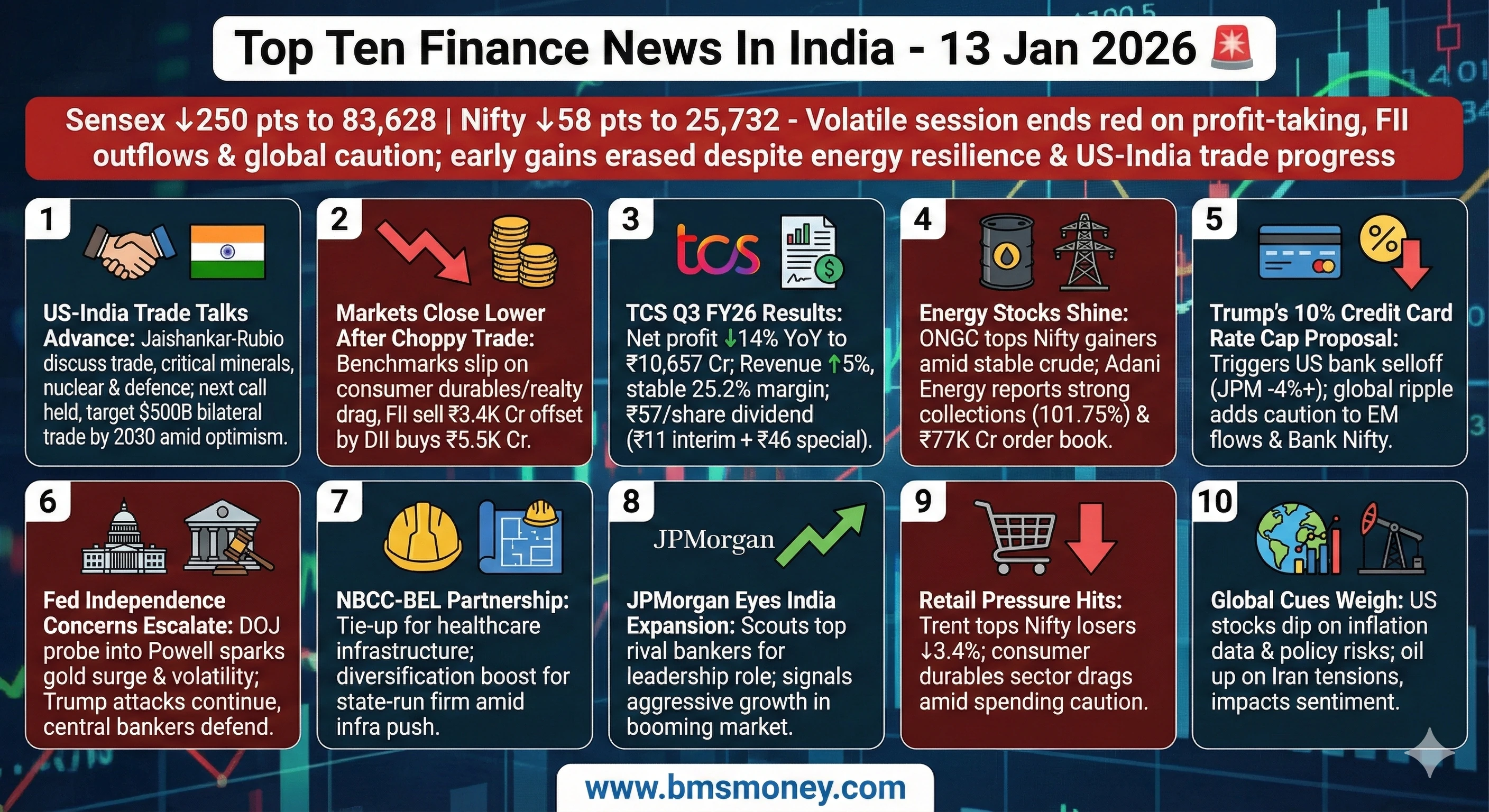

The Indian equity markets closed lower in a volatile session marked by profit-taking, FII outflows, and caution over global cues including US policy developments. Overall sentiment remained cautious to bearish, with early gains erased amid mixed Q3 earnings and uncertainties related to geopolitics and trade. Key themes revolved around IT sector weakness, energy resilience, banking sector stability, and international influences from US financial policy debates.

Sensex and Nifty Close Lower Amid Profit-Taking and FII Outflows

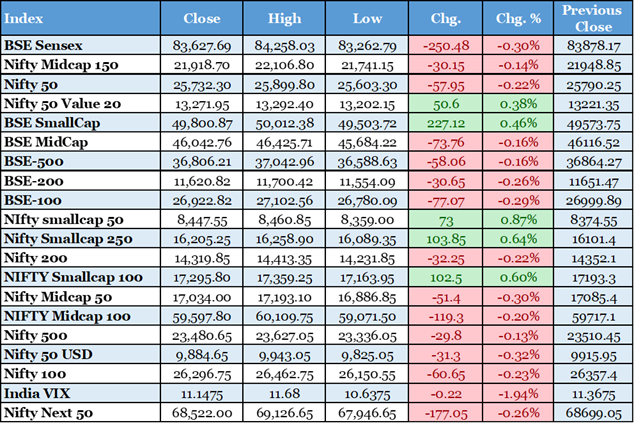

Indian benchmark indices concluded the trading day on a negative note following significant intraday volatility. The BSE Sensex declined by 250.48 points or 0.30% to settle at 83,627.69. The NSE Nifty 50 fell by 57.95 points or 0.22% to close at 25,732.30. Early morning gains were driven by positive global cues and optimism around trade discussions. However, profit-booking intensified in the afternoon session. Consumer durables and realty sectors emerged as major drags on the indices. Blue-chip stocks witnessed broad-based selling pressure throughout the day. Foreign institutional investors offloaded shares worth ₹3,443 crore net. Domestic institutional investors countered with purchases amounting to ₹5,500 crore. The session highlighted ongoing caution among investors. Geopolitical tensions involving US-Iran relations contributed to the unease. Upcoming US-India trade negotiations added to the uncertainty. Q3 earnings season kickoff influenced sentiment variably. The Nifty traded in a range between 25,899.80 high and 25,603.30 low. Sensex similarly swung from 84,258.03 to 83,324.84 intraday. This volatility underscores fragile market confidence currently. Short-term downward bias may persist without strong catalysts. Domestic inflows continue to provide crucial support to benchmarks. Overall, the close reflects a bearish tilt for the day.

The Hindu Business Line, https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-13-jan-2026/article70502287.ece

TCS Q3 Profit Declines 11.7% QoQ Amid Stable Margins

Tata Consultancy Services released its Q3 FY26 results showing challenges in profitability. Net profit declined 11.7% quarter-on-quarter to ₹10,657 crore. Revenue increased modestly by 2% to ₹67,087 crore during the period. EBIT margins held steady at 25.2% level. The company announced a third interim dividend of ₹11 per share. A special dividend of ₹46 per share was also declared. Deal total contract value disappointed market expectations. This contributed to immediate pressure on IT sector stocks. TCS performance reflects broader demand volatility in global markets. Year-on-year net profit fell 13.9% from previous levels. Revenue growth beat some analyst estimates marginally. The results triggered selling in Nifty IT index constituents. Management highlighted stable operational efficiency despite headwinds. Attrition and wage pressures remain managed effectively. Client spending patterns show caution in discretionary projects. The dividend announcements provide some shareholder comfort. Special dividend underscores strong cash position. Overall, the quarter indicates muted near-term growth outlook. IT sector faces ongoing transformation challenges globally. TCS remains a bellwether for Indian tech performance. Market reaction was negative on the disappointing aspects.

Trump Proposes 10% Credit Card Rate Cap, Triggering Global Bank Selloff

US President Donald Trump proposed a temporary 10% cap on credit card interest rates for one year. The announcement came via social media platform. It aimed to address consumer cost-of-living concerns ahead of elections. Wall Street reacted sharply with financial stocks declining. JPMorgan Chase shares fell around 4.2% in response. Visa dropped 4.5% while Mastercard declined 3.8%. Banking executives issued warnings on potential impacts. JPMorgan CEO Jamie Dimon highlighted severe consequences for consumers. Reduced credit availability could harm economic activity. The proposal surprised the industry significantly. Banks argued it would limit lending to higher-risk borrowers. Global ripple effects emerged in emerging markets including India. Financial services linkages could transmit volatility. Bank Nifty may face indirect pressure from sentiment. FII flows to Indian markets could turn cautious. The move adds to broader policy uncertainty in the US. Credit card portfolios face margin compression risks. Industry pushback has been strong and coordinated. Proposal remains subject to legislative processes. Overall, it signals populist approach to financial regulation. Markets digested the news with increased caution.

Fed Independence Probe Sparks Gold Surge and Market Volatility

US Department of Justice initiated a probe into Federal Reserve Chair Jerome Powell. This followed criticisms from President Trump on central bank policies. Gold prices surged to record levels above $420 per ounce. The move raised fears over erosion of institutional independence. US equity indices retreated with S&P 500 down 0.2%. Dow Jones declined 0.8% during the session. Inflation data showed stability reinforcing rate pause expectations. Wall Street executives rallied in support of Powell. JPMorgan CEO expressed respect for Fed leadership. Former Fed chairs condemned the unprecedented action. Bond markets reflected heightened uncertainty. Gold acted as a safe-haven amid political tensions. Emerging markets including India faced risk-off flows. Rupee stability could come under pressure indirectly. Commodity prices like crude oil showed mixed responses. The episode highlights political risks to monetary policy. Fed independence remains crucial for credibility. Global investors monitor developments closely. Volatility increased across asset classes. This could influence Indian market sentiment negatively. Overall, concerns center on long-term economic stability.

Bloomberg, https://www.bloomberg.com/news/articles/2026-01-12/stock-market-today-dow-s-p-live-updates

Adani Energy Reports Steady Collections and Strong Order Book

Adani Energy Solutions provided positive operational updates for the period. Collection efficiency stood steady at 101.75% year-on-year. System availability remained high at 99.69%. Transmission order book under construction reached ₹77,787 crore. Mumbai distribution network achieved 99.998% supply reliability. These metrics demonstrate operational excellence in the sector. Energy stocks outperformed broader market declines. The update boosts investor confidence in infrastructure growth. Rising power demand supports long-term prospects. Adani Group's execution track record remains strong. Transmission segment shows robust pipeline of projects. Distribution business maintains high reliability standards. Financial implications include sustained revenue visibility. Sectoral indices benefited from the positive news flow. Market participants viewed it favorably amid volatility. This highlights resilience in utility and energy segments. Government infrastructure push aids such developments. Overall, the announcement provides stability to portfolios. Energy sector continues to attract attention. Positive outlook persists for related stocks.

India Infoline, https://www.indiainfoline.com/news/markets/top-stocks-for-today-13th-january-2026

NBCC Partners with Bharat Electronics for Healthcare Infrastructure

NBCC entered into a strategic partnership with Bharat Electronics Limited. The MoU focuses on healthcare infrastructure development. It aims to create manufacturing and services ecosystem. This marks diversification for the state-run construction firm. Synergies in engineering and project management expected. Hospital and healthcare projects form the core focus. NBCC leverages its expertise in large-scale execution. BEL brings technological capabilities to the venture. Move aligns with government healthcare initiatives. Potential for significant order inflows exists long-term. Infrastructure stocks could see positive sentiment spillover. Strategic step enhances growth diversification. Market reaction viewed it as constructive development. Healthcare sector expansion remains a priority area. Partnership could lead to new project wins. Execution risks managed through combined strengths. Overall, this enhances NBCC's order book prospects. Infrastructure sector benefits from policy support. Announcement adds to positive corporate news flow. Investors monitor implementation progress closely.

JPMorgan Scouts Top Bankers for India Expansion Leadership

JPMorgan Chase approached senior bankers from competitors. The search targets leadership for India operations expansion. This signals aggressive growth strategy in the region. India's booming economy attracts increased foreign interest. Investment banking and services see heightened activity. Move intensifies competition in financial sector. Corporate fundraising and M&A could benefit. Bank Nifty may experience positive global linkages. Talent acquisition reflects confidence in market potential. Expansion plans include broader product offerings. India remains a key emerging market focus. JPMorgan's strategy aligns with economic growth trends. Competitive landscape in banking intensifies further. Domestic players face increased pressure. Overall, this indicates rising foreign engagement. Capital flows could see supportive trends. Announcement underscores India's attractiveness. Long-term implications positive for sector. Investors watch for execution outcomes.

ONGC Leads Gainers as Energy Stocks Outperform

Oil and Natural Gas Corporation topped the Nifty gainers list. Energy sector showed relative strength during the session. ONGC benefited from stable crude oil price environment. Global energy cues remained supportive. PSU stocks provided cushion to broader indices. Sectoral outperformance highlighted resilience. Nifty energy index moved positively. Market volatility spared energy counters largely. Production and exploration updates aided sentiment. Crude oil prices held steady influencing positively. Energy demand in India continues robust. ONGC's performance reflects sector tailwinds. Broader market declines contrasted with gains here. Investors rotated towards defensive plays. Overall, energy provided stability amid weakness. Sector outlook remains constructive. Commodity trends support near-term momentum. Gainers list leadership underscores strength.

Trent Tops Losers Amid Retail Sector Pressure

Trent emerged as the top loser on the Nifty index. Shares declined 3.39% during the trading session. Retail and consumer durables faced broad selling. Nifty consumer durables index dropped 0.89%. Concerns over discretionary spending weighed heavily. Economic uncertainties impacted sentiment negatively. Consumer-facing sectors showed vulnerability. Trent's performance reflected sectoral weakness. Mid-cap and consumption stocks under pressure. Profit-taking intensified in the segment. Broader market caution spilled over. Retail landscape faces demand moderation risks. Discretionary purchases slowed amid volatility. Overall, this highlights sector-specific challenges. Nifty midcap indices felt additional drag. Investors adopted cautious stance here. Recovery depends on consumption revival. Current trends indicate short-term pressure.

Upcoming US-India Trade Talks Add to Market Caution

Indian markets traded cautiously ahead of key US-India trade discussions. Negotiations influence export-oriented sectors significantly. Positive remarks from US Ambassador provided some optimism. However, global tariff concerns persisted. IT and automobiles remain sensitive to outcomes. Nifty and Sensex trajectories hinge on progress. Volatility increased due to uncertainty. Trade deal prospects impact sentiment variably. Export growth could accelerate on favorable terms. Current phase shows negotiation complexities. Markets await concrete developments closely. Global cues interplay with domestic factors. Overall, caution dominates investor approach. Potential for positive surprises exists. Trade relations remain critical for economy. Outcomes could drive sectoral rotations. Short-term market direction influenced heavily.