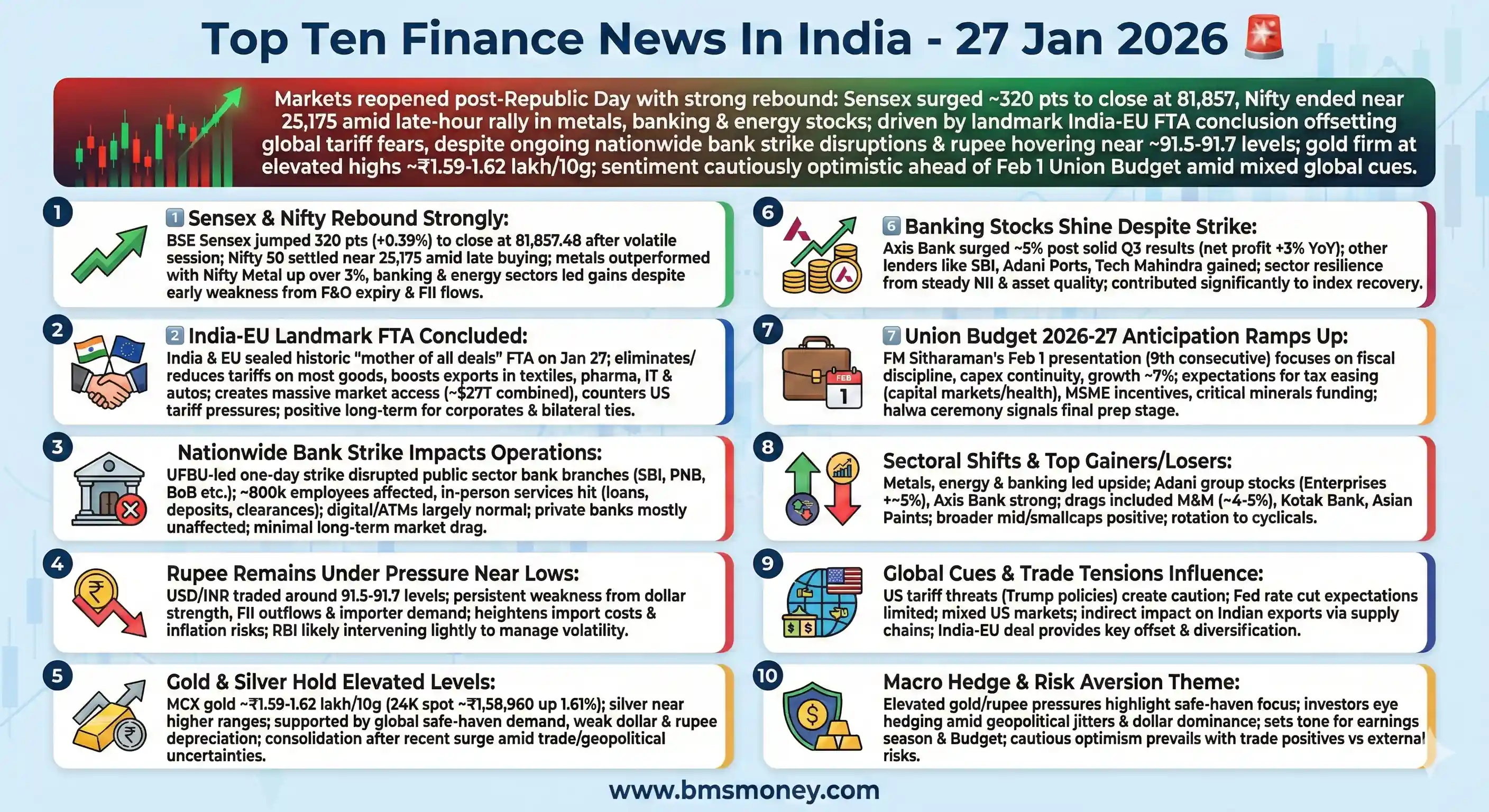

Indian markets staged a resilient bullish rebound on January 27, 2026, as optimism from a landmark India-EU free trade agreement countered persistent global trade tensions. The announcement fueled gains in metals, banking, and energy stocks, driving benchmark indices higher despite a disruptive nationwide bank strike. Attention now shifts to the upcoming Union Budget and the detailed implementation of the trade pact, while safe-haven demand continued to lift gold prices.

Indian markets displayed a resilient bullish rebound on January 27, 2026, with the Sensex gaining around 300-400 points in volatile trade, buoyed by the landmark India-EU Free Trade Agreement announcement that countered US tariff pressures and supported sectors like metals, banking, and textiles. Global cues remained mixed amid US Fed rate expectations and tariff uncertainties, but domestic optimism from trade diversification and upcoming budget preparations dominated sentiment. Key overarching themes centered on strategic trade realignments, banking sector performance amid a nationwide strike, and commodity strength.

- Landmark India-EU FTA slashes tariffs, boosting bilateral trade and offsetting US pressures.

- Sensex and Nifty recover in volatile session with gains in metals, banks, and energy stocks.

- Nationwide bank strike disrupts operations while Q3 earnings from banks show resilience.

- Gold prices surge over 1.6% in India tracking global safe-haven demand and weak dollar.

- Upcoming Union Budget 2026-27 focuses on fiscal discipline amid growth expectations of 7%.

India and EU Seal Landmark Free Trade Agreement to Counter Global Trade Tensions India and the European Union finalized a comprehensive free trade agreement on January 27, 2026, described as the "mother of all deals" by leaders. This pact eliminates or significantly reduces tariffs on most goods traded between India and the 27-nation bloc. It creates enhanced market access for Indian exports such as textiles, pharmaceuticals, and automobiles into Europe. European products like wines, spirits, and machinery gain better entry into the Indian market. The deal accelerates after prolonged negotiations spanning over two decades. It directly addresses escalating US tariff threats under President Trump. Indian exports to the US have already declined due to duties linked to Russian oil purchases. This FTA is expected to add substantial value to bilateral trade volumes. It fosters stronger supply chain integration between the two economies. Investment flows are anticipated to rise significantly in coming years. The agreement includes provisions for innovation partnerships and technology transfers. It strengthens India's position in global trade amid geopolitical shifts. European leaders highlighted shared prosperity and rules-based order. Indian Prime Minister emphasized its role as a blueprint for mutual growth. The pact excludes immediate relief on EU's Carbon Border Adjustment Mechanism. Overall, it provides a strategic hedge against protectionist policies elsewhere. Markets reacted positively with gains in export-oriented sectors. This development marks a pivotal moment in India-EU relations. It could unlock billions in additional trade opportunities. The deal's implementation will require parliamentary approvals on both sides. Long-term benefits include job creation and economic diversification for India. This FTA stands out as one of the largest in India's history.

Moneycontrol / Reuters - https://www.moneycontrol.com/ (referencing Reuters coverage) / https://www.reuters.com/business/autos-transportation/india-eu-slash-tariffs-autos-spirits-textile-landmark-deal-2026-01-27

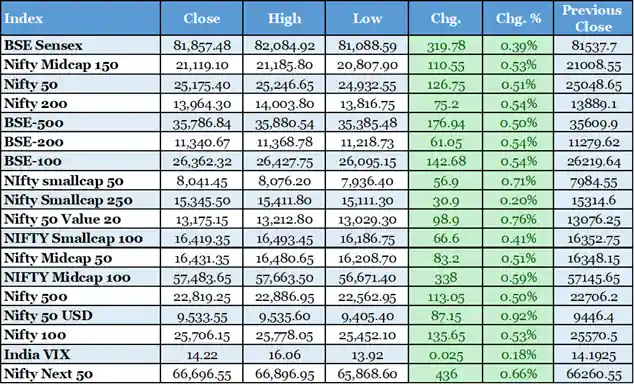

Sensex Gains Over 300 Points in Volatile Trade on India-EU FTA Optimism Indian equity benchmarks rebounded sharply on January 27, 2026, after a Republic Day holiday. The BSE Sensex climbed approximately 300-400 points during the session. Nifty 50 hovered around the 25,100-25,150 level by close. Early trade saw some weakness due to FII outflows and F&O settlement pressures. Late buying in metal, banking, and energy stocks drove the recovery. The India-EU FTA announcement fueled positive sentiment. GIFT Nifty indicated a firm opening earlier in the day. Volatility persisted amid mixed global cues. Banking stocks rallied despite an ongoing nationwide strike. Metal and energy sectors led the gains. Adani group stocks and Axis Bank featured among top performers. Mahindra & Mahindra and Kotak Bank saw notable declines. Market breadth remained positive with advances outpacing declines. Foreign institutional investors continued net selling in recent sessions. Domestic institutional buying provided support. Technical analysts noted key support levels around 81,000 on Sensex. Resistance is seen near 82,000-83,000. The rally reflects resilience despite recent underperformance. Q3 earnings from banks offered mixed but stable results. Overall, the session highlighted trade deal-driven confidence. Broader market participation increased in late trade. This bounce could set the tone ahead of the Union Budget. Investors remain cautious on global tariff risks. The close marked a strong recovery from early lows. Sector rotation favored cyclicals over defensives. This performance underscores India's market adaptability.

The Financial Express - https://www.financialexpress.com/market/sensex-nifty-50-stock-market-today-live-updates-india-eu-fta-union-budget-crude-oil-gold-rate-trump-tariff-fii-january-27-2026-4120220

Nationwide Bank Strike Disrupts Services as Unions Demand Five-Day Week Bank unions across India commenced a nationwide strike on January 27, 2026. The action presses for a five-day work week in the banking sector. Major public and private banks faced operational challenges. Customers encountered difficulties with branch services and transactions. ATMs and digital platforms remained largely functional. State Bank of India issued advisories on potential disruptions. Arrangements were made to minimize customer inconvenience. The strike coincides with key quarterly earnings releases. Banking stocks still managed gains amid the market rally. Negotiations between unions and management continue. The demand stems from work-life balance concerns. Wage revisions and other issues are also part of discussions. The banking sector plays a critical role in the economy. Disruptions could affect liquidity and credit flows temporarily. Markets monitored the situation closely for broader implications. Previous strikes have had limited long-term impact. Union participation appeared widespread across regions. Government intervention remains a possibility if prolonged. The strike highlights ongoing labor issues in public sector banking. Private banks maintained relatively normal operations. Overall economic activity saw minor short-term effects. This event occurs ahead of the Union Budget. It underscores challenges in the financial services landscape. Resolution is expected through dialogue in coming days. Banking sentiment stayed resilient due to strong Q3 numbers. The strike concludes by end of day in most cases.

Economic Times - https://economictimes.indiatimes.com/industry/banking/finance

Gold Prices in India Rise 1.61% to ₹158,960 per 10 Grams Gold rates in India surged on January 27, 2026, aligning with global trends. The 24K gold price reached ₹158,960 per 10 grams. This reflects a gain of ₹2,520 from the previous close. 22K gold stood at ₹145,713 per 10 grams. International spot prices drove the domestic increase. A weakening US dollar supported the rally. Safe-haven demand rose amid trade uncertainties. Gold crossed significant milestones globally. Silver prices also moved higher in tandem. Indian prices remained premium over Dubai rates. Import duties and local taxes contribute to the gap. Investors turned to gold amid equity volatility. The commodity serves as a hedge against inflation. Central bank purchases continue to bolster demand. MCX futures reflected similar upward momentum. Jewellery demand picked up seasonally. Global economic concerns fueled buying interest. The move aligns with precious metals' strong 2026 performance. Indian consumers faced higher costs for purchases. Investment in gold ETFs and sovereign bonds increased. This trend supports portfolio diversification strategies. Prices could face resistance at higher levels. Overall, gold's appeal remains strong in uncertain times. The day's gain marks continued bullish momentum. Markets expect sustained interest in coming sessions.

Financial Express - https://www.financialexpress.com/market/gold-pulse/gold-rate-today-on-27th-january-2026-check-22k-24k-mcx-gold-price-today-in-delhi-mumbai-hyderabad-chennai-bangalore-dubai/4120389

US Fed Anticipates Limited Rate Cuts Amid Tariff and Policy Uncertainties The US Federal Reserve's stance influenced global markets on January 27, 2026. Expectations point to cautious monetary policy ahead. Policymakers see rates near neutral levels currently. Tariff impacts raise inflation concerns potentially. Fiscal stimulus adds complexity to the outlook. Divisions within the Fed create policy challenges. The upcoming chair transition adds uncertainty. Markets anticipate only one or two cuts in 2026. The dollar weakened to multi-year lows. This supports emerging market currencies including the rupee. US stocks hit records despite mixed signals. Tech sector led gains amid earnings optimism. Tariff threats persist on various imports. The Fed's decision draws close scrutiny worldwide. Indian markets feel ripple effects through FII flows. Global growth projections remain positive overall. The US economy shows resilience in data. Inflation hovers near target levels. Rate path influences commodity and equity trends. Emerging markets benefit from a softer dollar. Indian investors monitor for capital flow implications. The Fed's approach prioritizes stability. This environment favors selective risk-taking. Overall sentiment ties to US policy directions. The day's developments reinforce cautious optimism globally.

Reuters / CNBC - https://www.reuters.com/markets/battle-fed-heats-up-challenge-rate-horizon-2026-01-26

Axis Bank and Other Lenders Post Solid Q3 Results Despite Strike Axis Bank reported a 3% rise in Q3 net profit for FY26. The figure reached Rs 6,489.6 crore year-on-year. Net interest income grew 5% to Rs 14,286.4 crore. Asset quality metrics remained stable overall. Provisions were managed prudently. The stock surged up to 5% intraday. Other banks delivered mixed but resilient performances. Kotak Mahindra saw some pressure post-results. Banking sector contributed to market recovery. Earnings reflect steady loan growth. Deposit mobilization continued effectively. NIMs held firm in a competitive environment. Digital initiatives boosted efficiency. The nationwide strike had limited immediate earnings impact. Valuations appear reasonable for the sector. Credit growth supports economic expansion. Regulatory oversight remains vigilant. Investors favor banks with strong fundamentals. Q3 results bolster confidence ahead of budget. Sector outlook ties to macro conditions. Overall, banking resilience shines through. This performance aids broader market sentiment. Future quarters will test sustained momentum.

Financial Express / Moneycontrol - https://www.financialexpress.com/market/sensex-nifty-50-stock-market-today-live-updates-india-eu-fta-union-budget-crude-oil-gold-rate-trump-tariff-fii-january-27-2026-4120220

Union Budget 2026-27 Preparations Focus on Fiscal Discipline and Growth India's upcoming Union Budget on February 1 draws intense anticipation. Finance Ministry emphasizes fiscal consolidation. Borrowing clarity is a key market expectation. Growth targets aim around 7% for FY27. Tax rationalization proposals surface from sectors. Capital expenditure push is likely to continue. Healthcare and infrastructure seek policy support. Bond markets desire predictable fiscal path. Foreign outflows pressure rupee stability. Budget must balance stimulus and prudence. Expectations include MSME and export incentives. Critical minerals funding gains attention. GST refinements could ease business costs. Capital market taxation relief is demanded. Healthcare leaders prefer steady measures. Overall, fiscal room remains constrained. Prior tax cuts limit aggressive spending. Growth challenges persist globally. Domestic reforms can offset external risks. Budget will influence market direction significantly. Investors await policy signals on key sectors. This event shapes economic trajectory for the year. Preparations reflect cautious optimism. The focus remains on sustainable development.

Moneycontrol / The Hindu - https://www.moneycontrol.com/

Adani Group Stocks Lead Gains Amid Broader Market Recovery Adani Enterprises surged nearly 5% on January 27, 2026. It ranked among top Nifty gainers. Other Adani group companies participated in the rally. Positive sentiment stemmed from trade deal optimism. Infrastructure and ports benefit indirectly. Market focus shifted to cyclicals. Precious metals exposure aided performance. Axis Bank and similar stocks complemented gains. M&M faced pressure with a 4-5% decline. Broader Adani ecosystem shows strength. Investor interest remains high in the group. Regulatory clarity supports confidence. Valuation metrics appear attractive now. Group diversification aids resilience. Market cap additions were notable. This performance ties to macro tailwinds. Future projects drive long-term potential. Overall, Adani stocks contributed to index upside. Sentiment reflects renewed risk appetite. Sector momentum could sustain if cues remain positive. Investors monitor for continued participation.

ET Now / Various - https://www.etnownews.com/markets/sensex-nifty-50-today-stock-market-live-updates-27-january-2026-sensex-nifty-movement-top-gainers-losers-market-trends-liveblog-153511372

US Stocks Mixed with S&P 500 Hitting Records on Tech Strength US markets showed divergence on January 27, 2026. The S&P 500 reached all-time highs intraday. Tech stocks led the charge amid earnings. Nasdaq performed strongly overall. Dow Jones faced pressure and declined. UnitedHealth plunged nearly 20% on guidance. Health insurers weakened broadly. Tariff concerns lingered in background. Fed policy anticipation influenced trading. Earnings season picks up pace significantly. Big Tech results drive sentiment. Dollar weakness supports global risk assets. Global stocks rose in tandem for sessions. US economic data remains resilient. Investor focus shifts to rate signals. This mixed close reflects sector rotation. Tech optimism counters tariff worries. Ripple effects reach emerging markets including India. Overall, US cues provide cautious positivity. Markets digest policy and earnings interplay. Future sessions hinge on Fed outcomes.

Reuters / Investopedia - https://www.reuters.com/world/china/global-markets-wrapup-1-2026-01-27