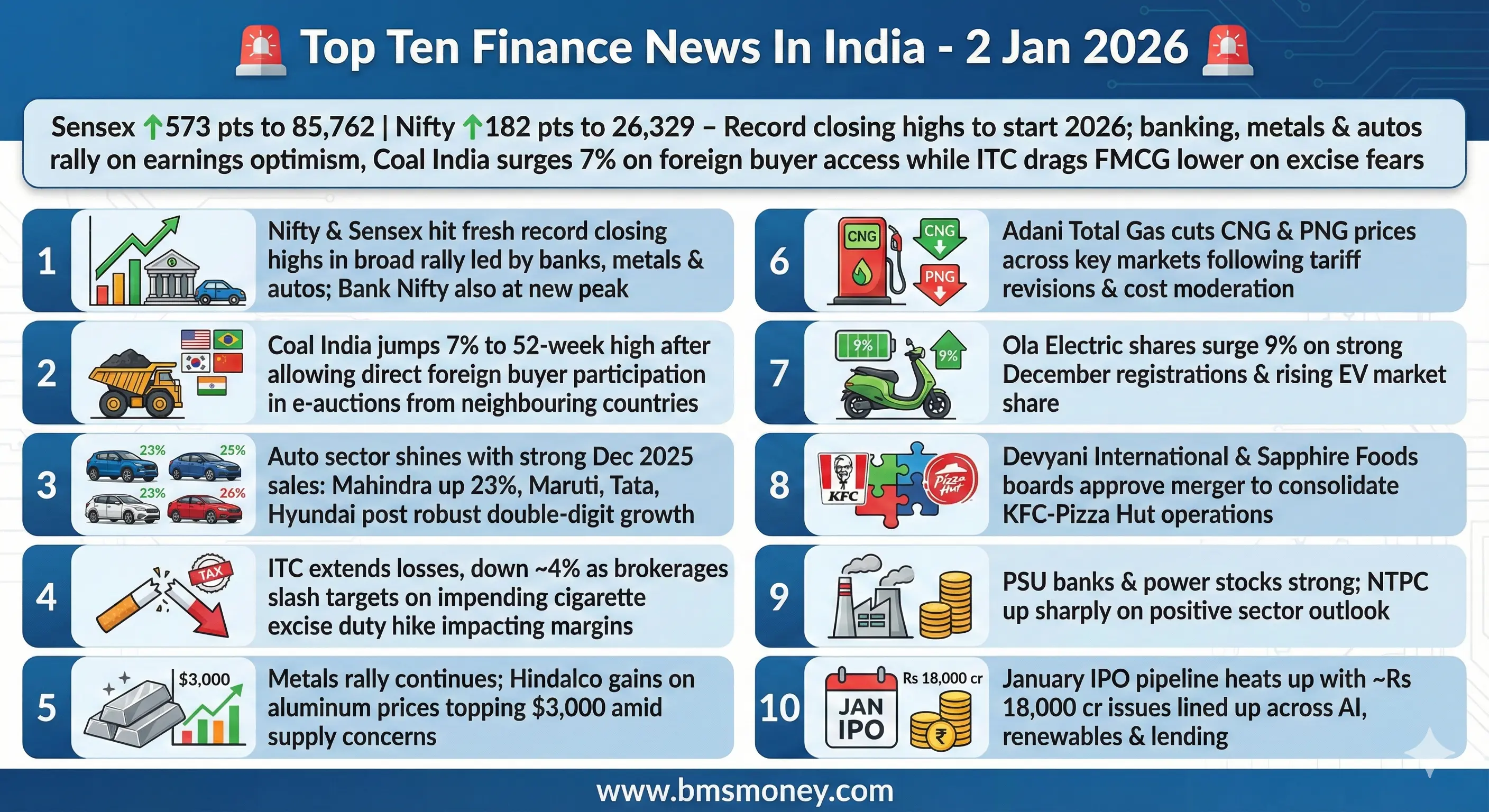

Markets surged to record highs on January 02, 2026, driven by broad-based sectoral gains, a strong corporate earnings outlook, and positive global sentiment.

Key Themes & Picks

-

Indices hit record highs on broad-based banking, metal, and auto gains.

-

Corporate earnings optimism and domestic demand fuel the rally.

-

FMCG lags, with ITC pressured by excise duty hike fears.

-

Banking and metals sectors lead the bullish momentum.

-

Regulatory risks emerge as a key sectoral differentiator.

Nifty 50 and Sensex Hit Record Closing Highs Amid Broad Rally

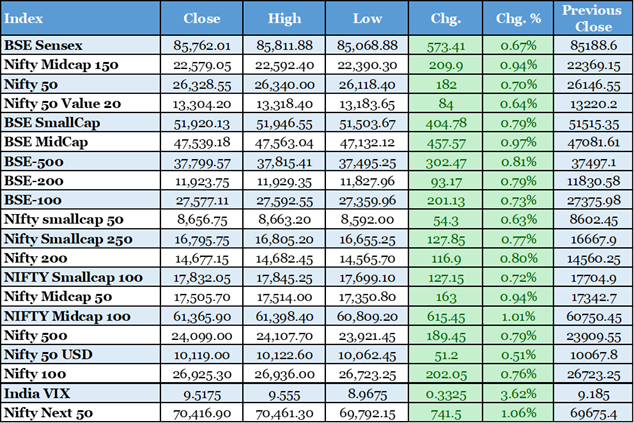

The Nifty 50 index closed at a new all-time high of 26,328.55, up 182 points or 0.70%. The BSE Sensex ended 573 points higher at 85,762.01. This marked a strong start to 2026 trading. Gains were led by financials, metals, and automobiles. Investors bet on earnings recovery in the December quarter. Banking stocks shone as Bank Nifty crossed 60,000. Metal stocks rose on commodity price firmness. Auto shares gained amid expectations of sustained demand. Power and capital goods sectors also contributed significantly. Broader markets participated with midcaps and smallcaps up around 1%. Foreign institutional investors were net sellers on January 1. Domestic institutions provided buying support. The rally reflected confidence in India's growth story. Lower inflation and potential rate cuts supported sentiment. Global markets started 2026 positively influencing cues. Analysts expect earnings growth to accelerate in FY27. Valuations appear reasonable after 2025 underperformance. Sector rotation favored cyclicals over defensives. FMCG underperformed due to specific stock pressure. Volatility remained low indicating stable sentiment. This performance sets a positive tone for the year. Investors monitor upcoming Q3 results closely. Policy stability from RBI and government aids outlook. Overall, the market breadth was healthy with advances outnumbering declines.

Coal India Surges on Allowing Direct Foreign Buyer Participation in E-Auctions

Coal India shares jumped nearly 7% to a 52-week high. The company permitted buyers from Bangladesh, Bhutan, and Nepal to bid directly in e-auctions. This policy change starts from January 1, 2026. It aims to boost coal utilization and transparency. Domestic demand for power generation has softened. This opens new export avenues for the state-run miner. The move enhances revenue potential amid global energy needs. Coal India led Nifty gainers on high volumes. Other PSU stocks like NTPC also rose strongly. The power sector benefited from similar dynamics. Analysts view this as positive for earnings visibility. It reduces dependence on local offtake. Geopolitical factors support coal demand regionally. Investors cheered the strategic initiative. This contributed to the metal and mining sector rally. Broader commodity themes played a role. Hindalco and others gained on aluminum price surge. The decision aligns with export promotion goals. Regulatory approvals were in place. Market reaction was immediate and robust. This underscores PSU reform momentum. Long-term implications include diversified buyer base. Overall, it bolsters investor confidence in energy PSUs.

Reuters India - https://www.reuters.com/world/india/indian-equity-benchmarks-likely-open-higher-foreign-fund-outflows-may-cap-gains-2026-01-02/

ITC Shares Decline on Impending Excise Duty Hike Concerns

ITC stock fell around 3.8% amid fears of higher cigarette taxes. The government notified excise amendments effective February 1, 2026. This includes increased duties on tobacco products. ITC derives significant profits from cigarettes. Brokerages highlighted potential earnings pressure. The FMCG index dropped over 1%. Nestle India also faced selling. Regulatory risks in sin goods intensified. Health cess provisions were activated. Investors rotated out of defensive stocks. This contrasted with cyclical gains elsewhere. LIC holds substantial stake in ITC. Market cap erosion was notable. Analysts recommend monitoring budget details. Diversification away from tobacco exposure advised. Sector peers may see indirect impact. Overall sentiment on FMCG turned cautious. This highlighted policy-driven volatility. Broader market ignored the drag. Gains in other sectors offset losses. Long-term investors assess dividend yield sustainability. Management commentary awaited in earnings. This event underscores governance risks. Market prefers growth-oriented segments currently.

Adani Total Gas Slashes CNG and PNG Prices Across Markets

Adani Total Gas reduced CNG and piped gas prices effective January 2. This follows tariff overhaul and input cost moderation. Multiple geographies saw cuts up to certain percentages. Consumers benefit from lower fuel bills. The move enhances affordability of clean energy. City gas distribution sector gains competitiveness. Shares reacted positively in trade. This aligns with government push for natural gas. Volume growth potential improves. Competitors may follow suit. Regulatory framework supports pricing flexibility. Investor sentiment on energy utilities lifted. Broader implications for inflation control. Household budgets get relief. Industrial users also advantaged. This supports economic activity. Analysts upgrade volume estimates. Margin stability maintained despite cuts. Long-term demand outlook robust. Transition to greener fuels accelerated. Overall, positive for sector valuation.

Livemint - https://www.livemint.com

Ola Electric Shares Surge on Strong December Sales

Ola Electric stock rose 9% to Rs 40.77. December vehicle registrations showed robust growth. The company outperformed peers in EV segment. Market share gains evident. Battery technology advancements highlighted. Investors optimistic on execution. Subsidy clarifications aided sentiment. Competition intensifies but leadership maintained. Volume trajectory encouraging for FY26. Analysts maintain buy ratings. This boosted broader auto index. Electric mobility theme in focus. Government incentives supportive. Charging infrastructure expansion key. Long-term potential in two-wheelers huge. Share price recovery from lows noted. Volatility remains high in EV space. Management guidance crucial ahead. This reflects consumer shift to sustainable options. Broader implications for energy transition. Positive spillover to ancillary stocks.

Economic Times - https://pulse.zerodha.com/

Devyani International and Sapphire Foods Approve Merger

Boards of Devyani and Sapphire cleared merger scheme. Effective from April 1, 2026. This consolidates QSR operations in India. KFC, Pizza Hut portfolios combined. Synergies in supply chain and costs expected. Market leadership strengthened. Share swap ratio announced. Investors view as value accretive. Restaurant sector consolidation trend. Competition from new entrants managed better. Scale benefits operational efficiency. Earnings accretion projected post merger. Regulatory approvals pending. This creates larger listed entity. Franchise models optimized. Consumer preferences for branded food rise. Long-term growth in organized dining. Positive for hospitality theme. Broader consumer discretionary outlook bright.

ETCFO - https://cfo.economictimes.indiatimes.com/news/corporate-finance/

US Stocks Edge Higher on Semiconductor Gains to Start 2026

US markets opened 2026 with modest gains. S&P 500 closed slightly higher led by chips. Nasdaq outperformed on tech strength. Dow mixed but positive overall. AI demand continues driving semiconductors. Nvidia and peers advanced. Treasury yields rose marginally. Dollar firmed against basket. Precious metals rallied further. This provided supportive global cues. Indian markets benefited from positive sentiment. FII flows monitored closely. Trade policy uncertainties linger. Earnings season approaches in US. Investor caution on valuations noted. Rotation into cyclicals observed. Overall, risk appetite intact. This influences emerging market inflows. India positioned well relatively. Broader commodity firmness aids. Positive start sets tone for year.

Gold and Aluminum Prices Advance on Supply Concerns

Gold extended gains building on 2025 performance. Aluminum crossed $3,000 per ton first since 2022. Supply risks from producers cited. Indian metal stocks like Hindalco benefited. Commodity correction themes reversed. Safe-haven demand persists amid uncertainties. Central bank buying supports gold. Industrial metals gain on growth hopes. This lifted Nifty Metal index. Investor allocation to commodities rises. Hedging strategies employed. Volatility in prices expected. Long-term bullish case intact. Inflation hedge properties highlighted. Portfolio diversification benefits. Broader implications for mining firms. Earnings boost from higher realizations. This contributed to market breadth. Positive for export-oriented companies. Overall, commodity supercycle talks resurface.

Economic Times - https://economictimes.indiatimes.com/

Force Motors Shares Jump on Positive Updates

Force Motors stock saw significant gains. Company-specific developments drove rally. Commercial vehicle demand robust. Export orders potentially in pipeline. Analysts positive on niche positioning. This added to auto sector strength. Broader mobility theme supportive. Rural recovery aids sales. Festive season spillover effects. Margin improvement expected. Debt reduction progress noted. Investor interest in undervalued plays. Volatility managed well. Long-term partnerships key. This reflects sectoral tailwinds. Positive for ancillary ecosystem. Overall, cyclical recovery evident.

Economic Times - https://pulse.zerodha.com/

Upcoming IPO Pipeline Signals Active Primary Market in January

Five major IPOs worth Rs 18,000 crore lined up. Sectors include AI, renewables, lending. Investor appetite tested early in year. Listings expected strong amid liquidity. Regulatory filings completed. This boosts market depth. Capital raising for expansion. Broader participation from retail. SEBI oversight ensures transparency. Positive for ecosystem vibrancy. Long-term supply increase noted. Valuations monitored closely. This sets tone for 2026 fundraising. Overall, maturing capital markets sign.

Economic Times - https://pulse.zerodha.com/