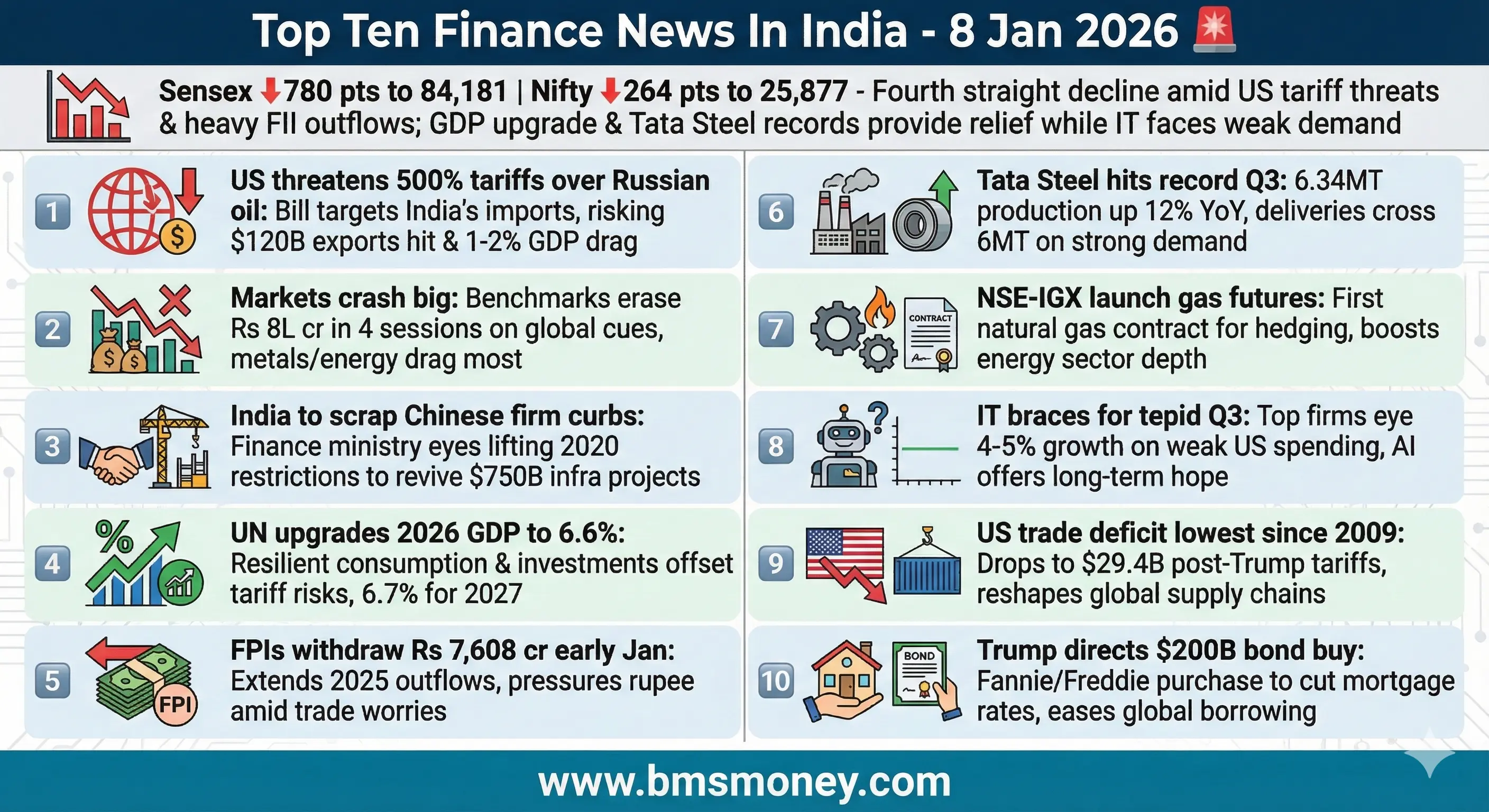

Indian markets experienced a bearish and volatile day, pressured by renewed U.S. tariff threats and persistent foreign investor outflows, overshadowing positive GDP revisions and corporate production highs. Key themes included geopolitical trade tensions, regulatory easing on foreign investments, and sector-specific resilience amid global economic uncertainties.

US Threatens 500% Tariffs on India Over Russian Oil Sanctions

US President Donald Trump has warned of raising tariffs on India quickly. This follows his approval of a bipartisan bill that could impose duties as high as 500% on countries trading in Russian goods. The Sanctioning Russia Bill is co-sponsored by Senator Lindsey Graham. It seeks to pressure nations like India, China, and Brazil to stop purchasing cheap Russian oil. This oil funds Russia's war in Ukraine. Graham stated the bill would give the president tremendous leverage against such countries. The bill has 84 co-sponsors from both Democrats and Republicans. Graham anticipates a strong bipartisan vote as early as next week. A key provision requires the US President to increase duties on goods and services imported from countries engaging in trade with Russia. These duties are set at least at 500% relative to the value of Russian-origin uranium and petroleum products. Ajay Srivastava from the Global Trade Research Initiative warned that a 500% tariff could effectively halt India's $120 billion annual exports to the US. Srivastava noted there is no legal mechanism to directly tariff services. Escalation might involve taxing US firms on payments for Indian services. India is already facing 50% additional tariffs on its exports to the US under national security and unfair trade practices laws. These additional tariffs are under legal challenge in the US Supreme Court. The court is expected to rule on their legality without congressional authority. India's imports of Russian crude reduced to 1.2 million barrels per day in December. This is the lowest in three years, down from 1.84 million in November. Reliance Industries reported no Russian oil supplies for the past three weeks and none expected in January. Resolving the Russia-India oil trade issue is crucial for concluding an interim trade deal and Bilateral Trade Agreement between India and the US. Financial Express - https://www.financialexpress.com/policy/economy/india-faces-early-prospect-of-500-tariffs-in-us-market/4101202/

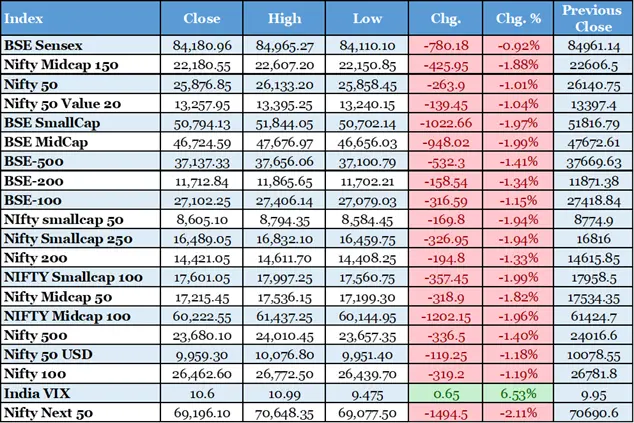

Indian Markets Crash: Sensex Down 780 Points, Nifty Below 25,900

Indian benchmark indices traded lower for the fourth straight session. The BSE Sensex tumbled over 600 points to 84,367.47. The Nifty 50 dropped below 25,950 at 25,905.20. This marked a 235.55-point decline. All sectors were in the red. This reflected widespread weakness and selling pressure. Metals, information technology, and banking faced particular pressure. Defensives offered limited relief. The market slump was driven by geopolitical tensions. Looming U.S. tariffs under Trump contributed to the decline. Uneven corporate earnings added to the pressure. Trump's Russia tariff bill impacted India. Heavyweights dragged benchmarks down. Venezuela's political upheaval influenced sentiment. Subdued global markets played a role. A looming growth slowdown in H2 FY26 was a factor. Technicals signaled non-directional trading. Broader weakness was evident with cautious sentiment. Profit-taking and risk aversion suggested subdued markets. Stronger triggers are needed for recovery.

India Plans to Scrap Curbs on Chinese Firms for Government Contracts

India's finance ministry is planning to eliminate five-year-old restrictions on Chinese firms. These curbs limited Chinese firms from bidding on government contracts. The restrictions were imposed in 2020 following a deadly border clash. They required Chinese bidders to register with an Indian government committee. They also needed political and security clearances. This effectively excluded them from contracts valued between $700 billion and $750 billion. One source indicated officials are working to abolish the registration requirement. Prime Minister Narendra Modi's office will decide on final implementation. The finance ministry did not respond to requests for comment. The prime minister's office also did not respond. Reuters was the first to report this development. The aim is to ease curbs amid reduced border tensions. The restrictions caused shortages and project delays. Other government departments requested relief. China's state-owned CRRC was disqualified from a $216 million contract. A high-level committee recommended lifting the restrictions. A 2024 report showed a 27% drop in projects awarded to Chinese bidders. Limitations on importing Chinese equipment impeded power sector goals. The plan follows Modi's visit to China last year. Shares of Bharat Heavy Electricals fell 10.5% following the report. Reuters - https://www.reuters.com/world/china/india-plans-scrap-curbs-chinese-firms-bidding-government-contracts-sources-say-2026-01-08/

UN Upgrades India's 2026 GDP Forecast to 6.6%

The United Nations has raised India's GDP growth forecast for 2026 to 6.6%. This is up from a previous estimate of 6.4%. It projected 6.7% growth for 2027. The upward revision is driven by resilient private consumption. Strong public investments are expected to offset negative effects. Steep US tariffs on Indian exports are a challenge. Recent policy measures include income tax cuts. Goods and services tax rationalization is anticipated. Lower interest rates will boost expansion. India's GDP is expected to grow by 7.4% in 2025. It maintains status as one of the fastest-growing economies. On a financial year basis, growth is projected at 7.2% in 2025-26. It is 6.6% in 2026-27. This aligns with National Statistics Office forecasts. Inflation in India is expected to be 4.1% in 2026. The US imposed a 50% tariff on India. This includes a 25% penalty on Russian oil imports. The US accounts for 18% of India's exports. Robust demand from Europe and West Asia will mitigate impact. South Asia growth is forecasted at 5.6% in 2026. Economic Times - https://economictimes.indiatimes.com/news/economy/indicators/un-raises-indias-2026-gdp-forecast-to-6-6-pegs-next-yrs-growth-at-6-7/articleshow/126420735.cms

FPIs Withdraw Rs 7,608 Crore from Indian Equities in Early 2026

Foreign portfolio investors initiated 2026 with a cautious approach. They continued their selling trend from 2025. They withdrew Rs 7,608 crore from Indian equities. This occurred in the first two trading days of January. The amount equals USD 846 million. This follows a Rs 1.66 lakh crore exodus in 2025. That was USD 18.9 billion. Outflows were driven by volatile currency fluctuations. Escalating global trade disputes contributed. Worries about impending US tariffs played a role. Persistent FPI selling caused the rupee's 5% depreciation in 2025. Experts anticipate a potential reversal in FPI strategies. VK Vijayakumar highlighted stronger domestic economic foundations. These could draw net foreign inflows. Robust GDP expansion is a positive indicator. Expected improvements in corporate profits are noted. Vaqarjaved Khan pointed to stabilizing India-US trade ties. A favorable global interest rate environment supports. USD-INR exchange rate steadiness is helpful. Equity valuations have become more attractive. Economic Times - https://economictimes.indiatimes.com/markets/stocks/news/fpis-pull-out-rs-7608-cr-from-equities-in-just-2-days-of-jan/articleshow/126331696.cms

Tata Steel Reports Record Quarterly Production and Deliveries

Tata Steel reported its best-ever quarterly crude steel production for Q3FY26. Production reached 6.34 million tons. This is a 12% increase year-on-year. It is also a 12% increase sequentially. Domestic deliveries hit a record. They crossed 6 million tons. This was driven by strong demand in key segments. Growth was driven by higher output at Jamshedpur. It was also from Kalinganagar facilities. Tata Steel India’s deliveries crossed 6 million tons for the first time. India deliveries rose 9% quarter-on-quarter. They rose 14% year-on-year. For 9MFY26, crude steel production increased 6% to 17.2 million tons. Deliveries rose 6% to 16.3 million tons. Automotive & Special Products achieved 0.9 million tons. Q3 volumes rose 20% YoY. Branded Products & Retail surpassed 2 million tons. This registered 12% YoY growth. Industrial Products & Projects reported 1.9 million tons. Gross Merchandise Value from e-commerce reached Rs 2,380 crore. Economic Times - https://economictimes.indiatimes.com/markets/stocks/news/tata-steel-shares-in-focus-after-company-reports-best-ever-quarterly-deliveries-in-q3/articleshow/126405221.cms

NSE and IGX to Launch India's First Natural Gas Futures Contract

India's National Stock Exchange is in discussions with the Indian Gas Exchange. They aim to develop natural gas futures contracts. This collaboration was announced by NSE. It intends to introduce Indian natural gas futures. The partnership aligns with India's energy goals. It promotes increasing natural gas share in energy. It supports market-based pricing mechanisms. The collaboration is subject to regulatory approvals. NSE and IGX will collaborate with stakeholders. This ensures a smooth launch of the derivatives contract. Energy markets experienced heightened volatility recently. Global uncertainty includes potential U.S. tariffs. This impacts oil and gas stocks. Natural gas futures assist producers in hedging. They help city gas distributors against volatility. Power generators benefit from price hedging. Industrial consumers can manage risks. This could develop a credible gas price benchmark. The Multi Commodity Exchange offers natural gas futures. Competitive landscape exists for this development. Economic Times - https://economictimes.indiatimes.com/markets/stocks/news/nse-in-talks-with-igx-to-launch-natural-gas-futures-contract/articleshow/126415841.cms

Indian IT Firms Brace for Tepid Q3 Amid Weak U.S. Demand

India's top IT firms are gearing up for muted earnings. This is driven by weak U.S. demand. Holiday-period client shutdowns suppress spending. Nine brokerages reported this outlook. Analysts project 4% year-on-year revenue growth. This is for the top six IT firms. Profits rise 5%. This is down from 6.5% in September quarter. Slowdown continues demand softness. Last double-digit growth was in March 2023. Post-pandemic surges drove previous growth. Industry valued at $283 billion faces headwinds. Uncertainty over U.S. tariffs affects. Proposed $100,000 visa fees impact. Subdued client spending concerns growth. U.S. derives significant IT revenue. Accenture exceeded expectations due to AI. But maintained unchanged outlook. Clients cautious on incremental spending. Foreign outflows reached $8.5 billion in 2025. Economic Times - https://economictimes.indiatimes.com/markets/stocks/news/indian-top-it-firms-set-for-another-tepid-quarter-on-weak-us-demand-client-spending/articleshow/126407753.cms

U.S. Trade Deficit Hits Lowest Since 2009 Post-Trump Tariffs

The U.S. trade deficit in October 2025 reached $29.4 billion. This is its lowest level since mid-2009. It dropped 39% from the previous month. Exports increased 2.6%. Imports decreased 3.2%. The deficit is smallest since Q2 2009. This follows Trump's "liberation day" tariffs in April 2025. Economists concerned about retaliation. Trump softened aggressive proposals. Data shows robust demand for U.S. products. Year-to-date deficit 7.7% higher than 2024. Reduced imbalance supports Q4 growth. Chris Rupkey noted tariffs curbed imports. Trading partners buy more U.S. goods. Recession forecasts prove inaccurate. Productivity sustains growth. Third-quarter productivity rose 4.9%. Unit labor costs declined 1.9%. No inflationary pressure from labor. Firms achieve more with fewer workers. CNBC - https://www.cnbc.com/2026/01/08/trade-deficit-in-october-hits-smallest-since-2009-after-trumps-tariff-moves.html

Trump Directs $200 Billion Mortgage Bond Purchase to Lower Rates

U.S. President Donald Trump announced purchasing $200 billion in mortgage bonds. This aims to reduce housing costs. He stated on Truth Social about not selling Fannie Mae and Freddie Mac. They are worth many times more now. They have $200 billion in cash. Trump instructed representatives to buy the bonds. This would drive mortgage rates down. Monthly payments would decrease. Owning a home becomes more affordable. Federal Housing Finance Agency Director Bill Pulte confirmed execution. Fannie Mae and Freddie Mac have ample liquidity. This includes nearly $100 billion available at each. Figures account for assets beyond cash. As of September 30, Fannie Mae has $12.2 billion in cash. It has $27.2 billion in restricted cash. It has $61.5 billion in securities to resell. Freddie Mac has $4.6 billion in cash equivalents. It has $86.3 billion in securities to resell. Pulte declined timeline details. Purchases expected to lower rates and revive housing. Reuters - https://www.reuters.com/world/us/trump-orders-his-representatives-buy-200-billion-dollars-mortgage-bonds-2026-01-08/