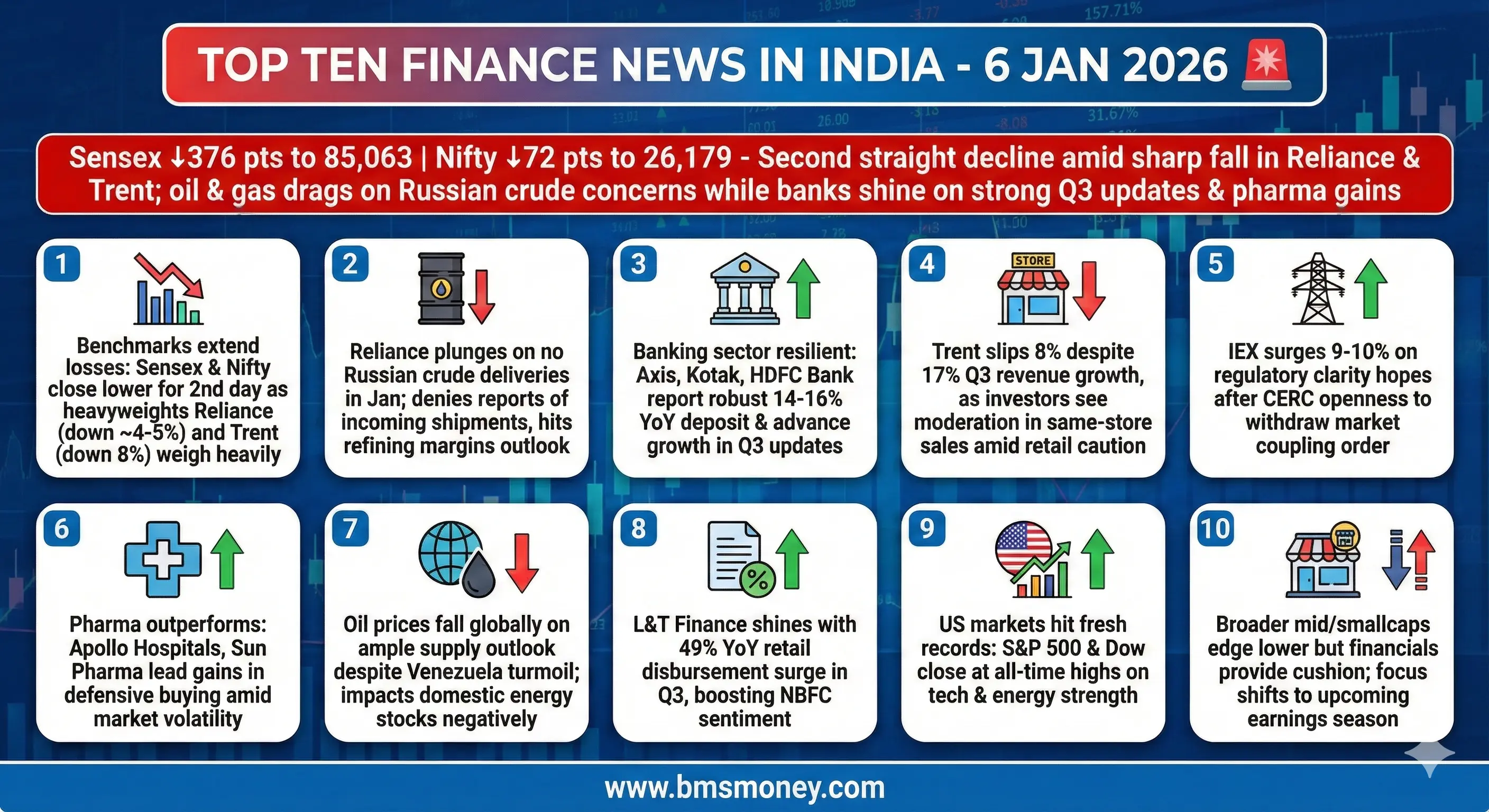

The Indian stock markets exhibited bearish sentiment on January 6, 2026, extending losses for the second consecutive session amid profit booking in heavyweight stocks and lingering concerns over global trade tariffs and geopolitical developments. Key themes included sector-specific resilience in banking and pharma, contrasted by weakness in oil & gas and retail, while positive Q3 business updates provided some support amid broader caution driven by Reliance Industries' sharp decline and uncertainty around Russian oil supplies.

Indian Benchmarks Extend Losses Amid Heavyweight Drag

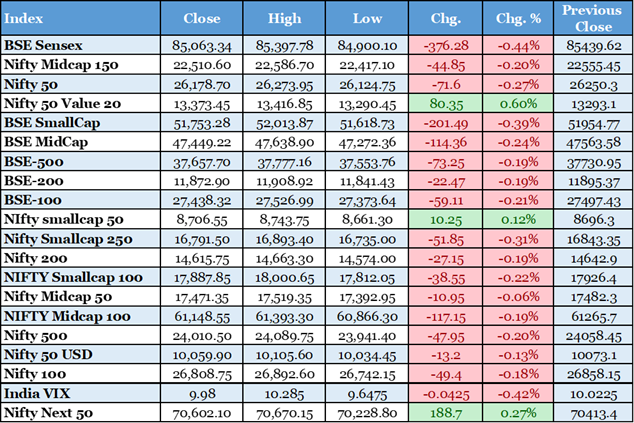

The BSE Sensex closed down 376 points at 85,063.34, while the NSE Nifty 50 settled 71.6 points lower at 26,178.70. This marked the second straight day of declines for the Indian markets. Selling pressure intensified in blue-chip stocks like Reliance Industries and Trent. Broader market indices also edged lower, with midcaps and smallcaps declining marginally. The downturn reflected investor caution amid global uncertainties. Profit booking emerged after recent record highs. Sectoral performance was mixed, with financials outperforming. Nifty Bank rose 74 points to 60,118. Gains came from ICICI Bank and insurance stocks. In contrast, oil & gas and infrastructure sectors lagged. Volatility remained elevated as markets digested Q3 updates. Foreign institutional investors maintained selective buying. Domestic institutions provided support. The rupee strengthened slightly against the dollar. Overall trading volume was moderate. Advance-decline ratio favored decliners. Market breadth indicated underlying weakness. Analysts expect range-bound trade ahead of more earnings. Key support levels for Nifty are around 26,100. Resistance is seen near 26,300. Global cues from US records provided limited uplift. Geopolitical risks continued to weigh on sentiment. This close highlighted vulnerabilities in large-caps. Investors shifted focus to defensive sectors like pharma.

Reliance Industries Shares Decline Sharply on Oil Supply Concerns

Reliance Industries, a key market heavyweight, saw its shares drop significantly during the session. The decline contributed heavily to the benchmarks' losses. Reports indicated no expected Russian crude deliveries in January. This raised concerns over refining margins and energy costs. Reliance operates the world's largest refining complex. Disruptions in discounted Russian supplies could impact profitability. The stock posted its sharpest fall in months. Market value erosion was substantial. Broader oil & gas sector felt the ripple effects. Investors worried about rising input costs. Global crude prices remained volatile amid Venezuelan developments. Reliance's retail and telecom arms provided some offset. However, energy segment weighs heavily on valuations. Analysts downgraded near-term outlook. Long-term fundamentals remain intact due to diversification. Jio and retail growth stories continue to attract interest. Share buybacks in past supported price. Current pressures stem from commodity cycles. Management commentary on Q3 awaited. Potential margin compression flagged. Stock trading at premium to peers. Valuation multiple contraction possible. Investor sentiment turned cautious. This move amplified overall market bearishness.

Banking Sector Reports Strong Q3 Deposit and Loan Growth

Major banks released positive Q3 business updates on January 6. Advances and deposits showed robust year-on-year growth. Axis Bank and Kotak Mahindra highlighted healthy expansion. This signaled sustained credit demand despite headwinds. Nifty Bank index outperformed broader market. Gains led by private sector lenders. Deposit mobilization remained key focus area. Loan books expanded across retail and corporate segments. Asset quality improvements noted. Margin stability expected in coming quarters. Regulatory compliance strengthened. Digital initiatives boosted customer acquisition. Branch expansion continued selectively. Rural and semi-urban penetration increased. Festive season demand aided growth. Analysts upgraded earnings estimates. Sector resilience amid economic slowdown concerns. Banking stocks provided market cushion. ICICI Bank and HDFC Bank also contributed. Overall financials rose amid rate cut expectations. RBI policy stance supportive. Liquidity management effective. This update countered broader selling pressure. Positive implications for economic recovery. Credit offtake indicates capex revival signs.

Trent Posts Moderate Q3 Revenue Growth Amid Retail Caution

Tata Group's Trent reported 17% year-on-year standalone revenue growth for Q3. Expansion driven by new Zudio store additions. However, shares declined sharply in trade. Investors viewed growth as below expectations. Same-store sales growth moderated. Competitive intensity in fashion retail increased. Margin pressures from discounts flagged. Store count reached new highs. Like-for-like sales trends softened. Consumer discretionary spending cautious. Economic uncertainties impacted footfalls. Online channel showed promise. Inventory management remained efficient. Cost controls implemented. Expansion plans intact for FY27. Valuation appeared stretched pre-update. Post-update correction brought multiples lower. Analysts maintained buy ratings long-term. Brand strength and execution track record positive. Market share gains continued. Zudio format disruptive. Westside premium positioning solid. This performance highlighted retail sector challenges. Broader consumption slowdown evident. Implications for FMCG and auto sectors.

Business Standard - https://www.business-standard.com/markets/news/stocks-to-watch-today-january-6-2026-swiggy-trent-l-t-finance-axis-bank-indisind-bank-ongc-adani-power-126010600087_1.html

US Markets Achieve Record Closes on Tech and Energy Strength

US benchmarks ended at all-time highs on January 6. S&P 500 rose 0.6% to new record. Dow Jones advanced nearly 1% above 49,000. Nasdaq Composite gained amid tech rally. Energy stocks surged on geopolitical developments. Venezuelan situation boosted oil-related names. Tech giants like Nvidia and AMD led gains. CES announcements fueled AI optimism. Small-caps Russell 2000 outperformed. Broader risk-on sentiment prevailed. Fed policy independence concerns lingered. Rate cut expectations moderated. Inflation data awaited. Corporate earnings season approaching. This performance provided positive global cues. Indian ADRs reacted mixed. IT stocks faced pressure domestically. Energy and financials drew indirect support. Record US closes contrasted Indian weakness. Divergence highlighted local factors dominance. Tariff threats on India persisted. Export-oriented sectors cautious. Overall, mixed implications for Dalal Street. Bullish US trend supportive long-term.

Reuters - https://www.reuters.com/business/global-markets-outlook-graphic-2026-01-06/

Crude Oil Prices Decline Amid Ample Supply Outlook

Global crude benchmarks fell sharply on January 6. Brent settled around $60.70 per barrel. WTI dropped to near $57. Venezuelan uncertainties weighed initially. However, ample supply expectations dominated. OPEC+ maintained steady output. Non-OPEC growth robust. Demand growth concerns persisted. Indian refiners faced higher costs potentially. Reliance highlighted no Russian deliveries. Discounted supplies disruption risk. Energy sector stocks declined domestically. HPCL and ONGC under pressure. Import bill implications for India. Rupee strength provided some relief. Medium-term prices expected softer. Analysts forecast averages in $50s-60s. Geopolitical risks premium faded. Inventory builds anticipated. Refining margins compressed. This decline impacted oil marketing companies. Broader commodity basket mixed. Implications for inflation trajectory positive. RBI policy space enhanced. Fuel prices stability likely.

Pharma Sector Gains Amid Defensive Buying

Pharma stocks outperformed on January 6. Sun Pharma and Apollo Hospitals led gainers. Defensive buying emerged amid market decline. Export-oriented names benefited from rupee dynamics. Domestic formulations stable. US generics pipeline updates positive. Regulatory approvals boosted sentiment. Healthcare demand resilient. Hospital chains reported steady occupancy. API business margins improved. Biosimilars progress noted. Valuation reasonable compared to IT. Analysts favored sector for stability. Dividend yields attractive. Global funding winter less impactful. R&D investments continued. Patent cliffs managed effectively. This strength provided market buffer. Broader sectoral rotation evident. Risk aversion favored defensives. Long-term growth drivers intact. Aging population theme supportive. Policy support for industry positive.

L&T Finance Highlights Robust Q3 Disbursements

L&T Finance announced strong Q3 performance metrics. Retail disbursements surged 49% year-on-year. Focused lending segments drove growth. Asset quality remained stable. Collection efficiency high. Digital platforms aided disbursements. Rural finance book expanded. Management optimistic on FY26 outlook. NBFC sector gained traction. Funding costs managed effectively. Liquidity position comfortable. Regulatory compliance strengthened. Portfolio diversification progressed. Analysts raised targets post-update. Valuation rerating potential. This update bolstered financials sentiment. Broader credit growth positive signal. Economic activity indicators supportive. Capex cycle revival hints. Investor confidence in NBFCs boosted. Sector outperformance continued.

India Infoline - https://www.indiainfoline.com/news/markets/top-stocks-for-today-6th-january-2026

IEX Shares Surge on Regulatory Developments

Indian Energy Exchange stock rose sharply. CERC openness to withdraw market coupling order cited. Previous order caused significant drop. Volume growth in Q3 strong. Electricity trade up 11.9%. Renewable energy certificates demand robust. Platform enhancements implemented. Competition dynamics favorable. Management guidance positive. Power sector reforms supportive. Renewable integration accelerated. Tariff discoveries efficient. Investor interest revived post-news. Valuation attractive post-correction. Long-term monopoly-like advantages. This gain highlighted utility sector potential. Broader PSU banks also resilient. Regulatory clarity key driver. Market sentiment toward exchanges improved.

Business Standard - https://www.business-standard.com/markets/news/stocks-to-watch-today-january-6-2026-swiggy-trent-l-t-finance-axis-bank-indisind-bank-ongc-adani-power-126010600087_1.html

Potential US Tariff Threats Pressure Export Sentiment

Fresh concerns over US tariffs on India emerged. Trade policy uncertainties heightened. Export-oriented sectors cautious. IT and pharma relatively insulated. Textiles and gems vulnerable. Government negotiations ongoing. Diversification efforts intensified. Domestic demand focus increased. Rupee depreciation partial hedge. Analysts flagged risks to growth. Earnings downgrades possible. Market discounted some impact. Long-term FTAs mitigating factor. This theme contributed to bearish tone. Global trade slowdown concerns amplified. Investor positioning defensive. Broader implications for current account. Policy responses anticipated in budget. Resilience through services exports noted. Overall caution prevailed.