Indian equity markets closed lower for the third consecutive session amid cautious sentiment driven by foreign outflows, rupee volatility, and mixed global signals, with the Sensex declining 120 points and the Nifty settling below 25,850. Key themes included anticipation around major IPO allotments, corporate acquisitions in pharma and packaging sectors, and subdued US economic indicators raising concerns over global demand.

- Persistent FII outflows pressure indices amid year-end adjustments.

- Rupee volatility eases slightly after RBI interventions.

- Robust demand for ICICI Prudential AMC IPO signals strong AMC sector interest.

- SEBI approves regulatory overhauls for brokers and mutual funds.

Indian Markets Extend Losses for Third Session Amid Caution

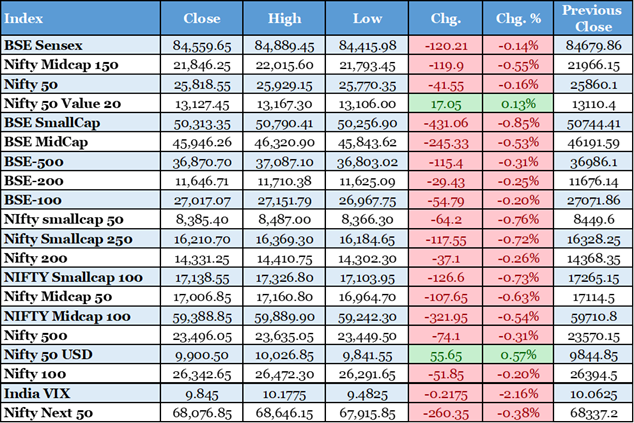

The BSE Sensex closed down 120 points at 84,559.65, while the Nifty 50 fell 41.55 points to 25,818.55, marking the third straight decline. This extended weakness stemmed from persistent foreign institutional investor selling and selective profit booking in key sectors. Broader markets underperformed, with midcap and smallcap indices dropping more sharply. Banking stocks faced pressure, though PSU banks outperformed. Volatility remained elevated as investors awaited clarity on global trade policies. The decline eroded recent gains, signaling short-term caution. Export-oriented sectors like IT felt indirect impacts from rupee movements. Overall market breadth was negative, reflecting waning retail participation. This could lead to further consolidation unless positive cues emerge. Analysts expect range-bound trading ahead of key data releases.

Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-december-17-nse-bse-sensex-today-nifty-gift-nifty-icici-prudential-amc-ipo-allotment-125121700090_1.html

ICICI Prudential AMC IPO Allotment Finalised After Strong Subscription

The Rs 10,602 crore ICICI Prudential AMC IPO allotment was finalised following overwhelming demand, subscribed 39.17 times overall. Qualified institutional buyers led the bidding, underscoring confidence in India's largest active asset manager. Retail and non-institutional portions also saw robust participation. The issue marks one of 2025's largest offerings in the financial sector. Shares are expected to list on December 19 amid moderate grey market premiums. This reflects sustained investor appetite for asset management firms amid growing mutual fund inflows. The IPO proceeds will support general corporate purposes and expansion. It highlights the maturing Indian capital markets ecosystem. Successful allotment boosts liquidity in the secondary market. Long-term prospects remain positive given rising financialisation in India.

Zerodha Pulse - https://pulse.zerodha.com/

Rupee Volatility Persists Amid Trade Uncertainties

The Indian rupee exhibited high volatility, touching intraday lows near 90.49 before partial recovery supported by RBI interventions. Depreciation of about 5.74% in the fiscal year continues due to dollar strength and trade imbalances. Importers' dollar demand added pressure amid ongoing US-India trade negotiations. This raises import costs, particularly for oil and commodities. Exporters in IT and pharma may benefit from competitive advantages. Fiscal deficit concerns could widen with higher borrowing costs. Analysts anticipate gradual weakening unless trade deals materialise. Currency management remains key for macroeconomic stability. Broader emerging market currencies faced similar headwinds. Investor sentiment in rupee-denominated assets stays cautious.

The Indian Express - https://indianexpress.com/section/business/

Biocon Consolidates Control with $1.17 Billion Stake Acquisition

Biocon acquired minority stakes in Biocon Biologics Limited from partners including Mylan, Serum Institute, Tata Capital, and Activ Pine for $1.17 billion. This move enhances full ownership and strategic control over its biosimilars portfolio. The transaction strengthens Biocon's position in global biologics markets. It supports expanded manufacturing and R&D capabilities. Biosimilars demand is rising amid affordable healthcare needs worldwide. The deal reflects confidence in long-term growth in specialty pharmaceuticals. Funding through internal accruals demonstrates financial prudence. This could drive future revenue synergies and margin improvements. Pharma sector sentiment received a boost from the announcement. Investors view it as a positive step for value unlocking.

The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-17th-december-2025/article70403140.ece

SEBI Approves Overhaul of Stock Broker and Mutual Fund Regulations

SEBI board approved comprehensive reforms replacing outdated 1992 broker rules and revising mutual fund expense ratios for greater transparency. Statutory levies like GST and STT will be excluded from total expense ratios. This aims to reduce investor costs and improve disclosure. Broker regulations introduce streamlined compliance and risk management. Measures enhance investor protection in digital trading era. Changes facilitate ease of doing business while curbing misuse. Market participants welcomed the transparency boost. Implementation expected through new 2026 regulations. This aligns with broader capital market deepening efforts. Positive implications for retail investor participation anticipated.

Economic Times - https://economictimes.indiatimes.com/markets/stocks/live-blog/bse-sensex-today-live-nifty-stock-market-updates-17-december-2025/liveblog/126028858.cms

ITC Strengthens Packaging Vertical Through Acquisition

ITC announced an acquisition to expand its paperboards and packaging business, a core non-tobacco segment. This diversifies revenue streams amid growing demand for sustainable packaging. The move leverages rising consumer goods and e-commerce needs. It enhances ITC's competitive edge in value-added products. Synergies expected in supply chain and distribution networks. FMCG peers may face increased competition. Deal size and details to be disclosed soon. This supports ITC's long-term de-risking strategy from cigarettes. Investor confidence in diversified conglomerates bolstered. Packaging sector outlook remains robust with environmental shifts.

The Hindu BusinessLine - https://www.thehindubusinessline.com

India's Russian Oil Imports Poised to Exceed Expectations

Imports of Russian crude are set to surpass 1 million barrels per day in December, sourced from non-sanctioned entities at discounts. This helps narrow the trade deficit significantly from prior months. Energy security bolstered amid global supply disruptions. Refining margins are supported for domestic players. Geopolitical diversification reduces dependency risks. Trade deficit improved to $24.5 billion in November. This stabilizes fuel prices for consumers. Oil marketing companies benefit from lower input costs. Broader macroeconomic stability enhanced. Policy continuity in energy imports affirmed.

Moneycontrol - https://www.moneycontrol.com/news/business/

US Business Activity Slows to Six-Month Low

US flash PMI data showed business activity growth decelerating sharply in December, with new orders declining in manufacturing and services. Policy uncertainties from tariffs and immigration changes weighed heavily. This signals potential cooling in the world's largest economy. Impacts Indian exports, particularly in IT services and pharmaceuticals. Global trade sentiment dampened ahead of holiday season. Federal Reserve policy path may face recalibration. Emerging markets including India vulnerable to spillover effects. Investor risk appetite reduced internationally. Broader commodity demand outlook softened. Long-term implications for bilateral trade ties monitored.

Reuters - https://www.reuters.com/business/us-business-activity-growth-hits-6-month-low-december-2025-12-16/

US Unemployment Rate Rises to Four-Year High

Delayed data revealed US unemployment climbing to its highest in four years, with retail sales stalling at holiday start. Job market cooling evident post-government shutdown backlog clearance. This raises recessionary concerns amid policy shifts. Indian IT firms reliant on US clients may see demand moderation. Global financial markets reacted with caution. Federal Reserve's rate trajectory under scrutiny. Consumer spending slowdown affects trade partners. Broader economic warning signs flashed. Policy responses anticipated in coming meetings. Implications for emerging market capital flows noted.

ABC News - https://abcnews.go.com/US/us-economy-flashes-warning-signs-new-data-analysts/story?id=128463726

Trump's Economic Approval Rating Hits Record Low

Polls showed President Trump's economic handling approval at just 36%, with the majority viewing costs as unaffordable. Perceptions of recession divided along demographics. This erodes confidence amid ongoing policy implementations. Bilateral trade negotiations with India potentially impacted. Investor sentiment in risk assets cautious. Tariff effects contributing to inflation concerns. Public opinion shift influences future policy direction. Global partners are monitoring US domestic dynamics. Long-term trade deal prospects uncertain. Market volatility linked to political narratives heightened.

NPR - https://www.npr.org/2025/12/17/nx-s1-5645003/trump-poll-economy-approval