The surge reflects broader market enthusiasm for infrastructure plays. Overall, this could pave the way for more exchange listings. The Economic Times, https://economictimes.indiatimes.com/markets/stocks/news/nse-shares-surge-after-ipo-clouds-seem-to-clear/articleshow/126494736.cms

Power Finance Plans ₹50 Billion Retail Bond Issue

Power Finance Corporation, a state-owned entity, announced plans to raise ₹50 billion through retail bonds. This marks its return to the retail bond market after a two-year hiatus. The funds will support lending to power and infrastructure projects. It aligns with the government's push for infrastructure development. Bond issues provide stable, long-term funding amid fiscal constraints. This could influence bond yields in the domestic market. Retail participation is expected to be high due to attractive rates. Financial implications include enhanced liquidity for infrastructure sectors. It also diversifies funding sources for public sector undertakings. Analysts view this as a positive step for economic growth. Potential risks include interest rate fluctuations. Overall, it supports India's ambitious infrastructure agenda. Bloomberg, https://www.bloomberg.com/news/articles/2026-01-12/india-s-state-owned-power-finance-plans-555-million-retail-bond

Nestle, Unilever India Units Face Margin Squeeze

Hindustan Unilever and Nestle India reported challenges in their recent performance updates. Sales growth remained sluggish due to intense competition and subdued demand. Margins eroded as input costs rose without corresponding price hikes. This reflects broader issues in the consumer goods sector. Multinational operations in India face pressure from local rivals. Economic slowdown has impacted consumer spending patterns. Financial implications include potential stock downgrades and reduced profitability. Companies are focusing on cost optimization and product innovation. Analysts expect recovery with improved economic conditions. Sectoral shifts towards premium products may help. This news highlights vulnerabilities in fast-moving consumer goods. Overall, it calls for strategic adjustments to sustain growth. Reuters, https://www.reuters.com/commentary/breakingviews/nestl-and-unilevers-india-engine-risks-stalling-2026-01-12/

US December Job Growth at 50,000, Unemployment Dips to 4.4%

The US labor market added only 50,000 jobs in December, below expectations. Previous months' figures were revised downward, indicating a cooling trend. Unemployment rate decreased slightly to 4.4%, showing resilience. Services sector expansion offset manufacturing weaknesses. This data influences global markets, including India. Weaker US growth could impact Indian exports negatively. FII flows may fluctuate based on US economic signals. Financial implications include increased volatility in emerging markets. Analysts anticipate Fed policy adjustments in response. Currency movements, like dollar weakening, affect commodities. This report adds to concerns over global recovery. Overall, it shapes investor risk appetite worldwide. Reuters, https://www.reuters.com/business/finance/us-job-growth-slows-december-unemployment-dips-2026-01-09/

Trump Threatens Fed Indictment, Rattling Global Markets

US President Trump escalated his criticism of the Federal Reserve with threats of indictment. Targeted at Chair Powell, this feud caused market turmoil. The dollar weakened significantly, boosting gold prices to $4,600 per ounce. Global equities experienced heightened volatility as a result. Indian markets felt the ripple effects through currency and commodity fluctuations. Risk aversion increased among international investors. Financial implications include potential shifts in monetary policy expectations. This uncertainty could lead to capital outflows from emerging economies. Analysts monitor for further escalations and resolutions. Commodity-dependent sectors in India may benefit from price surges. The situation underscores political influences on economic institutions. Overall, it heightens global financial risks. Reuters, https://www.reuters.com/business/finance/global-markets-global-markets-2026-01-12/