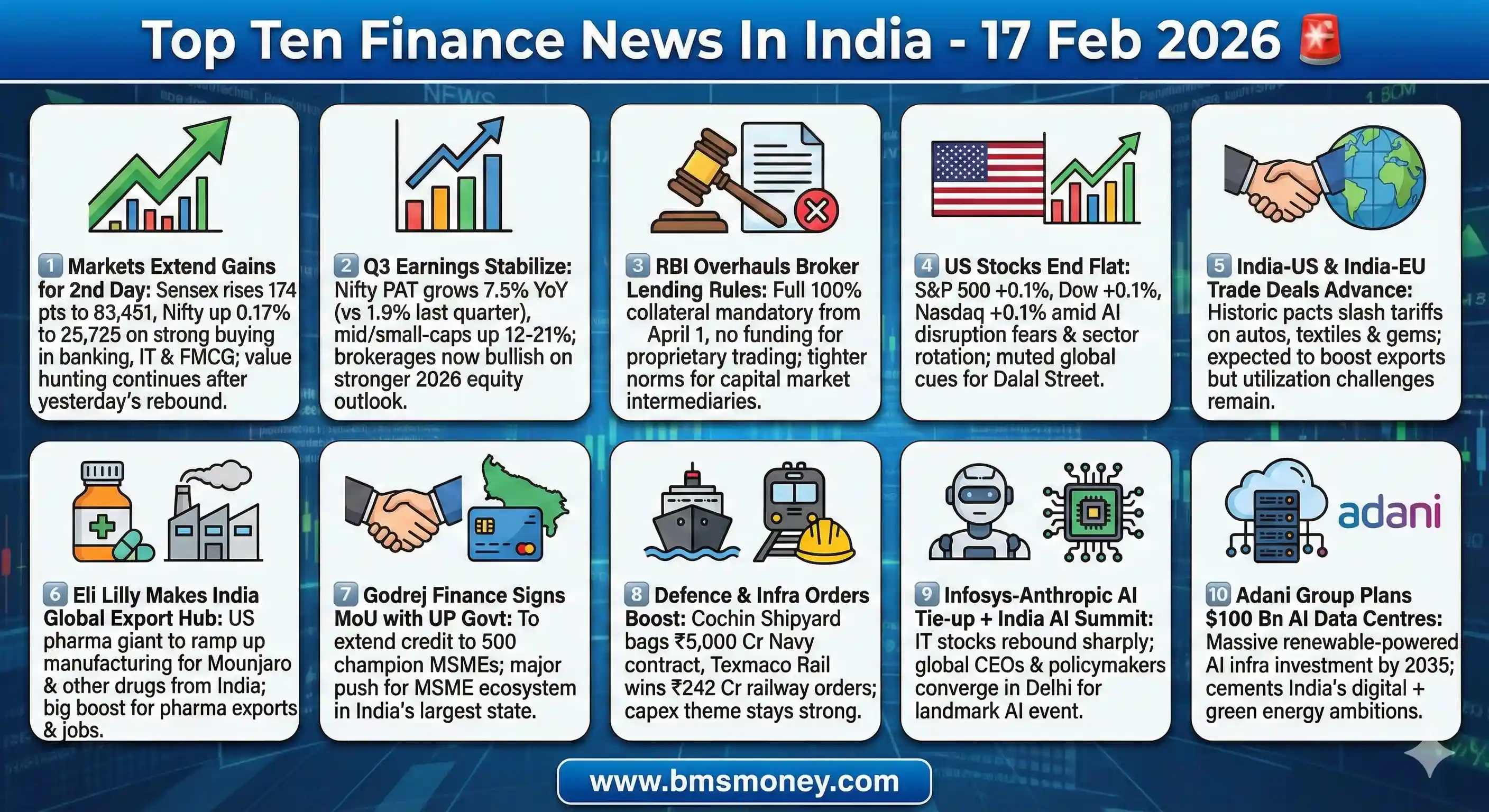

Indian equity markets extended gains for a second session on February 17, 2026, driven by domestic buying in banking, IT, and FMCG sectors amid stabilizing Q3 earnings and AI optimism. Positive brokerage outlooks and steady trade developments offset subdued global cues and regulatory tightening, keeping sentiment cautiously bullish.

Indian benchmarks extend second-day gains on banking and IT strength The BSE Sensex rose 173.81 points or 0.21% to close at 83,450.96, while the NSE Nifty 50 advanced 42.65 points or 0.17% to settle at 25,725.40 after trading in a range between 82,987 and 83,598. This marked the second consecutive session of positive closes, reflecting sustained domestic investor confidence despite an initial cautious open triggered by lingering geopolitical tensions around US-Iran nuclear talks.

Gains were broad-based but led by strong performances in banking, IT, capital goods, and FMCG stocks. Key contributors included ITC and Bharat Electronics rising over 2% each, while Infosys surged nearly 3% on the back of its strategic AI partnership announcement. Larsen & Toubro, Asian Paints, Titan, Adani Ports, HCL Technologies, Sun Pharmaceuticals, Maruti Suzuki, IndiGo, State Bank of India, and Tech Mahindra also featured among the top Sensex gainers.

In contrast, stocks such as Eternal (Zomato), Tata Steel, Trent, Reliance Industries, Mahindra & Mahindra, Bajaj Finserv, Axis Bank, Bharti Airtel, Kotak Mahindra Bank, and Hindustan Unilever ended in the red, capping broader upside. The broader market participated well, with the BSE Smallcap Select Index rising 0.49% and the Midcap Select Index advancing 0.26%.

Analysts attributed the recovery to robust value buying in heavyweight financials and technology names, coupled with easing macroeconomic concerns and stable crude oil prices. Domestic institutional investors continued their buying spree, offsetting muted foreign flows. The session underscores resilience in Indian equities as the December-quarter earnings season winds down on a stabilizing note and policy continuity expectations remain intact.

The Hindu Business Line: https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-17th-february-2026/article70638782.ece

Q3 earnings stabilize; brokerages turn more constructive on 2026 outlook Indian companies delivered a much-improved set of December-quarter results, with Nifty 50 firms reporting 7.5% year-on-year growth in profit after tax — a noticeable improvement from the 1.9% expansion recorded in the previous quarter. The broader BSE 500 universe performed even better, posting 16% profit growth, primarily driven by strong showings in the energy and consumer discretionary sectors, while information technology remained a laggard.

Mid-cap and small-cap companies outperformed their large-cap peers, delivering 12% and 21% earnings growth respectively. After adjusting for the one-time impact of new labour codes (which mandated higher basic salary components and increased gratuity liabilities, shaving roughly 5% off headline numbers), underlying earnings growth stood at approximately 14%. Five heavyweight Nifty stocks — State Bank of India, Tata Steel, HDFC Bank, Tata Consultancy Services, and Bharti Airtel — accounted for nearly 78% of the incremental profit expansion.

Leading brokerages, including J.P. Morgan, highlighted that strong festive and rural demand, a stable interest-rate environment, improved credit growth, and lower input costs have collectively driven a broad-based earnings recovery. With valuations having moderated after recent market corrections and progress on trade negotiations with the United States and European Union, most houses now expect a meaningful acceleration in Nifty profit growth during FY27.

The stabilization of earnings after seven consecutive quarters of single-digit growth is being viewed as an important turning point. It provides a solid foundation for equity markets in 2026, especially as consumption revives and fiscal-monetary policy coordination remains supportive through measures such as reduced consumption taxes on essential items. However, analysts cautioned that sustained AI-led disruption in the IT services space could remain an overhang for the sector.

RBI overhauls collateral and secured lending norms for capital market intermediaries The Reserve Bank of India has introduced comprehensive amendments to the guidelines governing credit facilities extended by commercial banks to capital market intermediaries, including stockbrokers, commodity brokers, and clearing members. These changes, which come into force from April 1, 2026, aim to strengthen risk management frameworks while continuing to support legitimate market-making and liquidity-provision activities.

Under the new rules, all credit facilities to intermediaries must be fully (100%) secured by eligible collateral such as cash, government securities, receivables from qualified central counterparties, or other high-quality financial assets. For margin trading facilities and guarantees issued in favour of exchanges or clearing corporations, a minimum 50% of the collateral must be in cash or cash equivalents. Banks have also been barred from financing proprietary trading or investments by intermediaries on their own account.

Additional provisions allow for need-based working capital support, including short-term warehousing of debt securities up to 45 days and intra-day limits for settlement mismatches, subject to strict collateral and haircut requirements (minimum 40% haircut on equity shares). Guarantees for proprietary trading activities must similarly be backed by at least 50% cash collateral.

Market participants expect the tighter norms to reduce systemic risk in the broking ecosystem while maintaining adequate liquidity for orderly market functioning. The move is consistent with the RBI’s ongoing efforts to align banking exposures with global best practices on collateral quality and counterparty risk management.

Finadium: https://finadium.com/india-central-bank-overhauls-secured-lending-and-collateral-rules-for-banks/

US stocks close marginally higher amid volatility and AI concerns Wall Street ended a quiet trading session on a modestly positive note, with the S&P 500 rising 7 points or 0.1% to close at 6,843.22, the Dow Jones Industrial Average gaining 32 points or 0.1% to 49,533.19, and the Nasdaq Composite advancing 32 points or 0.1% to 22,578.38. Beneath the surface, however, the session was marked by significant intra-day swings, as the S&P 500 fluctuated between a gain of 0.5% and a loss of nearly 1%.

Investor focus remained squarely on artificial intelligence themes, with continued rotation away from certain software and technology names that had been market leaders in previous years. Media stocks provided some support following reports of potential consolidation activity, while defensive consumer staples faced pressure after cautious commentary from major players.

The absence of fresh high-impact economic data allowed market participants to digest the previous week’s stronger-than-expected jobs report and moderating inflation prints. With Federal Reserve rate-cut expectations now largely anchored around the middle of the year, attention is shifting toward corporate earnings and the trajectory of AI-related capital expenditure.

The relatively muted close provided neutral-to-mildly positive cues for Asian markets, including India, where domestic factors continued to dominate price action.

Yahoo Finance: https://finance.yahoo.com/news/major-us-stock-indexes-fared-211658861.html

India advances landmark trade pacts with US and EU India has concluded a comprehensive Free Trade Agreement with the European Union and an interim trade framework with the United States in early 2026, marking a decisive shift from its historically cautious approach to multilateral trade liberalization. These pacts represent the country’s 10th FTA since 2014 and are accompanied by the initiation of negotiations with the Gulf Cooperation Council, which accounts for nearly 15% of India’s total trade.

The EU deal is expected to significantly reduce tariffs on automobiles, spirits, textiles, and engineering goods, while the US interim agreement focuses on lowering barriers in agriculture, pharmaceuticals, and digital trade. Both arrangements are viewed by policymakers as critical to integrating India deeper into global value chains and supporting the government’s export target of $1 trillion by 2030.

Analysts note that sectors such as gems and jewellery, ready-made garments, and auto components are likely to be early beneficiaries. However, industry bodies have highlighted persistent challenges around low FTA utilization rates (currently around 25%), complex Rules of Origin documentation, non-tariff barriers, and inconsistent customs procedures that continue to limit the actual gains for exporters, particularly micro, small, and medium enterprises.

The developments are being closely watched by equity investors, as improved trade access is expected to support earnings growth in export-oriented sectors and contribute to a more balanced current account position in the coming years.

Yahoo Finance: https://finance.yahoo.com/news/historic-trade-deals-put-india-000226259.html

Eli Lilly designates India as global export hub for key therapies US pharmaceutical giant Eli Lilly has outlined ambitious plans to transform its Indian operations into a major global supply-chain and export hub, leveraging the country’s cost-competitive manufacturing ecosystem and skilled talent pool. The announcement, made during a visit to its Hyderabad facility, comes against the backdrop of surging international demand for its blockbuster diabetes and obesity drug Mounjaro and related therapies.

Senior executives indicated that India will play a central role in producing active pharmaceutical ingredients and finished formulations not only for emerging markets but also for select regulated markets in Europe and Latin America. The move is expected to involve significant capacity expansion, technology transfers, and increased local R&D investment over the next few years.

For the Indian economy, the decision signals continued confidence in the country’s pharmaceutical prowess and could attract follow-on investments from other multinational players. It is also likely to generate high-quality employment in the life-sciences sector and strengthen India’s position in the global generics and specialty pharmaceuticals value chain.

The development was positively received by domestic pharma stocks and underscores the growing strategic importance of India within global healthcare supply networks.

Reuters (via US News): https://money.usnews.com/investing/news/articles/2026-02-17/lilly-targets-india-as-global-export-hub-amid-booming-mounjaro-sales-executive-says

Godrej Finance partners with Uttar Pradesh to boost MSME credit access Godrej Finance, part of the diversified Godrej Group, has entered into a strategic partnership with the Government of Uttar Pradesh to provide structured credit and capacity-building support to 500 carefully identified high-potential “champion” micro, small, and medium enterprises across the state.

The MoU, signed on February 17, focuses on addressing the long-standing financing gap faced by MSMEs in India’s most populous state by offering customized working-capital solutions, term loans, and digital lending products tailored to sector-specific needs. The collaboration also includes knowledge-sharing initiatives on financial literacy, compliance, and market linkages.

This initiative aligns with the state government’s broader industrial and MSME promotion agenda and is expected to unlock additional economic activity, generate employment, and support the formalization of smaller businesses. From an investor perspective, the partnership enhances the growth visibility of Godrej Finance’s retail and MSME lending vertical and reinforces the group’s commitment to inclusive growth in high-potential regions.

The development was noted positively in market circles as another example of private-sector participation in government-led ecosystem-building efforts.

Cochin Shipyard and Texmaco Rail secure major defence and railway orders Defence and infrastructure stocks witnessed renewed interest after Cochin Shipyard Limited secured a ₹5,000 crore contract from the Ministry of Defence for the construction of next-generation survey vessels. In a separate development, Texmaco Rail & Engineering won multiple orders worth over ₹242 crore from Indian Railways for wagon and track-related supplies.

These wins come at a time when the government is accelerating capital expenditure in both defence indigenization and railway modernization under the Atmanirbhar Bharat and National Infrastructure Pipeline initiatives. Cochin Shipyard’s order, in particular, highlights the growing capability of Indian shipyards to execute complex naval projects and is expected to provide multi-year revenue visibility.

Market reaction was swift, with both stocks posting sharp intra-day gains of 6% and 8% respectively. The developments reinforce the positive earnings outlook for companies operating in the capital goods and defence manufacturing ecosystem and are likely to encourage further investor interest in the broader industrials space.

The Hindu Business Line: https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-17th-february-2026/article70638782.ece

Infosys ties up with Anthropic; India AI Impact Summit lifts IT sentiment Infosys announced a strategic collaboration with Anthropic, a leading US-based artificial intelligence safety and research company, to co-develop enterprise-grade AI solutions across multiple industry verticals. The partnership is expected to combine Infosys’ deep domain expertise and global delivery capabilities with Anthropic’s advanced Claude AI models.

The announcement coincided with the high-profile India AI Impact Summit 2026 being held in Delhi, which has brought together global technology leaders, policymakers, and investors to discuss India’s emerging role in responsible AI adoption. IT stocks, which had been under pressure for several sessions, staged a smart recovery on the back of these positive developments, with Infosys, HCL Technologies, Tech Mahindra, and Wipro all closing in the green.

Broader market participants view the summit and associated corporate announcements as important catalysts that could help narrow the valuation discount of Indian IT services companies relative to global peers. The developments are also expected to support fresher deal wins and margin expansion in the medium term as enterprises accelerate their AI transformation journeys.

The Hindu Business Line: https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-17th-february-2026/article70638782.ece

Adani Group announces $100 billion plan for renewable-powered AI data centres The Adani Group has unveiled a transformative $100 billion investment roadmap to build one of the world’s largest networks of renewable-energy-powered artificial intelligence data centres by 2035. The ambitious plan envisages setting up hyperscale facilities across multiple locations in India, fully powered by the group’s expanding green energy portfolio.

This mega-investment is aligned with both national ambitions to become a global digital infrastructure hub and the group’s own strategy of integrating energy transition with next-generation technology infrastructure. The project is expected to create thousands of direct and indirect jobs, drive demand for advanced semiconductors and cooling technologies, and position India as a competitive destination for AI compute capacity.

Equity investors welcomed the announcement as a clear signal of long-term growth opportunities in the intersection of energy and technology sectors. The plan is likely to open up new investment avenues in related ecosystem plays ranging from renewable equipment manufacturers to specialized real-estate and construction firms.

The Hindu Business Line: https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-17th-february-2026/article70638782.ece