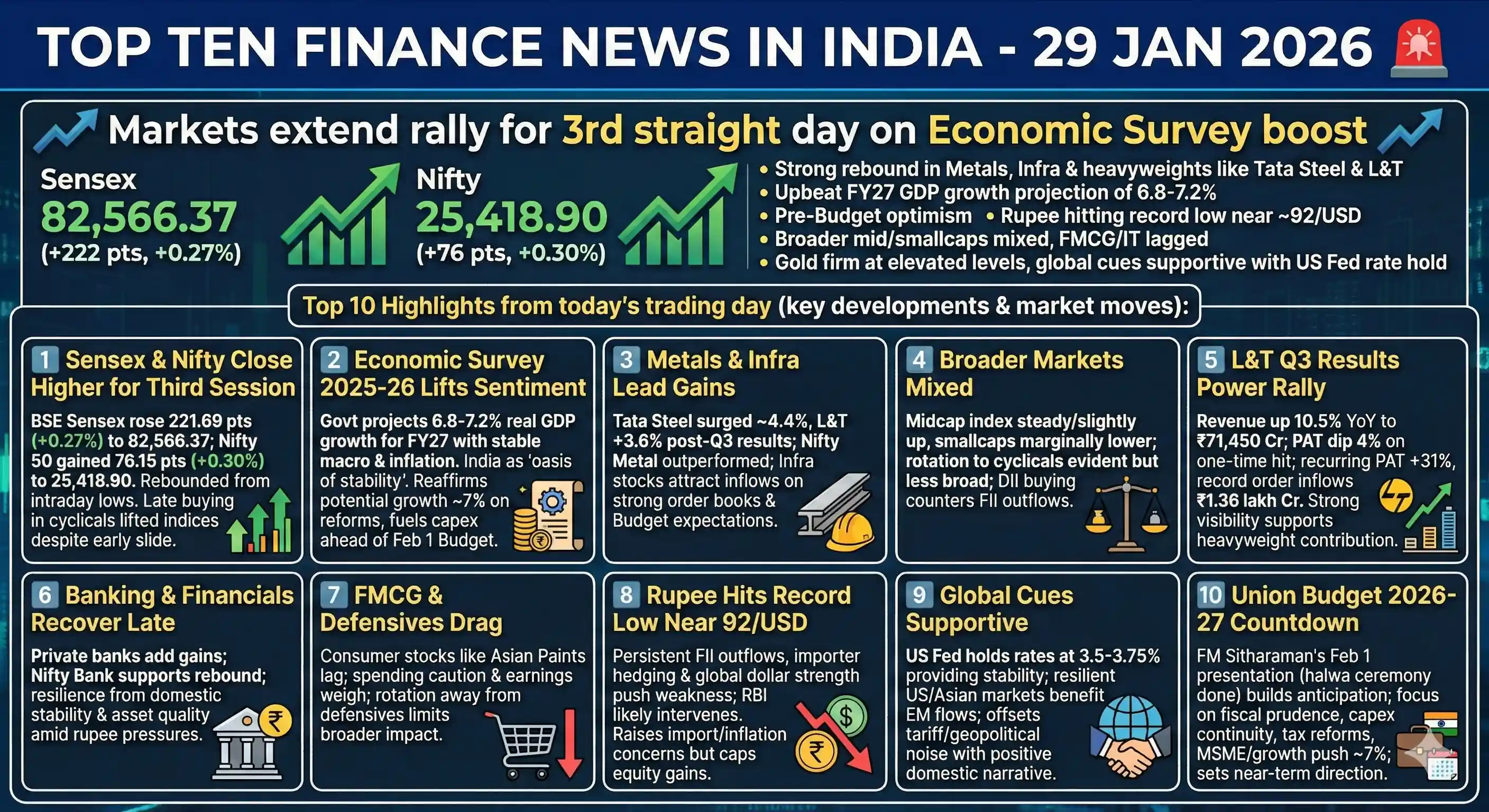

Indian markets exhibited cautious optimism on January 29, 2026, edging higher after a supportive Economic Survey projected robust GDP growth, though gains were limited by the rupee hitting a record low and mixed corporate earnings. Strength in metals and infrastructure sectors drove the indices, while investor sentiment balanced domestic fiscal hopes against persistent global headwinds.

Indian markets displayed cautious bullishness on January 29, 2026, with Nifty 50 and Sensex gaining 0.3% each amid Economic Survey optimism, though capped by rupee's record low near 92/USD. Overarching themes centered on steady GDP growth projections, Q3 corporate earnings resilience, pre-Budget positioning, and global cues from US Fed rate pause and widening trade deficit.

- Economic Survey forecasts FY27 GDP at 6.8-7.2%, up from prior 6.5% potential, amid global risks.

- Nifty 50 reclaims 25,400, Sensex adds 222 pts on metal, infra gains post-survey boost.

- Rupee hits all-time low ~91.98/USD on FII outflows, importer hedging; RBI intervenes.

- L&T Q3 revenue up 10% to ₹71,450 Cr, PAT dips 4% on labour code hit; order book ₹7.33 lakh Cr.

- US Fed holds rates at 3.5-3.75%; Powell cites solid growth, sticky inflation delaying cuts.

India's Economic Survey Projects 6.8-7.2% GDP Growth for FY27

Finance Minister Nirmala Sitharaman tabled the Economic Survey 2025-26 in Parliament, forecasting real GDP growth of 6.8-7.2% for FY27, slightly below FY26's 7.4% estimate. This reflects strong domestic demand, anchored macro stability, and reforms lifting potential growth to ~7% from 6.5% earlier. The survey describes India as an "oasis of stability" amid global volatility from geopolitics, US tariffs, and weak exports. FY26 GVA growth is pegged at 7.3%, with private consumption up 7% and GFCF at 30% of GDP. Inflation remains benign at historic lows ~1.7%, supporting RBI's policy. Risks include external shocks, but balance is even with domestic drivers dominant. Equity markets rebounded post-release, Nifty up 0.3% to 25,418.90. Survey flags three 2026 scenarios: managed disorder, multipolar tension, systemic shocks—India better equipped. Exports rose 4.3% to $634.3B despite headwinds. Fiscal deficit on track at 4.4% FY26. This pre-Budget document sets tone for Feb 1 announcements on capex, reforms. Metal, infra stocks led gains on growth outlook. FII outflows persist at ~₹20,000 Cr YTD, pressuring rupee. Survey urges caution, not pessimism, emphasizing manufacturing, MSMEs. PM Modi hailed inclusive focus on farmers, youth jobs. CEA Nageswaran notes trade no longer reciprocal, markets non-neutral. Impacts: boosts sentiment, signals continuity in infra push.

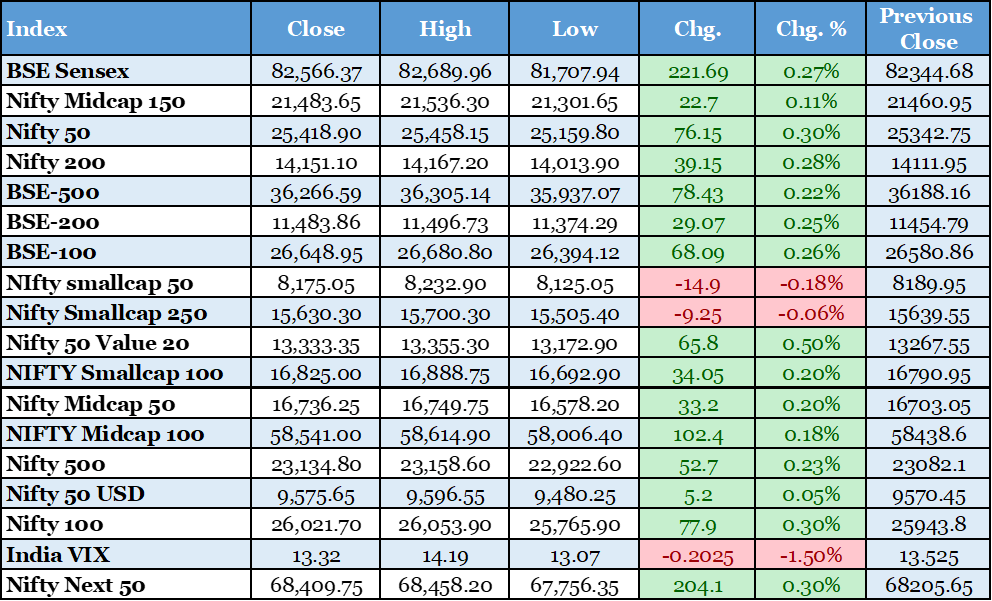

Nifty 50, Sensex Rise 0.3% for Third Session on Survey Optimism

Benchmark indices extended gains third straight day, Nifty 50 up 76 pts (0.3%) to 25,418.90, Sensex +222 pts (0.27%) at 82,566.37, recovering from early 0.8% dip. Rally driven by Economic Survey's upbeat FY27 growth view, buying in L&T (+3.6%), Tata Steel (+4.5%), Axis Bank. Metals, infra outperformed; midcaps +0.18%, smallcaps +0.20%. Early weakness from rupee low, FII selling ~₹1,500 Cr, global trade fears. Volumes robust, DIIs net buyers ₹800 Cr offsetting FIIs. Nifty held 200-DEMA support ~25,160; resistance 25,500. Pre-Budget caution prevails, volatility elevated (India VIX ~16). Q3 earnings mixed: L&T revenue beat, Dabur PAT +7%. Survey's stability narrative countered external risks like US tariffs. Gold rallied to records, aiding sentiment. Sectors: metals +2%, banks +0.8%, IT flat. Broader participation vs prior sessions. Analysts see upside to 25,500 if 25,400 holds, else 25,160 test. FII/DII flows key; Budget capex hopes. Rupee drag capped gains despite positives. Momentum indicators improving, but below key EMAs bar 200D. Trade setup: watch 25,400; Budget to dictate direction.

US Federal Reserve Holds Rates Steady at 3.5-3.75%

The Fed maintained federal funds rate at 3.5-3.75% post-three 25bps cuts in late 2025, as expected. Powell highlighted solid GDP growth, stabilizing unemployment ~4.4%, but elevated inflation delaying further easing. Economic activity "expanding solidly," job gains low but steady. No timeline for cuts; data-dependent amid uncertainties. Markets pricing ~two 2026 cuts vs prior three. Upgraded language from "moderate" growth signals resilience. Dissent: two members for 25bps cut. Impacts EMs: higher US yields pressure capital flows to India. Rupee weakened further; FII outflows accelerated. Indian bonds yields up 5bps. Equity muted reaction, focus on hawkish tone. Powell: policy "higher end of neutral," not restrictive. Trump pressures ignored; independence stressed. Trade deficit data worsened outlook. Gold surged post-decision on safe-haven bid. Indian markets opened lower on Fed pause, recovered on domestic cues. Implications: delays RBI rate cuts, tightens global liquidity. USD index flat; 10Y Treasury ~4.26%. FOMC minutes next key. For India: costlier imports, hedging demand up. Sentiment: cautious, supports rupee defense.

CNBC, https://www.cnbc.com/2026/01/28/fed-rate-decision-january-2026.html

Larsen & Toubro Q3 PAT Falls 4.3% to ₹3,215 Cr on Labour Code Hit

L&T reported Q3FY26 consolidated revenue up 10.5% YoY to ₹71,450 Cr, driven by infra, hydrocarbons execution. PAT declined 4.3% to ₹3,215 Cr from ₹3,359 Cr due to ₹1,191 Cr (net) one-time provision for new labour codes. Recurring PAT surged 31% to ₹4,406 Cr. EBITDA +18.6% to ₹7,831 Cr, margins 11%. Order inflows record ₹1.36 lakh Cr (+17% YoY), book ₹7.33 lakh Cr (+30%). International 40% inflows; India infra strong. Working capital efficiency: net WC/revenue 8.2% (-450bps YoY). Guidance: 15% revenue growth FY26, margins steady. Shares +3.6% to top Nifty gainer. Brokerages upbeat: Goldman 'Buy' ₹4,950; order visibility 3x revenue. Domestic inflows muted, overseas robust. Labour codes overhaul hit one-off across sectors. Infra order book 80%; defence, Middle East key. Capex FY26 ₹12,000 Cr. Analysts: execution key pre-Budget. Impacts sector: peers like HCC up 2%. Q4 inflows expected strong on govt spend. RoE ~15%; debt/equity stable. Positive for Nifty infra index.

Rupee Hits Record Low Near 92/USD; RBI Likely Intervenes

Indian rupee plunged to all-time low 91.9850/USD intra-day, closed 91.9550 (-0.2%), past prior 91.9650 on FII outflows ~₹1,500 Cr, importer hedging, NDF maturities. RBI sold dollars pre-open to cap at 92 psychological mark. Weakness contrasts buoyant economy; survey notes rupee "punches below weight." YTD -2%, -5% post-US tariffs. Pressures: global risk-off, dollar strength post-Fed, equity FII exit ₹20,000 Cr YTD. Spillover: G-Sec yields +5bps, liquidity squeeze. Import costs up: oil, gold; inflation risk. Exports gain competitiveness but margins squeezed. Forex reserves ~$700 Bn buffer. Analysts: 94/USD in 12 months; intervention to continue. Capped equity gains despite survey boost. DIIs bought ₹800 Cr. Budget fiscal prudence key for flows. History: 2025 depreciated 4% on similar cues. Implications: higher CAD, policy tightens. Gold imports costlier amid rally.

US Trade Deficit Surges 94.6% to $56.8 Bn in November

US trade gap ballooned 94.6% to $56.8 Bn Nov 2025 from Oct's $29.2 Bn (r), widest since 1992; beat forecasts $40.5 Bn. Goods deficit +47.3% to $86.9 Bn on capital goods imports (AI boom); services surplus $30.1 Bn. Exports -3.6% to $292.1 Bn (gold, pharma, oil); imports +5% to $348.9 Bn (pharma, computers). Widest monthly swing tempers Q4 GDP; Atlanta Fed cuts to 5.4%, banks <3%. China deficit $14.7 Bn, Vietnam $16.2 Bn, EU $14.5 Bn. Tariff efforts failed amid policy flux. Implications for India: commodity volatility, export competition; steel, textiles hit by US duties. Rupee pressure from dollar; FII caution. Global trade slowdown risks EM growth. Fed data adds to pause rationale. Indian exports to US ~$80 Bn vulnerable. Q4 GDP revisions down; recession odds low. Markets: USD rebound, Treasuries flat. India-EU FTA offsets partial.

Reuters, https://www.reuters.com/business/us-trade-deficit-widens-by-most-nearly-34-years-november-2026-01-29

Dabur India Q3 Profit Rises 7% to ₹560 Cr on Tax Cut Boost

FMCG major Dabur posted Q3 consolidated PAT +7% YoY to ₹560 Cr ($60.9 Mn), in-line estimates despite ₹150 Cr one-time labour code hit. Revenue +6% to ₹35.59 Bn; 60% portfolio now 5% GST vs prior 12-18%, boosting volumes. Demand strong post-tax cuts; rural recovery. Analysts expected ₹556 Cr PAT. Home care, foods grew; health care steady. EBITDA margins held despite costs. Outlook: tax tailwind continues Q4. Shares flat; sector peers HUL -1%. Labour codes impact one-off across cos. Consumption rebound aids Nifty FMCG. Budget tax relief hopes. Rural sales +8%; urban +4%. Inventory rationalization done. Capex ₹500 Cr FY26. RoCE ~20%. Positive for staples amid inflation low.

Gold, Silver Futures Hit Record Highs in India

MCX gold futures +6% to record ₹1,75,869/10g, silver ₹4,07,456/kg (+6%) early trade, tracking global spot gold $5,330/oz (-1.3% from $5,595 high). Rupee low amplifies import costs. Global rally on geopolitics, Fed pause; Jan +24%. Central banks bought aggressively; gold reserves $5 Tn > US Treasuries first in 20 yrs. India imports surge; festival demand ahead. Investors profit-booked post-peak. Nifty commodities +1.5%. Outlook: $5,500 test; rupee drag. CB diversification from USD amid tariffs. Domestic spot 24K ₹1,78,850/10g (+₹11,770). Silver industrial demand (solar, EV). Volatility high; support ₹1,65,000 gold.

Reuters, https://www.reuters.com/world/india/indian-gold-silver-extend-rally-record-highs-2026-01-29

India to Revamp CPI: Cuts Food Weight to 36.75% from 45.86%

Statistics Ministry announced new CPI series base 2024, overlapping 2025; food weight -9.11% to 36.75%, housing/electricity 17.66%. Groups double to 12 for better tracking. Aims less volatile headline inflation, smoother RBI policy. Current CPI ~3-4%; core steady. Impacts: lowers food shock passthrough (veggies 23% now). Monetary policy freer for growth. Markets: bonds steady, equity neutral. Budget alignment on agri. Rural-urban split refined. Data backseries for continuity. Global best practice; ECB similar. Inflation target 4% +/-2% intact. Positive for rate cycle.

Reuters, https://www.reuters.com/world/india/india-cut-food-weighting-cpi-new-inflation-series-2026-01-29

Reliance to Import Up to 150,000 bpd Russian Oil from Feb

Reliance Industries, world's largest refinery operator, to buy up to 150kbpd sanctions-compliant Russian crude from Feb for Jamnagar complex. Pause ended post-Jan; sources confirm non-sanctioned sellers. Discounts attract vs Brent ~$70/bbl. India 5th largest importer; Russia share ~40%. Saves $2-3/bbl; margins key. Rupee low raises costs, but volumes steady. Energy security amid geopolitics. Peers like Nayara follow. Budget green energy push. Stock flat; oil marketing cos down. Domestic fuel demand +5%. OPEC+ output key. Forex outgo ~$50 Bn/yr oil.