The Indian stock markets exhibited a bearish sentiment, closing lower for the fourth consecutive day amid volatility and weak global trends, though IT sector gains provided some cushion. In contrast, positive US inflation data boosted Wall Street, potentially influencing international investor confidence.

- Volatile trading led to marginal declines in major indices despite IT support.

- Regulatory proposals aimed at enhancing SEBI's powers and transparency.

- Rupee showed slight recovery amid merchant flows and RBI vigilance.

- Corporate sector saw key leadership changes and green investment talks.

- US soft inflation data spurred global market optimism and rate cut hopes.

Sensex Dips 78 Points, Nifty Remains Flat Amid Market Volatility

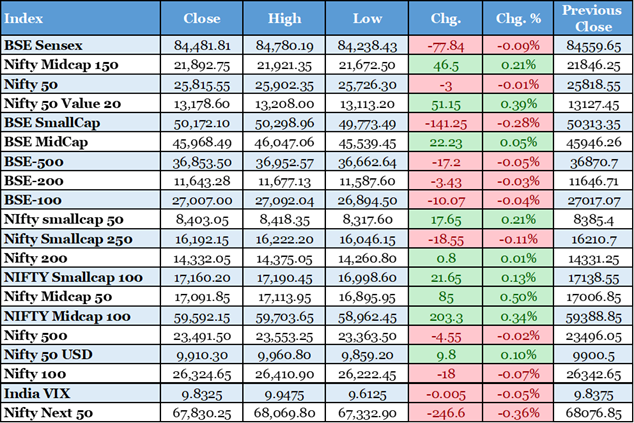

The benchmark Sensex closed down 78 points at 84,482, marking the fourth straight day of losses, while Nifty 50 ended nearly unchanged at 25,816. Weak global cues and uncertainties over trade deals pressured the market, with broad-based selling in sectors like FMCG and realty. However, gains in IT stocks like Infosys and TCS helped limit the downside, reflecting resilience in tech amid positive US developments. This performance underscores ongoing investor caution in the face of mixed economic signals. The session highlighted the impact of international factors on domestic sentiment. Broader indices like midcap and smallcap also underperformed. Analysts expect continued volatility until clearer policy directions emerge. Overall, the day's trading volume was moderate. Immediate financial implications include potential short-term pressure on equity valuations.

Government Proposes Enhanced Powers for SEBI and Board Conflict Disclosures

India's government has proposed granting greater authority to the Securities and Exchange Board of India (SEBI) to regulate markets more effectively. The draft includes requirements for board members to disclose potential conflicts of interest, aiming to boost transparency and governance. This move comes amid rising concerns over market manipulations and investor protection. It could streamline enforcement actions against violations. The proposal is part of broader reforms to align with global standards. Immediate implications include stronger oversight on listed companies and intermediaries. Retail investors may benefit from reduced risks. Corporate compliance costs could rise slightly. The changes are expected to foster a more robust capital market ecosystem. Consultation with stakeholders is underway before finalization.

Indian Rupee Strengthens Slightly After Rebounding from Record Low

The Indian rupee extended its gains marginally, closing at a stronger level driven by merchant dollar inflows and suspected RBI interventions. This follows a sharp recovery from all-time lows amid global risk-off sentiment. Traders remain vigilant for further central bank actions to stabilize the currency. The rupee's performance impacts import costs and inflation outlook. Exporters may face headwinds from appreciation. Overall, it signals tentative confidence in India's economic fundamentals. Immediate financial implications include lower hedging costs for businesses. Bond yields remained steady despite the move. Analysts predict range-bound trading ahead. This development supports efforts to curb currency volatility.

Reuters India https://www.reuters.com/world/india/rupee-traders-alert-rbi-follow-through-amid-risk-off-mood-2025-12-18/

Bharti Airtel Appoints Soumen Ray as New Group Finance Chief

Telecom giant Bharti Airtel has named Soumen Ray as its new group chief financial officer, effective immediately. Ray brings extensive experience from prior roles in finance and strategy. This leadership change aims to strengthen financial operations amid competitive market dynamics. It could influence investor perceptions of corporate governance. The appointment aligns with Airtel's growth strategies in 5G and digital services. Immediate implications include potential shifts in capital allocation and fundraising plans. Stock reaction was muted in the session. Analysts view it positively for long-term stability. Ray's expertise may aid in navigating regulatory challenges. Overall, it bolsters the company's executive team.

Reuters India https://www.reuters.com/world/india/indias-bharti-airtel-names-soumen-ray-group-finance-chief-2025-12-18/

India Plans to Overhaul M&A Regulations to Safeguard Retail Investors

The government is set to revise merger and acquisition rules to expedite deals while enhancing protections for retail shareholders. Key changes include stricter disclosure norms and faster approval processes. This reform addresses concerns over minority investor rights in corporate transactions. It could boost M&A activity in sectors like tech and infrastructure. Immediate financial implications involve reduced deal timelines and costs. Listed companies may see improved valuations from better governance. The move supports India's ambition to attract more foreign investments. Stakeholder feedback is being incorporated. Overall, it aims to create a more investor-friendly environment. Potential challenges include implementation timelines.

AM Green and Mitsui Explore Investments in Green Aluminium Production

India's AM Green has partnered with Japan's Mitsui to discuss potential investments and offtake agreements for sustainable aluminium. This collaboration focuses on low-carbon production to meet global green demands. It highlights India's push towards eco-friendly manufacturing in metals. Immediate implications include funding for new facilities and supply chain enhancements. The deal could reduce carbon footprints in key industries. Stock markets may react positively to green initiatives. It aligns with national sustainability goals. Challenges involve technology integration and costs. Overall, it boosts India's position in global green economy. Future expansions are anticipated.

Parliament Passes Bill to Raise FDI Limit to 100% in Insurance Sector

Lawmakers approved a bill increasing foreign direct investment in insurance from 74% to 100%, aiming to attract more capital. This follows rejections of a $108 billion proposal, signaling openness to global players. The reform could infuse fresh funds into the sector, enhancing competition and product innovation. Immediate financial implications include potential mergers and expanded market access. Insurers' stocks may see upward movement. It supports economic growth through better risk coverage. Regulatory oversight will ensure stability. Challenges involve data security concerns. Overall, it strengthens India's financial landscape. Implementation details are forthcoming.

Financial Express https://epaper.financialexpress.com/r/4095118

Wall Street Closes Higher Boosted by Tech Rally and Soft Inflation Data

US stocks ended the day up, with the S&P 500 and Dow gaining on cooler-than-expected inflation figures. Tech giants like Micron led the rally after strong earnings. This data reinforced bets on Federal Reserve rate cuts next year. Immediate implications for India include positive global cues potentially lifting sentiment. Treasury yields dipped, easing borrowing costs. The Nasdaq surged over 1%. Analysts see continued momentum in AI-driven sectors. Volatility remains ahead of options expiration. Overall, it signals resilient US economy. Indian exporters may benefit from dollar dynamics.

US Core Inflation Slows, Fueling Expectations for Rate Cuts

US core CPI rose less than anticipated, marking the slowest pace in months and boosting market optimism. Stocks staged a comeback, with S&P 500 up amid Treasury gains. This development could influence global capital flows, including to emerging markets like India. Immediate financial implications involve lower US yields, potentially easing pressure on the rupee. Fed's policy outlook brightens for dovish moves. Tech and growth stocks outperformed. Economists revise growth forecasts upward. Challenges include persistent services inflation. Overall, it supports soft landing narrative. Indian bonds may see indirect benefits.

Bloomberg https://www.bloomberg.com/news/articles/2025-12-17/stock-market-today-dow-s-p-live-updates

US Dollar Weakens Against Yen Following Lower-Than-Expected Inflation Rise

The dollar fell versus the yen after US inflation data came in softer, enhancing rate cut prospects. Euro also eased amid central bank decisions. This currency shift could impact Indian imports and exports, given trade ties. Immediate implications include cheaper oil if trends persist. Global markets reacted positively overall. BOJ held rates steady, adding to dynamics. Analysts monitor for further volatility. Emerging currencies like rupee may strengthen relatively. Overall, it reflects shifting monetary policies. Indian policymakers watch closely for spillover effects.