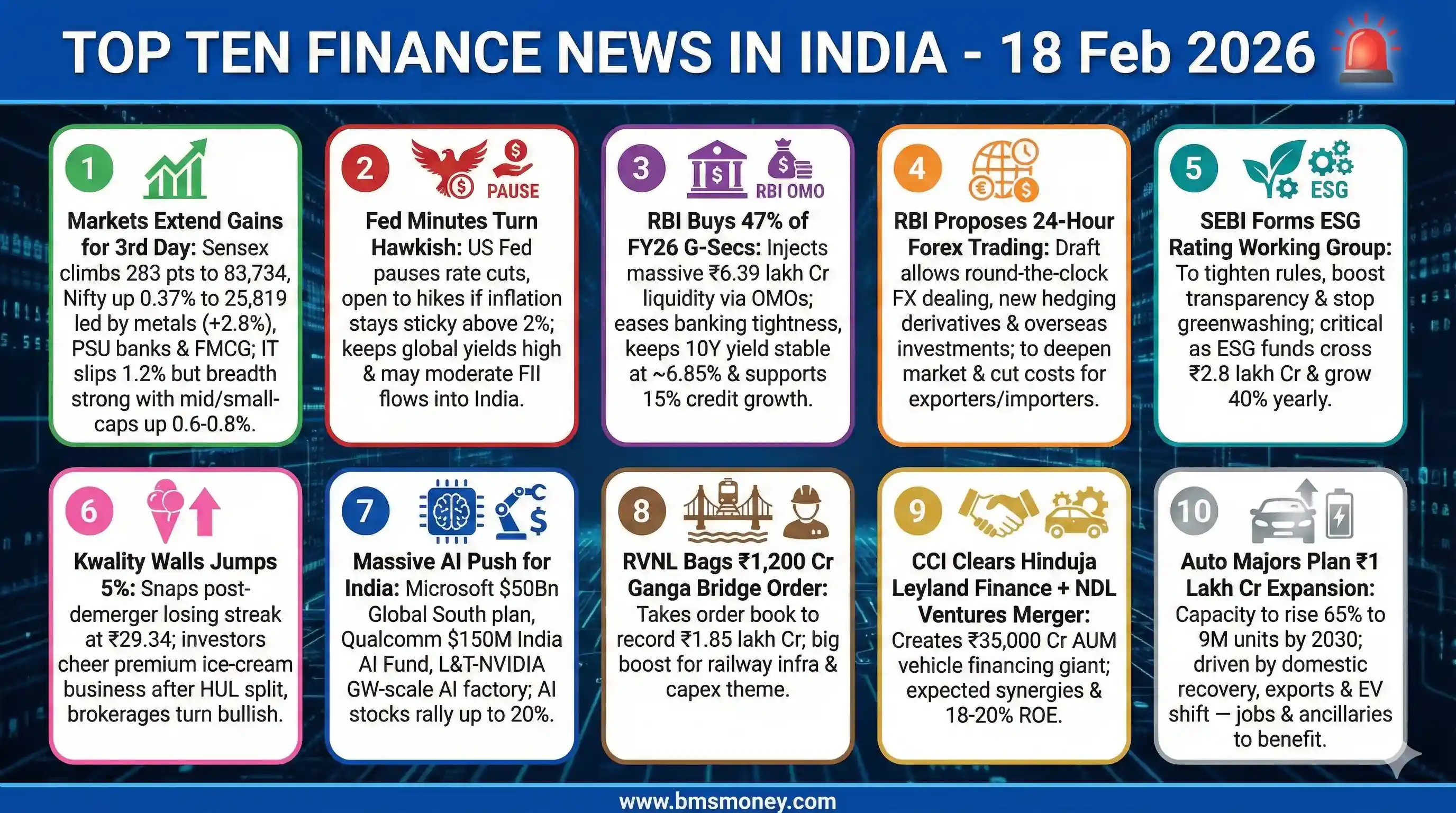

Indian markets extended gains for a third session on February 18, 2026, driven by strong domestic buying in metals, PSU banks, and FMCG, which helped offset IT sector weakness and cautious global signals from the US Fed minutes. Liquidity support from the RBI and positive momentum in AI and infrastructure sectors further bolstered sentiment.

Sensex Climbs 283 Points to 83,734; Nifty Ends Above 25,800 Led by Metals and PSU Banks

Indian benchmark indices closed higher for the third straight session on February 18, 2026, with the BSE Sensex rising 283 points or 0.34% to close at 83,734.25 while the NSE Nifty advanced 94 points or 0.37% to settle at 25,819.35. The session was marked by strong sectoral rotation, with the metal index surging over 2.8% on expectations of improved global demand and firm commodity prices, while PSU banks gained nearly 1.8% on robust credit offtake data and easing liquidity concerns. FMCG stocks also participated in the rally amid steady rural demand signals, even as the IT index slipped 1.2% on continued global tech headwinds and cautious commentary from multinational peers. Market breadth remained firmly positive with 2,150 advances against 1,180 declines on the NSE, and midcap and smallcap indices rose 0.6-0.8% each, reflecting broad-based participation. India VIX declined nearly 3% to 13.8 levels, indicating reduced near-term uncertainty among traders. Foreign institutional investors turned net buyers to the tune of ₹1,248 crore after two sessions of selling, while domestic institutional investors continued their consistent buying at ₹2,156 crore. Analysts noted that the rally was supported by resilient domestic macros, including steady GST collections and improving PMI prints, even as global cues remained mixed. Going forward, the Nifty is expected to face immediate resistance at 26,000 while finding strong support near 25,500, with any sustained move above 26,000 potentially opening the door for a fresh leg higher towards 26,500 in the coming weeks. Overall, the session reinforced confidence in India’s relative economic resilience amid global uncertainties.

Economic Times

Federal Reserve Minutes Signal Caution on Rate Cuts Amid Persistent Inflation Concerns

The US Federal Reserve released the minutes of its January 2026 policy meeting on February 18, revealing a cautious stance among policymakers regarding the future path of interest rates. Several members highlighted that while inflation has moderated from its peak, it remains stubbornly above the 2% target, particularly in services and shelter components, prompting a majority to favour maintaining the current policy rate at 4.25-4.50% for the foreseeable future. A minority of participants even expressed openness to considering rate hikes if incoming data showed reacceleration in price pressures or if labour market tightness persisted. The minutes also noted balanced risks to the economic outlook, with solid consumer spending and business investment offsetting cooling in the housing sector. For Indian markets, the hawkish undertone is likely to keep US Treasury yields elevated in the 4.3-4.5% range, which could moderate FII inflows into emerging markets including India in the near term. However, the rupee is expected to find support from strong domestic fundamentals and continued RBI intervention in the forex market. Bond market participants in India will closely watch the US data releases scheduled for the coming week, as any further delay in Fed rate cuts could exert upward pressure on domestic bond yields. Overall, the minutes reinforced the view that global monetary policy normalisation will be gradual, providing Indian policymakers room to focus on domestic growth objectives without immediate external pressure.

CNBC

RBI Acquires 47% of FY26 Government Bond Issuances to Inject Liquidity

The Reserve Bank of India has emerged as the dominant buyer in the government securities market during the current financial year, acquiring securities worth ₹6.39 lakh crore, which accounts for 47% of the Centre’s total bond issuances so far in FY26. This aggressive open market operation strategy has been deployed to counter the liquidity tightness arising from heavy government borrowing, strong credit demand from both retail and corporate segments, and the ongoing currency intervention to support the rupee. By absorbing a significant portion of the supply, the RBI has successfully prevented any sharp spike in bond yields, keeping the 10-year benchmark yield stable around 6.85-6.90%. Banking system liquidity, which had slipped into deficit mode in early February, has now improved to a surplus of ₹45,000 crore on average in the last fortnight. Market participants view this as a clear signal of the central bank’s commitment to financial stability and its willingness to support credit growth, which remains robust at 15% year-on-year. The development is particularly positive for banks and NBFCs, as lower funding costs and improved liquidity should translate into better net interest margins in the coming quarters. Analysts expect the RBI to continue calibrated interventions while monitoring inflation and fiscal deficit numbers closely before the Union Budget later this year.

Financial Express

RBI Proposes 24-Hour Forex Trading and Enhanced Hedging Tools for Market Participants

In a significant move to deepen and modernise India’s foreign exchange market, the Reserve Bank of India on February 18 released a comprehensive draft framework that proposes 24-hour trading facilities for authorised dealers and the introduction of new derivative instruments for both currency and interest-rate risk hedging. Banks will be allowed to offer round-the-clock trading in major currency pairs, enabling Indian corporates and investors to transact beyond domestic business hours and align better with global liquidity pools in London and New York. The draft also permits banks to invest surplus foreign currency balances abroad and relaxes several procedural requirements for cross-border transactions. These changes are expected to improve price discovery, reduce transaction costs, and provide more effective hedging mechanisms for exporters, importers, and portfolio investors who face currency volatility. Industry bodies have welcomed the proposals, noting that they will bring Indian forex market practices closer to global standards and enhance the rupee’s international appeal. The RBI has invited stakeholder comments by March 15, 2026, with final guidelines likely to be issued by June. Once implemented, the liberalised regime could significantly boost daily forex trading volumes, which currently stand at around $80-85 billion, and strengthen India’s position as a regional financial hub.

Financial Express

SEBI Forms Working Group to Strengthen ESG Rating Providers Regulation

The Securities and Exchange Board of India has constituted a high-level working group on February 18 to comprehensively review and strengthen the regulatory framework governing Environmental, Social, and Governance (ESG) rating providers operating in the country. The group, chaired by a former SEBI executive director, will focus on enhancing transparency, standardising methodologies, addressing conflicts of interest, and improving data quality in ESG assessments. With assets under management in ESG-focused funds crossing ₹2.8 lakh crore and growing at over 40% annually, the regulator aims to build greater investor confidence and prevent greenwashing practices. The working group is expected to submit its recommendations within four months, which could include mandatory registration, periodic audits, and disclosure norms for rating agencies. Corporate India has been increasingly integrating ESG parameters into business strategy, and a robust rating ecosystem is seen as critical for attracting long-term sustainable capital from both domestic and international investors. The move aligns with global trends where regulators in Europe and the US have already tightened oversight of ESG data providers.

SEBI

Kwality Walls Shares Jump 5%, Snapping Post-Demerger Losing Streak

Shares of Kwality Walls (India) Ltd surged nearly 5% on February 18 to close at ₹29.34, marking a sharp recovery after the 26% listing discount witnessed on its debut on February 16 following the demerger from Hindustan Unilever. The rebound made the stock one of the top gainers on the NSE, with trading volumes nearly three times the average as investors reassessed the long-term potential of the standalone ice-cream and frozen dessert business. Market participants cited the company’s strong premium brand portfolio, improving rural demand, and expansion plans into ready-to-eat categories as key positives. Brokerages initiated coverage with “buy” ratings and target prices ranging from ₹38 to ₹42, citing expected 18-20% revenue CAGR over the next three years supported by capacity additions and distribution reach. The demerger has unlocked value by allowing focused management attention and potential strategic partnerships in the high-growth indulgence category. With FMCG sentiment turning positive on the back of improving macros, analysts believe the stock could gradually bridge the valuation gap with larger peers over the next 12-18 months.

Moneycontrol

Microsoft, Qualcomm, and L&T-NVIDIA Announcements Boost India AI Sentiment

Major technology announcements at the India AI Impact Summit on February 18 significantly lifted sentiment around India’s emerging AI ecosystem. Microsoft detailed a $50 billion Global South AI infrastructure push with a substantial India component, Qualcomm committed up to $150 million to an India-specific AI Strategic Fund, and Larsen & Toubro announced a strategic partnership with NVIDIA to build a gigawatt-scale AI factory. These developments triggered sharp rallies in related stocks, with Netweb Technologies and E2E Networks jumping up to 20% each, while broader IT and capital goods indices also found support. The announcements underscore India’s rising importance as a global AI talent and data centre hub, with potential to attract additional private capital estimated at $20-25 billion over the next five years. Government sources indicated that these partnerships will complement the IndiaAI Mission’s ₹10,000 crore outlay and help create high-skilled employment in tier-2 and tier-3 cities. Market strategists believe the momentum in AI-related themes will continue, with several more global technology majors expected to announce India-centric investments in the coming months.

Moneycontrol

Rail Vikas Nigam Secures Rs 1,200 Crore Ganga Bridge Project Order

Rail Vikas Nigam Ltd (RVNL) received a letter of acceptance from Northern Railway for the construction of a major bridge over the river Ganga in Varanasi at a project cost of ₹1,200 crore. The order, which includes civil, structural, and associated electrification works, is expected to be executed over the next 36 months and will significantly enhance rail connectivity in the culturally and economically important region. The win takes RVNL’s order book to a record ₹1.85 lakh crore, providing strong revenue visibility for the next three to four years. The stock reacted positively, gaining over 3% on the news, in line with the broader infrastructure and capital goods rally. Analysts highlighted that the order aligns perfectly with the government’s National Infrastructure Pipeline and the accelerated Bharatmala and Gati Shakti initiatives. With execution capabilities already proven on several high-profile projects, RVNL is well-positioned to benefit from the expected 20-25% annual growth in railway capex over the medium term.

Moneycontrol

CCI Approves Merger of Hinduja Leyland Finance with NDL Ventures

The Competition Commission of India has granted approval for the merger of Hinduja Leyland Finance with NDL Ventures, clearing the way for a significant consolidation in the vehicle financing and mobility services space. The transaction, valued at approximately ₹4,500 crore, is expected to create operational synergies, expand geographic reach, and improve cost efficiencies through shared technology platforms and branch networks. Post-merger, the combined entity will have an asset under management exceeding ₹35,000 crore and a presence in over 25 states, strengthening its position in both retail and commercial vehicle financing segments. The approval comes at a time when the NBFC sector is witnessing healthy credit growth and stable asset quality, providing a conducive environment for scale-building through M&A. Market reaction was positive, with both entities gaining 2-4% on the news. Brokerages view the merger as value-accretive for shareholders and expect the combined business to deliver return on equity of 18-20% within two years.

Moneycontrol

Indian Automakers Plan Rs 1 Lakh Crore Capacity Expansion

Leading Indian automobile manufacturers have collectively announced plans to invest nearly ₹1 lakh crore over the next five years to expand annual production capacity by 65% to approximately 9 million units. The expansion is driven by expectations of sustained domestic demand recovery, rising exports to Europe and Latin America, and the shift towards electric and hybrid vehicles. Major players including Maruti Suzuki, Hyundai, Tata Motors, and Mahindra have outlined specific greenfield and brownfield projects, many of which will incorporate advanced manufacturing technologies and localised EV component ecosystems. The move is expected to generate over 1.5 lakh direct and indirect jobs while strengthening the entire auto ancillary and metals value chain. Industry experts believe the capacity addition will help India maintain its position as the world’s third-largest auto market and potentially move to second place by 2030. The announcement provided a positive trigger for auto stocks, which rose 1.2-2.5% on the day, and is likely to support related sectors such as steel, tyres, and electronics.

Moneycontrol