Indian equity markets staged a strong recovery on December 19, 2025, snapping a four-day losing streak with benchmark indices rising over 0.5%, driven by positive global cues from softer US inflation data and renewed hopes for Federal Reserve rate cuts. Sentiment remained cautiously optimistic amid foreign inflows into financial stocks, robust tax collections, and significant cross-border investments, though concerns over slowing growth and rupee volatility persisted.

Indian Benchmarks Snap Four-Day Losing Streak Amid Global Rally

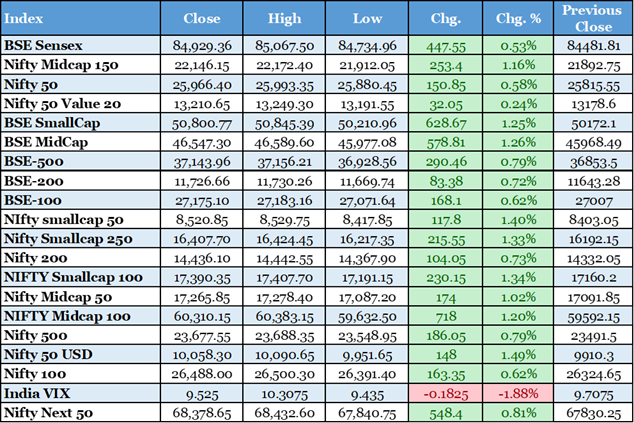

The BSE Sensex jumped 448 points to close at 84,929 while the NSE Nifty rose 151 points to 25,966, ending a four-session decline as markets tracked gains in Asian peers following cooler-than-expected US inflation data. This rebound was supported by broad-based buying in heavyweights like Reliance Industries, HDFC Bank, and financial stocks, with midcap and smallcap indices outperforming. Positive global cues, including expectations of Federal Reserve rate cuts in 2026, attracted foreign inflows and lifted investor confidence. Sectorally, auto, pharma, and realty led gains, while IT lagged slightly. The recovery highlights resilience despite ongoing concerns over foreign outflows and trade uncertainties, potentially setting a positive tone for year-end rallies. Broader market breadth was strong, with advances outnumbering declines 2:1, indicating sustained domestic participation.

The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-19th-december-2025/article70412314.ece

MUFG Acquires 20% Stake in Shriram Finance for $4.4 Billion

Japan's Mitsubishi UFJ Financial Group (MUFG) announced the acquisition of a 20% stake in Shriram Finance for approximately $4.4 billion, marking the largest single foreign investment in India's financial services sector to date. This deal underscores growing international confidence in India's non-banking financial companies (NBFCs) amid robust economic growth and regulatory reforms encouraging foreign participation. Shriram Finance, a major player in vehicle and rural financing, will benefit from enhanced capital base, improved lending capacity, and strategic expertise from MUFG, potentially expanding its market reach in underserved segments. The transaction reflects a broader trend in 2025 where cross-border deals in Indian financials reached record levels, driven by attractive valuations and policy easing. For the broader market, it boosted sentiment in financial stocks, with Shriram shares surging nearly 4% on the announcement day. This investment could pave the way for deeper collaborations, technology transfers, and increased competition in retail lending. Overall, it signals India's appeal as a high-growth destination for global banks seeking diversification amid slower growth in mature markets.

Reuters India - https://www.reuters.com/world/india/japans-mufg-buys-20-stake-indias-shriram-finance-2025-12-19/

Rupee Posts Strongest Single-Day Gain in Years on RBI Intervention

The Indian rupee appreciated sharply beyond the 90-per-dollar level, recording its biggest single-day rise in over three years, closing around 89.27 amid aggressive Reserve Bank of India interventions through state-run banks. This move countered speculative positioning and supported recovery from recent record lows, bolstered by softer US inflation aiding global risk sentiment. The strengthening reduces import costs for crude oil and commodities, easing inflationary pressures and improving the current account balance. Forward premiums also hit three-year highs due to year-end adjustments and hedging demand. While volatility persists amid trade negotiations, RBI's actions signal commitment to orderly markets, potentially attracting carry trades and stabilizing sentiment for exporters and importers alike.

Reuters India - https://www.reuters.com/world/india/soft-us-inflation-adds-rbi-support-tentative-rupee-recovery-2025-12-19/

India's Net Direct Tax Collections Rise 8% to 17 Trillion Rupees

Net direct tax collections in India grew 8% year-on-year to 17 trillion rupees ($188.5 billion) for the period April 1 to December 17, 2025, reflecting sustained economic activity and improved compliance. This robust performance provides fiscal headroom for government spending on infrastructure and welfare, supporting growth amid moderating inflation. Strong corporate and personal income tax mop-ups indicate resilience in formal sectors, potentially aiding deficit targets and bond market stability.

Reuters India - https://www.reuters.com/world/india/indias-direct-tax-collections-rise-8-yy-april-december-2025-12-19/

ICICI Prudential AMC Debuts with 19% Premium on Stock Exchange

Shares of ICICI Prudential Asset Management Company surged 19% on their trading debut, achieving a market valuation exceeding $14 billion following a successful $1.2 billion IPO. This strong listing highlights investor enthusiasm for India's asset management sector amid rising retail participation and mutual fund inflows. The performance could encourage more financial services firms to tap public markets, boosting liquidity and sector growth.

Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-december-19-nse-bse-sensex-today-nifty-gift-nifty-icici-prudential-amc-ipo-listing-125121900090_1.html

US Consumer Sentiment Remains Subdued Amid Affordability Concerns

University of Michigan's consumer sentiment index rose slightly to 52.9 in December 2025 but stayed nearly 30% below last year's levels, weighed by persistent inflation worries, high costs, and unemployment at 4.6%. This subdued outlook reflects challenges from policy uncertainties, potentially dampening US demand for imports and indirectly affecting Indian exports while influencing global investor risk appetite toward emerging markets.

Cooler US Inflation Data Fuels Rate Cut Expectations

US consumer price index rose 2.7% year-over-year in November, below forecasts, prompting markets to price in Federal Reserve rate cuts in 2026. Treasury yields adjusted mildly as investors digested the data alongside stable jobless claims. Softer inflation supports easier global monetary conditions, benefiting emerging markets like India through potential capital inflows and lower borrowing costs.

Reuters - https://www.reuters.com/business/finance/global-markets-view-usa-2025-12-19/

Piramal Finance Divests Stake in Shriram Life Insurance

Piramal Finance announced the sale of its 14.72% stake in Shriram Life Insurance to Sanlam for ₹600 crore, allowing monetization of non-core assets and strengthening its balance sheet. This move aligns with focus on core lending operations amid sector consolidation.

The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-19th-december-2025/article70412314.ece

NSE Adds Stocks to F&O Segment Amid Regulatory Tightening

The National Stock Exchange admitted Swiggy, Waaree Energies, Premier Energies, and Bajaj Holdings to its futures and options segment from December 31, 2025, under tightened SEBI criteria emphasizing liquidity. This enhances trading opportunities in high-growth consumer and renewable sectors.

Pulse by Zerodha - https://pulse.zerodha.com/

Cross-Border Financial Deals Surge in India During 2025

India's financial sector recorded $8 billion in cross-border M&A by September 2025, up significantly, highlighting reforms attracting foreign capital and positioning the country as a key growth market for global institutions.

Insurance Journal - https://www.insurancejournal.com/news/international/2025/12/19/851727.htm