The Indian markets exhibited bearish sentiment on December 08, 2025, with sharp declines in major indices driven by profit booking, persistent FII outflows, and rupee depreciation near record lows. Global cues, including anxiety over the upcoming US Federal Reserve decision, added to the volatility, overshadowing recent RBI rate cut benefits. Overarching themes focused on market corrections, corporate mergers, and sector-specific pressures amid broader economic uncertainties.

- Sensex and Nifty post worst day in months on FII selling.

- Investor wealth erodes by over ₹7 lakh crore in single session.

- IndiGo shares crash amid operational disruptions and market caution.

- US stocks dip ahead of anticipated Fed rate decision.

- Trump announces $12 billion aid for disrupted US farmers.

Indian Stock Markets Suffer Sharp Decline Amid FII Outflows and Global Uncertainty

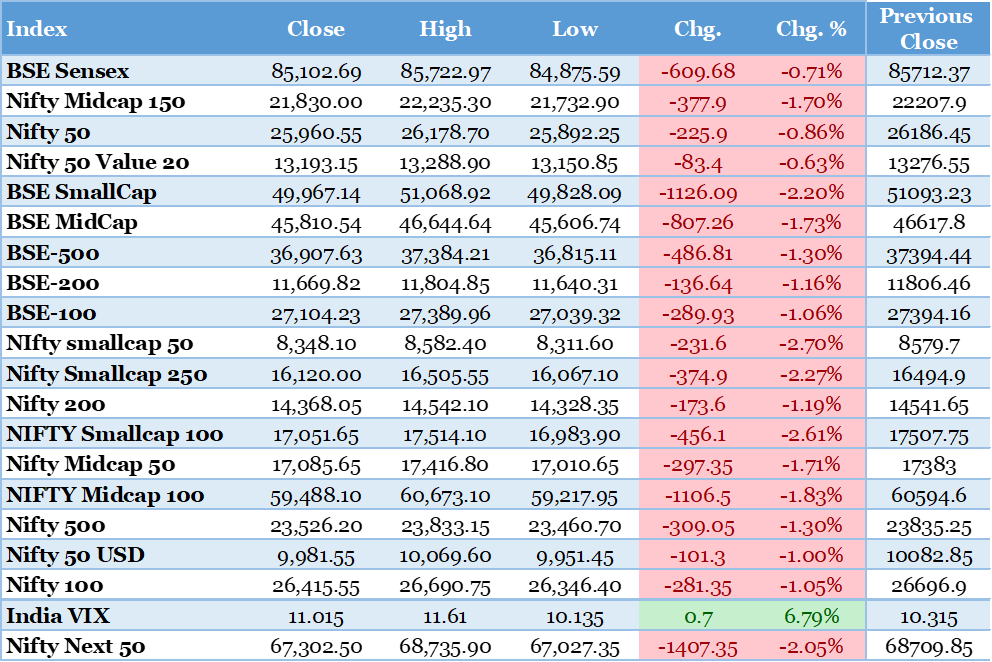

Benchmark indices closed significantly lower, with the Sensex dropping 610 points to 85,103 and Nifty falling 226 points to 25,961, marking the worst session in over two months due to profit booking, foreign fund outflows exceeding ₹10,000 crore in early December, rupee weakness at 90.15 against the dollar, and caution ahead of the US Fed meeting. This broad sell-off impacted all sectors, with realty down 3.53% and mid/small caps losing 1.83% and 2.61% respectively, leading to heightened volatility as VIX rose 8%. The Hindu Business Line, https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-8th-dec-2025/article70368657.ece

Investor Wealth Erodes by Over ₹7 Lakh Crore in Market Crash

Market capitalization of BSE-listed firms plummeted from ₹471 lakh crore to below ₹464 lakh crore, resulting in a staggering ₹7 lakh crore loss for investors in a single day, fueled by rupee depreciation, FII selling, yen carry trade concerns, and uncertainty over India-US trade deal terms. The downturn was exacerbated by surging crude oil prices and lack of fresh domestic catalysts, hitting mid and small caps harder with declines of 1.73% and 2.20%. Livemint, https://www.livemint.com/market/stock-market-news/sensex-crashes-over-800-points-investors-lose-7-lakh-crore-nifty-50-why-is-indian-stock-market-falling-explained-11765182227608.html

IndiGo Shares Plunge 9% Amid Operational Disruptions

InterGlobe Aviation (IndiGo) stock tumbled 9%, its biggest drop in four years, closing at a multi-week low due to reported operational challenges including flight delays and cancellations, compounded by broader market weakness and aviation sector headwinds. The decline contributed to the airline's underperformance, with analysts forecasting continued pressure on margins from rising fuel costs and competitive pricing. CNBC TV18, https://www.cnbctv18.com/market/stock-market-live-updates-sensex-nifty-50-today-midcaps-ipo-rush-lenskart-pine-labs-eternal-vil-biocon-cochin-shipyard-share-price-liveblog-19783529.htm

Biocon Announces $5.5 Billion Merger of Biologics Unit

Biocon shares slipped 3% following the announcement of a merger involving its biologics subsidiary in a $5.5 billion transaction aimed at streamlining operations and enhancing global biosimilars presence. The deal is expected to unlock value for shareholders through improved efficiency and expanded market access, though short-term integration costs may pressure earnings. CNBC TV18, https://www.cnbctv18.com/market/stock-market-live-updates-sensex-nifty-50-today-midcaps-ipo-rush-lenskart-pine-labs-eternal-vil-biocon-cochin-shipyard-share-price-liveblog-19783529.htm

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsJSW Infra Acquires Rail Units for ₹1,212 Crore, Enters Railway Business

JSW Infrastructure's arm acquired JSW Group rail entities in a ₹1,212 crore deal to expand into railway rakes operations, boosting logistics capabilities and supporting port-to-consumer supply chains. This strategic move is poised to enhance revenue diversification and operational synergies, positively impacting the infrastructure sector amid government push for multimodal transport. CNBC TV18, https://www.cnbctv18.com/market/stock-market-live-updates-sensex-nifty-50-today-midcaps-ipo-rush-lenskart-pine-labs-eternal-vil-biocon-cochin-shipyard-share-price-liveblog-19783529.htm

Kaynes Technology Shares Tank Over 30% on Disclosure Inconsistencies

Kaynes Technology extended its slide, falling over 30% in four sessions after inconsistencies were flagged in FY2025 financial disclosures, eroding investor confidence and triggering regulatory scrutiny. The electronics firm's stock hit lower circuits, reflecting broader concerns in the technology sector over governance and reporting accuracy. Business Standard, https://www.business-standard.com/markets/news/stock-market-live-updates-december-8-sensex-nifty-gift-nifty-ipos-today-fed-rate-cut-indigo-airlines-shares-125120800070_1.html

Top Performing Equity Fund Categories for You

Top Performing Large Cap Funds Top Performing Mid Cap Funds Top Performing Small Cap FundsDr Reddy's Signs $370 Million Licensing Pact for Cancer Drug

Dr Reddy's Laboratories entered a licensing agreement with Australia's Immutep for a cancer immunotherapy drug, receiving $20 million upfront and potential milestones up to $349.5 million, strengthening its oncology portfolio. The deal is anticipated to drive long-term revenue growth through exclusive distribution rights in key markets, bolstering pharmaceutical sector innovation. Business Standard, https://www.business-standard.com/markets/news/stock-market-live-updates-december-8-sensex-nifty-gift-nifty-ipos-today-fed-rate-cut-indigo-airlines-shares-125120800070_1.html

US Stocks Fall Ahead of Federal Reserve Policy Decision

Major US indices declined, with the S&P 500 down 0.3% to 6,846.51, Dow Jones dropping 0.4% to 47,739.32, and Nasdaq edging 0.1% lower to 23,545.90, as investors turned cautious before the Fed's anticipated 25 basis point rate cut. The pullback was influenced by leadership changes at Berkshire Hathaway and a buyout offer for Warner Bros. Discovery, signaling broader market anxiety over monetary policy trajectory. Yahoo Finance, https://finance.yahoo.com/news/major-us-stock-indexes-fared-212022290.html

Top Performing Debt Fund Categories for You

Top Performing Liquid Funds Top Performing Ultra Short Duration Funds Top Performing Corporate Bond FundsTrump Administration Announces $12 Billion Farmer Bridge Payments

The US government unveiled $12 billion in one-time aid for farmers hit by trade disruptions, high input costs, and inflation from prior policies, with $11 billion for row crops and $1 billion for specialties like sugar, bridging to upcoming farm bill enhancements. This support aims to stabilize agriculture amid a $50 billion trade deficit, potentially easing commodity price volatility and benefiting global markets including India's imports. USDA, https://www.usda.gov/about-usda/news/press-releases/2025/12/08/trump-administration-announces-12-billion-farmer-bridge-payments-american-farmers-impacted-unfair

US Regulators Relax Rules on High-Risk Bank Lending

Federal regulators eased Obama-era restrictions on banks' corporate lending risks, fostering growth in private credit markets but prompting calls from senators for stress tests to mitigate potential systemic threats. The change could increase liquidity in US financial systems, indirectly influencing global capital flows and investment in emerging markets like India. Morningstar, https://www.morningstar.com/news/dow-jones/2025120831/dow-jones-top-financial-services-headlines-at-12-am-et-regulators-relax-rules-on-high-risk-lending-for-banks-sequoia