The Indian markets exhibited a bearish sentiment on December 29, 2025, marked by continued declines in major indices amid year-end profit booking and persistent foreign outflows. Volatility was heightened by commodity price swings and global economic uncertainties, particularly from US policy shifts. Key themes included corporate acquisitions boosting IT confidence, regulatory focuses on debt markets, and anticipation of stronger global growth in 2026.

- Markets fell for fourth day due to profit-taking and caution.

- Record foreign outflows capped 2025 stock rally significantly.

- Commodity volatility, especially silver, influenced metal stocks.

- Corporate deals like Coforge's acquisition lifted IT sentiment.

Indian Stock Markets Extend Losses for Fourth Consecutive Day

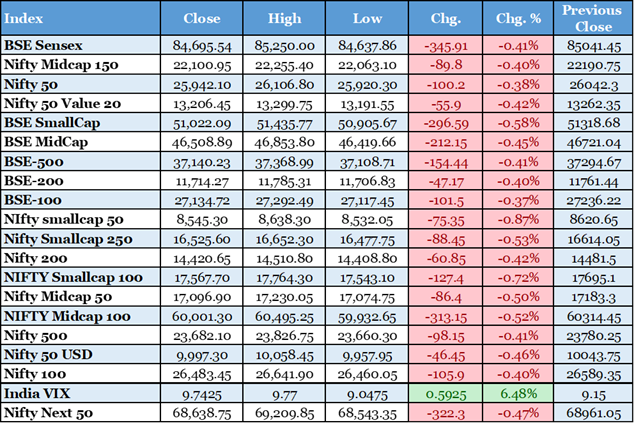

The Sensex closed 346 points lower at 84,695.54, while the Nifty 50 fell 100 points to 25,942.10, amid thin trading and year-end profit booking. This marked the fourth straight session of declines, reflecting investor caution after a volatile 2025. Broader indices like Midcap and Smallcap also dropped, with Nifty Midcap down 0.52% and Smallcap by 0.72%. Sectoral weakness was evident in IT and consumer goods, pressured by global tech selloffs. The India VIX rose 6.23% to 9.72, signaling increased market anxiety. Foreign institutional investors continued net selling, exacerbating the downturn. This movement underscores year-end repositioning, potentially capping annual gains at modest levels. Immediate implications include reduced liquidity and delayed recoveries in retail-driven segments. Analysts expect volatility to persist into early 2026, influenced by upcoming budget announcements. Overall, the session highlighted structural challenges in sustaining rally momentum.

Economic Times, https://m.economictimes.com/markets/stocks/live-blog/bse-sensex-today-live-nifty-stock-market-updates-29-december-2025/liveblog/126222491.cms

Record Foreign Outflows Cap India's 2025 Stock Rally

Foreign investors recorded unprecedented net outflows from Indian equities in 2025, limiting benchmark gains despite fresh highs earlier in the year. Outflows totaled billions, driven by global risk aversion and attractive valuations elsewhere. This capped the BSE Sensex's annual rise to around 5.9%, the smallest among major indices. Domestic institutional buying provided some buffer, but retail investors turned net sellers in mid and small-caps. The trend reflects shifts in global capital flows amid US policy changes. Selling pressure eased slightly toward year-end, with expectations of moderation in 2026. Impacts include depressed valuations in key sectors like banking and infrastructure. Regulatory responses from SEBI may stabilize flows. This development signals caution for foreign-dependent growth stories. Long-term, improved macroeconomic data could reverse the trend. Reuters India, https://www.reuters.com/world/india/record-foreign-outflows-cap-india-stock-rally-2025-selling-may-ease-next-year-2025-12-29/

Coforge Acquires Encora for $2.35 Billion in Major IT Deal

Coforge announced a $2.35 billion acquisition of US-based Encora, marking one of the largest outbound deals in India's IT sector for 2025. The move aims to expand digital engineering capabilities and client base. Shares rallied over 2% on the news, hitting a 52-week high. This bolsters Coforge's position amid slowing global tech spending. Analysts project up to 49% upside, citing synergies in AI and cloud services. The deal impacts the Nifty IT index, which declined 0.75% overall that day. It highlights consolidation trends in IT amid US visa restrictions. Funding via debt and equity could strain balance sheets short-term. Positive for sector sentiment, potentially spurring similar M&A. Immediate financial boost through revenue diversification. Business Standard, https://www.business-standard.com/markets/news/stocks-to-watch-today-december-29-2025-coforge-tech-mahindra-lenskart-ola-electric-pnb-timex-vedanta-125122900060_1.html

Silver Prices Hit Record Highs Before Sharp Retreat

Silver surged 181% in 2025, hitting Rs 2.54 lakh/kg on MCX and over $80/oz globally, before dropping 5% on profit-taking. This volatility boosted stocks like Hindustan Zinc, up 3% to a 52-week high. Driven by industrial demand and safe-haven buying amid geopolitical tensions. Outperformed gold, which rose 70%, becoming a top asset class. Impacts Indian commodity markets and jewelry sector. Metal indices gained, with Tata Steel up 1.88%. Potential China stimulus added upward pressure. Retreat signals overbought conditions, affecting importer margins. Long-term bullish on supply constraints. Immediate implication: Heightened sector volatility. Livemint, https://www.livemint.com/market/stock-market-news/top-stocks-to-buy-best-stock-picks-ankush-bajaj-sensex-nifty-11766930229261.html

US Economy to Ride Tax Cut Tailwind But Faces Risks in 2026

The US economy is projected to strengthen in 2026, buoyed by President Trump's tax cuts, following a mixed 2025. Growth acceleration forecasted by Goldman Sachs, potentially lifting global markets including India. However, risks from trade wars and inflation persist. This influences FII flows into emerging markets like India. Positive for export-oriented sectors such as IT and pharma. US stocks slipped amid tech selloffs, with Nasdaq down. Mortgage rates fell to 6.18%, boosting housing data. Implications for India: Stronger dollar pressure on rupee. Overall, supportive for global sentiment if risks abate. Key for Indian policymakers monitoring FED cues. Reuters, https://www.reuters.com/sustainability/sustainable-finance-reporting/us-economy-ride-tax-cut-tailwind-faces-risks-2025-12-29/

Trump's H-1B Visa Fee Hike to Impact India-US Tech Relations

A proposed $100,000 H-1B visa fee under Trump administration sparked legal battles, expected to hurt Indian IT firms reliant on US talent mobility. This chaos prompts Wall Street to expand jobs in India, mitigating costs. Affects Nifty IT, down amid broader selloffs. Indian economy faces short-term headwinds in services exports. Banks like Goldman adding India-based roles. Long-term, boosts domestic hiring but disrupts global operations. Court halts initial rulings, heading to Supreme Court. Implications: Reduced remittances, sector rerating. Positive for local talent pool development. Critical for bilateral trade ties. Bloomberg, https://www.bloomberg.com/news/features/2025-12-29/india-s-blinkit-zomato-tailor-quick-commerce-for-tier-2-tier-3-cities

Reliance Industries Denies $30 Billion Claim Against It and BP

Reliance refuted a $30 billion arbitration claim related to energy ventures with BP, calling it inappropriate. Shares dipped 0.87% amid the clarification. This averts potential liability impacting balance sheets. Context: Ongoing disputes in oil and gas partnerships. Boosts investor confidence in corporate governance. Affects energy sector valuations. No immediate financial hit, but monitors legal proceedings. Positive for stock stability. Highlights risks in joint ventures. Broader implication: Strengthens focus on domestic energy security. Reuters India, https://www.reuters.com/business/energy/indias-reliance-industries-says-there-is-no-30-billion-claim-against-company-bp-2025-12-29/

Blackstone-Backed Horizon Industrial Files Rs 2,600 Cr IPO

Horizon Industrial, supported by Blackstone, filed for a Rs 2,600 crore IPO with SEBI, targeting infrastructure expansion. This adds to 2025's robust fundraising pipeline. Boosts capital market liquidity and investor interest in industrials. Potential listing gains amid sector growth. Impacts Nifty indices through new entrants. Context: Rising private equity exits. Immediate implication: Enhanced funding for logistics and manufacturing. Analysts eye valuation metrics. Supports economic recovery via capex. Key for monitoring IPO trends. Economic Times, https://economictimes.indiatimes.com/markets/ipos/fpos/blackstone-backed-horizon-industrial-files-rs-2600-cr-ipo-papers-with-sebi/articleshow/126235777.cms

Indian Bonds Dip After RBI's Focus on Short-Term Notes

Government bonds declined as RBI emphasized short-term instruments, with heavy state debt sales looming. Yields rose, affecting fixed-income returns. Context: Liquidity management amid fiscal pressures. Impacts banking sector profitability. Attractive for 2026 with expected rate cuts. Broader implication: Stabilizes rupee but pressures borrowing costs. Monitors inflation data. Positive for debt mutual funds. Highlights policy shifts in monetary framework. Key for portfolio adjustments. Economic Times, https://economictimes.indiatimes.com/markets/bonds/india-bonds-dip-after-rbi-focus-on-short-term-notes-state-debt-sale-eyed/articleshow/126232014.cms

Goldman Sachs Forecasts Accelerated US Growth in 2026

Goldman Sachs predicts US GDP growth to speed up in 2026, driven by tax reforms despite stagnant jobs. This follows 2025's resilience, influencing global commodity prices like oil, up 2%. Positive spillover for Indian exports and FII inflows. Risks from tariffs remain. Affects rupee and trade balances. US stocks edged lower, but outlook boosts sentiment. Implications: Stronger dollar challenges emerging markets. Supports India's growth via trade deals. Monitors job data. Critical for global economic linkage. Fox Business, https://www.foxbusiness.com/economy/us-economy-expected-grow-faster-2026-despite-stagnant-job-market-goldman-sachs