The Indian markets closed marginally lower on December 30, 2025, in thin year-end trading amid persistent foreign fund outflows and holiday-shortened volumes, reflecting cautious sentiment. Key themes centered on India's milestone of becoming the world's fourth-largest economy, strong macroeconomic performance with high growth and low inflation, and pre-Budget consultations for sustained expansion. International cues from the US remained subdued with slight declines in major indices.

- India surpasses Japan to become fourth-largest economy at $4.18 trillion GDP.

- PM Modi holds pre-Budget meeting with economists on growth strategies.

- Markets end flat to lower amid low volumes and FII selling pressure.

India Overtakes Japan to Become World's Fourth-Largest Economy

India has achieved a significant economic milestone by surpassing Japan to become the world's fourth-largest economy, with a nominal GDP valued at $4.18 trillion as of the end of 2025. This positioning reflects sustained high growth rates, resilient domestic demand, and effective structural reforms amid global uncertainties. The government attributes this to robust performance across industrial and services sectors, with real GDP expanding 8.2% in Q2 FY2025-26. Projections indicate India could overtake Germany to claim third place within 2.5-3 years, reaching $7.3 trillion by 2030. International agencies like the IMF, World Bank, and Moody's forecast India as the fastest-growing major economy in coming years. This shift underscores India's rising global economic influence, bolstered by low inflation at 0.71% in November and declining unemployment to 4.7%. Strong forex reserves and export growth further support this trajectory. The achievement marks a 'Goldilocks' phase of balanced high growth and price stability. It positions India favorably for long-term goals toward Viksit Bharat by 2047. Immediate implications include enhanced investor confidence and potential for increased capital inflows.

Economic Times - https://economictimes.indiatimes.com/news/economy/indicators/2025-turns-into-a-goldilocks-year-for-indias-economy-govt/articleshow/126229175.cms

PM Modi Chairs Pre-Budget Consultation with Economists and Experts

Prime Minister Narendra Modi held a key pre-Budget meeting on December 30, 2025, with eminent economists and sectoral experts at NITI Aayog to gather insights for the Union Budget 2026-27. The discussions focused on strategies for sustaining long-term growth, boosting employment, and achieving Aatmanirbharta through structural transformations. Finance Minister Nirmala Sitharaman, NITI Aayog Vice Chairman Suman Bery, and CEO B.V.R. Subrahmanyam were present. Experts shared suggestions on enhancing productivity in manufacturing and services sectors. Emphasis was placed on skill development to align workforce capabilities with industry needs. The meeting highlighted the need for mission-mode reforms to maintain economic momentum. Topics included private investment attraction, export promotion, and infrastructure development. This consultation forms part of broader pre-Budget engagements, including public suggestions via MyGov. The Budget, expected on February 1, 2026, aims to build on 2025's strong performance. Implications involve potential policy measures for job creation and inclusive growth in the upcoming fiscal plan.

The Hindu - https://www.thehindu.com/news/national/pm-modi-meets-economists-ahead-of-2026-27-budget/article70452395.ece

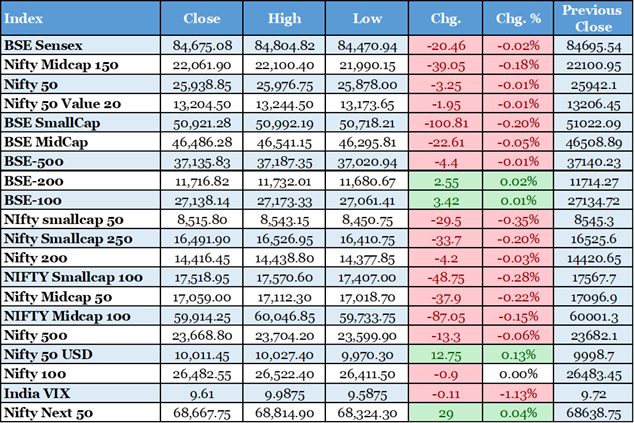

Sensex and Nifty Close Marginally Lower in Thin Trading

Indian benchmark indices ended slightly lower on December 30, 2025, with the Sensex down around 20-346 points variations reported, settling near 84,675, and Nifty flat to marginally down at approximately 25,938. Trading volumes remained low due to year-end holidays and caution ahead of derivatives expiry. Foreign institutional investors continued outflows, pressuring sentiment amid global uncertainties. Gains in metals, auto, and PSU banks offset losses in IT, FMCG, and pharma sectors. Broader markets also dipped modestly. Volatility was subdued as investors adopted a wait-and-watch approach. Despite the flat close, markets added significant investor wealth over 2025, up over 8%. This session reflected consolidation after recent gains. Immediate implications include limited directional moves until fresh triggers emerge in the new year. Overall, resilience persists supported by domestic inflows.

The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-30th-december-2025/article70449474.ece

Investors' Wealth Surges Rs 30.2 Lakh Crore in 2025

Indian stock markets delivered decent returns in 2025, boosting investors' wealth by Rs 30.2 lakh crore despite global headwinds like FII outflows and tariff concerns. Benchmarks Sensex and Nifty rose over 8-9%, driven by strong domestic institutional inflows and macroeconomic stability. This wealth creation highlights market resilience amid elevated valuations and rupee weakness. Earnings recovery and policy support played key roles in sustaining upside. Broader participation from retail investors further bolstered gains. The year saw record IPO activity and sectoral rotations. Despite challenges, domestic demand and reforms underpinned performance. This surge reflects confidence in India's growth story. Implications include continued attraction for long-term investments. Future momentum depends on corporate earnings and global cues.

India Ends 2025 in 'Goldilocks' Phase with Robust Growth and Low Inflation

The government declared 2025 a landmark year for India's economy, characterized by high growth, low inflation, and improving employment. Real GDP grew strongly, with Q2 FY26 at 8.2%, while CPI softened to 0.71% in November. Unemployment declined to 4.7%, and exports expanded amid resilient demand. This 'Goldilocks' balance provided policy space for supportive measures. Forex reserves rose, and fiscal indicators remained stable. Structural reforms enhanced competitiveness. International projections affirm India's fastest-growing status. The review emphasizes sustained momentum into FY26 at 7.3%. Implications boost optimism for capital markets and investment inflows. This foundation supports ambitions for higher global ranking.

Business Standard - https://www.business-standard.com/economy/news/india-economy-2025-review-inflation-fta-gdp-growth-us-tariffs-rupee-fall-125123000461_1.html

NBCC Successfully Concludes Major Real Estate E-Auction

NBCC (India) Ltd announced the successful e-auction of 417 residential units in Greater Noida and Noida on December 30, 2025, achieving a total sale value of approximately Rs 1,045.40 crore. The company will receive a 1% marketing fee. This transaction highlights strong demand in the real estate sector. It contributes to infrastructure development and revenue generation. The deal underscores recovery in property markets post-challenges. Implications include positive sentiment for related stocks and sector growth. Broader economic benefits from housing activity support GDP. This aligns with government push for urban development. Investor interest in PSU infrastructure firms may rise. Overall, it signals healthy realty momentum into the new year.

The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-30th-december-2025/article70449474.ece

Shyam Metalics Subsidiary Commences Commercial Production

Shyam Metalics and Energy Limited's step-down subsidiary, Ramsarup Industries Limited, started commercial production at its modern blast furnace and linear sinter plant on December 30, 2025. This expansion enhances capacity in steel and energy sectors. It aims to meet rising domestic demand efficiently. The development strengthens integrated operations. Implications include potential revenue growth and margin improvement. Stock performance may benefit from operational milestones. This supports industrial sector contributions to GDP. It reflects private investment in manufacturing. Broader implications for metal prices and supply chain. Positive for sector outlook amid infrastructure push.

The Hindu BusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-30th-december-2025/article70449474.ece

Logistics Leasing Hits Record 60 Million Sq Ft in 2025

Strong demand from manufacturing and e-commerce drove logistics and warehousing leasing to a record 60 million square feet in 2025. Infrastructure push and premiumisation trends shaped real estate dynamics. This growth signals robust industrial activity. It supports job creation and supply chain efficiency. Implications for related stocks and REIT pathways. Sector attracts increased investments. This aligns with economic expansion narratives. Positive spillover to construction and transport. Sustained momentum expected into 2026. Overall, reinforces India's consumption and production strength.

Moneycontrol - https://www.moneycontrol.com/

US Stocks Close Slightly Lower in Holiday-Thin Trade

US major indices ended marginally lower on December 30, 2025, with S&P 500 and Nasdaq dipping fractionally amid low volumes. Gains in communication services offset tech and financial declines. Fed minutes reinforced rate cut expectations for 2026. Markets posted strong annual gains despite tariff concerns. This influences global sentiment, including Indian flows. Implications for emerging markets via dollar strength. Indian investors watch for cues on capital movements. Subdued close reflects year-end positioning. Potential impact on FII behavior in India. Overall, supports stable global risk appetite.

Fed Minutes Highlight Divisions on Rate Path Ahead

Recently released Federal Reserve minutes from the December meeting revealed deep divisions among officials on the pace of interest rate cuts in 2026. Debates centered on economic growth risks and neutral rate levels around 3%. This uncertainty affects global liquidity and capital flows. Implications for India include potential volatility in rupee and inflows. Emerging markets sensitive to US policy shifts. Minutes reinforce expectations for further easing. This could support risk assets globally. Indian markets may benefit from softer dollar. Broader context of tariff policies adds complexity. Investors monitor for January signals.

Reuters - https://www.reuters.com/business/final-fed-minutes-2025-shed-light-policy-divisions-2025-12-30/