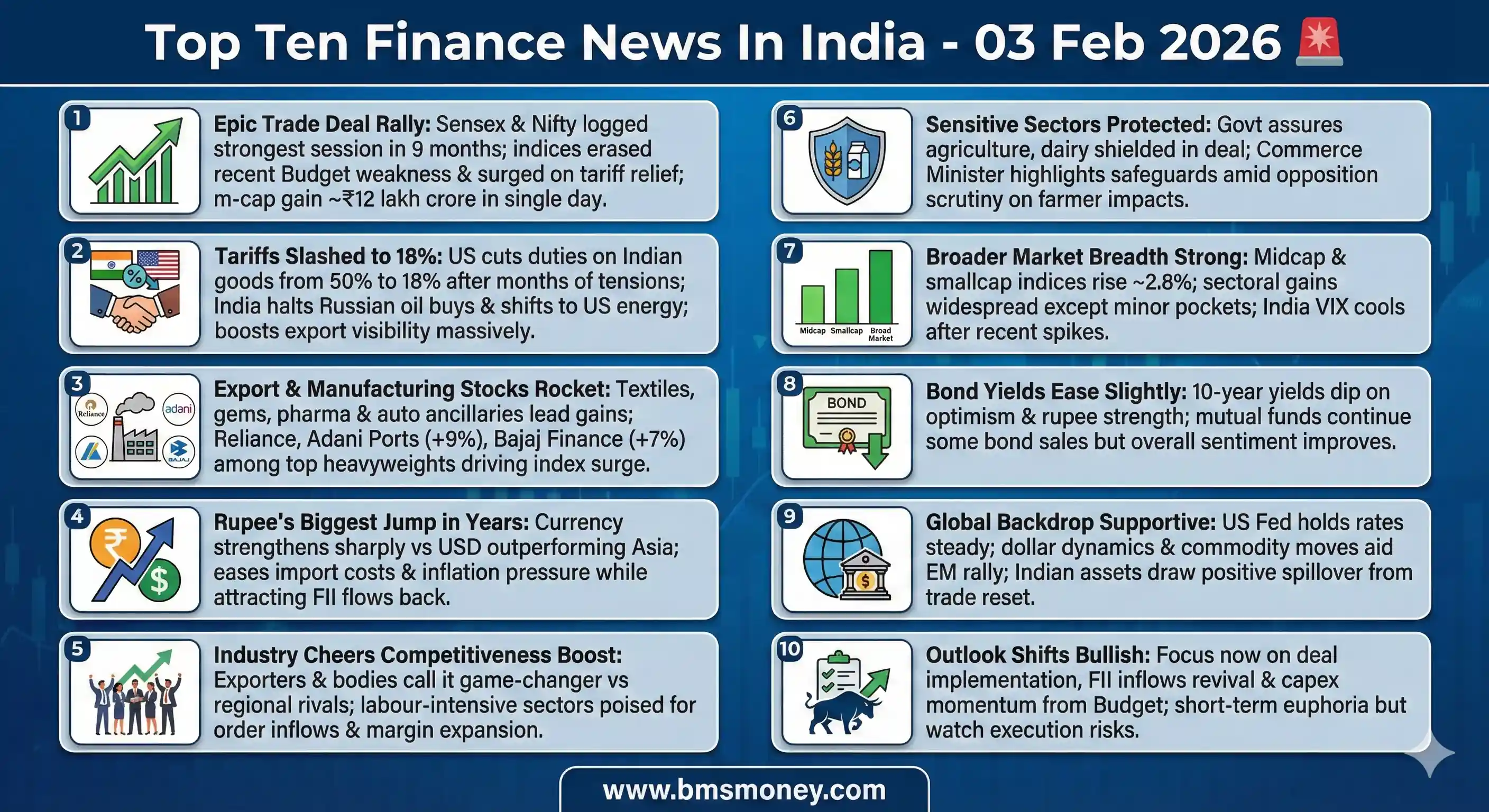

Indian markets surged in a historic rally on February 03, 2026, propelled by a landmark India-US trade deal that drastically reduced punitive tariffs on exports, providing a major relief from prolonged trade tensions and sparking a euphoric, broad-based buying spree that lifted the rupee and all major indices to record single-day gains.

Indian markets delivered a powerful bullish performance, fueled primarily by the landmark India-US trade deal that reduced US tariffs on Indian exports to 18% from punitive levels as high as 50%. This development removed a significant overhang from months of trade tensions, sparking broad-based buying, rupee appreciation, and record single-day gains for major indices. Overarching themes centered on enhanced export prospects, relief from tariff pressures, strengthened bilateral ties, and optimism for sectors like manufacturing, textiles, and IT, though some uncertainties lingered around implementation details and domestic sensitivities.

- Historic India-US pact drives euphoric market rally.

- Tariffs slashed to 18%, boosting export competitiveness.

- Sensex surges over 2,000 points in relief buying.

- Nifty crosses 25,700 amid broad sectoral gains.

- Rupee strengthens sharply on improved trade outlook.

India-US Trade Deal Slashes Tariffs to 18%, Boosting Exports and Market Sentiment

The United States and India finalized a significant trade agreement that reduces US tariffs on Indian goods from 50% to 18%. This deal follows prolonged negotiations amid tensions over India's purchases of Russian oil. President Trump announced the pact after discussions with Prime Minister Modi. India has committed to halting Russian crude imports and shifting toward US energy sources. The agreement also includes pledges for substantial Indian purchases of American products in agriculture, technology, and energy. Commerce Minister Piyush Goyal emphasized that sensitive sectors like agriculture and dairy remain protected. This development marks a strategic reset in bilateral economic relations. It is expected to enhance India's export competitiveness significantly. Sectors such as textiles, manufacturing, and pharmaceuticals stand to benefit the most. Investors viewed the deal as a major positive catalyst for growth. The pact follows India's recent EU trade agreement, signaling proactive global engagement. Immediate market reaction was overwhelmingly bullish. The rupee appreciated strongly against the dollar. Bond yields eased slightly amid optimism. Long-term benefits depend on smooth implementation and detailed follow-up. Overall, the deal alleviates a key drag on Indian equities and currency stability.

Reuters https://www.reuters.com/world/india/trump-says-agreed-trade-deal-with-india-2026-02-02

Sensex and Nifty Surge Over 2.5% in Historic Rally on Trade Deal Euphoria

Indian benchmark indices staged one of their strongest single-day performances in recent history. The BSE Sensex closed at 83,739, gaining 2,073 points or 2.54%. The NSE Nifty settled at 25,727, rising 639 points or 2.55%. This marked the best daily gain since May 2025 for the Nifty. Market capitalization surged by over Rs 12 lakh crore. Broad-based buying dominated across large-cap, mid-cap, and small-cap segments. Export-oriented sectors led the charge with sharp rallies. Banks, IT, and textiles posted strong gains. The rally erased recent weakness from Budget-related volatility. GIFT Nifty had signaled a robust opening earlier. Investors cheered the removal of the US tariff overhang. Foreign inflows are anticipated to accelerate. Domestic institutions also participated actively. Volatility subsided as sentiment turned decisively positive. The indices reclaimed key psychological levels. Adani Ports, Bajaj Finance, and other heavyweights contributed significantly. This performance reflects renewed confidence in India's growth story. Analysts expect continued momentum if global cues remain supportive. The day highlighted the market's sensitivity to positive geopolitical developments.

Rupee Leads Asian Peers with Sharp Appreciation Post-Trade Pact

The Indian rupee recorded its strongest single-day gain in years against the US dollar. It strengthened by over 1% in early trading. The currency outperformed most Asian peers amid regional optimism. The relief came directly from the US tariff reduction announcement. Reduced trade tensions improved India's external outlook. Importers and exporters adjusted positions favorably. The rupee's rally supported lower import costs for key commodities. It also eased pressure on inflation expectations. Bond markets saw yields decline modestly. Foreign portfolio inflows are likely to benefit from currency stability. The development counters recent FII outflows. Domestic factors like improved trade balance contributed. Central bank intervention remained measured. Analysts project sustained strength if the deal holds. This appreciation boosts investor confidence broadly. It enhances attractiveness for equity and debt investments. Currency stability aids corporate earnings visibility. The rupee's performance amplified overall market gains. Long-term trajectory depends on oil dynamics and global flows.

Reuters https://www.reuters.com/world/india/indian-rupee-stocks-soar-after-trade-deal-with-us-2026-02-03

Industry Bodies Hail Deal as Major Boost for Competitiveness

Indian industry leaders and export associations welcomed the trade agreement enthusiastically. They described it as a game-changer for global competitiveness. Textile, gems, and manufacturing sectors anticipate significant expansion. The tariff cut positions India favorably against regional rivals. Exporters expect higher order inflows from the US market. Labor-intensive industries stand to gain substantially. Commerce Minister Goyal highlighted protections for vulnerable sectors. The deal aligns with India's manufacturing ambitions. It complements recent EU pact successes. Business confidence surveys are likely to improve. Investment in export-oriented capacities may accelerate. Job creation potential in key sectors rises. Analysts forecast 5-7% annual export growth uplift. The agreement fosters deeper economic integration. It signals India's proactive trade diplomacy. Domestic consumption sectors could see indirect benefits. Overall sentiment across corporate India turned positive. Implementation details will be closely monitored.

Opposition Voices Concerns Over Potential Agriculture Sector Impacts

Opposition lawmakers expressed reservations about the trade deal's implications. They focused on possible concessions in agriculture and dairy. Fears of widened trade deficits surfaced in discussions. Critics questioned the government's assurances on protections. PM Modi and officials reiterated safeguards for farmers. The deal excludes sensitive items as per statements. Political scrutiny highlights domestic sensitivities. Public discourse emphasized balancing growth and livelihoods. Government sources stressed long-term economic stability. The agreement aims to deepen US ties without compromising core interests. Opposition calls for transparency in full details. Farmer organizations seek clarifications. This debate underscores India's complex trade negotiations. It reflects broader concerns over globalization impacts. Market reaction remained resilient despite political noise. Analysts view it as manageable risk. The focus shifts to execution and monitoring.

US Stocks Rise Modestly as Markets Digest Policy Signals

US major indices closed higher to start February trading. The Dow Jones added over 500 points. The S&P 500 approached record levels but fell short. The Nasdaq showed moderate gains amid sector rotation. Investors reacted to factory data and dollar movements. Metals faced pressure while equities benefited. Fed policy uncertainty lingered in the background. Trump's Fed chair nomination influenced sentiment. Treasury yields remained relatively stable. Economic resilience supported risk appetite. Consumer confidence showed some weakness. Upcoming data like job openings awaited. Geopolitical factors played a role. The session reflected cautious optimism. It provided supportive global cues for emerging markets. Indian assets drew positive spillover. Broader US trends will influence flows.

Investopedia https://www.investopedia.com/dow-jones-today-02022026-11897235

Federal Reserve Maintains Rates Amid Resilient Economy

The US Federal Reserve held benchmark rates steady at 3.50-3.75%. The decision reflected solid activity but sticky inflation. Job gains moderated while unemployment stabilized. Chair Powell indicated proximity to neutral policy. The economy demonstrated notable resilience. Inflation concerns persisted despite progress. Markets anticipated a pause in adjustments. Upcoming payrolls data loomed large. Policy path remains data-dependent. This stance supports global stability. It avoids abrupt shifts in capital flows. Emerging markets like India benefit indirectly. Borrowing costs for exposed firms stay predictable. Investor focus turns to future signals. The Fed's approach underscores caution. It balances growth and price stability.

Budget 2026 Aftermath Continues with STT Hike Scrutiny

Markets digested ongoing effects from Union Budget 2026 proposals. The hike in securities transaction tax on derivatives drew attention. It aimed to curb excessive speculation. Trading volumes in F&O segments faced potential moderation. Analysts assessed limited downside risks post-crash. Recovery signs emerged amid trade deal positivity. Infrastructure spending commitments remained supportive. Fiscal discipline emphasis reassured investors. Corporate earnings mixed in the season. The budget's capex push favors select sectors. Policy continuity supports long-term growth. Short-term volatility from tax changes persists. Broader sentiment improved with external positives. Monitoring implementation remains key.

Export Stocks Like Textiles Poised for Gains from Tariff Relief

Textile and apparel companies emerged as key beneficiaries of the trade deal. Stocks in this sector rallied sharply on February 3. Lower US tariffs enhance pricing power and margins. Export orders from the US are expected to rise. Labor-intensive nature aligns with employment goals. Gokaldas Exports, Pearl Global, and peers gained traction. The sector's competitiveness improves regionally. Supply chain shifts favor India. Government support for textiles continues. This development counters recent global headwinds. Investor interest in export plays surges. Valuation re-rating possible for leaders. Broader manufacturing ecosystem benefits. The rally underscores sector-specific tailwinds. Long-term outlook brightens significantly.