Indian markets closed lower on November 24, 2025, amid volatile trading and profit-taking, with the Sensex declining over 331 points and Nifty slipping below 26,000, reflecting cautious investor sentiment despite IT sector gains. The day was influenced by global cues, RBI's signals on potential rate cuts, and ongoing corporate earnings recovery. Key themes included currency interventions, macroeconomic stability, and regulatory enhancements in financial sectors.

- Sensex falls 331 points on profit-taking and mixed cues.

- RBI sees scope for a rate cut based on macro indicators.

- Rupee rebounds after RBI's aggressive intervention.

- Jefferies notes end of weak earnings cycle.

- Business growth slows to six-month low per PMI.

Indian Benchmark Indices Decline Amid Profit-Taking

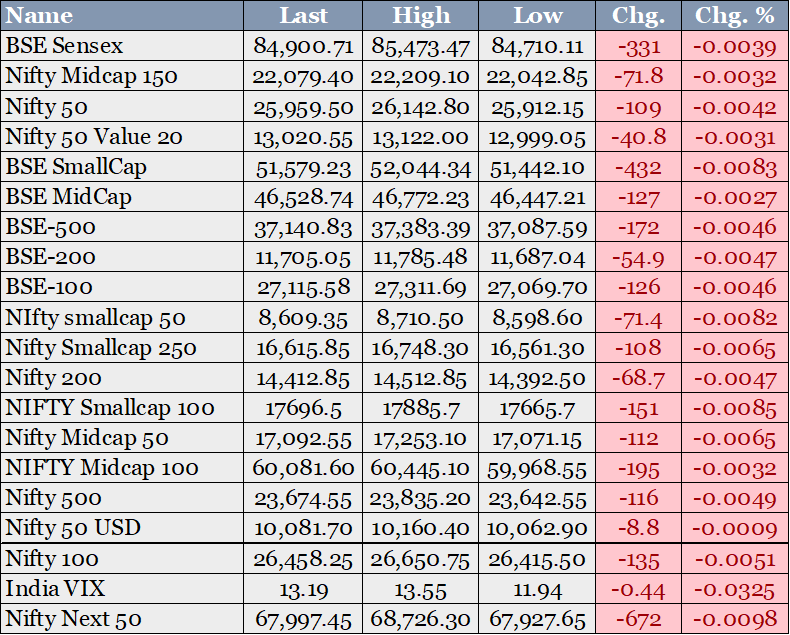

The Sensex closed down 331.21 points at 84,900.71, while the Nifty fell 108.65 points to 25,959.50, marking the second consecutive day of losses. This downturn was driven by profit-booking in key sectors like metals and realty, despite gains in IT stocks capping broader declines. Global mixed cues, including US rate cut odds, contributed to the volatility, with broader market indices also ending lower. The session saw weak market breadth, with more decliners than advancers, signaling subdued participation. Immediate implications include reduced investor wealth by over ₹7 lakh crore in two sessions, potentially dampening short-term sentiment. However, weekly gains earlier suggest underlying resilience if positive triggers emerge.

RBI Governor Indicates Scope for Rate Cut

Reserve Bank of India Governor Sanjay Malhotra stated that recent macroeconomic data supports room for a policy rate reduction, though timing rests with the Monetary Policy Committee. This comes after a 100 basis point cut earlier in 2025, with pauses since August amid inflation concerns. The comments reinforce expectations of easing to spur growth, potentially lowering borrowing costs for businesses and consumers. Bond yields fell in response, signaling market anticipation of accommodative policy. Financially, this could boost credit growth and investment in rate-sensitive sectors like real estate and automobiles. It aligns with efforts to maintain economic momentum despite global headwinds. Moneycontrol - https://www.moneycontrol.com/news/business/macroeconomic-indicators-support-scope-for-rate-cut-timing-up-to-mpc-rbi-governor-13693583.html

RBI Intervenes to Support Falling Rupee

The Reserve Bank of India aggressively intervened in forex markets to curb the rupee's slide, helping it rebound from recent lows. The currency had hit 89.49 last week but strengthened amid central bank actions before local market opening. This move addresses pressures from global risk aversion and potential US-India trade uncertainties. Implications include stabilized import costs, particularly for oil, aiding inflation control. It may enhance investor confidence in Indian assets, though bearish undercurrents persist. The intervention underscores RBI's commitment to forex stability. Reuters - https://www.reuters.com/world/india/indian-central-bank-likely-intervenes-prop-up-rupee-before-local-market-open-2025-11-24/

Jefferies Signals End of Weak Earnings Cycle

Global brokerage Jefferies indicated that the worst phase of India Inc's earnings downturn is over, with momentum expected to strengthen and downgrades limited. This assessment follows Q2 results showing resilience across sectors, signaling a potential recovery in corporate profitability. The outlook positions Indian markets for stability, attracting investor interest amid global shifts. Financially, it could lead to upward revisions in stock valuations and portfolio reallocations. It highlights broad demand recovery, benefiting manufacturing and services. The view supports long-term bullish sentiment despite near-term volatility. Moneycontrol - https://www.moneycontrol.com/news/business/markets/worst-of-india-inc-s-earnings-cycle-over-jefferies-says-momentum-to-strengthen-downgrades-to-be-limited-13692635.html

India's Business Growth Slows to Six-Month Low

Flash PMI data showed India's private sector expansion decelerated to its weakest since May, led by a nine-month low in manufacturing output. The composite PMI dipped due to softening new orders and rising costs, amid global uncertainties. Services remained steady but couldn't offset industrial weakness, impacting employment growth. This signals potential GDP moderation, prompting policy vigilance. Investors may adopt caution, affecting equity flows. The data underscores challenges in sustaining high growth trajectories. Reuters - https://www.reuters.com/world/india/indias-november-business-growth-slows-6-month-low-weak-manufacturing-pmi-shows-2025-11-21/

Fiscal and Monetary Measures to Boost Growth

The RBI reported that India's fiscal and monetary policies are set to enhance investment and economic expansion, projecting 6.8% growth for FY26. Declining inflation supports this outlook, enabling stimulus without overheating risks. This framework aims to leverage festive demand and resilient consumption for momentum. Implications include improved corporate capex and job creation across sectors. It could attract foreign investments, strengthening forex reserves. The measures reflect coordinated efforts for sustainable development. US News - https://money.usnews.com/investing/news/articles/2025-11-24/indias-fiscal-monetary-measures-to-boost-investment-and-growth-rbi-report-says

SEBI Unveils New Materiality Framework for RPTs

SEBI introduced a revised framework for materiality thresholds in related party transactions, setting limits based on turnover to ensure transparency. For entities up to Rs 20,000 crore, transactions exceeding 10% are material, aiming to curb potential abuses. This enhances corporate governance, protecting minority shareholders. Financially, it may increase compliance costs but foster trust in markets. Listed companies must adapt policies accordingly. The change aligns with broader regulatory reforms. Economic Times - https://bfsi.economictimes.indiatimes.com/news/policy/sebi-unveils-new-materiality-framework-for-related-party-transactions/125532751

Growth Momentum Strengthens on Festive Demand

India's economy accelerated further despite global challenges, driven by festive consumption and resilient domestic demand, per RBI bulletin. This includes positive Q2 corporate earnings and improved primary market activity. The trend supports 7% growth forecast for 2025 by Moody's, with 6.4% in 2026. Implications involve boosted retail and manufacturing sectors, enhancing GDP contributions. It may ease fiscal pressures through higher revenues. The resilience positions India favorably in emerging markets. Economic Times - https://m.economictimes.com/news/economy/indicators/indias-growth-momentum-strengthens-on-festive-demand-resilient-consumption-rbi-bulletin/articleshow/125543382.cms

S&P Retains India's FY26 Growth Forecast at 6.5%

S&P Global maintained its 6.5% growth projection for India's FY26, citing potential benefits from a US-India trade deal. This stability reflects managed external risks and strong internal drivers. The forecast supports policy continuity, potentially influencing investor strategies. Financially, it bolsters sovereign ratings and borrowing terms. Sectors like exports may gain from trade pacts. The outlook reinforces economic confidence. The Hindu Business Line - https://www.thehindubusinessline.com/markets/share-market-nifty-sensex-live-updates-24-november-2025/article70313979.ece

Gold Prices Decline on Rupee Rebound

Gold futures dropped 1.21% to Rs 1,22,652 per 10 grams, pressured by a strengthening rupee and global cues. This reflects reduced safe-haven demand amid market volatility. Implications include lower import costs for jewelers, benefiting retail margins. It may shift investor preferences toward equities. The trend aligns with seasonal adjustments post-festive period. Broader commodity markets remain watchful of currency movements. Times Online - http://business.times-online.com/times-online/article/marketminute-2025-11-24-rupee-rebound-and-global-cues-weigh-on-gold-sparking-market-volatility