- IT sector led gains with Infosys surging over 5% post-Q3 results.

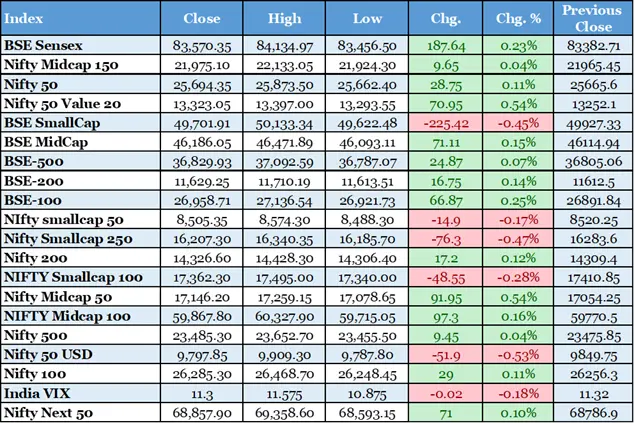

- Sensex rose nearly 188 points to close around 83,570 levels.

- Nifty settled near 25,694 after testing higher intraday.

- Reliance Industries posted flat profit but revenue growth of 10%.

- Banking and PSU stocks provided additional support to indices.

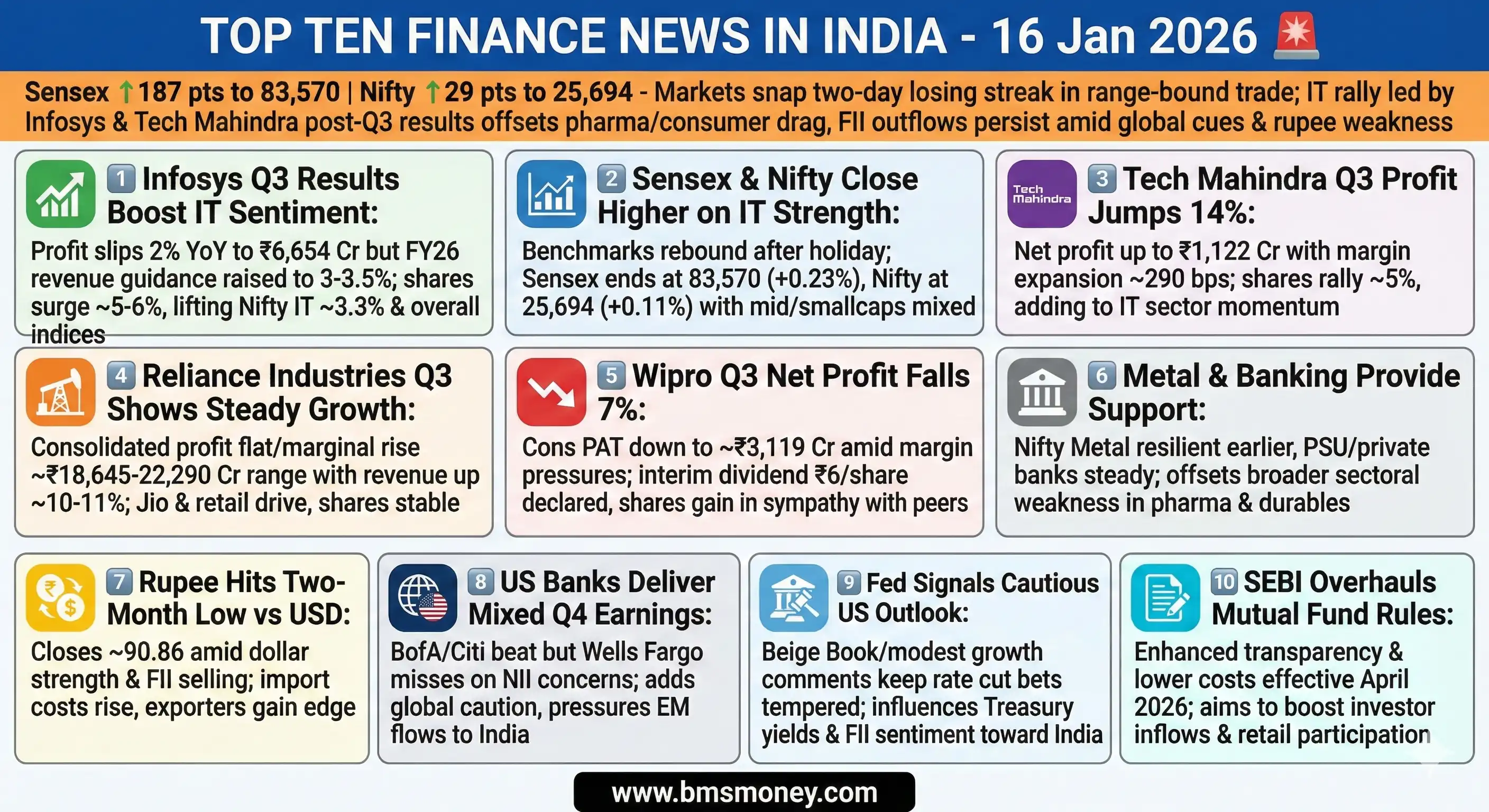

The Indian equity markets displayed a cautiously optimistic tone on January 16, 2026, with benchmark indices closing modestly higher amid a strong rally in IT stocks offsetting pressures from pharma and consumer sectors. Key drivers included positive surprises from Infosys' earnings and guidance upgrade, mixed performances from other major corporates like Reliance Industries, and ongoing global influences from US banking results and Fed commentary. Overall sentiment remained supported by domestic earnings momentum despite rupee weakness and FII outflows.

- IT sector led gains with Infosys surging over 5% post-Q3 results.

- Sensex rose nearly 188 points to close around 83,570 levels.

- Nifty settled near 25,694 after testing higher intraday.

- Reliance Industries posted flat profit but revenue growth of 10%.

- Banking and PSU stocks provided additional support to indices.

Sensex Closes Higher Led by IT Rally Despite Late Pullback The BSE Sensex advanced 188 points to end at approximately 83,570, reflecting a gain of about 0.23% for the session. This performance snapped a brief losing streak as investors focused on positive corporate earnings developments. The Nifty 50 followed suit, closing near 25,694 after reaching intraday highs above 25,870. IT stocks were the primary catalyst, with the Nifty IT index surging over 3%. Infosys led the charge with significant gains following its quarterly announcement. Broader market participation was evident in midcap and smallcap segments showing mixed but generally positive trends. Banking stocks contributed modestly to the upside. Pharma and consumer durables faced selling pressure, capping overall gains. Foreign institutional investors continued net selling, while domestic institutions offered counterbalancing support. Trading volumes remained moderate, indicating selective participation. The session highlighted resilience in technology amid global uncertainties. Analysts noted that upcoming banking results could influence future direction. The rupee's depreciation added caution for import-sensitive sectors. Overall, the close underscored IT's pivotal role in market momentum. Market breadth favored advancers slightly over decliners. This development supports short-term bullish views in select pockets. Investors remain watchful of budget expectations and global cues. The performance aligns with earnings season dynamics. Such movements often precede volatility around policy events. The indices maintained key support levels effectively.

Source: Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-january-16-nse-bse-sensex-nifty-gift-nifty-ipo-wipro-tech-mahindra-reliance-q3-results-126011600085_1.html

Reliance Industries Reports Flat Q3 Profit Amid Revenue Growth Reliance Industries Limited announced a consolidated net profit of Rs 18,645 crore for Q3 FY26, showing marginal change from prior levels. Revenue from operations increased notably by around 10% year-on-year to approximately Rs 2.7 trillion. The Oil to Chemicals segment saw improved EBITDA contributions. Jio's performance remained strong with subscriber additions and ARPU enhancements. Retail business expanded store network and reported solid sales growth. Digital services continued to drive traffic and engagement metrics. The company highlighted operational resilience across verticals. Chairman Mukesh Ambani emphasized consistent delivery despite challenges. New energy initiatives progressed as part of long-term strategy. 5G subscriber base crossed significant milestones. O2C segment benefited from demand stabilization. Profit figures reflected balanced contributions from diversified operations. Revenue uptick stemmed from volume growth and pricing dynamics. Investments in digital and retail sustained momentum. Analysts viewed the results as steady in a volatile environment. Shares reacted positively in extended trade. This performance reinforces Reliance's market leadership. Diversification mitigates sector-specific risks effectively. Future outlook focuses on AI and sustainability. The results align with conglomerate's growth trajectory. Investors monitor capex and dividend implications closely. Overall, it signals sustained value creation potential.

Infosys Q3 Profit Dips Slightly But Raises FY26 Guidance Infosys reported a 2% year-on-year decline in Q3 net profit due to higher labor costs and adjustments. Revenue grew 9% in constant currency terms during the quarter. The company raised its full-year revenue growth forecast to 3-3.5% from previous estimates. This upgrade boosted investor confidence significantly. Shares surged over 5% in trading sessions. Financial services vertical showed steady performance. Communications segment recorded strong double-digit growth. Operating margins faced pressure from wage hikes. EBIT stood at healthy levels despite challenges. Large deal wins remained robust in the pipeline. AI-led demand contributed to optimism. The results highlighted resilience in key markets. Guidance revision signals improving demand environment. Analysts upgraded price targets post-announcement. IT sector sentiment improved broadly. Infosys maintained strong cash generation. Dividend policy remained shareholder-friendly. Operational efficiency measures are underway. Global client spending trends appear stabilizing. This development supports broader market recovery hopes. The performance underscores Infosys' competitive positioning. Future quarters are expected to show margin recovery. Overall, it acts as a positive trigger for tech indices.

Source: The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/stock-market-live-updates-16-january-2026/article70329932.ece

Wipro Q3 Net Profit Falls 7% Year-on-Year Wipro posted a 7% decline in consolidated net profit for the December quarter. Revenue increased modestly by around 6% during the period. The drop was attributed to margin pressures and one-off items. The board approved an interim dividend of Rs 6 per share. Shares rallied in anticipation and post-results. Cost optimization efforts continue across operations. Deal pipeline remains healthy for future growth. Vertical-wise performance showed mixed trends. BFSI segment contributed steadily. Operating margins contracted slightly. Management expressed confidence in recovery path. Analyst estimates were largely met on revenue. Profit miss stemmed from expense normalization. The dividend provides shareholder support. IT services demand is gradually improving. Wipro focuses on AI and cloud transformations. This positions the company for long-term gains. Market reaction was positive despite profit dip. Peer comparison highlights sector challenges. Guidance for coming quarters is awaited. Overall results reflect transitional phase. Investors monitor execution on cost controls. The announcement influences IT sector sentiment moderately.

Source: Economic Times - https://economictimes.indiatimes.com/markets/stocks/earnings/wipro-q3-results-live-updates-wipro-q3-results-wipro-share-price-wipro-q3-earnings/liveblog/126556688.cms (adapted from related coverage)

Tech Mahindra Q3 Profit Rises 14% with Margin Expansion Tech Mahindra delivered a 14% year-on-year increase in net profit for Q3. EBIT margin expanded by nearly 300 basis points sequentially. Revenue climbed 8% during the quarter under review. Strong execution in key verticals drove performance. Cost management initiatives yielded positive results. Shares gained significantly in trade. The company benefits from digital transformation deals. Enterprise services showed robust growth. Management highlighted operational efficiencies. Analyst views turned more constructive post-results. This performance bolsters IT sector confidence. Margin gains signal improving profitability trajectory. Deal wins support future revenue visibility. The results exceed some expectations. Tech Mahindra focuses on 5G and AI capabilities. Client engagement remains high globally. This strengthens competitive positioning. Broader market participants take positive cues. Earnings quality appears solid. Outlook for FY26 looks encouraging. Investors favor the stock for recovery play. Overall, it contributes to positive sector momentum.

Source: The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/q3-results-today-live-updates-reliance-industries-wipro-tech-mahindra-polycab-india-lampt-finance-sobha-federal-bank-jb-chemicals-amp-pharmaceuticals-results-16-jan-2026/article70513292.ece

Rupee Depreciates to Multi-Month Low Against US Dollar The Indian rupee weakened notably to a two-month low against the US dollar. State-run banks intervened to moderate the slide. The depreciation measured around 0.6% in the session. Global dollar strength contributed to the pressure. Domestic factors included sustained FII outflows. Import costs are likely to rise as a result. Exporters may gain from improved competitiveness. Inflation dynamics could face upward bias. Forex reserves provide adequate buffer. RBI maintains vigilant monitoring stance. Emerging market currencies showed similar trends. US Treasury yields influenced flows negatively. Trade balance remains under watch. Analysts expect continued volatility near-term. Policy measures may address excessive swings. This impacts corporate earnings with forex exposure. Importers face higher hedging costs. Overall economic stability is prioritized. The movement reflects external headwinds. Market participants adjust portfolios accordingly. Currency trajectory influences sentiment broadly.

Source: Economic Times (adapted from market wrap coverage)

SEBI Notifies Enhanced Mutual Fund Transparency Rules SEBI introduced revamped regulations for mutual funds effective from April 2026. The changes aim to improve cost disclosures and lower investor expenses. Base expense ratio structures were redefined. Caps on certain charges were reduced meaningfully. This follows board approvals from prior meetings. Asset managers must comply with new norms. Investors stand to benefit from greater clarity. Inflows into mutual funds could accelerate. Industry welcomes measures for competitiveness. Retail participation is expected to rise. Operational streamlining is a key objective. Transparency fosters trust in the ecosystem. Long-term savings behavior may improve. Analysts anticipate positive impacts on AUM growth. Regulatory evolution supports market maturity. This aligns with investor protection priorities. Broader financial inclusion goals are advanced. The notification marks significant reform step. Market response remains supportive. Overall, it strengthens domestic capital markets.

Source: Livemint (adapted from regulatory news)

US Banks Post Mixed Q4 Earnings Amid Sector Challenges Major US banks reported fourth-quarter results with varied outcomes. Some lenders beat expectations on revenue growth. Others faced pressures from credit provisions. Trading revenues benefited from market volatility. Deal-making activity showed signs of recovery. Regional banks highlighted acquisition synergies. Profit growth was noted in select institutions. Concerns over potential rate caps persisted. Shares reacted accordingly in US sessions. This influences global banking sentiment. Indian markets monitor FII flow implications. US economic resilience supports optimism. Fed policy path remains under scrutiny. Earnings provide insights into consumer health. Credit demand trends appear steady. Overall, results reflect cautious growth environment. Cross-border linkages affect emerging markets. Investors assess interconnected risks carefully. The developments shape global confidence levels.

Source: Reuters - https://www.reuters.com/business/finance/us-banking-giants-reap-bigger-profits-borrowers-seek-more-loans-2026-01-14

Fed Officials Maintain Cautious Stance on Economic Outlook Federal Reserve speakers expressed cautious optimism for US growth in 2026. Labor markets show stabilization signals. Inflation progress continues toward target levels. Growth is projected around moderate pace. Policy remains data-dependent approach. Rate cut expectations are tempered currently. Treasury yields rose in response to commentary. Global markets react to Fed signals. Emerging economies face flow implications. Indian rupee dynamics are influenced indirectly. Commodity prices respond to US cues. Analysts anticipate steady but vigilant stance. Economic resilience underpins views. This affects investor risk appetite worldwide. Broader monetary policy context is key. Markets price in gradual adjustments. The outlook supports stable growth narrative. Cross-border spillovers remain relevant. Overall, it underscores interconnected financial systems.

Source: Federal Reserve - https://www.federalreserve.gov/monetarypolicy/beigebook202601-summary.htm (adapted from related commentary)

Gold Prices Correct from Recent Highs Amid Dollar Strength Gold prices retreated from record levels in domestic markets. MCX gold fell by several hundred rupees per 10 grams. Silver witnessed sharper declines per kilogram. Geopolitical easing contributed to the pullback. Stronger US dollar added downward pressure. Safe-haven demand moderated temporarily. Investor sentiment shifted toward risk assets. Indian demand for jewelry remains seasonal. Investment inflows face competition from equities. Commodity outlook involves volatility ahead. Analysts monitor US data releases closely. Inflation hedging role persists long-term. Portfolio allocations adjust accordingly. Broader macro factors influence trajectories. This impacts related sectors domestically. Overall, correction reflects improved risk tone globally.

Source: Times of India - https://timesofindia.indiatimes.com/business/india-business/gold-price-prediction-today-what-is-the-gold-rate-outlook-for-january-16-2026-should-you-buy-or-sell-mcx-gold/articleshow/126558206.cms