The Indian markets closed on a bearish note amid volatile trading, driven by persistent foreign institutional investor outflows and broad-based profit booking. Overall sentiment remained cautious, pressured by global uncertainties, though select corporate performances provided some offsets. Key themes included regulatory reforms to enhance market efficiency, calls for banking sector scaling, and fluctuations in commodities like gold and crude oil.

- Indices dipped due to FII selling, with Sensex down 148 points and Nifty below 25,510.

- SEBI pushed IPO simplifications and retail bond incentives to boost participation.

- Finance Minister urged development of world-class banks for economic growth.

- Gold prices declined amid US rate cuts and global uncertainties.

- Record US crude imports expected to sustain, aiding trade balance.

Indian Indices Close Lower Amid FII Outflows and Profit Booking

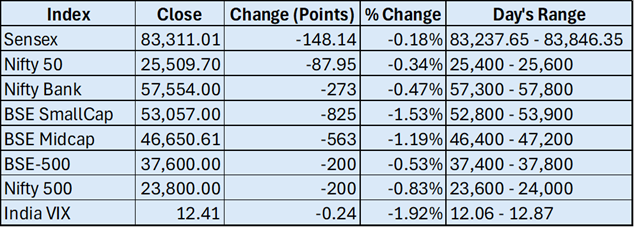

On November 6, 2025, Indian equity indices closed lower amid broad-based profit booking and sustained FII outflows of Rs 1,067 crore on November 4. The Sensex was down 148.14 points or 0.18% at 83,311.01, while the Nifty fell 87.95 points or 0.34% to 25,509.70. Major losers included Hindalco, Grasim Industries, Adani Enterprises, Power Grid Corp, and Eternal, whereas gainers were Asian Paints, Interglobe Aviation, M&M, Reliance Industries, and UltraTech Cement. Sectors such as metal, media, power, and realty declined 1.5-2.5%, with marginal gains in FMCG, auto, and IT. Broader indices like BSE Midcap fell 1.2% and smallcap shed 1.5%, reflecting weak underlying trends. The Nifty slipped below its 20-day EMA, forming a bearish candle and signaling potential correction toward 25,300-25,150. DII inflows of Rs 1,203 crore cushioned the fall, but stretched valuations and global risks may keep markets range-bound.

Finance Minister Calls for World-Class Banks to Support India's Growth

Finance Minister Nirmala Sitharaman stated on November 6, 2025, that India needs big and world-class banks, with discussions underway with the Reserve Bank of India and other lenders. She emphasized adhering to system-driven lending practices and learning from past experiences to maintain financial discipline. Sitharaman highlighted financial inclusion as a key pillar for achieving Viksit Bharat by 2047. She urged banks to deepen and widen credit flow to industries, expressing confidence that recent GST rate cuts would stimulate demand and trigger a virtuous investment cycle. The minister also underscored the government's focus on infrastructure development, noting capital expenditure has increased fivefold over the past decade. This push could enhance banking sector capacity to fund large-scale projects and boost economic expansion.

SEBI Plans Further Rationalization of IPO Offer Documents

SEBI will further rationalize the summary of IPO offer documents to reduce information overload and make it available separately for investor feedback. The regulator plans to streamline lock-in conditions for pre-IPO shares that are pledged, ensuring automatic enforcement to prevent listing delays. SEBI aims to boost retail participation in corporate bonds by allowing issuers to offer incentives and launching an education campaign. The regulator is working with RBI to enable institutional participation in commodity markets and allow FPIs to trade in non-cash settled non-agricultural commodity derivatives. SEBI is strengthening market integrity through a mandated Cybersecurity & Cyber Resilience Framework, AI-driven surveillance, and secure UPI pathways. Governance at market infrastructure institutions is being tightened to prioritize public interest. These changes could improve market accessibility and efficiency. Moneycontrol, https://www.moneycontrol.com/news/business/markets/sebi-to-rationalise-offer-document-summary-further-says-sebi-chairman-tuhin-kanta-pandey-13658277.html

RBI and SEBI Consult on Introducing Bond Derivatives The Reserve Bank of India and the Securities and Exchange Board of India are consulting on the introduction of bond derivatives as announced on November 6, 2025. The consultation aims to explore the feasibility and regulatory framework for bond derivatives in the Indian financial market. Tuhin Kanta Pandey highlighted the discussions during a recent event. The move is intended to enhance liquidity and price discovery in the bond market. The outcome could influence the development of new financial instruments. Specific details on the timeline or final decisions remain pending. This could deepen the corporate bond market and provide hedging tools for investors.

Financial Express, https://www.financialexpress.com/market/rbi-sebi-consulting-on-bond-derivatives-tuhin-kanta-pandey-4034809/

SEBI Open to Raising Cap on Mutual Fund Fees to Brokerages

On November 6, 2025, SEBI indicated openness to raising the proposed cap on fees mutual funds pay to brokerages, initially set at 2 basis points from 12 for cash market transactions. This proposal was part of SEBI's mutual fund fee structure overhaul to enhance transparency and reduce investor costs. Industry concerns highlighted potential revenue impacts on institutional brokers and challenges in stock selection. Reduced fees could limit payments to sell-side research analysts, affecting returns and favoring foreign investors. SEBI acknowledged these concerns but noted foreign investors' conservative research spending. The final cap will be determined after consultations by mid-November 2025. This adjustment may balance cost reduction with industry viability. CAalley, https://caalley.com/news-updates/indian-news/sebi-open-to-raising-cap-on-fees-paid-by-mutual-funds-to-brokerages

India Retains Cap on Voting Rights for Large Bank Shareholders

India plans to retain the cap on voting rights for large shareholders in domestic banks, limiting single shareholders to 26% in private banks and 10% in government-owned ones. The RBI and finance ministry discussed easing these caps but decided against it to prevent excessive control by any entity. The government aims to maintain safeguards against sole decision-making by large shareholders. Despite liberalization efforts to attract foreign investment, the voting rights cap remains unchanged. This could deter large investors from acquiring controlling stakes amid growing foreign interest. Sources express confidence that the cap will not deter investment through reduced stakes. The policy supports stable bank governance.

Bajaj Housing Reports Slowest Profit Growth Since Listing

India's Bajaj Housing Finance reported its slowest quarterly profit growth since its September 2025 listing on November 6. Net profit rose 21% to 5.46 billion rupees for the quarter ended September 30, compared to faster growth in prior periods. The slowdown was attributed to higher provisions for potential loan losses amid rising interest rates. Assets under management grew 23% year-on-year, reflecting continued expansion in housing loans. Shares declined 2% post-announcement, signaling investor concerns over margins. This may pressure the housing finance sector amid economic headwinds. Overall, it highlights challenges in sustaining growth post-IPO. Reuters, https://www.reuters.com/world/india/indias-bajaj-housing-posts-slowest-profit-growth-since-listing-2025-11-06/

Gold Prices Dip Amid Global Economic Uncertainties

On November 6, 2025, gold prices in India dipped, with 24K gold at Rs 12,147 per gram in cities like Mumbai and Kolkata. Chennai saw the highest at Rs 12,196 per gram, while Delhi and others were at Rs 12,162 per gram. Internationally, gold traded at $3,973.15 per ounce in Singapore, below $4,000. The decline follows a 50% surge earlier in the year, with analysts predicting a drop below Rs 1.2 lakh per 10 grams. Factors include US Federal Reserve rate cuts and a government shutdown delaying data. Market sentiment is cautious, viewing gold as a safe-haven. This could impact jewelry demand and investor portfolios.

India's Record US Crude Imports Likely to Sustain

India imported a record 5,68,000 barrels per day of crude oil from the US in October 2025, dislodging the UAE as the fourth largest supplier. Experts expect November imports to sustain at 4,50,000–5,00,000 b/d, above the year-to-date average of 3,00,000 b/d. The increase is driven by a strong arbitrage window, wider Brent–WTI spread, and weak Chinese demand. Cargos were agreed before US sanctions on Russian oil firms, reflecting diversification efforts. Rising US share helps narrow India's trade deficit with the US and reinforces energy cooperation. Upside is limited by longer voyages and higher freight costs. This supports energy security and economic balance.

The Hindu Business Line, https://www.thehindubusinessline.com/economy/indias-record-october-crude-oil-imports-from-us-may-sustain-in-november-2025/article70247300.ece

Indian Rupee to Trade in Tight Range Due to RBI Interventions

The Indian rupee is expected to trade in a tight range as the RBI chokes off speculative bets through interventions. On November 6, 2025, the rupee closed at 84.38 against the US dollar, showing minimal volatility. RBI's actions include directing banks to reduce long positions in dollar-rupee forwards. This curbs speculation amid global currency fluctuations and domestic inflows. The strategy aims to stabilize the rupee despite FII outflows. Implications include reduced forex market volatility and support for export competitiveness. Overall, it reinforces RBI's focus on currency management.