Indian equity markets displayed volatility on January 05, 2026, with the Nifty 50 hitting a record high intraday before closing lower amid IT sector weakness and geopolitical concerns from US-Venezuela tensions. Key themes included cautious foreign investor sentiment, robust banking updates offsetting drags, and global energy surges impacting commodity costs.

Indian Benchmarks Close Lower After Intraday Record High on Nifty

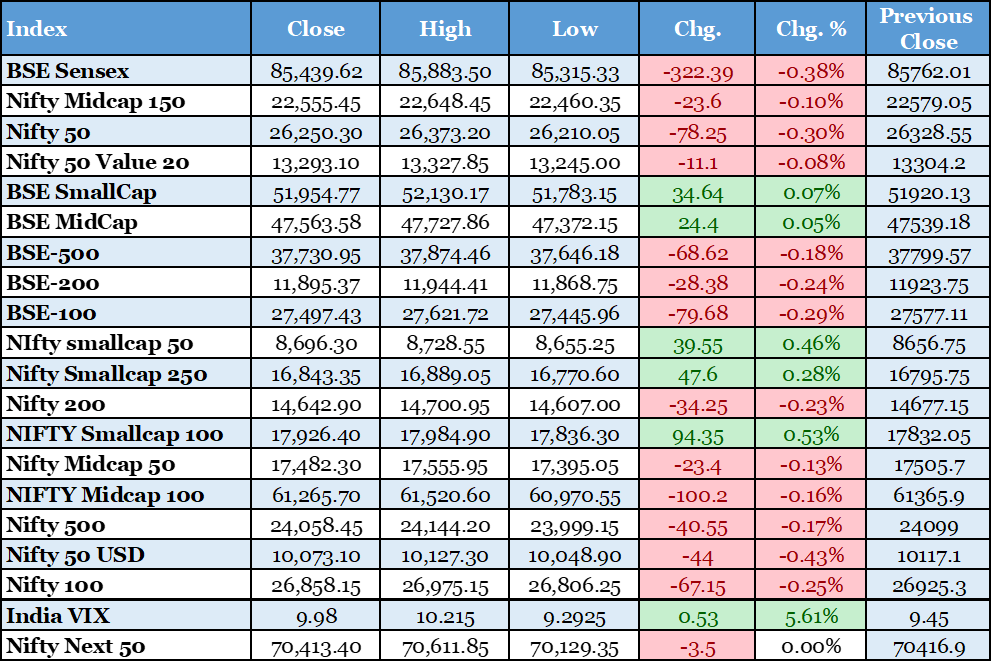

The Indian stock markets experienced a volatile trading session on January 05, 2026. The Nifty 50 index briefly touched a new all-time high of 26,373 during the day. However, profit booking emerged in the afternoon. This led to a reversal of early gains. The index closed 78 points lower at 26,250. Similarly, the BSE Sensex ended 322 points down at 85,439. IT stocks were the major drag. Concerns over potential US tariffs affected export-oriented sectors. Oil and gas shares also declined despite global crude surges. Banking stocks provided some support with positive quarterly updates. Broader market indices like midcaps and smallcaps ended flat. Sectorally, realty and consumer durables gained. Metal and FMCG added modestly. The volatility reflected mixed global cues. Asian markets rose on energy boosts. US markets awaited further developments. This session highlighted fragile underlying sentiment. High valuations persisted as a concern. Foreign outflows continued to pressure liquidity. Domestic institutional buying cushioned falls. Q3 earnings season approaches soon. Investors eye corporate results for direction. Geopolitical risks remain elevated. Venezuela events could sustain oil volatility. This may increase India's import bill. Overall market breadth weakened. Advance-decline ratio favored declines. Trading volume remained healthy. Options data showed cautious positioning. Implied volatility rose slightly. Near-term support for Nifty seen at 26,000 levels. Resistance placed around 26,400. Analysts recommend selective stock picking. Focus on fundamentally strong names. This closure sets a cautious tone for the week ahead.

FPIs Withdraw ₹7,608 Crore from Equities in Early January

Foreign portfolio investors extended their cautious stance into 2026. They sold Indian equities worth ₹7,608 crore in the first two trading days of January. This outflow continued the trend from 2025's record withdrawals. Global trade tensions played a role. Elevated valuations deterred fresh buying. Currency volatility added pressure. Geopolitical developments influenced sentiment. US actions in Venezuela heightened risk aversion. FPIs historically withdraw in January. This pattern held in eight of the past ten years. Analysts expect sensitivity to global cues. Macroeconomic data will be key. Potential US-India trade normalization could help. Benign interest rates globally may support later inflows. Domestic fundamentals remain strong. GDP growth projections are robust. Corporate earnings recovery anticipated. This could attract FPIs back. Reasonable valuations relative to peers offer opportunity. Low FPI ownership despite strong outlook noted. Market beta remains low. Steady domestic mutual fund inflows provide buffer. SIP contributions continue rising. EPFO and NPS flows support liquidity. Equity returns superior to other assets. Experts predict shift in FPI strategy. Improving fundamentals may drive net buying. Robust growth and earnings bode well. Near-term volatility likely persists. Outflows pressure major indices. Nifty and Sensex face downward bias short-term. Long-term outlook positive. Investors advised monitoring flows closely. This development signals ongoing foreign caution. It exacerbates market fragility amid external shocks. The Hindu | https://www.thehindu.com/business/markets/foreign-investors-outflow-7608-crore-indian-equities-january-2026/article70470133.ece

Banks Report Strong Q3 Loan Growth and Business Updates

Major Indian banks announced robust quarterly business updates for December 2025. HDFC Bank, Kotak Mahindra, and Bank of Baroda led gains. Loan growth accelerated across segments. Retail and secured lending drove momentum. Deposits showed healthy traction. Credit demand rebound signaled. This indicated improving economic activity. Systemic credit growth rose to 11.4%. From lows earlier in the year. Gold loans and vehicle financing emerged strong. NBFCs like Bajaj Finance reported solid AUM growth. Customer franchise expanded significantly. Disbursements surged year-on-year. This positivity offset IT sector weakness. Banking index provided market support. Analysts view this as earnings revival sign. Q3 results expected positive. Margin stability anticipated. Asset quality improvements continue. Provisions likely lower. Capital adequacy remains comfortable. Rate cuts by RBI supported lending. Further easing possible. This boosts credit offtake. Private banks outperformed public peers. Digital initiatives enhanced customer acquisition. Rural and MSME segments showed promise. Government schemes aided disbursements. Overall banking health strengthened. This development bodes well for financial sector. It contributes to broader economic recovery. Investors favor banking stocks. Valuations appear attractive. Growth visibility high for 2026. This update highlights sector resilience amid challenges. Reuters | https://www.reuters.com/world/india/indias-hdfc-bank-posts-loan-growth-higher-deposits-december-quarter-2026-01-05/

Bharat Coking Coal IPO Price Band Set, Strong GMP Interest

Bharat Coking Coal Limited, a Coal India subsidiary, fixed its IPO price band at ₹21-23 per share. The ₹1,071 crore offer-for-sale opens January 9. It marks the first mainboard IPO of 2026. Grey market premium jumped significantly. Indicating robust demand expectation. BCCL holds dominant position in coking coal. It supplies critical input to steel industry. Market share around 58.5%. Long reserve life supports sustainability. Proceeds benefit government disinvestment. No fresh issue component. This pure OFS aids fiscal targets. Investor interest high in PSU stocks. Energy security theme gains traction. Geopolitical events boost commodity focus. Listing scheduled mid-January. Subscription likely strong. Anchor booking precedes retail. Institutional participation expected heavy. Retail and HNI categories watched. GMP signals premium listing potential. This could set positive tone for primary market. Pipeline remains healthy for 2026. Multiple filings await approval. PSU divestment continues priority. Coal sector expansion aligns with infrastructure push. Domestic production emphasis grows. Import substitution benefits BCCL. Steel demand drives coking coal needs. This IPO highlights resource sector opportunities. It reflects government fundraising strategy amid budget constraints. Business Today | https://www.businesstoday.in/markets/ipo-corner/story/first-ipo-of-2026-bharat-coking-coal-rs1071-crore-issue-sees-strong-interest-gmp-jumps-70-509534-2026-01-05

Hindustan Laboratories Files DRHP for IPO with SEBI

Generic drug manufacturer Hindustan Laboratories filed draft papers with SEBI. The IPO comprises fresh share issuance. Proceeds fund working capital needs. Supply to government institutions prioritized. B2G model drives core business. Pharmaceutical sector growth evident. Healthcare affordability focus aligns with policy. Export potential enhances outlook. Company specializes in large-scale generics. Institutional supply ensures stable revenue. Fundraising strengthens balance sheet. Expansion plans include capacity augmentation. R&D investments planned. This move underscores pharma resilience. Domestic demand remains strong. Government tenders provide visibility. Margin profile stable historically. Competitive landscape intense but manageable. SEBI approval process underway. Timeline for launch expected soon. Investor appetite for healthcare stocks high. Defensive nature appeals amid volatility. Earnings consistency attracts long-term holders. This filing adds to robust IPO pipeline. Primary market activity picks up in 2026. Sector diversification benefits investors. Pharma exports face global opportunities. Regulatory compliance key strength. This development signals continued corporate fundraising. It supports sector capex cycle revival. The Hindu BusinessLine | https://www.thehindubusinessline.com/markets/stock-market-live-updates-january-05-2026/article70470476.ece

US Stocks Surge as Energy Shares Rally on Venezuela Developments

US markets closed sharply higher on January 05, 2026. The Dow Jones hit a new record high at 48,977. Energy stocks led gains. This followed US military actions capturing Venezuelan leadership. Oil reserves access boosted sentiment. Crude prices surged globally. This impacted India's energy import costs. Financial shares also rallied strongly. Nasdaq gained modestly with tech revival. Volume heavy amid geopolitical focus. Safe-haven demand rose initially. Gold and silver prices increased. Bitcoin hit multi-week highs. Crypto-linked shares advanced. Nonfarm payrolls data awaited. This could influence Fed policy. Rate easing priced in modestly. Trump administration policies supportive. Tax stimulus expected to sustain growth. US demand stability aids Indian exports. IT and pharma sectors benefit indirectly. Venezuela shock tests market resilience. Oil volatility pressures emerging markets. India's fiscal bill may rise. Energy sector stocks face headwinds domestically. Broader implications for global trade. This rally contrasts Indian market caution. Divergence highlights differing exposures. US growth projections around 2%. This provides external demand support. Overall event elevates geopolitical premium. Markets reassess supply risks near-term. Reuters | https://www.reuters.com/world/americas/us-stock-futures-tick-up-oil-companies-jump-venezuela-shock-2026-01-05/

Defence Stocks Gain Amid Rising Geopolitical Tensions

Indian defence stocks surged on January 05, 2026. Companies like BEL and HAL topped gainers. This followed heightened global tensions from US-Venezuela events. Geopolitical risk premium boosted sector. Order books remain strong. Government push for indigenization continues. Export opportunities emerging. Atmanirbhar Bharat initiative supportive. Capital expenditure allocations high. Multi-year contracts provide visibility. Margin expansion expected. Technology transfers enhance capabilities. Private players also participate actively. Ecosystem development accelerates. Investor interest rises in thematic plays. Volatility offers entry points. Long-term growth drivers intact. Border infrastructure focus persists. Naval and air force modernization ongoing. Missile and drone segments promising. This gain offset broader market drags. Sector outperforms benchmarks. Analysts recommend overweight positioning. Valuations reasonable relative to growth. Earnings upgrades likely ahead. This movement reflects security priority shift. It aligns with global uncertainty backdrop. The Hindu BusinessLine | https://www.thehindubusinessline.com/markets/stock-market-live-updates-january-05-2026/article70470476.ece

Palm Oil Imports Decline on Subdued Demand

India's palm oil imports fell to an eight-month low in December. Weaker winter demand cited primarily. Refiners shifted to rival oils like soyoil and sunflower. This substitution impacted volumes. Edible oil basket diversification evident. Price dynamics influenced choices. Global supply chains adjusted. Indonesia and Malaysia major sources. Trade policies stable currently. Inventory levels managed prudently. Consumer preferences evolve seasonally. Health considerations play role. This decline affects commodity trade balance. Agri imports moderation supports rupee. Food inflation remains benign. RBI policy space preserved. Overall soft commodity outlook. This data point highlights demand elasticity. It reflects refining sector flexibility amid volatility. The Hindu BusinessLine | https://www.thehindubusinessline.com/markets/stock-market-live-updates-january-05-2026/article70470476.ece

Record State Borrowing Plan Pressures Bond Yields

Indian states announced a record debt issuance calendar. January-March quarter borrowing at ₹5 trillion. Supply fears intensified. Government bond yields rose sharply. 10-year benchmark impacted most. Borrowing costs for entities increased. Fiscal deficit management challenged. Infrastructure funding needs persist. Capex cycle continuation critical. Central support mechanisms in place. Market absorption capacity tested. Investor demand for G-secs monitored. RBI interventions possible via OMOs. Yield curve steepened modestly. Corporate borrowing affected indirectly. This pressure reflects fiscal expansion phase. Revenue receipts growth needed. Tax buoyancy expected moderate. Expenditure priorities unchanged. This development raises cost of capital concerns. It may influence monetary transmission near-term. Reuters | https://www.reuters.com/world/india/indian-states-likely-borrow-record-5-trillion-rupees-january-march-quarter-2026-01-02/

Positive 2026 Outlook Amid Policy Support and Reforms

Analysts projected consumption-led resurgence in 2026. Moderate inflation enables rate cuts. Tax relief boosts disposable incomes. Policy reforms under Modi government cited. Global sourcing shift from China benefits India. Manufacturing and infrastructure sectors poised strong. Mark Mobius forecasted 12-15% market returns. Emerging markets veteran highlighted opportunities. Economic recovery through supports expected. Private investments revival anticipated. This optimism contrasts near-term caution. Long-term fundamentals drive confidence. Structural advantages remain intact. Demographics and digitization supportive. This outlook encourages selective investments. It underscores India's growth differential globally. Economic Times | https://economictimes.indiatimes.com/markets/expert-view/expect-indian-market-to-return-about-12-15-in-2026-mark-mobius/articleshow/126342237.cms