The Indian markets closed on a bullish note, propelled by the RBI's surprise rate cut and liquidity measures, offsetting global uncertainties. Sentiment was positive with major indices rallying, though rupee weakness persisted amid capital outflows. Key themes included monetary easing, corporate developments, and international rate cut expectations, influencing investor confidence.

- RBI's 25 bps repo rate cut boosted market liquidity and investor sentiment.

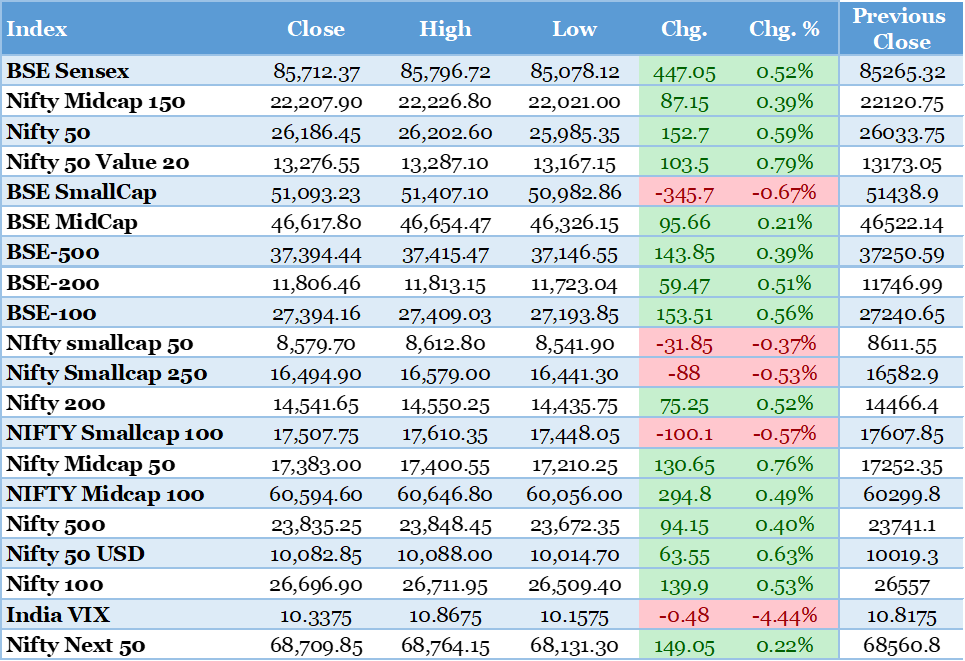

- Sensex and Nifty surged over 0.5% on positive domestic cues.

- Banking and IT sectors led gains amid policy support.

- Global Fed cut bets supported gold and equity rallies.

- Rupee breached 90, impacted by tariffs and outflows.

RBI Cuts Repo Rate by 25 bps, Injects Liquidity to Bolster Growth

The Reserve Bank of India's Monetary Policy Committee, led by Governor Sanjay Malhotra, reduced the repo rate by 25 basis points to 5.25 percent on December 5, 2025, while adopting a neutral stance to support economic momentum. This marks the fifth rate cut in 2025, aimed at countering moderating growth amid easing inflationary pressures. The central bank lowered its FY26 inflation forecast to 2 percent from 2.6 percent and raised the growth projection to 7.3 percent from 6.8 percent, reflecting optimism on domestic demand recovery. To enhance liquidity, the RBI announced measures including open market operations to infuse up to ₹1.45 lakh crore through bond purchases and dollar-rupee swaps. This unexpected easing, despite robust Q2 GDP data, spurred a risk-on environment, particularly benefiting rate-sensitive sectors like automobiles, real estate, and non-banking financial companies. Reduced borrowing costs are expected to lower EMIs for consumers, potentially stimulating investments and consumption. The BSE Sensex gained 447.05 points or 0.52 percent to close at 85,712.37, while the NSE Nifty 50 rose 152.7 points or 0.59 percent to 26,186.45. Broader markets showed mixed trends, with Nifty MidCap up 0.49 percent but SmallCap down 0.57 percent. Sectoral gains were led by PSU Bank at 1.5 percent, followed by Bank, Auto, IT, Metal, Realty, Oil & Gas, and Chemicals. However, risks from a widening current account deficit and global trade tensions could temper the positive outlook. Overall, the policy signals a proactive approach to sustaining growth while monitoring external vulnerabilities. Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-december-5-rbi-mpc-rate-cut-sensex-nifty-meesho-ipo-gift-nifty-ipos-today-125120500062_1.html

Sensex Surges 447 Points, Nifty Hits 26,186 on RBI Policy Cheer

Benchmark indices rallied on December 5, 2025, as investors embraced the RBI's 25 basis point repo rate cut to 5.25 percent, driving renewed optimism across rate-sensitive sectors. The BSE Sensex closed at 85,712.37, up 447.05 points or 0.52 percent, recovering from recent weekly losses amid positive domestic cues. The NSE Nifty 50 settled at 26,186.45, gaining 152.7 points or 0.59 percent, with broad-based participation from banking and IT heavyweights. This uptick offset lingering global uncertainties, including U.S. tariff threats and commodity volatility. Top performers on the Sensex included State Bank of India, Bajaj Finserv, Maruti Suzuki, Bajaj Finance, and HCL Tech, reflecting strength in financials and autos. Laggards like Hindustan Unilever, Eternal, Trent, Sun Pharma, Tata Motors PV, and Bharat Electronics highlighted selective pressure in consumer and pharma spaces. The rally underscored the market's sensitivity to monetary easing, with lower rates poised to enhance corporate profitability through cheaper debt. Foreign institutional investors turned net buyers, injecting over ₹2,000 crore, signaling confidence in India's growth trajectory. Domestic liquidity measures announced by the RBI further bolstered sentiment, potentially stabilizing rupee inflows. Looking ahead, sustained policy support could push indices toward new highs, though geopolitical risks remain a watchpoint. The day's gains contributed to a cautiously positive short-term outlook for equities.

Top Gainers Include Patanjali Foods, RBL Bank Amid Sector Rebound

Patanjali Foods shares rebounded 4 percent to close at ₹547.80 on December 5, 2025, recovering from prior selling pressure amid broader market cheer from the RBI's rate cut. RBL Bank emerged as a key gainer in the banking sector, rallying alongside peers as financial stocks benefited from anticipated lower borrowing costs. The RBI's 25 basis point repo rate reduction to 5.25 percent ignited optimism, particularly in rate-sensitive areas like consumer goods and finance. PSU banks spearheaded the advance, with the Nifty PSU Bank index surging 1.55 percent on improved liquidity prospects. The Nifty IT index climbed 0.66 percent, signaling a sector recovery driven by global tech demand and domestic easing. Metals also gained 0.66 percent, with stocks like Hindustan Copper hitting 52-week highs amid commodity tailwinds. This policy shift, the first in six months, responds to easing price pressures and U.S. tariff-related economic risks. Banks and NBFCs, including RBL Bank, posted gains between 2.4 percent and 6 percent, enhancing lending margins. Reduced loan EMIs are likely to spur consumer demand for financial products and durables. Consumer stocks showed resilience, with Patanjali Foods exemplifying sentiment-driven recovery in FMCG. The overall rally fosters stability in financial and consumer sectors, potentially boosting corporate earnings in Q3. Market breadth improved, with advancing stocks outpacing decliners, underscoring the policy's broad positive impact. Livemint - https://www.livemint.com/market/stock-market-news/top-gainers-losers-on-dec-05-patanjali-foods-rbl-bank-wockhardt-mcx-suzlon-energy-among-top-gainers-11764928267422.html

ONGC Secures 20% Stake in Russia's Sakhalin-1 Oil Project

India's Oil and Natural Gas Corp (ONGC) advanced toward retaining its 20 percent stake in the Sakhalin-1 oil and gas project on December 5, 2025, by committing to the abandonment fund using frozen dividends in roubles. This development follows Western sanctions imposed after Russia's 2022 invasion of Ukraine, which blocked ONGC Videsh from accessing about $800 million in dividends from Russian assets. Ahead of Russian President Vladimir Putin's visit to New Delhi, Indian firms agreed to loan these stuck funds to enable the payment, ensuring continuity in the project. The abandonment fund finances decommissioning efforts, such as well shutdowns and environmental safeguards, critical for long-term operations. Since October 2022, when Putin authorized the seizure of Sakhalin-1 and foreign investor rights review, ONGC Videsh has actively pursued stake preservation. In August 2025, Putin decreed that foreign investors could regain shares by aiding sanction lifts, securing equipment contracts, and transferring funds to project accounts. Payments in roubles require Russian approval due to restrictions on dollar transfers under sanctions. Rosneft's Sakhalinmorneftegaz-shelf subsidiary manages the project, which remains vital for India's energy imports. This move enhances India's energy security by stabilizing crude supplies from Russia, a key partner. It could positively influence energy sector valuations, supporting stocks like ONGC amid volatile global oil prices. The agreement also strengthens bilateral trade ties, potentially mitigating import cost risks from geopolitical tensions. Reuters - https://www.reuters.com/business/energy/indias-ongc-moves-closer-keeping-20-stake-russias-sakhalin-1-project-sources-say-2025-12-05/

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsRupee Falls Below 90 Against Dollar Due to Tariffs and Outflows

The Indian rupee depreciated to a record low below 90 against the U.S. dollar on December 5, 2025, pressured by escalating U.S. tariffs and sustained foreign capital outflows. This breach exacerbates import costs, particularly for oil and electronics, widening India's trade deficit amid global commodity spikes. U.S. President Trump's proposed 60 percent tariffs on Chinese goods and 10-20 percent on others threaten to disrupt supply chains, indirectly hitting Indian exporters. Foreign institutional investors withdrew over $1.5 billion from equities in the week, citing valuation concerns and global risk aversion. The depreciation fuels imported inflation, potentially challenging the RBI's 2 percent FY26 target despite recent easing. However, it provides a tailwind for export-oriented sectors like IT services and pharmaceuticals, enhancing competitiveness. Software firms such as TCS and Infosys could see margin improvements from dollar earnings. The RBI may intervene via dollar sales to cap volatility, drawing from its $650 billion forex reserves. This currency weakness aligns with broader emerging market trends, influenced by a strengthening dollar index at 98.98. Economists warn of a 5-7 percent passthrough to domestic prices if the slide persists. Immediate implications include higher fuel and input costs for corporates, pressuring profitability in manufacturing. Long-term, it underscores the need for diversified trade partners to buffer external shocks. Reuters - https://www.reuters.com/world/india/rupee-cracks-below-90-dollar-hit-by-tariffs-capital-outflows-2025-12-03/

Nifty PSU Bank Index Rebounds 1.55% Post-RBI Announcement

The Nifty PSU Bank Index surged 1.51 percent on December 5, 2025, leading sectoral gains after the RBI's 25 basis point repo rate cut and ₹1.45 lakh crore liquidity infusion via bond buys and swaps. This rebound reflects enhanced market liquidity, directly supporting public sector lenders' balance sheets and lending capacity. The policy easing lowers funding costs, improving net interest margins and profitability for banks like State Bank of India. Broader Nifty Bank rose 0.82 percent, with private banks up 0.49 percent, indicating uniform benefits across financials. Improved lending prospects are expected to boost credit growth to 15 percent in FY26, aiding economic recovery. Metals sector advanced, with Hindustan Copper and National Aluminium hitting 52-week highs on global commodity cues. IT stocks gained 0.90 percent, driven by U.S. rate cut optimism and domestic demand. Market breadth was positive, with 1,805 advances against 2,342 declines on the BSE out of 4,328 traded stocks. The Sensex added 447 points to 85,712.37, while Nifty climbed 153 points to 26,186.45. The midcap index rose 0.21 per cent, though the Smallcap dipped 0.67 percent amid profit-taking. As many as 91 stocks touched 52-week highs, particularly in metals and IT, highlighting policy-driven momentum. Overall, the rally signals stronger financial stability and investment flows. Livemint - https://www.livemint.com/market/stock-market-news/sensex-jumps-over-400-points-after-rbi-cuts-repo-rate-10-key-highlights-from-indian-stock-market-today-nifty-50-11764928433706.html

Top Performing Equity Fund Categories for You

Top Performing Large Cap Funds Top Performing Mid Cap Funds Top Performing Small Cap FundsFed Rate Cut Expectations Boost Global Markets, Impacting India

Global equities advanced on December 5, 2025, fueled by U.S. September PCE data meeting expectations, solidifying bets for a Federal Reserve 25 basis point rate cut next week. Wall Street closed higher, with Dow up 0.22 percent, S&P 500 at 0.19 percent, and Nasdaq gaining 0.31 percent, led by tech and consumer sectors for a second weekly rise. European stocks ended flat but up 0.41 percent weekly, while MSCI's world index edged 0.06 percent higher. The dollar index slipped 0.10 percent to 98.98, poised for another weekly loss as easing expectations pressured the currency. Copper hit a record $11,705 per ton on supply worries and Fed bets, with Brent crude up 0.8 percent to $63.75 per barrel. In India, these dynamics spurred foreign inflows, with FIIs buying ₹2,000 crore in equities amid attractive valuations. Commodity surges raised import bills but lifted related stocks like metals, offsetting rupee pressures. A firmer yen at 155.30 against the dollar, post-Bank of Japan signals, added to emerging market currency strains. Indian indices rallied 0.5 percent on the global positivity, enhancing risk appetite. The linkages highlight how U.S. policy dovishness sustains capital flows to high-growth markets like India. This environment supports equity rallies but warrants vigilance on trade disruptions. Reuters - https://www.reuters.com/world/china/global-markets-global-markets-2025-12-05/

US PCE Inflation Data Cooler Than Expected, Lifting Yields

U.S. core PCE inflation for September eased to 2.8 percent annually on December 5, 2025, 0.1 percentage point below forecasts, signaling controlled price pressures. Headline PCE matched expectations at 2.8 percent, reinforcing the Federal Reserve's path to monetary easing. This outcome paves the way for a 25 basis point rate cut next week, bringing the federal funds rate to 3.50-3.75 percent. However, it offers no impetus for faster 2026 cuts, per analysts, maintaining a measured pace. The 10-year Treasury yield climbed nearly 3 basis points to 4.137 percent, with 30-year up over 2 basis points to 4.791 percent and 2-year rising more than 3 basis points to 3.564 percent. Higher yields stemmed from bond price dips post-data, reflecting market recalibration. For India, dovish Fed signals typically stabilize the rupee and draw FII inflows, countering recent outflows. Enhanced global liquidity could boost investments in emerging equities, supporting Nifty's rally. The absence of surprises minimized volatility in rupee-dollar pairs, aiding importer planning. Core PCE's monthly 0.2 percent rise aligns with softening trends, easing imported inflation risks for India. This report underscores a balanced U.S. recovery, indirectly fostering positive spillovers for Indian corporates via cheaper global funding. Overall, it bolsters confidence in sustained FII interest. CNBC - https://www.cnbc.com/2025/12/05/us-treasury-yields-investors-await-delayed-inflation-data.html

Top Performing Debt Fund Categories for You

Top Performing Liquid Funds Top Performing Ultra Short Duration Funds Top Performing Corporate Bond FundsGold Prices Rise on Fed Optimism, Silver Hits Record High

Gold prices climbed 0.5 percent to $4,226.99 per ounce on December 5, 2025, buoyed by heightened expectations of a U.S. Federal Reserve 25 basis point rate cut at the December FOMC meeting. Lower rates favor non-yielding assets like gold, especially after data showing weak private payrolls and ahead of PCE figures. Silver jumped 1.9 percent to $58.20 per ounce, following a record $58.98 intraday and a 3.2 percent weekly gain. Its 101 percent yearly surge stems from supply shortages, ETF inflows, rate cut hopes, and U.S. critical minerals designation. In India, gold neared record highs, dampening physical demand as buyers eye dips amid spot volatility. A weaker dollar and currency swings further propelled precious metals gains. Industrial silver demand, particularly in solar and electronics, amplified its rally. Mining stocks like Hindustan Zinc benefited, with shares up 2 percent on sentiment. The uptick hedges against rupee depreciation and inflation, appealing to Indian jewelers and investors. Importers may face higher costs, but festive season stockpiles mitigate immediate pressures. Globally, Fed optimism links gold's strength to broader risk-off trades. This trend supports portfolio diversification in volatile markets. Reuters - https://www.reuters.com/world/india/gold-flat-higher-yields-counter-weak-dollar-ahead-us-inflation-read-2025-12-05/

US Consumer Spending Slows in September Amid High Prices

U.S. consumer spending rose just 0.3 percent in September 2025, per data released on December 5, decelerating from a revised 0.6 percent in August after three months of robust increases. Elevated prices, exacerbated by President Trump's tariffs on imports, have restrained demand, hitting middle- and lower-income households hardest with affordability strains. The PCE Price Index increased 0.3 percent monthly, pushing annual inflation to 2.8 percent—the quickest in 1.5 years—with goods prices up 0.5 percent due to tariffs and energy costs soaring 3.6 percent. Durable goods spending on vehicles, recreation, and apparel fell, while overall goods held flat and services grew 0.4 percent, led by affluent consumers. This K-shaped recovery, where high earners propel growth amid labor market woes for others, hints at a looming global slowdown. For India, weaker U.S. demand threatens exports in IT services and consumer goods, potentially trimming $10-15 billion in annual revenues. Tariffs could further elevate costs, curbing imports from Indian suppliers. The Fed eyes a 25 basis point cut next week, as softer spending and core PCE at 0.2 percent monthly support easing amid labor softening. This moderation aligns with global disinflation, but risks imported slowdowns for export-dependent economies. Indian IT firms like Infosys may face contract delays, pressuring Q3 earnings. Policymakers in India could counter via stimulus to offset external drags. The data underscores interconnected risks in a tariff-laden trade environment. Reuters - https://www.reuters.com/world/us/us-consumer-spending-moderates-september-2025-12-05/