The Indian markets exhibited subdued sentiment on December 26, 2025, characterized by thin year-end trading volumes and minor declines in major indices amid a lack of significant triggers. Global cues from a resilient US economy provided some support but did not spur strong momentum.

- Markets slipped on low volumes, signaling year-end caution and liquidity crunch.

- Precious metals rallied to records, boosting investor interest in safe-haven assets.

- Major IT acquisition highlighted sector consolidation and growth potential.

- Banking fraud disclosure raised concerns over financial sector integrity.

- Strong SIP inflows reflected sustained retail investor confidence.

Indian Equities End Lower Amid Thin Year-End Volumes

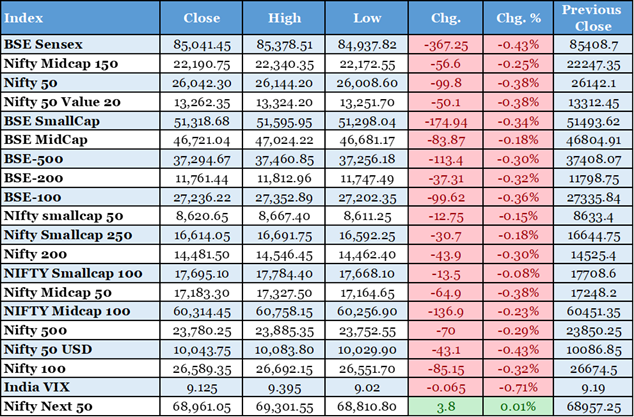

India's equity benchmarks slipped on December 26 as trading volumes thinned toward year-end, with the Sensex at 85,041.45 (down 0.43%) and Nifty at 26,042.3 (down 0.38%). After hitting records in November, indices shed marginally in December due to lack of triggers and global holiday impacts. Financial institutions engaged in book squaring, reducing liquidity. This subdued close reflects investor caution, potentially delaying rallies until quarterly earnings. It implies short-term volatility for markets, affecting retail and institutional strategies.

Business Standard https://www.business-standard.com/

Precious Metals Surge: Silver Tops $75, Gold and Platinum Hit Records

Silver breached $75 per ounce for the first time, while gold and platinum reached all-time highs, driven by US rate cut expectations, a weaker dollar, and geopolitical tensions. In India, gold discounts widened to six-month highs due to curbed retail buying amid the rally. Spot silver rose 3.8% to $74.65, gold 0.7% to $4,511.70, and platinum 9.3% to $2,426.20. Precious metals posted strong year-to-date gains, with silver up 158%. This surge enhances portfolio values for Indian investors but pressures physical demand. It signals safe-haven appeal amid global uncertainties, potentially supporting rupee stability through commodity-linked inflows.

Reuters https://www.reuters.com/world/india/silver-tops-75-gold-platinum-surge-records-2025-12-26/

Coforge Acquires Encora in $2.35 Billion All-Stock Deal

Coforge announced the acquisition of California-based Encora for $2.35 billion in an all-stock transaction, marking the largest outbound deal in Indian IT history. The board also approved a $550 million qualified institutional placement to fund growth. This move aims to enhance Coforge's AI and digital engineering capabilities, expanding its US presence. The deal underscores consolidation in the IT sector amid global demand for tech services. It could boost Coforge's market valuation and competitiveness, positively impacting investor sentiment in IT stocks. However, integration risks remain in a volatile economic environment. The acquisition reflects India's growing outbound M&A activity, potentially strengthening the sector's contribution to GDP.

PNB Reports Rs 2,434 Crore Fraud Linked to SREI Former Promoters

Punjab National Bank disclosed a Rs 2,434 crore borrowal fraud involving SREI Equipment Finance and SREI Infrastructure Finance, linked to their erstwhile promoters. The bank informed the RBI and plans further actions. This revelation highlights ongoing issues in non-banking financial companies post-SREI's insolvency. It could erode investor confidence in public sector banks, impacting stock performance. The fraud underscores the need for stricter regulatory oversight, potentially leading to tighter lending norms. For the economy, it raises concerns over asset quality in the financial sector, affecting credit flow.

Financial Express https://www.financialexpress.com/business/news-pnb-reports-rs-2434-borrowal-fraud-linked-to-former-srei-group-promoters-4089392/

RBI Conducts Rs 1 Trillion OMO to Inject Liquidity

The Reserve Bank of India executed a Rs 1 trillion open market operation purchase to add liquidity, addressing rupee depreciation and maturing forex swaps. This move aims to stabilize banking system funds amid year-end pressures. It could ease borrowing costs for corporates and support economic growth. The intervention highlights RBI's proactive stance on currency management, potentially bolstering market confidence. For investors, it signals supportive monetary policy, positively influencing bond yields and equity sentiment.

Business Standard https://www.business-standard.com/finance/news/rbi-omo-purchase-1-trillion-liquidity-rupee-depreciation-forex-swaps-explained-125120500341_1.html

SIP Inflows Surpass Rs 3 Trillion in 2025

Systematic Investment Plan inflows exceeded Rs 3 trillion for the first time in 2025, reflecting steady retail investor participation despite market volatility. This record underscores growing financial literacy and long-term wealth creation trends. It bolsters mutual fund assets, supporting capital market depth. For the economy, it indicates robust domestic savings channeled into investments, aiding corporate funding. The trend could sustain bull runs in equities, benefiting indices like Nifty and Sensex.

Business Standard https://www.business-standard.com/

Credit Growth Approaches 12% Amid Sustained Lending

India's credit growth inched closer to 12%, driven by momentum in lending across sectors. This reflects resilient economic activity and bank confidence despite global headwinds. It supports business expansions and consumer spending, contributing to GDP growth. However, it raises vigilance on asset quality amid fraud reports. For markets, it signals positive banking sector outlook, potentially lifting Bank Nifty.

Financial Express https://www.financialexpress.com/business/banking-finance/credit-growth-inches-closer-to-12-as-lending-momentum-holds/4089424/

Zepto Files Draft IPO Papers Amid Widening Losses

Quick-commerce firm Zepto confidentially filed draft IPO papers on December 26, despite FY25 net losses widening 177% to Rs 3,367 crore. This move aims to capitalize on sector growth for fundraising. It highlights challenges in profitability but potential for market expansion. The IPO could invigorate investor interest in e-commerce, impacting related stocks. For the economy, it underscores rapid digital adoption in retail.

Financial Express https://www.financialexpress.com/business/news/zeptos-fy25-net-loss-widens-177-to-rs-3367-crorenbsp/4089662/

US S&P 500 Eyes 7,000 Mark in Upbeat Year-End Close

The S&P 500 neared the 7,000 milestone, up nearly 18% in 2025, amid rotation from tech to financials and industrials, signaling broad economic strength. Fed rate cuts and upcoming minutes add to optimism, though divided policy views persist. This resilience boosts global sentiment, potentially aiding Indian markets through FII inflows and trade ties. It implies sustained risk appetite, supporting emerging economy recoveries.

US Stocks Log Weekly Gains Amid Santa Claus Rally

US indices posted over 1% weekly gains in a holiday-shortened period, with S&P 500 and Nasdaq up 18% and 20% YTD, despite tariff concerns. Precious metals rallied on supply issues, and Nvidia's AI deal lifted tech. This positive momentum reinforces US economic stability, influencing global commodities and equities. For India, it could ease export pressures and enhance investor confidence amid shared geopolitical risks.