Indian markets displayed a mildly bullish sentiment on December 04, 2025, snapping a four-day losing streak with marginal gains driven by IT sector strength and positive global cues, though persistent rupee weakness and FII outflows tempered enthusiasm. Key themes revolved around currency pressures influencing exports, international banking expansions, and commodity import adjustments amid broader economic stability.

- Sensex, Nifty end higher, snapping four-day losing streak.

- Rupee weakens further, impacting import costs significantly.

- Russian banks seek entry into Indian market.

- India reduces Russian oil imports by 38%.

- Gold imports widen current account deficit to 1.3%.

Markets Snap Four-Day Losing Streak with Marginal Gains

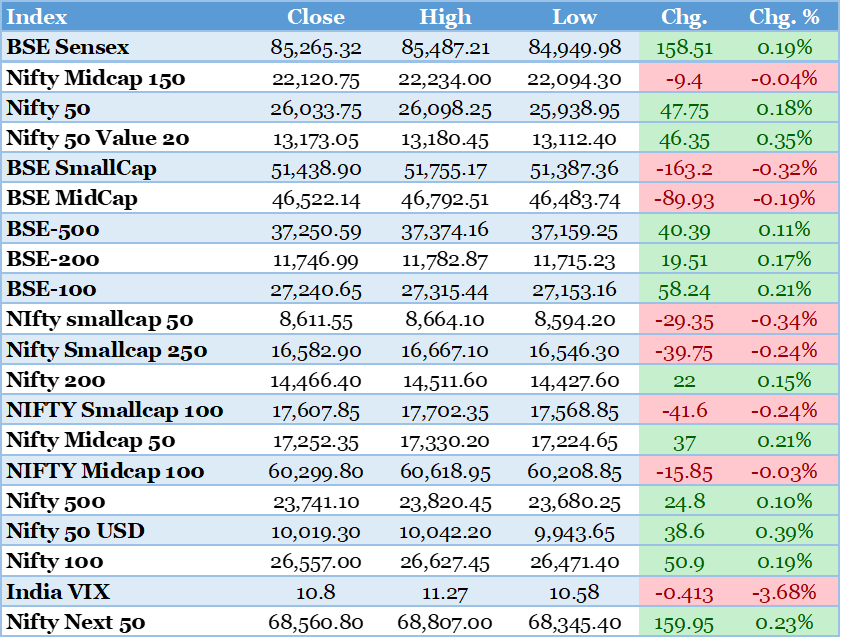

Benchmark indices closed marginally up on December 04, 2025, reversing a four-session losing streak led by gains in IT heavyweights amid rupee weakness enhancing export competitiveness. The BSE Sensex advanced 158.51 points or 0.19% to 85,265.32, while the NSE Nifty 50 rose 47.75 points or 0.18% to 26,033.75. IT sector surged over 1.3%, with TCS, Tech Mahindra, and HCL Tech among top performers, offsetting drags from banking and autos. Broader markets saw midcaps gain 0.3%, though smallcaps remained flat. FIIs continued net selling at Rs 3,207 crore, countered by DII purchases of Rs 4,730 crore. This rebound signals cautious optimism ahead of RBI's policy decision. Sustained IT momentum could support further recovery. Volatility index eased slightly, aiding sentiment. Implications include stabilized valuations for largecaps. Overall, it underscores domestic resilience against global headwinds.

The Hindu BusinessLine, https://www.thehindubusinessline.com/markets/stock-market-highlights-4-december-2025/article70353053.ece

Rupee Crosses 90-Mark, Hits New Low Against Dollar

The Indian rupee depreciated further to breach the 90 level against the US dollar on December 04, 2025, amid sustained foreign capital outflows. This marks a continuation of recent weakness driven by dollar strength and trade uncertainties. Exporters in IT and pharmaceuticals stand to gain from enhanced competitiveness. However, importers face higher costs, potentially fueling inflation. RBI's intervention remains limited, preserving forex reserves. Uday Kotak highlighted the need for domestic firms to counter foreign dominance. This depreciation impacts corporate earnings in dollar-linked sectors. Market participants await RBI cues on currency management. The trend underscores emerging market vulnerabilities. Immediate effects include adjusted hedging strategies by businesses. Economic Times, https://m.economictimes.com/news/economy/finance

Russian Lenders Seek Approval to Operate in India

Gazprombank and Alfa Bank from Russia applied for regulatory clearance to establish branches in India on December 04, 2025. This move aims to facilitate trade amid shifting geopolitical dynamics. Indian authorities are evaluating the proposals under bilateral agreements. It could enhance financial ties despite global sanctions. Potential benefits include diversified banking options for Indo-Russian commerce. Risks involve compliance with international norms. The development reflects India's balancing act in foreign relations. Immediate implications encompass boosted cross-border transactions. Approval may take several months. Overall, it signals deepening economic engagement. Reuters India, https://www.reuters.com/business/finance/russian-lenders-gazprombank-alfa-bank-seek-indias-approval-set-up-branches-2025-12-04/

India Cuts Oil Imports from Russia by 38%

India reduced its oil imports from Russia by 38% in value and 31% in volume during October 2025, as reported on December 04, 2025. This shift diversifies energy sources amid price fluctuations. Lower imports help manage trade deficits. However, it may affect bilateral trade balances. Alternative suppliers like Middle Eastern nations gain prominence. The cut aligns with global market adjustments. Financially, it eases pressure on foreign exchange outflows. Domestic refiners adapt to new sourcing. This could stabilize fuel prices internally. Broader impacts include refined product exports. The Hindu, https://www.thehindu.com/news/top-news-of-the-day-december-4-2025/article70357496.ece

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsGold Imports Drive CAD to 1.3% in Q2 FY26

Elevated gold imports widened India's current account deficit to 1.3% of GDP in Q2 FY26, analysts noted on December 04, 2025. This reflects festive demand and safe-haven buying. The deficit remains manageable amid strong services exports. It prompts monitoring of external vulnerabilities. RBI's policies aim to contain imbalances. Financial implications include potential rupee pressures. Trade data underscores commodity influences. Mitigation through export promotion is key. The figure beats earlier estimates. Overall, it highlights balanced growth dynamics. Economic Times, https://m.economictimes.com/news/economy/finance

Top Gainers Include Hindustan Copper and India Cements

Hindustan Copper, India Cements, and Petronet LNG led gainers on December 04, 2025, amid sector-specific buying. Coforge and HFCL also advanced significantly. This performance boosted metals and energy segments. Market recovery supported these moves. Losers included select banks on interest rate concerns. The session highlighted rotational trading. Implications encompass enhanced sector valuations. Investors eye commodity trends. Gains reflect demand recovery. Overall, it aids index stability. Livemint, https://www.livemint.com/market/stock-market-news/top-gainers-losers-on-dec-04-hindustan-copper-india-cements-petronet-coforge-hfcl-among-top-gainers-11764842573225.html

Top Performing Equity Fund Categories for You

Top Performing Large Cap Funds Top Performing Mid Cap Funds Top Performing Small Cap FundsData Center Portfolio Expands in India

India's colocation data center market added 132 existing and 84 upcoming facilities, per a December 04, 2025 report. This growth supports digital economy demands. Investments target hyperscale and edge computing. It bolsters IT infrastructure resilience. Financially, it attracts foreign capital inflows. Sectors like cloud services benefit. The expansion aligns with data sovereignty norms. Immediate effects include job creation. Projections indicate sustained capacity buildup. Overall, it enhances tech competitiveness. Yahoo Finance, https://finance.yahoo.com/news/india-colocation-data-center-portfolio-092900458.html

US Jobless Claims Fall to Three-Year Low

US unemployment claims dropped to a three-year low last week, reported on December 04, 2025. This signals robust labor market conditions. The decline reassures amid economic slowdown fears. It may influence Fed's rate decisions. For India, it suggests stable global demand. Implications include sustained export opportunities. The data contrasts with private payroll weakness. Market reactions favored equities. This bolsters confidence in US recovery. Overall, it supports emerging market sentiments. Morningstar, https://www.morningstar.com/news/dow-jones/202512047345/dow-jones-top-markets-headlines-at-1-pm-et-us-jobless-claims-fall-us

Top Performing Debt Fund Categories for You

Top Performing Liquid Funds Top Performing Ultra Short Duration Funds Top Performing Corporate Bond FundsK-Shaped Economy Raises Investor Concerns

A widening K-shaped divide in the US economy has investors cautious, as per a December 04, 2025 analysis. Wealthy segments thrive while lower-income groups lag. Bank of America views it as less destabilizing than feared. This inequality affects consumer spending patterns. For Indian markets, it signals potential shifts in global trade. Implications encompass adjusted investment strategies. The trend highlights policy challenges. Markets may see sector rotations. Data supports ongoing monitoring. Overall, it underscores economic disparities. Yahoo Finance, https://finance.yahoo.com/news/a-k-shaped-economy-has-investors-on-edge-bofa-says-it-may-hold-up-110013215.html

Fed Seeks Input on Check Services Changes

The Federal Reserve requested public feedback on strategic changes to check services on December 04, 2025. This aims to modernize payment systems. Proposals include digital enhancements for efficiency. It reflects evolving financial infrastructure. For international markets, it promotes seamless transactions. Implications include reduced processing costs. Stakeholders have input opportunities. The move aligns with tech advancements. Immediate effects involve operational adjustments. Overall, it strengthens banking reliability. Federal Reserve, https://www.federalreserve.gov/newsevents/pressreleases/other20251204b.htm