The Indian markets displayed a bullish sentiment on November 20, 2025, propelled by robust corporate earnings and positive economic outlooks despite global headwinds. Major indices like Sensex and Nifty recorded gains, underscoring market resilience and investor confidence in domestic growth drivers. Overarching themes revolved around optimistic GDP forecasts, regulatory prudence on emerging assets, and strategic international trade positioning.

- Sensex surges 446 points amid strong IT and auto sector performance.

- Moody's forecasts 7% GDP growth for India in 2025.

- Core sector output remains flat, indicating potential economic moderation.

- HSBC projects Sensex at 94,000 by end-2026 on earnings recovery.

- RBI adopts cautious stance on cryptocurrencies and stablecoins.

Indian Markets Rally with Nifty Approaching All-Time High

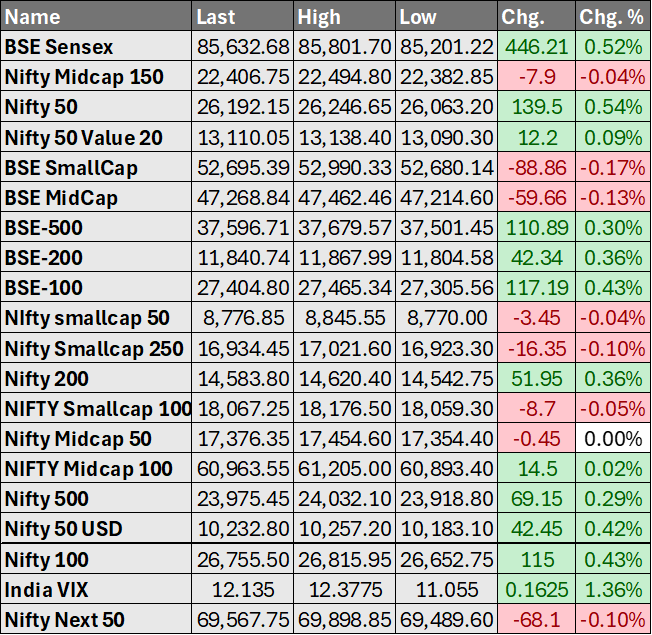

The benchmark indices closed on a positive note, with the Nifty settling near 26,200 and the Sensex gaining over 446 points. This uptick was fueled by strong buying in heavyweight stocks like Reliance Industries and Bajaj Finance, amid improved investor sentiment. The rally reflects recovery from recent volatility, supported by foreign inflows and solid quarterly results from key sectors. Broader markets showed mixed performance, but major indices outperformed, signaling sustained bullish momentum. Immediate implications include boosted investor confidence and potential for further gains if global cues remain favorable. Banking and IT sectors led the advance, contributing to the overall market capitalization increase. Money Control, https://www.moneycontrol.com/news/business/markets/stock-market-live-sensex-nifty-50-share-price-gift-nifty-latest-updates-20-11-2025-liveblog-13687099.html

Moody's Projects 7% GDP Growth for India in 2025

Moody's Ratings has forecasted India's economy to expand by 7% in 2025, followed by 6.4% in 2026, highlighting robust domestic demand. This projection comes amid global economic uncertainties, positioning India as a resilient performer among emerging markets. The agency notes strong consumption and investment as key drivers, despite potential external pressures. Financial implications include enhanced attractiveness for foreign investments and stable credit ratings for Indian entities. The outlook supports policy continuity, potentially easing borrowing costs for the government. Overall, it reinforces India's growth narrative in a challenging international landscape. Economic Times, https://economictimes.indiatimes.com/news/economy/indicators/moodys-pegs-indias-growth-at-7-in-2025-6-4-at-2026/articleshow/125469503.cms

India's Core Sector Output Growth Remains Flat in October

India's eight core industries recorded flat growth in October, marking a 14-month low due to declines in key segments like steel and cement. This stagnation weighs on overall industrial output, reflecting subdued demand in infrastructure-related sectors. Contextually, it follows a period of moderate expansion, influenced by seasonal factors and global commodity trends. Financially, it could signal slower GDP momentum in the current quarter, impacting investor expectations. Policymakers may respond with stimulus measures to revive activity. The data underscores the need for diversified economic drivers beyond traditional industries. Economic Times, https://economictimes.indiatimes.com/news/economy/indicators/indias-core-output-growth-stays-flat-in-october/articleshow/125469542.cms

HSBC Forecasts Sensex at 94,000 by End-2026

HSBC anticipates the BSE Sensex to reach 94,000 by the end of 2026, driven by earnings recovery and cooling valuations. This 10% upside projection from current levels factors in improved corporate profitability and stable macroeconomic conditions. In context, it follows recent market corrections, offering a positive long-term view for equity investors. Implications include potential portfolio reallocations towards Indian stocks, boosting market liquidity. The forecast assumes moderating inflation and supportive monetary policies. It highlights India's appeal as a growth-oriented market amid global shifts. Reuters, https://www.reuters.com/world/india/hsbc-sees-indias-sensex-94000-by-end-2026-earnings-recovery-cooling-valuations-2025-11-20/

RBI Cautious on Cryptocurrencies and Stablecoins

The Reserve Bank of India is taking a measured approach to cryptocurrencies and stablecoins, emphasizing financial stability risks. Governor's remarks underscore concerns over volatility and regulatory gaps in these assets. This stance aligns with ongoing global discussions on digital currencies, aiming to protect retail investors. Financially, it may limit crypto adoption in India, affecting related fintech innovations. Banks and institutions could face stricter guidelines, impacting cross-border transactions. The policy signals a preference for central bank digital currencies over private alternatives. Reuters, https://www.reuters.com/world/india/being-cautious-about-cryptocurrencies-stablecoins-india-cenbank-chief-says-2025-11-20/

Resilient Economy Aids India in US Trade Negotiations

India's strong domestic economy provides leverage in negotiating trade deals with the US, amid tariff concerns. Exports to the US declined 8.6% in October, but overall resilience minimizes broader impacts. This positioning allows New Delhi to push for favorable terms in bilateral talks. Implications include stabilized trade balances and protected sectors like textiles and pharmaceuticals. It could lead to diversified export strategies, reducing dependency on single markets. The development supports long-term economic diplomacy efforts. Reuters, https://www.reuters.com/world/india/resilient-domestic-economy-gives-india-space-negotiate-us-trade-deal-sources-say-2025-11-20/

Top Performing Funds for You

Top Performing Equity Funds Top Performing Debt Funds Top Performing Hybrid FundsMarvell Technology Plans Hiring Spree and R&D Boost in India

US chipmaker Marvell is expanding operations in India with increased hiring and research investments to capitalize on AI demand. This move targets India's talent pool for semiconductor and tech advancements. Contextually, it aligns with global AI infrastructure growth, positioning India as a key hub. Financially, it could create jobs and attract further FDI in the tech sector. Enhanced R&D may spur innovation, benefiting local supply chains. The initiative supports India's ambitions in electronics manufacturing. Reuters, https://www.reuters.com/world/india/us-chipmaker-marvell-plans-india-hiring-spree-rd-push-tap-ai-boom-2025-11-20/

India's Crude Oil Imports Hit Six-Month High in October

India's crude oil imports rose to a six-month peak in October, driven by increased demand from refiners. Russia remained the top supplier, accounting for significant volumes amid global supply dynamics. This uptick reflects recovering economic activity and energy needs. Financial implications include potential pressure on the current account due to higher import bills. It may influence fuel prices and inflation trends domestically. The data highlights India's role in global oil markets. Reuters, https://www.reuters.com/business/energy/indias-october-crude-oil-imports-rise-six-month-high-2025-11-20/

Goldman Sachs Highlights India's Strong Growth and Digital Push

Goldman Sachs praises India's robust economic growth and digital advancements amid emerging market opportunities. The report notes India's outperformance in GDP expansion and tech adoption. In context, it positions India favorably against peers facing slowdowns. Financially, this could enhance investor inflows into equities and bonds. It supports sectors like fintech and e-commerce for sustained expansion. The endorsement bolsters India's global economic narrative. Economic Times, https://bfsi.economictimes.indiatimes.com/news/industry/india-shines-with-strong-growth-digital-push-amid-rising-opportunities-in-emerging-markets-goldman-sachs/125458435

Reliance Stops Importing Russian Crude for Refineries

Reliance Industries has halted imports of Russian crude oil for its refinery operations, shifting to alternative sources. This decision follows supply chain adjustments amid geopolitical factors. Contextually, it impacts India's overall crude procurement strategy, given Reliance's market share. Financial implications include potential cost variations and refining margins. It may influence domestic fuel supply stability. The move aligns with diversifying energy imports for risk mitigation. Reuters, https://www.reuters.com/business/energy/indias-reliance-stops-importing-russian-crude-refinery-operations-2025-11-20/