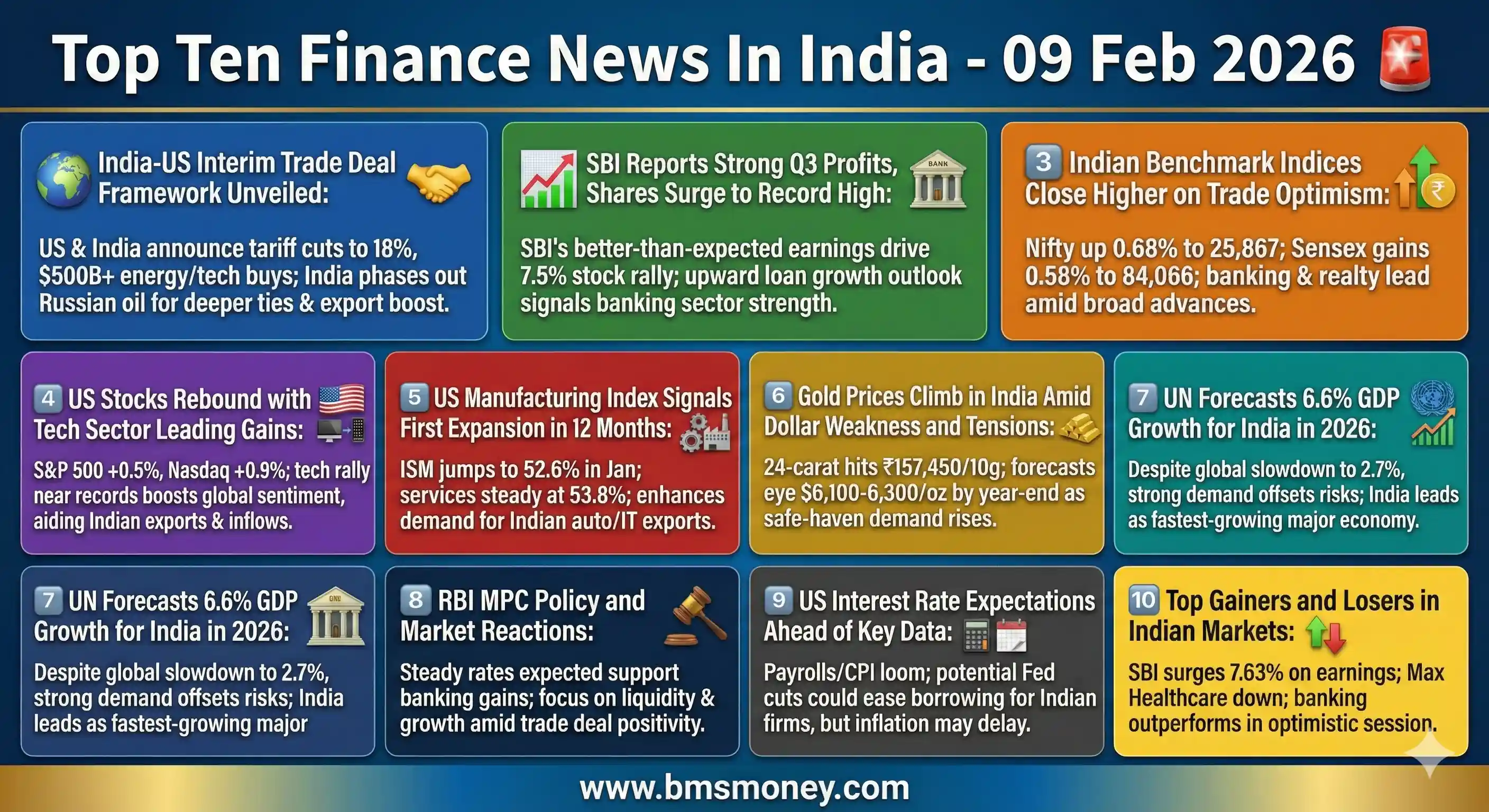

The Indian markets displayed a bullish sentiment on February 9, 2026, fueled by the announcement of an interim India-US trade deal framework and impressive quarterly earnings from State Bank of India. Positive global signals, including a rebound in US equities and robust manufacturing data, contributed to broad-based gains across sectors. Overarching themes revolved around enhanced bilateral trade relations, banking sector resilience, and optimistic economic projections amid geopolitical shifts.

India-US Interim Trade Deal Framework Unveiled

The United States and India announced an interim trade framework on February 9, 2026, aimed at reducing tariffs and resolving longstanding disputes. This agreement follows high-level discussions between President Trump and Prime Minister Modi, committing India to phase out Russian oil imports while boosting purchases of US energy and technology worth over $500 billion. The deal is designed to enhance supply chain resilience and promote reciprocal trade, particularly in agriculture and manufacturing sectors. Indian exports are expected to receive a significant boost, potentially increasing foreign exchange reserves and stimulating domestic production. However, it may introduce competition for local farmers from cheaper US imports, necessitating protective measures. The framework addresses tariff barriers, with reductions to 18% on key goods, fostering deeper economic integration. This move aligns with India's diversification strategy amid global uncertainties. Financial markets reacted positively, with indices climbing on renewed investor optimism. Broader implications include improved bilateral relations and potential for full-fledged trade agreements. Analysts predict sustained inflows of foreign investment, supporting rupee stability and growth. Overall, this pact underscores a shift towards Western alliances, impacting energy and commodity markets. The agreement's success hinges on implementation and compliance monitoring. Reuters - https://www.reuters.com/world/india/indian-shares-set-higher-open-india-us-trade-optimism-global-cues-2026-02-09

SBI Reports Strong Q3 Profits, Shares Surge to Record High

State Bank of India announced better-than-expected quarterly profits on February 9, 2026, leading to a 7.5% jump in its shares to a new record. The bank revised its full-year loan growth outlook upwards, reflecting robust demand in corporate and retail segments. This performance highlights improving economic conditions and credit expansion in India. SBI's results contributed significantly to gains in the Nifty 50 and Sensex indices. The banking sector overall benefited, with public sector banks showing resilience amid policy support. Analysts attribute the profit beat to lower provisioning and higher interest income. This development is likely to encourage further lending, supporting infrastructure and consumer spending. Investors view it as a positive signal for financial stability in the economy. Potential challenges include asset quality monitoring in volatile times. The surge underscores confidence in India's largest lender's management strategy. Broader market rallies could follow if similar trends emerge from peers. SBI's outlook revision may attract more foreign portfolio investments. Angel One - https://www.angelone.in/news/market-updates/top-gainers-and-losers-on-february-9-2026-sbi-surges-up-to-8-max-health-leads-top-losers

Indian Benchmark Indices Close Higher on Trade Optimism

On February 9, 2026, the Nifty 50 rose 0.68% to 25,867.30, while the Sensex gained 0.58% to 84,065.75, driven by the India-US trade deal and strong banking stocks. Fifteen of sixteen major sectors advanced, with small-cap and mid-cap indices up 2.6% and 1.6% respectively. The rally reflects broad-based optimism and recovery from recent volatility. Public sector banks and realty led the gains, buoyed by SBI's performance. This uptick indicates improved investor sentiment amid positive global cues. The market's response highlights the deal's potential to enhance exports and economic ties. Intraday highs showed strong buying interest throughout the session. Analysts expect continued momentum if trade implementations proceed smoothly. However, geopolitical risks remain a watch factor. The close above key levels suggests technical strength for further advances. Foreign inflows could accelerate with stabilized global markets. Overall, the day's performance reinforces India's economic resilience.

The HinduBusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-9th-february-2026/article70607060.ece

The HinduBusinessLine - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-9th-february-2026/article70607060.ece

US Stocks Rebound with Tech Sector Leading Gains

US equities advanced on February 9, 2026, with the S&P 500 up 0.5% near record highs, the Dow slightly higher at 50,135.87, and the Nasdaq gaining 0.9% to 23,238.67. The tech sector's rebound drove the rally ahead of key economic data releases. This recovery follows recent turbulence, signaling market resilience. For India, stronger US performance could boost export demand in IT and manufacturing. Portfolio investments may increase, supporting the rupee. The gains reflect optimism despite geopolitical uncertainties. Treasury yields remained steady, indicating balanced investor expectations. Analysts anticipate volatility with upcoming payrolls and CPI data. The uptick benefits global supply chains, aiding Indian firms. Emerging markets like India stand to gain from stabilized US growth. However, inflation concerns could temper enthusiasm. The session's close sets a positive tone for international markets. Yahoo Finance - https://finance.yahoo.com/news/major-us-stock-indexes-fared-211750051.html

US Manufacturing Index Signals First Expansion in 12 Months

The ISM Manufacturing Index surged to 52.6% in January 2026, marking the first expansion since August 2022 and exceeding the 50% threshold. This jump from 48.9% indicates robust business activity growth. The services sector stayed expansive at 53.8%, continuing its streak. For India, this could enhance global demand for exports in auto and IT sectors. Commodity prices may rise, impacting import costs. The data suggests a strengthening US economy, potentially influencing Fed policies. Indian manufacturers might benefit from improved supply chains. Analysts see this as a positive for emerging markets. However, higher yields could affect borrowing. The expansion underscores recovery amid uncertainties. Global trade ties could deepen with sustained US growth. India's economy may see indirect boosts through investments. AJG United States - https://www.ajg.com/news-and-insights/weekly-financial-markets-update-february-9-2026

Gold Prices Climb in India Amid Dollar Weakness and Tensions

Gold prices in India rose on February 9, 2026, with 24-carat reaching INR 157,450 per 10 grams due to a weaker dollar and geopolitical risks. Forecasts predict further increases to $6,100-$6,300 per ounce by year-end. This surge acts as a hedge for investors in uncertain times. Consumer spending on jewelry may dip with higher prices. Imports could strain the current account. The rise reflects global safe-haven demand. Indian markets may see diversified portfolios favoring gold. Central banks' buying supports the trend. Volatility in equities boosts appeal. Economic implications include inflation hedging. Traders eye Fed moves for direction. The commodity's performance impacts related sectors positively. Lemonn Blog - https://lemonn.co.in/blog/market-updates/india-stock-market-outlook-9-february-2026

UN Forecasts 6.6% GDP Growth for India in 2026

The United Nations projected India's GDP growth at 6.6% for 2026 on February 9, despite a global slowdown to 2.7% due to risks and tariffs. Strong demand in major markets is expected to mitigate impacts. India remains the fastest-growing major economy. This outlook bolsters fiscal stability and investor confidence. Policies focusing on infrastructure could amplify growth. Challenges include geopolitical tensions affecting trade. The forecast supports increased foreign direct investment. Domestic consumption drives resilience. Analysts see opportunities in exports. Global comparisons highlight India's advantages. Reforms may enhance projections further. The data aids in planning budgetary allocations. India Infoline - https://www.indiainfoline.com/blog/impact-of-indo-us-trade-deal-markets-next-week

RBI MPC Policy and Market Reactions

The RBI's Monetary Policy Committee verdict on February 9, 2026, influenced market sentiments alongside the trade deal. Expectations of steady rates supported banking stocks. The policy aims at inflation control amid growth. Markets reacted positively, with indices gaining. Credit growth outlook improved post-announcement. Implications include stable borrowing costs for corporates. Analysts monitor repo rate decisions. The MPC's stance reflects economic recovery. Liquidity measures could boost lending. Global cues integrated into policy. Future meetings may adjust based on data. The day's events underscored policy's role in stability. YouTube - https://www.youtube.com/watch?v=fwiYlSL5bOE

US Interest Rate Expectations Ahead of Key Data

US interest rate outlooks were scrutinized on February 9, 2026, with nonfarm payrolls and CPI data approaching. Recent volatility prompts reevaluation of Fed cuts. Potential reductions could lower global borrowing costs, benefiting Indian firms. Cross-border trade may stimulate. Persistent inflation might delay easing, affecting inflows. Markets anticipate data-driven decisions. Treasury yields' stability reflects caution. Analysts predict impacts on emerging economies. India's rates could align indirectly. The scrutiny highlights interconnected finances. Policy shifts influence currency values. Investors prepare for scenarios. Yahoo Finance - https://finance.yahoo.com/news/stock-market-news-feb-9-143200369.html

Top Gainers and Losers in Indian Markets

On February 9, 2026, State Bank of India and Shriram Finance led gains, while Max Healthcare and Power Grid were top losers. SBI surged 7.63% on earnings. The session saw broad advances. Market dynamics reflect sector shifts. Banking outperformed amid optimism. Healthcare faced pressures. This highlights stock-specific movements. Investors focus on earnings quality. Indices' performance tied to leaders. Volatility in losers signals caution. Overall, gains dominate sentiment. The list guides portfolio adjustments. ET Now - https://www.etnownews.com/markets/top-gainers-and-losers-today-09-february-2026-state-bank-of-india-shriram-finance-ltd-lead-gains-max-healthcare-institute-ltd-power-grid-corporation-of-india-ltd-among-top-losers-article-153583492