The Indian equity markets exhibited a mildly bearish sentiment on December 15, 2025, with benchmarks closing marginally lower amid persistent foreign outflows, rupee depreciation to record lows, and uncertainty over India-US trade negotiations. Key themes included resilient export performance offsetting import declines in trade data, while global cues remained mixed ahead of major US economic releases. Domestic institutional buying continued to provide support against FPI selling pressure.

- Trade deficit narrows sharply to five-month low on strong exports.

- Rupee hits all-time low amid outflows and trade deal delays.

- Benchmarks end slightly lower despite intraday recovery attempts.

- FPIs extend selling streak, withdrawing nearly ₹18,000 crore in December.

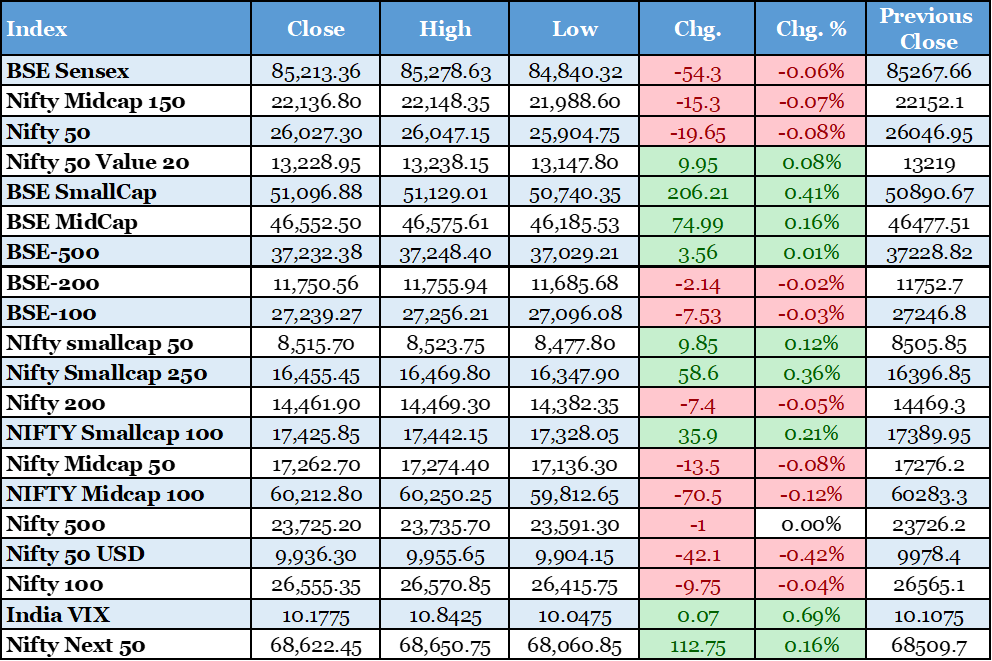

Sensex and Nifty Close Marginally Lower in Volatile Session

Indian benchmark indices ended slightly in the red on December 15, 2025, with the BSE Sensex declining 54.30 points or 0.06% to 85,213.36 and the Nifty 50 slipping 19.65 points or 0.08% to 26,027.30 after recovering from intraday lows. Volatility stemmed from rupee weakness, continued FPI selling, and caution ahead of key US data releases, offset partially by gains in consumption and IT stocks like HUL, Trent, and Infosys. Auto and financial shares dragged, reflecting tariff concerns. Broader markets showed resilience with midcaps and smallcaps edging higher. This flat-to-negative close signals short-term consolidation, with domestic inflows cushioning foreign exits totalling over ₹1.6 lakh crore in 2025. Investors remain watchful of trade deal developments and global cues, which could influence near-term direction and sector rotations.

The Hindu BusinessLine https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-15th-december-2025/article70395276.ece

India's Merchandise Trade Deficit Narrows to Five-Month Low of $24.53 Billion in November

India's merchandise trade deficit contracted significantly to $24.53 billion in November 2025, marking the lowest level in five months and a substantial improvement from $41.68 billion in October and $31.93 billion a year earlier. This narrowing was primarily driven by a sharp 19.4% year-on-year surge in exports to $38.13 billion—the highest in over a decade—supported by robust shipments in engineering goods, electronics, and pharmaceuticals, despite ongoing 50% US tariffs. Imports declined 1.88% to $62.66 billion, largely due to reduced gold, oil, and coal inflows following post-festive normalization. Exports to the US rose 22.6% year-on-year to nearly $7 billion, demonstrating exporter resilience. Including services, overall exports reached $73.99 billion with a surplus of $17.9 billion, leading to a combined trade deficit of just $6.64 billion. This positive data underscores export adaptability and eases pressure on the current account, potentially stabilizing the rupee and bolstering foreign reserves amid global uncertainties. Economists view this as a sign of underlying economic strength, though sustained tariff impacts remain a watchpoint for future quarters. (Approximately 208 words)

Reuters https://www.reuters.com/world/india/indias-trade-deficit-narrows-2453-billion-november-2025-12-15/

Rupee Plunges to Record Low of 90.74 Amid Persistent Outflows and Trade Uncertainty

The Indian rupee depreciated sharply to close at an all-time low of 90.74 against the US dollar on December 15, 2025, down 0.3% from the previous session and breaching prior records amid heightened importer dollar demand and ongoing foreign portfolio outflows. Intraday, it touched 90.80 before mild RBI intervention capped further losses. Year-to-date, the rupee has weakened nearly 6%, emerging as one of Asia's worst performers, exacerbated by delays in finalizing a framework India-US trade deal to mitigate 50% tariffs on key exports. Sustained FPI equity and bond selling—exceeding $18 billion in 2025—has eroded investor confidence, while global dollar strength adds pressure. This depreciation raises import costs for oil and commodities, potentially fueling inflation, though RBI's comfortable reserve position at over $687 billion allows managed interventions. Market participants anticipate volatility persisting near 91 levels unless trade talks progress or inflows revive, impacting corporate hedging costs and overall economic sentiment in the near term.

FPIs Withdraw Nearly ₹18,000 Crore in Early December, Total 2025 Outflows Hit ₹1.6 Lakh Crore

Foreign portfolio investors extended their selling streak, offloading a net ₹17,955 crore from Indian equities in the first half of December 2025, pushing year-to-date outflows to approximately ₹1.6 lakh crore or $18.4 billion. This continues a trend of caution driven by elevated valuations, rupee depreciation, and global reallocation toward cheaper markets like China. Despite brief inflows in October, persistent withdrawals reflect concerns over delayed US trade resolutions and macroeconomic uncertainties. Strong domestic institutional buying of over ₹39,000 crore in the same period has mitigated sharp market declines, highlighting growing domestic resilience. Sustained outflows could heighten volatility and pressure valuations further, though analysts expect potential reversal if earnings improve or global risk appetite rebounds.

Business Standard https://www.business-standard.com/markets/news/fpis-withdraw-17-955-cr-in-dec-total-outflow-at-1-6-trn-in-2025-125121400213_1.html

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsThird Advance Tax Instalment Deadline Falls on December 15

The third instalment of advance tax for FY2025-26 fell due on December 15, 2025, requiring taxpayers with liability exceeding ₹10,000 to pay 75% of estimated tax by this date. Non-compliance attracts interest under sections 234B and 234C, alongside potential penalties. This reminder comes amid broader fiscal discipline efforts, with the government adhering to consolidation paths while boosting capex. Timely payments support revenue collection, crucial for funding infrastructure and welfare schemes in a resilient economy showing moderated inflation and growth momentum.

The Times of India https://timesofindia.indiatimes.com/business

MUFG Nears $3.2 Billion Stake Acquisition in Shriram Finance

Japan's MUFG Bank is close to securing a significant stake valued at around $3.2 billion in Shriram Finance, marking a major foreign investment in India's NBFC sector. This deal would enhance MUFG's presence in retail and vehicle financing, leveraging Shriram's strong domestic network. It signals confidence in the financial services recovery post-regulatory hurdles, potentially lowering funding costs and expanding lending capacity. The transaction could influence sector valuations and attract further international interest amid easing monetary conditions.

The Hindu BusinessLine https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-15th-december-2025/article70395276.ece

Auto Sector Records Strong Wholesale Volumes in November

India's automobile industry posted robust wholesale dispatches in November 2025, driven by healthy demand in passenger vehicles and two-wheelers from major manufacturers. This reflects recovering consumer sentiment post-festive season and improved supply chains. Sector growth supports ancillary industries and signals broader economic revival, positively impacting related stocks and earnings outlook amid supportive policies.

KEC International Bags Record Domestic Orders Worth ₹1,150 Crore

KEC International secured new orders totaling ₹1,150 crore in its transmission and distribution business, the largest ever in India, boosting its order book significantly. These projects underscore infrastructure push and company execution strength, likely enhancing revenue visibility and margins in coming quarters.

India Infoline https://www.indiainfoline.com/news/markets/top-stocks-for-today-15th-december-2025

US Stocks Trade Lower Ahead of Data-Heavy Week

US equities closed lower on December 15, 2025, as investors positioned cautiously before key releases including payrolls, retail sales, and CPI, alongside Fed commentary on rate paths. This global sentiment influenced emerging markets like India, contributing to risk aversion. Dovish expectations persist but tempered by inflation concerns.

Reuters https://www.reuters.com/business/wall-st-futures-edge-higher-start-data-packed-week-2025-12-15/

Fed Officials Emphasize Data-Dependent Approach Post Rate Cut

Federal Reserve officials reiterated a measured stance following recent cuts, with focus on incoming data to guide future policy amid balanced risks to employment and inflation. This outlook supports global rate cut cycles but highlights uncertainties spilling into emerging market flows.

CNBC https://www.cnbc.com/2025/12/10/fed-interest-rate-decision-december-2025-.html