Indian markets exhibited a bearish sentiment on December 16, 2025, with major indices declining amid persistent foreign outflows and a weakening rupee, reflecting broader economic slowdown signals from PMI data.

- Markets fell due to foreign outflows and a weak rupee, impacting investor confidence.

- Private sector activity slowed to a 10-month low, signaling economic caution.

- Rupee hit record low, raising import costs and inflation concerns.

- Insurance FDI hiked to 100%, aiming to boost sector growth.

- US business activity weakened, influencing global market dynamics.

Sensex and Nifty Plunge Amid Foreign Outflows and Weak Rupee

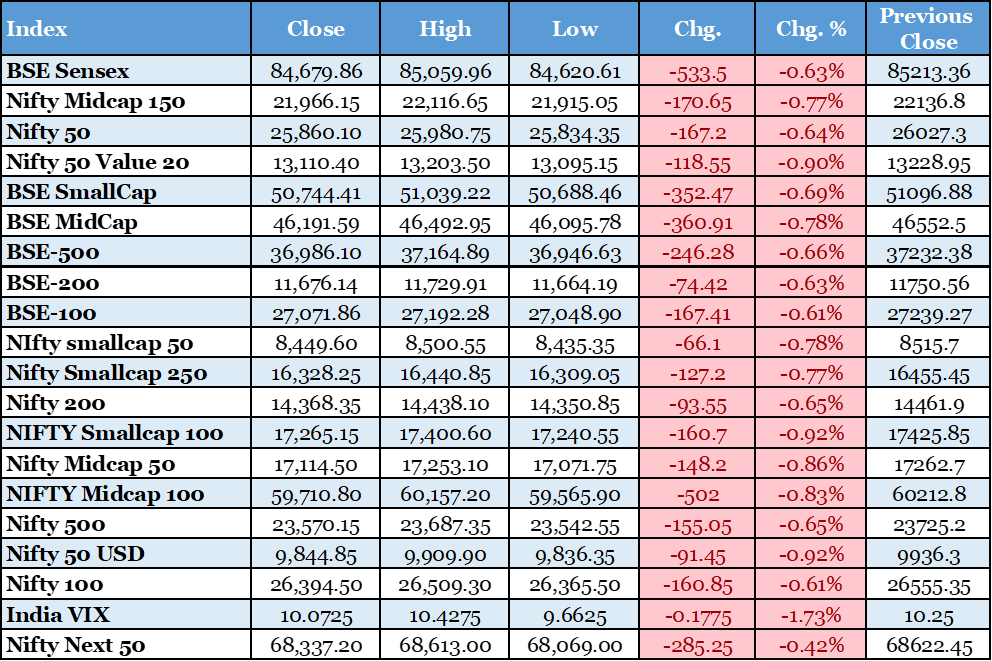

Indian equity benchmarks declined for the second straight session, with the BSE Sensex dropping 533.50 points or 0.63% to close at 84,679.86, and the NSE Nifty falling 167.20 points or 0.64% to 25,860.10. The downturn was driven by persistent foreign institutional investor outflows, a depreciating rupee beyond 91 per dollar, and sectoral weaknesses in IT and banking. This movement heightened volatility, potentially eroding short-term investor sentiment and pressuring corporate earnings in export-oriented sectors. The Hindu BusinessLine, https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-16th-december-2025/article70398790.ece

Rupee Hits Record Low of 91.08 Against USD

The Indian rupee depreciated to a historic low of 91.08 versus the US dollar, influenced by increased hedging demand and capital outflows amid global uncertainties. This weakening could elevate import costs, particularly for oil and commodities, exacerbating inflationary pressures and challenging the RBI's monetary policy stance. Immediate implications include higher borrowing costs for businesses and potential interventions by the central bank to stabilize the currency. Economic Times, https://economictimes.indiatimes.com/markets/forex/forex-news/rupee-hits-record-low-sapped-by-hedging-demand-and-outflows/articleshow/126001741.cms

Lok Sabha Approves 100% FDI in Insurance Sector

The Lok Sabha passed a bill allowing 100% foreign direct investment in insurance companies, up from 74%, with enhanced norms to protect policyholders through greater transparency. This reform is expected to attract significant foreign capital, bolstering the insurance industry's growth and penetration in India. Financially, it could lead to increased competition, lower premiums, and expanded coverage, supporting economic resilience. Livemint, https://www.livemint.com/economy/lok-sabha-passes-bill-to-raise-fdi-limit-to-100-in-insurance-sector-as-centre-aims-to-attract-investments-11765899116307.html

India's Private Sector Growth Slows to 10-Month Low

Private sector activity in India expanded at its weakest pace in 10 months, as per the PMI, due to slowdowns in new orders and services amid year-end softening. This indicates potential drags on GDP growth, with implications for employment and corporate investments. Policymakers may need to monitor for further deceleration, impacting market outlook. US News, https://money.usnews.com/investing/news/articles/2025-12-16/indias-private-sector-growth-hits-10-month-low-as-year-ends-on-softer-note-pmi-shows

US Business Activity Growth Hits 6-Month Low

US business activity slowed to its weakest pace since June, with declines in new orders for both manufacturing and services sectors, as per flash PMI data. This softening could signal broader economic caution, influencing global markets including India through reduced demand for exports and volatile commodity prices. Implications include potential Fed policy adjustments affecting capital flows to emerging markets like India. Reuters, https://www.reuters.com/business/us-business-activity-growth-hits-6-month-low-december-2025-12-16/

US Stock Markets End Mixed Amid Sector Declines

Wall Street closed mixed, with the Dow Jones falling 0.6% due to drops in healthcare and energy stocks, while the Nasdaq edged up 0.2% on tech gains. This performance reflects investor anticipation of key economic data, potentially impacting global sentiment. For India, it underscores risks from US slowdowns affecting FII flows and trade. Reuters, https://www.reuters.com/business/wall-st-futures-slip-investors-brace-key-jobs-report-2025-12-16/

Exports Rebound Leads to Largest Trade Deficit Correction

India's trade deficit saw its biggest monthly reduction as exports surged and imports moderated, bolstering foreign reserves and economic stability. This shift enhances competitiveness in global trade, potentially easing pressure on the rupee and supporting fiscal health. Sectors like manufacturing and services stand to benefit from sustained export growth. Livemint, https://www.livemint.com/news/exports-rebound-imports-cool-india-s-trade-deficit-sees-biggest-monthly-correction-11765890036614.html

ICICI Prudential AMC IPO Subscribed 39 Times

The ICICI Prudential AMC IPO was oversubscribed 39 times, with strong demand from QIBs and NIIs, and a GMP signaling a 14% premium. This reflects robust investor appetite for asset management firms amid mutual fund growth. Financially, it could inject capital into the sector, enhancing market liquidity and corporate expansions. Livemint, https://www.livemint.com/market/icici-prudential-amc-ipo-issue-booked-39-times-on-day-03-nii-qib-portions-see-huge-demand-gmp-signals-14-premium-11765887048598.html

PFRDA Permits 80% NPS Corpus Withdrawal

The Pension Fund Regulatory and Development Authority allowed private NPS subscribers to withdraw up to 80% of their corpus as lump sum for amounts over Rs 12 lakh, promoting flexibility in retirement planning. This change could boost participation in pension schemes, aiding long-term savings and financial inclusion. It addresses liquidity needs while maintaining annuity requirements for security. Financial Express, https://www.financialexpress.com/money/pfrda-allows-80-nps-corpusnbspwithdrawal-for-private-subscribers-4079283/

Axis Bank Forecasts 7.5% Growth in FY27 on Policy Tailwinds

Axis Bank projected India's GDP growth at 7.5% for FY27, driven by reforms, lower borrowing costs, and capital formation, though risks remain. This optimistic outlook could influence investor confidence and policy directions, supporting sectors like infrastructure and finance. Stable inflation and rate adjustments are key enablers. Financial Express, https://www.financialexpress.com/business/news/policy-tailwinds-to-lift-indias-growth-to-7-5-in-fy27-axis-bank/4078997/