Indian equity markets extended losses for a second consecutive session on January 14, 2026, closing modestly lower amid persistent foreign outflows, geopolitical uncertainties, and mixed global cues. The Nifty 50 and Sensex declined around 0.26-0.29%, reflecting pressure from IT and consumption sectors despite resilience in metals and PSU stocks. Overall sentiment remained cautious with consolidation expected until key resistance levels are cleared.

Indian Benchmarks Extend Losses as IT and Consumption Stocks Weigh

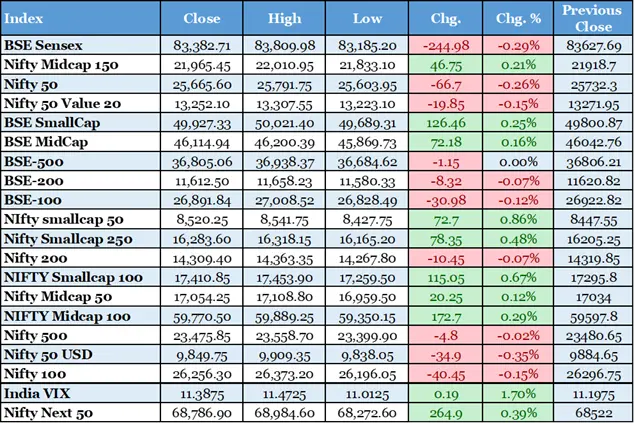

The BSE Sensex closed at 83,382.71, down 244.98 points or 0.29%, while the NSE Nifty 50 settled at 25,665.60, declining 66.70 points or 0.26%. This marked the second straight day of losses for major indices. Selling pressure was evident in heavyweight sectors like IT and FMCG. Metal stocks provided some support with notable gains. Foreign institutional investors continued net selling. Domestic institutions offered limited counterbalancing buys. Volatility remained contained as India VIX dipped slightly. Geopolitical tensions contributed to the cautious mood. US tariff-related uncertainties added to global risk aversion. The market traded in a narrow range for much of the session. Analysts noted immediate support near 25,600 for Nifty. Resistance persists around 25,900-26,000 levels. Consolidation appears likely in the near term. Broader markets showed mixed trends with midcaps outperforming marginally. This session reflected ongoing adjustment after a weak start to 2026. Investor focus shifted toward upcoming earnings and policy cues.

Tata Steel Leads Gainers Amid Metal Sector Resilience

Tata Steel emerged as a standout performer with a 3.71% gain to close higher. Metal stocks broadly outperformed on the day. This strength contrasted with weakness elsewhere. PSU stocks also showed positive momentum. NTPC and Axis Bank featured among notable gainers. The sector benefited from selective buying interest. Broader market declines limited overall upside. Tata Steel's performance highlighted defensive rotation. Investors sought value in cyclical names. This trend provided some cushion to indices. Metal sector recovery signals potential rotation. It reflects resilience despite global headwinds. Commodity prices influenced sentiment positively here. The move helped limit broader index damage. Analysts view it as a sign of selective optimism. Such sectoral divergence is common in consolidation phases. It underscores varied investor positioning currently. Metal outperformance could persist if global cues stabilize. This development offered a bright spot in an otherwise subdued session.

The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-14th-january-2026/article70505277.ece

Infosys Q3 Results in Focus Ahead of Earnings Announcement

Infosys remained a key stock to watch as markets anticipated its Q3FY26 results. The IT major's performance carries sector-wide implications. Previous peers like TCS reported mixed outcomes. Expectations centered on revenue guidance and margins. Infosys holds significant weight in indices. Any surprise could influence tech sentiment broadly. The sector faced selling pressure overall. IT stocks dragged benchmarks lower. Global demand concerns persist for the industry. Currency fluctuations add another layer of impact. Client spending trends remain under scrutiny. The results were due post-market or intraday. Investors positioned cautiously ahead of the release. This event highlighted ongoing earnings season dynamics. Tech sector recovery hopes hinge on positive surprises. Broader market caution limited aggressive bets. The anticipation contributed to volatility in related names. Such quarterly updates shape near-term trajectories significantly.

Business Standard - https://www.business-standard.com/markets/news/stocks-to-watch-today-january-14-2026-infosys-icici-lombard-tata-elxsi-just-dial-126011400081_1.html

Shriram Finance Gains Shareholder Approval for MUFG-Related Proposals

Shriram Finance secured shareholder approval for proposals linked to its strategic deal with MUFG. This development marks progress in the collaboration. It enhances the NBFC's growth prospects. Foreign partnership strengthens capital and expertise access. The nod facilitates smoother execution of terms. It signals continued foreign interest in Indian finance. Shriram Finance operates in a competitive segment. This tie-up could boost lending capabilities. Market response remained positive on the news. Such deals highlight globalization in Indian finance. Regulatory clearances may follow next. The approval boosts investor confidence in the entity. It aligns with broader FDI trends in the sector. Strategic moves like this support long-term value creation. The event drew attention amid financial sector focus. It exemplifies international collaboration benefits.

Reuters India - https://www.reuters.com/world/india/indias-shriram-finance-gets-shareholders-nod-mufg-deal-linked-proposals-2026-01-14

Tata Elxsi Reports Sharp Q3 Profit Decline, Shares Drop

Tata Elxsi posted an 82% plunge in Q3 net profit to Rs 108.89 crore. This compared to Rs 199 crore in the prior year period. Shares declined nearly 3% in response. The drop reflected sector-specific challenges. IT services faced margin pressures. The results disappointed market expectations. Stock reaction highlighted earnings sensitivity. Broader IT weakness amplified the impact. Investors reassessed growth prospects accordingly. Such sharp declines raise valuation concerns. The company operates in niche design areas. Demand fluctuations contributed to the outcome. This performance contrasted with sector peers. It underscored uneven recovery trends. Market sentiment turned cautious on the news. Earnings misses influence sentiment negatively. The development added to sector headwinds.

The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-14th-january-2026/article70505277.ece

Paytm Completes Full Acquisition of Ujjwal Fintech Services

Paytm finalized 100% stake acquisition in Ujjwal Fintech Services. This move expands its fintech ecosystem. It strengthens digital financial offerings. The deal aligns with strategic growth plans. Fintech sector sees consolidation trends. Paytm focuses on diversification post-challenges. The acquisition enhances service capabilities. It supports user base expansion efforts. Market viewed it positively for long-term potential. Such inorganic growth aids competitive positioning. Regulatory environment remains key for fintechs. The completion marks execution progress. It drew attention amid sector news flow. Fintech developments influence digital economy narratives. This step bolsters Paytm's recovery trajectory.

Swastika Investmart - https://www.swastika.co.in/blog/stocks-in-news-today-interarch-nlc-india-paytm-and-tata-elxsi-in-focus-on-14-january-2026

Interarch Buildcon Secures ₹130 Crore Order from PSU

Interarch Buildcon won a ₹130 crore order from a public sector undertaking. This boosts its order book visibility significantly. Infrastructure sector benefits from such wins. The deal supports revenue growth outlook. PSU orders provide stable cash flows. It reflects government spending continuity. Stock reacted favorably to the announcement. Order inflows remain crucial for construction firms. This development enhances execution confidence. Infrastructure push drives sector momentum. Such contracts aid in de-risking revenues. Market appreciates visible growth drivers. The win contributes to positive sentiment. It highlights selective opportunities in the space.

Swastika Investmart - https://www.swastika.co.in/blog/stocks-in-news-today-interarch-nlc-india-paytm-and-tata-elxsi-in-focus-on-14-january-2026

US Stocks Decline as Bank Earnings Disappoint Investors

US indexes closed lower with Nasdaq dropping 1%. Tech and bank stocks led the decline. Mixed Q4 earnings from major banks weighed heavily. Wells Fargo missed profit expectations notably. Citigroup and Bank of America shares fell despite beats. Concerns over net interest income persisted. Investors rotated to defensive sectors. This global weakness influenced Indian opening cues. Bank sector faced pressure from rate outlook. Earnings season highlights economic resilience mixed signals. Such moves impact FII sentiment toward emerging markets. Wall Street's performance sets tone for Asia. The session reflected caution amid policy uncertainties.

Reuters - https://www.reuters.com/business/wall-street-futures-decline-ahead-big-bank-earnings-2026-01-14

Federal Reserve Beige Book Notes Slight to Modest Growth

The Fed's Beige Book reported slight to modest economic activity rise in most districts. Consumer spending showed some improvement. Home sales declined in several regions. Banking conditions appeared stable or better. Loan demand increased in certain areas. Employment remained largely unchanged overall. Prices rose at a moderate pace. The summary influences rate path expectations. It provides qualitative insights into US economy. Investors monitor for policy implications. Such data affects global capital flows. It contributed to cautious market tone. The report underscores uneven recovery patterns. Fed speakers and data remain in focus.

Federal Reserve - https://www.federalreserve.gov/monetarypolicy/beigebook202601-summary.htm

Major US Banks Report Higher Q4 Profits on Loan Growth

US banking giants posted stronger Q4 profits driven by accelerated loan demand. Bank of America saw average loans grow 8%. Its net interest income hit a record level. JPMorgan reported solid year-over-year loan expansion. Citigroup and others noted positive borrower trends. This signals underlying economic strength. Higher lending supports future earnings visibility. However, shares declined on softer guidance. Net interest margin concerns emerged. Credit card dynamics drew scrutiny. The results offered mixed market reactions. Banking sector resilience appears intact. Loan growth bodes well for profitability. Global investors track US banking health closely. It influences cross-border flows including to India.