The Indian equity markets concluded December 23, 2025, on a flat note amid choppy trading, with the Sensex dipping slightly by 0.05% and the Nifty edging up 0.02%, reflecting cautious sentiment driven by IT sector weakness ahead of earnings and thin year-end volumes.

- Markets end flat; IT drags amid volatile session and thin volumes.

- Foreign inflows hit two-month high as rupee rebounds strongly.

- India-New Zealand financial pact enhances trade and fintech ties.

- US GDP surges 4.3% in Q3, boosting global market optimism.

- Indian stocks lag peers in 2025; positive outlook for 2026.

Top Ten Finance News in India - December 23, 2025

The Indian equity markets concluded December 23, 2025, on a flat note amid choppy trading, with the Sensex dipping slightly by 0.05% and the Nifty edging up 0.02%, reflecting cautious sentiment driven by IT sector weakness ahead of earnings and thin year-end volumes. Positive global cues from robust US economic data provided some support, but domestic focus remained on foreign inflows, bilateral trade pacts, and year-end market adjustments. Overarching themes included rupee recovery boosting investor confidence and anticipation of improved earnings in 2026.

- Markets end flat; IT drags amid volatile session and thin volumes.

- Foreign inflows hit two-month high as rupee rebounds strongly.

- India-New Zealand financial pact enhances trade and fintech ties.

- US GDP surges 4.3% in Q3, boosting global market optimism.

- Indian stocks lag peers in 2025; positive outlook for 2026.

Indian Markets Close Flat Amid IT Pressure and Thin Volumes

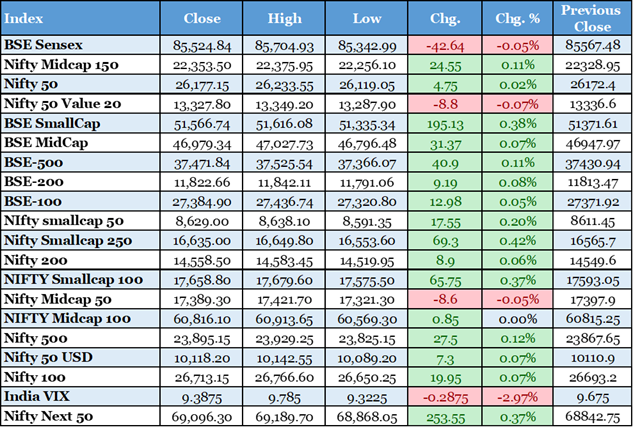

On December 23, 2025, Indian equity benchmarks ended flat amid thin year-end volumes and IT sector weakness ahead of Q3 earnings. Sensex closed at 85,524.84, down 42.64 points (0.05%), while Nifty 50 settled at 26,177.15, up 4.75 points (0.02%). Nine of 16 major sectors declined, with IT falling 0.8% due to a weak rupee near record lows and anticipation of U.S. rate cuts boosting export sentiment. Small-caps rose 0.4%, mid-caps were flat. Top gainers included Coal India (up 3.7% on subsidiary listing reports), Shriram Finance (up 2.5%, with 10.2% three-day gains post-deal), Ambuja Cements (up 1.3% on ACC-Orient merger for 10% value accretion), and Canara HSBC Life (up 5.2% after Buy initiation). Losers were led by IT stocks like Infosys and Bharti Airtel. Volatility was low with thin trading; 2,282 stocks advanced, 1,865 declined, 104 hit 52-week highs, 80 lows. Rupee rose 3 paise to 89.65 against USD on a weaker greenback. Financially, markets await U.S. GDP (expected 3.3% growth), supporting IT/pharma exports. Economy benefits from RBI's growth stance and Budget 2026-27 focus on domestic demand amid weak exports; investors eye earnings for confidence.

The Hindu Business Line

US Economy Grows at Robust 4.3% in Q3, Boosting Global Confidence

US GDP grew at a 4.3% annualized rate in Q3 2025, the fastest since Q3 2023, exceeding forecasts of 3.3%. Key drivers included consumer spending accelerating at 3.5%, the strongest since Q4 2024, fueled by recreational goods, vehicles, food, apparel, healthcare, and international travel. Exports rebounded, shrinking the trade deficit and adding 1.59 percentage points to growth, alongside business investments in equipment and AI, and defense spending. Inflation heated up, with the price index for gross domestic purchases rising 3.4%, the fastest since Q1 2023, and PCE Price Index at 2.8%. Corporate profits from current production surged to a $166.1 billion rate from $6.8 billion in Q2. For global markets, the robust growth and elevated inflation may delay Fed rate cuts, supporting a stronger 2026 economy via tax cuts and monetary easing. For India, the smaller trade deficit and export rebound could benefit from reduced US import tariffs' impact, though Trump's policies contribute to a K-shaped recovery favoring high-income households and large firms. Reuters

RBI Injects Liquidity with Rs 2 Lakh Crore OMO and $10 Billion Swap

On December 23, 2025, the RBI announced measures to infuse $32 billion in rupee liquidity into the banking system over the next month. This includes purchasing government bonds worth Rs 2 lakh crore through open market operations (OMO) in four tranches of Rs 50,000 crore each, scheduled for December 29, 2025; January 5, 2026; January 12, 2026; and January 22, 2026. Additionally, a $10 billion USD/INR buy/sell swap auction with a 3-year tenor is set for January 13, 2026. The RBI stated it will monitor liquidity and market conditions to ensure orderly conditions. These steps aim to support the banking system amid evolving economic pressures. Implications include easing funding costs for banks, stimulating lending, and bolstering economic growth by countering liquidity tightness, potentially lowering bond yields and aiding fiscal management. Financial Express

India and New Zealand Finalize Financial Services Annex Under FTA

India and New Zealand concluded negotiations on the Financial Services Annex under their Free Trade Agreement on December 22, 2025, following talks started in May 2025. The annex, part of the Trade in Services chapter, comprises 18 articles and exceeds GATS commitments, focusing on enhanced cooperation in financial services. Key provisions include collaboration on electronic payments and real-time transactions, leveraging India's UPI and NPCI for cross-border remittances and merchant payments. It promotes fintech innovation via regulatory sandboxes and knowledge exchange, while respecting data sovereignty and privacy. The annex ensures non-discriminatory treatment for Indian institutions, increased FDI limits in banking and insurance, and a liberalized bank branch regime (up to 15 branches over four years). It also supports back-office functions in India, utilizing its IT and BPO strengths. Benefits encompass strengthened digital payments ecosystems, market access for Indian providers, remittance support for the diaspora, and growth in India's financial and IT sectors. Implications include deeper bilateral economic integration, expanded institutional presence (e.g., Indian banks like Bank of Baroda already operating in New Zealand), and opportunities for mutual investment in each other's dynamic markets, fostering trade and finance ties. DD India

US Consumer Confidence Drops to Lowest Since Tariff Rollout

The US Consumer Confidence Index fell 3.8 points to 89.1 in December 2025 from November’s revised 92.9, hitting its lowest level since April 2025 when tariffs were introduced. Short-term expectations held steady at 70.7, below the 80 recession threshold for 11 months, while current economic assessments dropped 9.5 points to 116.8. Consumers cited persistent high prices, inflation, and Trump’s tariffs as key concerns, alongside declining job perceptions (26.7% called jobs plentiful, down from 28.2%; 20.8% said hard to get, up from 20.1%). The labor market shows slow hiring amid tariff uncertainty and high interest rates. This pessimism may curb US consumer spending, potentially disrupting international trade. For India, reliant on US exports, reduced demand and tariff-related supply chain shifts could lower export revenues and economic growth. ABC News

Indian Stocks Lag Emerging Markets and Asia in 2025 Year-Ender

In 2025, Indian benchmark indices BSE Sensex and NSE Nifty posted single-digit gains, with Nifty up 10.7% and Sensex up 9.5%, marking their worst performance in decades compared to global peers. They significantly underperformed the MSCI Asia Pacific Index (widest margin since 1998) and MSCI Emerging Markets Index (worst since 1993). Peers like Japan's Nikkei (+28%), South Korea's Kospi (+72%), China's CSI 300 (+17%), Hong Kong's Hang Seng (+29%), S&P 500 (+17%), and Nasdaq 100 (+21%) outperformed. Underperformance stemmed from global macro uncertainties including US tariffs, modest earnings growth, lower government capex, prolonged earnings slowdown, high valuations, earnings downgrades, weak FY26 growth expectations, lower consumption due to higher inflation, Russia-Ukraine war impacts, and limited AI exposure, with Nifty IT down 10% amid IT firms' transition phase. Outlook for 2026 is positive, driven by GST rate rationalisation, interest rate reductions, normal monsoon, low inflation, weak oil prices, improved earnings, strengthening domestic consumption, stable macro environment, and potential India-US trade deal reducing tariffs. Kotak Securities targets Nifty at 29,120 by December 2026 (13% above current levels). Business Standard

Hidden Year-End Bargains Emerge in Indian Stock Rally

India's Sensex and Nifty 50 indices rose 9.5% in 2025, nearing all-time highs, but underperformed many Asian peers due to rally concentration in a few firms and investor focus on AI themes. Of 828 large-cap companies, 109 traded within 5% of 52-week lows, with declines driven by idiosyncratic factors like Inox Wind's share dilution, Blue Dart's tax demands, Tata Chemicals' soda ash price drop and outages, and HFCL's revenue fall and share-backed loans. Despite this, 14 laggards show robust EPS growth (>10% through 2027), low debt, and reasonable valuations, including Inox Wind, HFCL, Tata Chemicals, and Blue Dart (EPS growth 28- strong). Outlook for 2026 remains positive for quality stocks left behind, potentially outperforming as fundamentals strengthen, though trade tensions with the U.S. pose risks; implies bargain opportunities amid market exuberance. Reuters

Indian Startups Secure Key Funding Amid Healthtech and Fintech Focus

On December 23, 2025, Indian startups secured key funding across sectors. Naxatra Labs raised $3 Mn in pre-Series A led by Rainmatter for digital health expansion. Prosperr.io bagged $4 Mn seed from Jungle Ventures to scale tax compliance solutions. CoreEL Technologies obtained $30 Mn to boost R&D in defence electronics. DJT Microfinance garnered INR 130 Cr from PSBs and NBFCs for geographic growth and lending. Developments included Paytm's overseas expansion with units in Indonesia and Luxembourg, plus a 49% stake sale in UAE payments arm. Rentomojo reported FY25 net profit of INR 43 Cr, up 92%, marking third-year profitability with expanded rental services. These deals signal investor confidence in tech-driven healthcare, fintech, defence, and financial inclusion, alongside fintech globalization and operational maturity. StartupTalky

Top Stock Picks Highlight Opportunities in Mining, Pharma, and Power

Top stock recommendations for December 23, 2025, from Mirae Asset Sharekhan: NMDC (Buy Rs 78-79, SL Rs 75, Target Rs 86; consolidating 15 weeks above 20/40 DMA, breakout from range with support at 76.20, positive momentum crossover); Glenmark Pharmaceuticals (Buy Rs 2036-2037, SL Rs 1890, Target Rs 2200; breakout from falling trendline above 20/40 DMA, consolidating two weeks with range breakout above 1954); BHEL (Buy Rs 281-282, SL Rs 266, Target Rs 310; consolidating month above 20/40 DMA, poised for breakout above 278.40, positive crossover). Market context: Nifty50 opens flat, BSE Sensex below 85,500 amid volatility. Implications: Breakouts signal uptrend resumption in metals, pharma, and engineering sectors. The Times of India

US Stocks Close at Record Highs Driven by Tech Gains

On December 23, 2025, major US stock indexes closed at record highs. The S&P 500 rose 0.5% (31.30 points) to 6,909.79, driven by big tech stock gains despite most stocks falling, following a strong summer economic growth report. The Dow Jones Industrial Average increased 0.2% (79.73 points) to 48,442.41. The Nasdaq composite advanced 0.6% (133.02 points) to 23,561.84. Key drivers included Novo Nordisk's 7.30% jump after US regulators approved an oral version of Wegovy, the first daily obesity treatment pill. Treasury yields rose in the bond market. Implications: Year-to-date, S&P 500 up 17.5%, Dow 13.9%, Nasdaq 22%. Weekly gains: S&P 1.1%, Dow 0.6%, Nasdaq 1.1%. These records signal positive momentum, potentially influencing global markets amid economic resilience. Yahoo Finance