The Indian markets exhibited a bearish sentiment on December 02, 2025, closing lower for the second consecutive day amid profit booking, a weakening rupee, and persistent foreign investor outflows, despite robust long-term growth projections. Key overarching themes included market corrections pressured by global cues and domestic currency depreciation, alongside optimism from upcoming IPO activity and economic forecasts.

- Sensex plunges 504 points; investors lose nearly ₹2 lakh crore.

- Rupee hits record low of 89.97 against the US dollar.

- Nomura forecasts Nifty to reach 29,300 by end-2026.

- December IPOs expected to raise nearly ₹30,000 crore.

- US equities rise amid Fed rate cut optimism.

Indian Markets Close Lower Amid Profit Booking

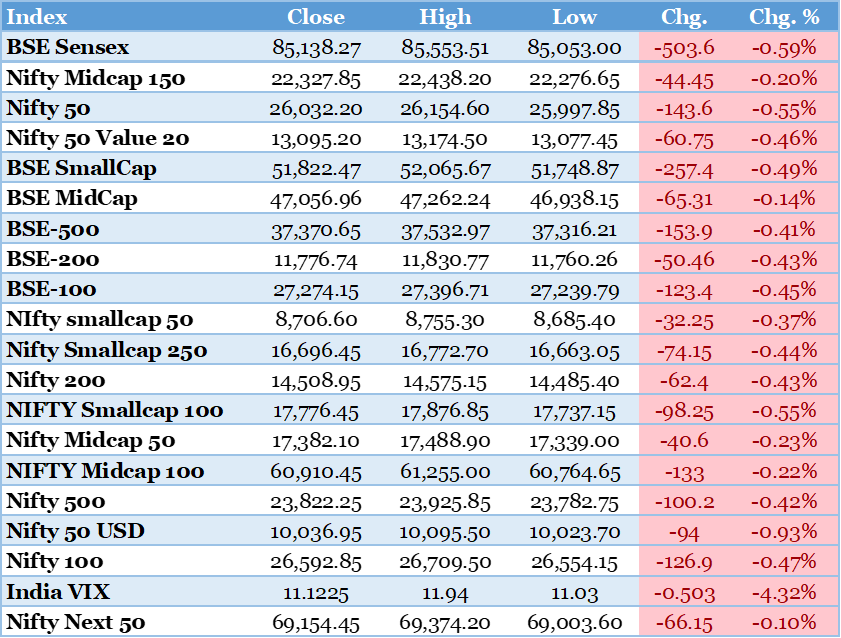

Indian stock markets extended losses for the second straight day on December 02, 2025, driven by profit booking at higher levels. The BSE Sensex closed down 504 points or 0.59% at 85,138, while the NSE Nifty settled 144 points or 0.55% lower at 26,032. Investors lost nearly ₹2 lakh crore as market capitalisation declined to ₹472.59 lakh crore. All major sectoral indices ended lower except Nifty Pharma, with Nifty Bank falling 0.68% and Nifty Financial Services dropping 0.90%. Broader markets outperformed benchmarks, with BSE Smallcap down 0.49% and BSE Midcap down 0.14%. The fall was attributed to a weakening rupee, persistent FII outflows, and NSE's sectoral index overhaul. Experts noted solid domestic macro fundamentals may provide support amid US-India trade uncertainties. Fading expectations for RBI rate cuts followed strong GDP data. This correction highlights short-term volatility but underscores underlying economic strength. Immediate implications include reduced investor confidence and potential pressure on rate-sensitive sectors.

Rupee Hits Record Low Against US Dollar

The Indian rupee depreciated to a record low of 89.97 per US dollar in intraday trade on December 02, 2025. It traded with a negative bias for the second consecutive day amid dollar strength and capital outflows. This weakening adds to market pressures alongside profit booking. The currency's decline impacts import costs and inflation outlook. It may prompt RBI interventions to stabilize forex markets. Broader economic implications involve challenges for exporters and importers. The rupee's performance reflects global risk-off sentiment. This could influence monetary policy decisions later in the week. Market participants monitor US Fed cues for further direction. Overall, it signals caution in emerging market currencies. Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-december-02-nse-bse-sensex-today-nifty-gift-nifty-us-fed-rate-cut-ipo-125120200072_1.html

Nomura Projects Nifty to 29,300 by End-2026

Nomura expects India's benchmark Nifty 50 to climb to 29,300 by end-2026, about 12% above current levels. This forecast is based on calmer geopolitics, stable macros, and cyclical recovery in growth and earnings. It reflects optimism in India's long-term economic trajectory post-recent corrections. The projection aligns with robust Q2 GDP data and policy supports. It may boost investor sentiment amid current volatility. Implications include potential FII inflows if growth materializes. Sectors like real estate and manufacturing stand to benefit. This outlook counters short-term bearish pressures. Analysts see it as a positive for equity allocations. The target underscores India's resilience in global markets. Reuters - https://www.reuters.com/world/india/nomura-projects-indias-nifty-rising-29300-by-2026-growth-recovers-2025-12-02/

December IPOs Set to Raise Nearly ₹30,000 Crore

December 2025 is poised for a surge in India's IPO market with around 25 public issues worth nearly ₹30,000 crore. Key companies include ICICI Prudential Asset Management (₹10,000 crore), Meesho (₹5,400 crore), and Clean Max Enviro Energy Solutions (₹5,200 crore). Others like Fractal Analytics (₹4,900 crore) and Juniper Green Energy (₹3,000 crore) add to the frenzy. This follows a record-breaking year for primary markets. The activity signals strong investor appetite amid economic growth. Implications include enhanced liquidity and capital for expansions. It may support market sentiment despite corrections. Sectors like tech and renewables dominate. This boom reflects confidence in India's corporate landscape. Regulators monitor for sustainable valuations. Economic Times - https://m.economictimes.com/markets/ipos/fpos/ipo-frenzy-continues-december-to-see-nearly-rs-30000-crore-worth-of-public-issues/articleshow/125707000.cms

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsBajaj Housing Finance Slumps 9% on Stake Sale

Bajaj Housing Finance shares slumped 9.1% on December 02, 2025, after promoters proposed selling 2% equity. This move aims to meet regulatory requirements for public shareholding. The decline impacted broader financial sector sentiment. It highlights liquidity events in housing finance. Market reaction reflects caution on dilution effects. Implications include potential pressure on earnings per share. The stock's performance contrasts with sector trends. This could influence peer valuations in NBFCs. Investors monitor for further stake adjustments. Overall, it underscores compliance-driven corporate actions. Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-december-02-nse-bse-sensex-today-nifty-gift-nifty-us-fed-rate-cut-ipo-125120200072_1.html

Hindustan Construction Jumps 14% on Rights Issue

Hindustan Construction Company shares jumped 14.2% after fixing December 5, 2025, as the record date for its rights issue. The fundraising targets existing shareholders for capital infusion. This development supports infrastructure projects amid growth. The surge boosts sector confidence in construction. Implications include strengthened balance sheet and expansion capacity. It aligns with national infrastructure push. Market gains reflect positive investor response. This may attract attention to similar firms. The move aids in debt management. Overall, it signals recovery in the sector. Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-december-02-nse-bse-sensex-today-nifty-gift-nifty-us-fed-rate-cut-ipo-125120200072_1.html

Top Performing Equity Fund Categories for You

Top Performing Large Cap Funds Top Performing Mid Cap Funds Top Performing Small Cap FundsAshok Leyland Rallies on Strong Sales

Ashok Leyland shares rallied 13% in a week, hitting ₹164.50, driven by strong November 2025 commercial vehicle sales. The growth indicates robust demand in transportation. This performance uplifts auto sector sentiment. Implications include higher revenues and market share gains. It reflects economic recovery in logistics. The stock's high underscores investor optimism. This may influence peer companies positively. Sales data supports FY26 outlook. The rally counters broader market declines. Overall, it highlights sector-specific strengths. Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-december-02-nse-bse-sensex-today-nifty-gift-nifty-us-fed-rate-cut-ipo-125120200072_1.html

US Equities Close Higher on Fed Optimism

US stocks closed higher on December 02, 2025, marking the sixth gain in seven sessions. The Dow rose 0.39% to 47,474.46, S&P 500 up 0.25% to 6,829.37, Nasdaq advanced 0.59% to 23,413.67. Optimism for a Fed rate cut next week drove gains, with 89.2% probability for 25 bps. Tech megacaps like Apple and Nvidia led advances. Boeing surged 10.1% on delivery forecasts. This performance influences global sentiment positively. For India, it may ease pressure on emerging markets. Implications include potential capital inflows. The rise reflects cooling economy signals. Overall, it supports risk appetite amid data waits. Reuters - https://www.reuters.com/business/us-stock-futures-steady-after-wall-st-selloff-eyes-fed-2025-12-02/

Top Performing Debt Fund Categories for You

Top Performing Liquid Funds Top Performing Ultra Short Duration Funds Top Performing Corporate Bond FundsWall Street Pressured by Bitcoin Drop

Wall Street closed lower on December 02, 2025, amid a 6% Bitcoin drop to $85,800. The Dow fell 0.9% to 47,289.33, Nasdaq declined 0.4% to 23,275.92, S&P 500 lost 0.5% to 6,812.63. Caution prevailed ahead of Fed announcements and economic reports. Sectors like Health Care and Industrials dropped sharply. This reflects volatility in crypto influencing equities. For Indian markets, it signals global risk-off tones. Implications include FII behavior adjustments. The decline contrasts with recent gains. Data like ISM Manufacturing at 48.2 added pressures. Overall, it highlights uncertainty in US economy. Yahoo Finance - https://finance.yahoo.com/news/stock-market-news-dec-2-124300275.html

Emkay Sees Real Estate Outperformance

Emkay noted small and mid-sized real estate players may outperform amid India's maturing housing upcycle. Organized developers doubled residential pre-sales share to 15% by FY25. This forecast supports sector investments. Implications include gains in realty stocks. It aligns with economic growth drivers. The upcycle reflects demand recovery. Market implications involve portfolio shifts. This counters broader declines. Analysts see long-term potential. Overall, it boosts confidence in property markets. Business Standard - https://www.business-standard.com/markets/news/stock-market-live-updates-december-02-nse-bse-sensex-today-nifty-gift-nifty-us-fed-rate-cut-ipo-125120200072_1.html