The Indian stock markets displayed bearish sentiment on January 07, 2026, closing lower for the third straight session amid geopolitical concerns, fresh US tariff threats, and cautious global cues. Key themes revolved around strong festive-driven jewellery sector updates providing selective buoyancy, resilient broader market performance in mid- and small-caps, and optimistic domestic growth projections offsetting external pressures. Overall, investor caution prevailed, though sector-specific strength limited downside.

Indian Benchmarks Close Lower for Third Consecutive Session

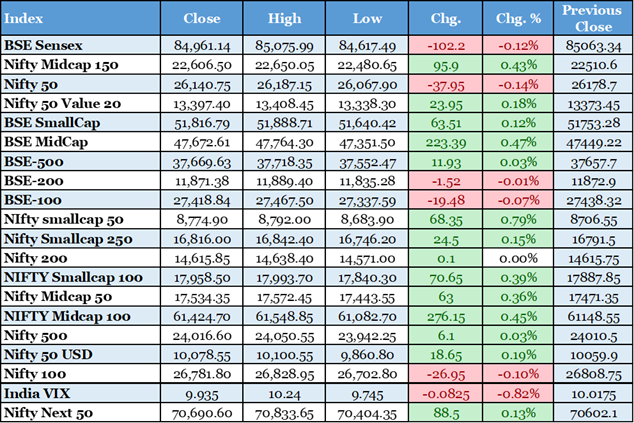

The BSE Sensex declined 102 points to close at 84,961. The NSE Nifty fell around 38-72 points, settling near 26,140-26,178. This marked the third straight day of losses. Weakness stemmed from banking, auto, and select heavyweights. Geopolitical tensions and US tariff concerns weighed on sentiment. However, broader markets showed resilience. The Nifty Midcap 100 and Smallcap indices gained modestly. Sectoral performance was mixed. Eleven out of sixteen sectors ended in red. Jewellery and select consumer stocks bucked the trend. The India VIX remained low, indicating subdued volatility. Foreign institutional investors continued selling pressure. Domestic institutions provided some support. Intraday, indices recovered from deeper losses. Global cues from retreating US markets added caution. This consolidation phase could persist short-term. Selective buying in quality midcaps emerged. Investor focus shifted to upcoming earnings season. Overall, the day reflected cautious consolidation. The immediate implication is potential range-bound trading ahead.

The Hindu BusinessLine, https://www.thehindubusinessline.com/markets/stock-market-highlights-january-07-2026/article70477753.ece

Government Projects 7.4% GDP Growth for FY 2025-26 Amid Tariff Risks

The Indian government forecasted 7.4% real GDP growth for FY26. This follows estimated 6.5-7% expansion in the current year. Nominal growth is seen at around 8-10%. The projection highlights India's resilience. Domestic demand remains a key driver. Infrastructure spending and policy reforms support outlook. Manufacturing and services sectors are expected to lead. Inflation control aids macroeconomic stability. External headwinds include potential US tariffs on exports. Trade diversification efforts mitigate risks. The forecast positions India as fastest-growing major economy. It could surpass Japan as fourth-largest soon. Fiscal discipline is emphasized. Revenue buoyancy from taxes supports spending. Private investment revival is anticipated. Consumption trends remain positive. This optimistic view could boost investor confidence. Foreign inflows may increase on growth visibility. The immediate financial implication is enhanced market sentiment toward domestic-focused sectors.

US Equities Retreat from Intraday Records with Dow Down 466 Points

Major US indices pulled back after hitting fresh highs. The Dow Jones fell 466 points or 0.94% to 48,996. The S&P 500 declined 0.3% to around 6,921. The Nasdaq managed a marginal 0.16% gain to 23,584. Profit-taking emerged in financials and energy sectors. Defense and homebuilder stocks faced pressure from policy statements. Crude oil prices dropped sharply. Venezuelan supply developments influenced energy markets. AI-related tech stocks provided support to Nasdaq. Early 2026 optimism faded slightly. Labor market data showed modest private job additions. This influenced Fed rate path expectations. Bond yields remained stable. Global risk aversion increased marginally. For Indian markets, this added to cautious cues. FII outflows could continue short-term. Sectoral rotations observed in US influenced global flows. The pullback signals potential increased volatility ahead. Immediate implication for India is pressure on export-oriented stocks.

CNBC, https://www.cnbc.com/2026/01/07/stock-market-today-live-updates.html

Jewellery Stocks Rally on Strong Festive Quarter Sales Updates

Major jewellery companies reported robust Q3 performance. Festive and wedding season demand drove growth. Higher gold prices aided revenue realization. Organized players gained market share. Store expansions contributed significantly. Titan, Kalyan, and Senco led the surge. Shares hit multi-month or record highs. The sector outperformed broader markets. Consumer discretionary spending showed strength. Margin pressures from inputs were managed. International operations also grew strongly. Inventory management improved efficiency. Marketing initiatives paid off. Footfalls increased notably. This highlights resilient urban consumption. Rural demand recovery signals broader positivity. Implications include upgraded earnings estimates. Investor interest in consumer stocks rises. The rally could sustain if gold trends stabilize. Overall, it provides a bright spot amid market caution.

Titan Company Shares Hit Record High on 40% Q3 Growth

Titan announced approximately 40-41% YoY revenue growth in Q3. Domestic jewellery division surged over 41%. Store additions reached dozens quarterly. Total retail footprint expanded meaningfully. International business grew even faster. Festive demand was a major catalyst. Elevated gold prices supported value growth. Buyer upgrades contributed positively. Operational efficiencies maintained margins. Management commentary remained optimistic. Share price rallied nearly 4-7%. It emerged as a top Nifty gainer. The update reinforced sector momentum. Analyst upgrades followed swiftly. Earnings visibility improved substantially. This performance underscores brand strength. Competitive positioning against unorganized segment strengthened. Implications include potential re-rating of valuation multiples. The strong results signal healthy discretionary spending trends.

Kalyan Jewellers Reports 42% Consolidated Revenue Growth

Kalyan Jewellers posted 42% YoY revenue increase for Q3. Domestic operations drove the bulk. International segment grew 36%. Festive season bookings were robust. New showroom launches accelerated expansion. Same-store sales growth remained healthy. Marketing campaigns proved effective. Gold rate advantages realized fully. Operational leverage benefited profitability. Shares surged significantly intraday. The update boosted sector sentiment broadly. Management targets sustained momentum. Market share gains continued. This reflects organized retail shift acceleration. Consumer confidence in branded jewellery evident. Implications include improved cash flows for further growth. Analyst targets revised higher. The performance highlights effective strategy execution. Potential for margin expansion ahead noted. Overall, it reinforces positive consumer sector outlook.

Senco Gold Delivers Over 50% Revenue Growth in Q3

Senco Gold achieved 51% standalone revenue rise YoY. Same-store growth stood at 39%. Showroom count increased substantially. Expansion into new markets progressed. Festive and wedding demand peaked. Gold price tailwinds fully captured. Operational efficiencies scaled up. Shares rallied sharply to new levels. The results exceeded expectations broadly. Management guided for over 25% annual growth. Profitability metrics improved sequentially. This underscores regional brand strength. Implications include enhanced earnings trajectory. Investor rotation toward consumer names accelerated. The update adds to jewellery sector positivity. Potential for further re-rating exists. Overall, it signals robust discretionary demand persistence. Broader retail recovery themes reinforced strongly.

The Hindu BusinessLine, https://www.thehindubusinessline.com/markets/stock-market-highlights-january-07-2026/article70477753.ece

SEBI Extends Timeline for Mutual Fund Distributor Incentives Implementation

SEBI announced extension till March 1, 2026. This pertains to additional incentives structure. The move applies to onboarding new individual investors. It provides relief to distributors and AMCs. Compliance preparations gain breathing room. The framework aims to boost retail participation. Trail-based incentives encouraged over upfront. This aligns with long-term industry growth. Investor protection remains core focus. Distribution costs rationalization expected gradually. Market reaction was neutral to positive. Mutual fund industry volumes could benefit. Implications include smoother transition for stakeholders. Potential increase in SIP inflows anticipated. The extension reflects pragmatic regulation. Overall, it supports financial inclusion goals. Broader capital market deepening aided indirectly. Immediate financial impact remains limited but positive long-term.

SEBI Official, https://www.sebi.gov.in/sebiweb/home/HomeAction.do?doListing=yes&sid=1&ssid=7&smid=0

Crude Oil Prices Decline on Venezuelan Supply Developments

US statements indicated control over Venezuelan oil sales. This aims to rebuild the sector post-regime change. Supply of 30-50 million barrels expected to US. Prices reacted with sharp declines. Energy sector stocks faced pressure globally. Indian import bill benefits substantially. Rupee strength received support indirectly. Refining margins could improve marginally. Oil marketing companies gained intraday. Geopolitical risks remain elevated however. Inventory builds possible short-term. Implications for India include lower inflation risks. Fiscal deficit management eased slightly. Transport and logistics sectors benefit. Consumer spending power preserved. The development adds to commodity volatility watch. Overall, it provides a positive cue for import-dependent economy. Immediate market implication is supportive for rate-sensitive sectors.

Investopedia, https://www.investopedia.com/5-things-to-know-before-the-stock-market-opens-january-7-2026-11880553

Broader Markets Outperform with Mid and Small Caps Gaining

Nifty Midcap and Smallcap indices rose 0.4-0.5%. This contrasted with benchmark declines. Rotational buying evident in quality names. Risk appetite persisted in broader segments. Select real estate and consumer stocks led. Lodha Developers' strong pre-sales added positivity. Defensive plays attracted flows amid caution. Valuation comfort versus large caps noted. Implications include sustained breadth in rallies ahead. Investor diversification away from frontline stocks. The outperformance signals underlying market strength. Potential for catch-up in undervalued segments. Overall, it limits downside in consolidated phases. FII selling absorbed better here. Domestic liquidity remains supportive factor. This trend could continue if global cues stabilize. Immediate financial implication is enhanced portfolio resilience for diversified investors.